Payment Gateways vs. Merchant Accounts: Differences Explained

The world of credit card processing is filled with different terms. If you’re not an expert in this space (most business owners aren’t), then it can be a bit confusing to keep track of the different terminologies and concepts.

This guide will clear the confusion between two key components of credit card processing—payment gateways and merchant accounts.

Whether you’re starting a new business online, expanding your existing operation, or accepting credit cards for the first time, you’ll have a clear understanding of payment gateways and merchant accounts by the time you finish reading this post. Let’s dive in.

Payment Gateways Explained

What is a payment gateway?

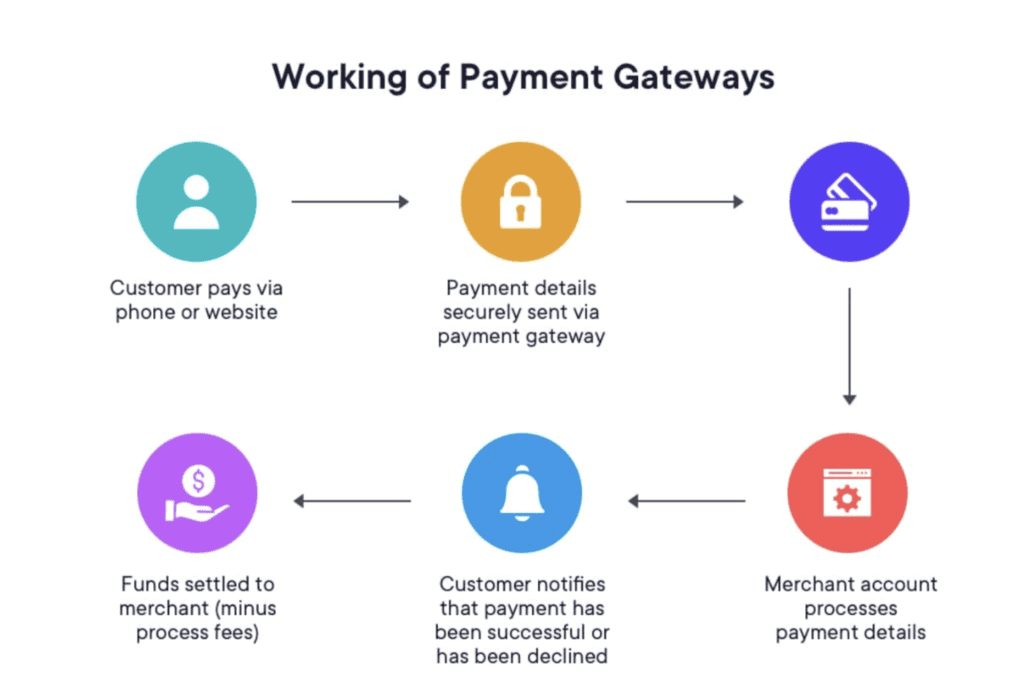

The term payment gateway refers to technology that connects merchants and payment networks. Here’s a quick overview of what payment gateways accomplish at a basic level:

- Ecommerce Integration — Payment gateways integrate with online stores, giving businesses the ability to process credit cards and debit cards online.

- Payment Information — When a customer buys something, the transaction details are sent to the payment gateway. Then the payment gateway encrypts the data before the transaction info moves to another party.

- Transaction Routing — Once encrypted, the transaction details are sent to the merchant’s payment processor or acquiring bank. It’s up to the acquiring bank to ultimately send the transaction to the card network for verification.

- Approval or Decline — Based on the response from the card network, an approved or declined message will be sent back to the merchant. If approved, the customer will be sent to a confirmation screen. If declined, the customer would need to enter new payment details.

All of this happens in about a second. Here’s a visual explanation showing the payment gateway’s role in the transaction:

Payment Gateway vs. Payment Processor

The terms payment gateway and payment processor are often confused with each other. But they aren’t the same thing.

Merchants don’t have a direct connection with credit card networks like Visa, Amex, Discover, or Mastercard. They need a payment processor to facilitate that connection. Payment gateways are used to connect merchants with payment processors.

Lots of large payment processors won’t work directly with a business. So they set up reseller arrangements with payment gateways to offer merchant services.

What Makes a Good Payment Gateway?

At its core, every payment gateway will accomplish the tasks explained above. But some of the best payment gateways on the market offer additional services and functions.

So as you’re shopping around and comparing payment gateways, keep the following features in mind:

- Fraud Detection and Prevention — Every time your business accepts a payment online, you’re at risk for fraud. This can lead to chargebacks, penalties, loss of goods, and potentially harm your reputation. So look for a payment gateway that has fraud detection and prevention services.

- Subscription Billing — Subscriptions are an excellent way to sell goods or services online. So if you’re planning to use this model, look for a gateway with recurring billing solutions. These tools support custom billing plans, payment reminders, and automated billing.

- Variety of Payment Acceptance — Beyond credit cards and debit cards, there are plenty of other ways to pay for goods and services. The best payment gateways support bank transfers, e-wallets, mobile payments, and more. This will make your online store more appealing to consumers.

- Analytics and Reporting Tools — Some gateways offer detailed reports and analytics about your payments. This will give you more information about your business and customers so you can make data-driven decisions.

Some of these features are more important than others. It all depends on your business. For example, subscription billing isn’t a must-have for everyone. But every business needs some type of fraud detection and prevention solution.

Merchant Accounts Explained

Now that you understand what a payment gateway is, let’s take a closer look at merchant accounts. What exactly is a merchant account?

A merchant account makes it possible for businesses to process credit and debit card payments. Payment gateways deposit the funds from your transactions into a merchant account. From here, the funds will be sent from your merchant account to your business bank account.

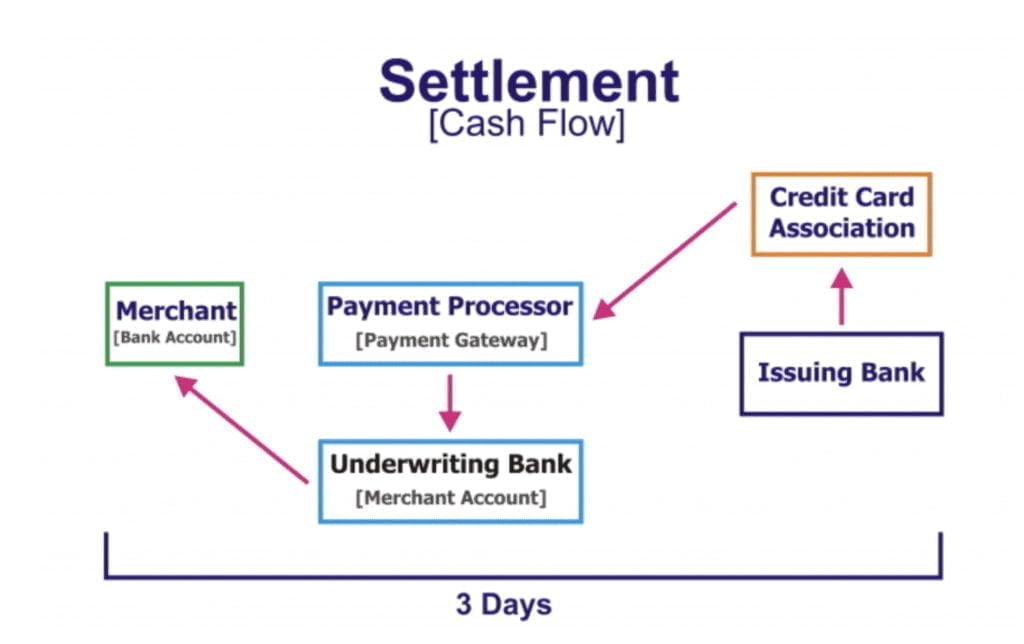

Here’s what that settlement process looks like:

As you can see from the image, the funds pass through the merchant account before ultimately being delivered to the merchant’s bank account.

So why doesn’t the money get sent straight to your bank account?

There are a few reasons for this. First, the processor accepts some risk when they work with a business. If a customer decides to return something, then the return amount gets subtracted from the funds in your merchant account.

It’s also possible that your payment gateway could be accumulating deposits from several sources (website sales, phone sales, recurring billing sales, etc.). Instead of giving you three different deposits, all of them get sent to the merchant account. From here, there’s just one deposit that gets sent to the business checking account, which makes it much easier for the merchant to reconcile transactions.

What Makes a Good Merchant Account?

Similar to payment gateways, not all merchant accounts are created equal. Some offer additional perks and services compared to others.

If you want to sell online to an international audience, you need a merchant account that works for cross-border ecommerce transactions. Some merchant accounts can only accept money in USD, which obviously wouldn’t work for consumers in other countries.

The underwriting process for your merchant account will vary depending on your business type, industry, sales volume, and other factors. While the underwriting process might seem like a pain, it can actually make your life easier down the road. It’s less likely that your merchant account will unexpectedly shut down your account due to unforeseen circumstances.

There are also aggregate merchant accounts. These accounts are easier to sign up for because the underwriting process is virtually nonexistent. While it may seem appealing to sign up for these, they tend to be really rigid, expensive, and don’t offer the same flexibility as a traditional merchant account.

Final Thoughts

I hope this guide clarified your questions about payment gateways and merchant accounts.

As you can see, the two terms are not the same. But both are crucial aspects for any business that wants to accept credit card payments online.

Are you overpaying for credit card processing? Reach out to our team for a free consultation. We’ll help get you the best possible rates without having to switch your processor.

0 Comments