Payment Processing Industry News – May 2024

Here at MCC, we’re always looking for ways to keep our readers informed with what’s happening in the payments space. May was a busy month that included some noteworthy rate increases, acquisitions, partnerships, new technology, and more.

Read on for the full scoop.

Shift4 is Acquiring Revel Systems

Shift4 just announced its plans to acquire Revel Systems, a cloud-based POS trusted by over 20,000 global businesses, particularly in the food, beverage, and restaurant space.

For businesses currently using Revel Systems for POS and payment processing, nothing is changing right now (and I imagine the transition will be seamless).

Both parties are hoping to finalize the $250 million cash deal by July 2024. Stay tuned for any additional updates, and check out our Shift4 review to learn more about this processor.

TSYS Increased Processing Fees Effective May 1st

As of May 1, 2024, TSYS increased the following fees:

- 0.65% increase to qualified discount rate

- 0.75% increase to non-qualified surcharge rate

- $0.20 increase to transaction network access fee

- 0.45% increase to settlement funding fee

See all of the latest TSYS rate increases here, and read our complete TSYS review for a complete breakdown.

OpenEdge/Global Payments Rolled Out New Fees and Rate Increases

Effective May 2024, OpenEdge (Global Payments) notified merchants that they may notice an increase to the following fees on their statements moving forward:

- Batch fees

- PCI non-compliance fee

- Network security fee

- Compliance fee

- Risk assessment fee

- Discount rates

- Per item fees

In some instances, these might appear on a merchant statement for the first time as a completely new fee that was previously not being charged.

If you see a charge that you don’t recognize on your statement, OpenEdge (Global Payments) gives you 30 days from the statement date to file a dispute. Alternatively, you can let our team here at MCC audit your statements for free to identify any potential overages or hidden fees.

Rectangle Health Announces Rate Increase That Goes Into Effect on June 1st

Rectangle Health is raising its payment processing rates by 0.40% per transaction on all Visa, Amex, Mastercard, and Discover cards.

We obtained a copy of this announcement (that wasn’t otherwise made publicly available), which you can view here.

Visa Rolls Out New Products at the Annual Visa Payments Forum in San Francisco

Visa held its Annual Visa Payments Forum in San Francisco on May 15th. New products were the most notable part of this event, and here’s a quick summary of what stood out the most:

Visa Flexible Credential

This new feature allows card users to access multiple accounts through a single credential, giving users the ability to toggle between payment methods. They can also set parameters to choose whether they’re paying via debit, credit, BNPL, or rewards points. Visa’s Flexible Credential is already live in Asia and Visa is planning to launch it in the US in the summer of 2024.

Tap to Everything

Visa’s tap-to-pay functionality penetrated 65% of its market in 2023—more than double the penetration rates just four years prior. In 2024, Visa is launching additional ways for cardholders to “tap” on mobile devices, including:

- Tap to Pay: Turns any device into a POS

- Tap to Confirm: To authenticate user identities for online sales

- Tap to Add Card: To enhance security when adding a new payment method to a digital wallet or app

- Tap to P2P: To send money between family and friends

Visa Payment Passkey Service

Visa’s latest identity verification service is built on FIDO standards and is used to confirm a customer’s identity and authorize an online payment through biometric scanning. This eliminates the needs for passwords and one-time codes, helping to provide more streamlined transactions while keeping everything secure.

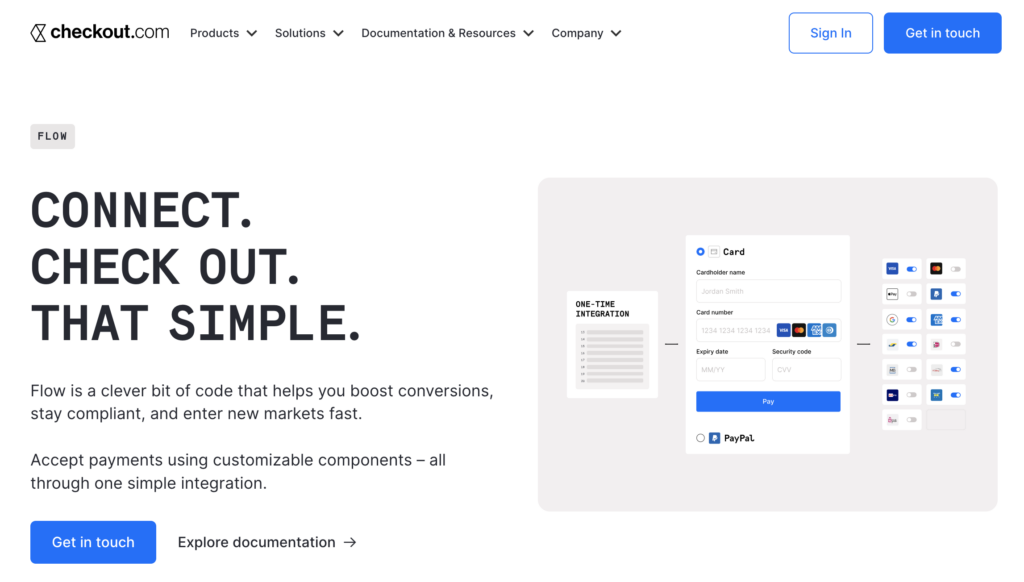

Checkout.com Launches New Product “Flow” For Online Transactions

Checkout.com just released its new product—Flow.

Built for global enterprises, Flow lets businesses create custom building blocks that present the right payment methods to their customers. It allows those businesses to easily enter new markets while maintaining PCI compliance and staying up-to-date with other security standards, like GDPR.

Using a one-time integration, Flow makes it easy for brands to access their preferred payment method, providing options like:

- Apple Pay

- Google Pay

- PayPal

- Sofort

- iDEAL

- Bancontact

- Giropay

- EPS

- Multibanco

- Przelewy24

- KNET

Pax Technology Announces Vendall For Unattended Transactions

Pax is a payment hardware provider. This month, they launched a new product called Vendall for unattended payments—designed to accommodate use cases like:

- EV charging stations

- Car washes

- Laundromats

- Gaming

- Smart coolers

- Air vacs

This new product can replace coin and cash vending or self-service stations with cashless alternatives, including electronic payments, without the need for on-site personnel.

Chase Announces its New RTP Service

Chase Payments just rolled out a new suite of digital products, including the ability for businesses to choose their payment speeds when sending a payment. Of those options, they can choose between:

- Standard ACH

- Same-day ACH

- Real-time payments (RTP)

The ACH and RTP services don’t have any monthly fees, and are assessed as pay-as-you-go services.

Chase is charging $2.50 for standard ACH payments (up to 10 per month), and $2.65 for standard ACH payments above 10 in a month. Same-day ACH and RTP are both billed at 1% of the transaction (with a $25 max per transaction).

New Square Integrations For Restaurants

Square has been making strides in recent years to improve the way it serves businesses in the restaurant space. In doing so, they added new integrations within the Square ecosystem, including:

- SevenRooms

- Restaurant365

- Popmenu

- Olo

- 7shifts

Square also announced new industry partnerships with big names like Performance Foodservice, Illinois Restaurant Association, California Restaurant Association, and the New York State Restaurant Association. Read more here.

Q1 Results Released From Several Major Processors

Three big players in the processing space announced their Q1 results in May. I’ve summarized those highlights below.

Global Payments

- Adjusted net revenue increased 7% (vs. 8% previous quarter)

- POS revenue grew 20%

- Adjusted net revenue forecast for FY2024 is 6% to 7%

- 50% increase in Heartland customers

- Issuer Solutions revenue grew 5% (vs. 6% previous quarter)

Square

- Total revenue up 19% (excluding Bitcoin)

- Translation revenue increased 9%

- US GPV increased 6%

- Cash App revenue up 18% (excluding Bitcoin)

- Expected to deliver $2.16 to $2.18 billion in gross profit for Q2

FIS

- Organic revenue increased by 3%

- Adjusted EBITDA margin 39.5%

- Forecasted revenue growth of 4.5% to 5.5% through 2026

- Banking solutions adjusted revenue growth 3% to 3.5%

- 100 bps increase in new sales margin in past 12 months in banking strategy

Noteworthy Partnerships in the Payments Space

- Visa is partnering with Worldline to issue virtual cards in the online travel space.

- NCR Voyix is partnering with Aloha Kiosk for restaurant self-service solutions.

- Mastercard is partnering with PrestaShop to introduce click-to-pay for ecommerce customers in Europe.

- Fiserv and Tilli are partnering for CTA alerts and notifications for personalized billing via email, text, IVR, and outbound calling.

- Checkout.com and Mastercard are collaborating in an effort to provide clients with access to Mastercard’s wholesale programs, virtual cards, and B2B payments.

- Marqueta is expanding its partnership with UberEats to provide payment solutions in eight additional markets—Canada, Australia, Mexico, Brazil, Colombia, Peru, Chile and Costa Rica.

- American Express and Worldpay signed a new agreement to make it easier for small businesses to accept Amex cards, including a single statement to reconcile statements and a single settlement process.

Subscribe to our newsletter to get all the biggest payment news delivered straight to your inbox. In case you missed it, here’s a link to last month’s stories.

0 Comments