Restaurant POS Credit Card Processing

The restaurant industry has its fair share of challenges. A major challenge being restaurant POS credit card processing.

Restaurant POS credit card processing has been a top priority for restaurant owners looking to lower their credit card processing fees. Whether you’re opening a new restaurant or you’ve been running one for a while, I’m sure you’re well aware of the hard work and time it takes to be successful with this.

Updating your restaurant POS credit card processing system is a quick and easy way to improve your processes, therefore maximizing margins.

If you’re using an outdated restaurant POS credit card processing system, it’s likely cutting into your profits and slowing down your operations.

Our team here at Merchant Cost Consulting has extensive experience working with restaurants of all shapes and sizes—we help them save money on credit card processing without switching processors. Based on our experience and some additional research, we’ve recognized how important a modern restaurant POS credit card processing system is for a restaurant’s success. Let’s dive in.

Do You Need a New Restaurant POS Credit Card Processing System?

If your billing system is five or ten years old, the short answer is likely yes. Today, cash payments are slowly becoming obsolete.

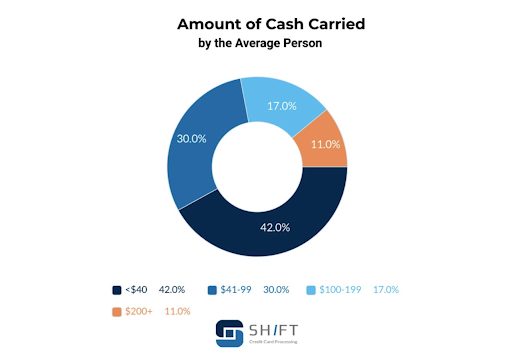

Consumers are carrying less cash, and the vast majority of people prefer cashless payments for most transactions.

As you can see from the graph, most people carry less than $40 in cash on them. Even for transactions less than $10, just 37% of people use cash—the rest still pay with a credit or debit card.

Additional Reading: How to Prepare For Cashless Payments

It’s all about customer convenience. You need to offer consumers a convenient way to pay and make that credit card processing process as smooth as possible. Seamless restaurant credit card processing also help you stand out from the competition in your area.

But the main reason why you need to update your restaurant POS credit card processing system is the cost.

I’m not just talking about the credit card processing fees associated with the transaction. An efficient restaurant POS credit card processing process helps you serve more people faster and improves productivity amongst your staff. At scale, the cost savings are astronomical and ultimately translate to more revenue at a higher profit margin.

How to Update Your Restaurant POS Credit Card Processing System

Now that you understand the importance of a modern billing system let’s dive into the specifics for how you can make this happen. Whether you have a small to-go counter or run a huge restaurant chain, the steps below can be applied to your unique situation.

Step #1: Evaluate Your Current Billing System

The first thing you need to do is assess your current situation. What software (if any) are you using? How does your Restaurant POS system work?

Look at every aspect of your current credit card processing acceptance and identify room for improvement.

The idea here is to figure out what’s working well and what isn’t. You’ll want to look beyond the initial sale as well and assess things like automated data entry, reporting, accounting integrations, and more.

Does your existing restaurant POS system help you with managing inventory? What’s that process look like?

Identify any task or process that’s time-consuming, and ask yourself if that can be automated with a modern tool.

Here’s an overview of the top restaurant challenges for both profitable and unprofitable businesses.

High operating costs, speed, and efficiency are common obstacles for all restaurants. See if there is any overlap between your top challenges and inefficiencies with your billing system.

Step #2: Assess Customer Payments

How are your customers currently paying for their meals?

Part of this answer will rely on the credit card processing acceptance methods you have available. But it’s also worth evaluating how many people take advantage of different options.

For example, some restaurants handwrite tickets and have customers take those tickets from the table to a register. Then someone has to punch those numbers into a restaurant POS system to process the sale. But if customers aren’t paying cash, you could consider using a restaurant POS credit card processing system that accommodates tableside credit card processing acceptance.

This will allow people to pay using a credit card or digital wallet, streamlining the process for everyone.

Step #3: Evaluate Solutions That Address Your Problems

Now that you’ve assessed every aspect of your current restaurant POS system, it’s time to find a solution to those problems. Restaurant POS credit card processing systems come in all different shapes and sizes—and your existing credit card processing company should have lots of options for you to choose from.

Here are some options and features to consider:

Mobile Payment Solutions — Great for food trucks, delivery services, farmers markets, and pop-up shops.

Virtual Terminals — Ideal for taking phone orders or restaurants that deliver and want to accept payments over the phone.

Online Payment Gateways — Allows you to create an online ordering system for pickup and delivery on your website. Customers can pre-pay at the time of the order using credit cards, debit cards, mobile wallets, etc.

Traditional POS System — You can use a computer monitor or tablet to set up fast payment acceptance at the register. This works well for quick-serve restaurants, coffee shops, and similar operations.

Depending on your setup, you might ultimately decide to use a combination of these solutions. In that case, it’s worth looking into an integrated restaurant POS system that offers all of these options from a single provider.

Other factors to consider as you’re shopping around and evaluating options include:

Costs (equipment, transactions, subscriptions, etc.)

Security (make sure your updated system is PCI compliant)

Customization

Ease of use

Employee training and support

Tickets vs. invoices

Inventory management

Accounting tools

Again, some of these credit card processing features will be more important to some restaurants compared to others. But generally speaking, the larger the operation, the more features you need to have.

Final Thoughts

Aside from the normal challenges faced by restaurants on a daily basis, everyone in the food industry has been dealing with unprecedented hurdles and barriers over the last year or so.

Profitability is more important than ever before. As the restaurant world slowly returns to normal, it’s the perfect opportunity for you to streamline your restaurant POS credit card processing system.

Talk to your current provider and discuss your needs. While you’re doing that, it’s also worth discussing your current credit card processing costs. Our team here at Merchant Cost Consulting can help negotiate those fees on your behalf, potentially saving you tens of thousands of dollars on credit card processing. Just reach out for a free consultation to see how much money your restaurant can save.

0 Comments