October is always a busy month for interchange adjustments, and this year was no exception. The card networks have implemented key changes this month and announced additional phases rolling into 2026.

Any merchant that accepts corporate cards, B2B payments, or PIN debit transactions needs to pay attention to these updates as they’ll affect how much you’re paying.

Here’s what you need to know.

Visa October 2025 Interchange Updates

Some of the biggest changes from this month came from Visa, particularly related to commercial card processing. If you accept corporate cards or B2B payments, these updates will directly impact your bottom line.

Phase II of Visa’s New Commercial Enhanced Data Program (CEDP)

Visa’s Commercial Enhanced Data Program was initially launched back in April 2025. And merchants have been paying a 0.05% participation fee on all eligible transactions since the roll out.

But effective October 17, 2025, only verified merchants will be eligible for reduced CEDP rates on qualifying small business and commercial transactions submitted with enhanced data.

For more information on Visa’s CEDP rates, data requirements, and understanding your verification status, check out our complete Visa CEDP guide here.

Visa’s Global Business-to-Business Virtual Payments Qualification

As of October 18 2025, Visa has removed the travel merchant category code limitations for its Global B2B Virtual Payments program.

Previously, certain MCC codes had restrictions on this product. But now all transactions made using Visa Global B2B Virtual Payments will be eligible for this interchange program, which ultimately gives merchants more flexibility in where and how they accept these payments.

So if your business uses virtual card numbers for B2B transactions, this considerably expands your options.

New Visa Commercial Choice Programs

Visa also expanded its Commercial Choice interchange program on October 18th.

These programs typically offer optimized rates for specific transactions. So if you process a high volume of commercial transactions, it’s worth reviewing the updated interchange matrix to see if there are new opportunities available to lower your effective rate.

Mastercard October 2025 Interchange Updates

Mastercard rolled out several changes in October that are important for merchants to keep an eye on, especially if you process international cards or high volumes of B2B transactions.

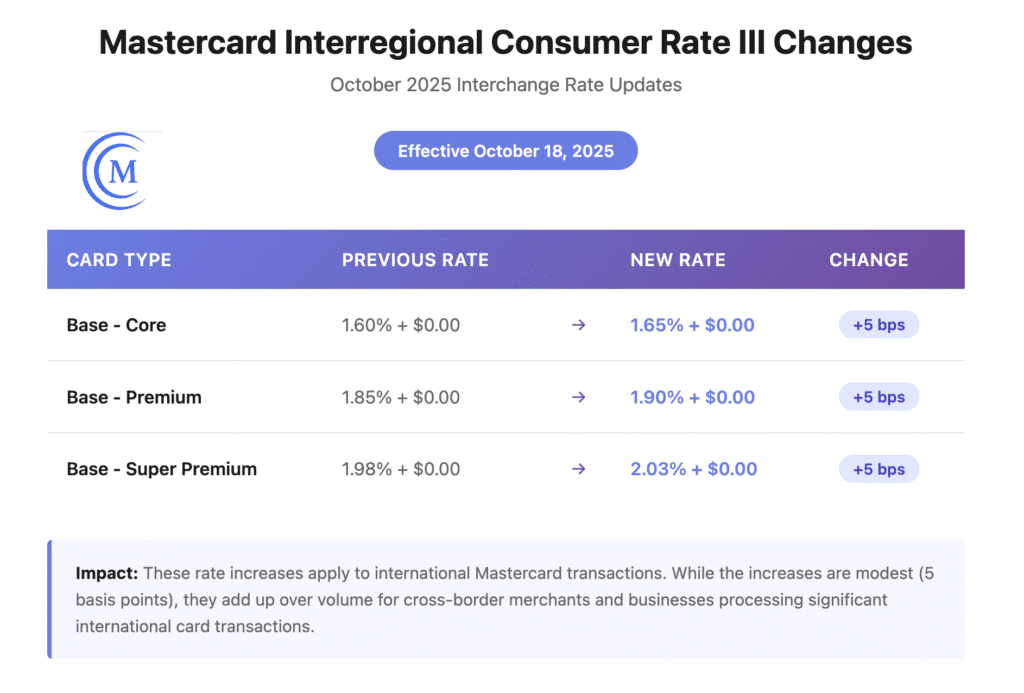

Mastercard Increase on Interregional Consumer Rate III Interchange

Businesses processing international Mastercard transactions will be subject to a 5 basis point increase on the following card types, effective October 18, 2025:

The five 0.05% increase applies to all Base Core, Base Premium, and Base Super Premium Mastercard Consumer Rate III interregional card transactions.

Refund Authorization Changes to Mastercard Transactions

As of October 1, 2025, Mastercard now requires refund transaction authorizations for most card-not-present environments.

This means that when you issue a refund, it must be authorized through the network (similar to an authorization on a sale), which allows cardholders to see pending refunds in real time.

A few categories are exempt from the new online authorization requirement, including:

- Airlines (MCC codes 3000 through 3350 and 4511)

- Passenger railways (MCC code 4112)

- Commercial card accounts issued with select product codes

- Contactless aggregated transit transaction merchants

But the majority of ecommerce and retail MCCs will need to comply with this. In some cases, you may need updated software or new terminals to properly process refund authorizations under Mastercard’s new guidelines.

Mastercard One Credential Product Launch

Mastercard launched its new One Credential product on October 18th, offering cardholders the ability to select from multiple payment methods using a single credential.

This product was originally announced in a joint development effort with PayPal back in June 2025. At the time, the launch date wasn’t official. But it makes sense that Mastercard rolled it out simultaneously with its fall 2025 interchange updates.

Cardholders can default to debit for certain transaction aunts and credit for others, all with the same card. Prepaid and installment payments are also available within this single credential.

While this is primarily a customer-facing feature, merchants may start seeing more complex routing behavior from what appears to be a single card. From the processing perspective, each transaction will still be routed through the appropriate interchange category based on the actual payment method selected by the cardholder.

New Mastercard Commercial B2B Program Codes

Mastercard added new product codes for its Commercial Business-to-Business interchange program on October 18, 2025.

NYCE PIN Debit Changes (October 2025)

The NYCE PIN debit network has made several important changes that impact pass-through fees for PIN debit transactions, effective October 1, 2025.

Elimination of NYCE Standard vs. Premier Rate Difference

NYCE eliminated the rate difference between NYCE Standard and NYCE Premier issuer card programs. Both programs now follow the same fee structure, simplifying the rate schedule for merchants.

Non-Regulated Debit Interchange Rate Increase

Non-regulated debit interchange rates are being increased for the following categories:

- NYCE Standard Petroleum

- NYCE Standard Supermarket

- NYCE Standard All Other MCCs

- NYCE Premier Issuer Supermarket

- NYCE Premier ISsuer All Other MCCs

Note: The regulated debit interchange rates of 0.05% + $0.21 per transaction (and 0.05% + $0.22 with fraud adjustment) will remain the same. The changes above only apply to non-regulated PIN debit transactions processed through NYCE.

Other Noteworthy Changes from 2025

To help put the Fall 2025 changes into perspective, here’s a quick recap of other updates that went into effect earlier this year:

- Visa initially rolled out its CEDP program in April 2025, introducing the framework and effectively putting an end to automatic interchange optimization.

- As of June 18, 2025, Mastercard no longer permits undefined authorization requests for dual authorizations.

- On July 1, 2025, Mastercard began charging 0.25% ($0.04 minimum) on its Transaction Processing Excellence Fee, applying to all approved authorizations submitted as undefined.

Upcoming Interchange Updates to Keep an Eye On

While the biggest changes for 2025 are already live, both Visa and Mastercard have additional changes scheduled for the months ahead:

- Visa is retiring Level 2 rates on CEDP transactions in April 2026, meaning all verified merchants will need to submit valid Level 3 data to qualify.

- Mastercard is also expanding its Merchant Advice Code Fee in January 2026, charging $0.03 on all declined CNP transactions using MAC 03 or 21 codes (not just identical amount retries).

- Effective January 2026, Mastercard is increasing its Transaction Processing Excellence Fee of 0.30% ($0.05 minimum) on undefined authorizations.

Mastercard also announced that the Transaction Processing Excellence Fee will increase to 0.35% ($0.10 minimum) the following year, in January 2027.

Why This Matters For Businesses

While card brand fees and changes at the interchange level are completely out of your hands, you still need to keep pace with these updates to understand how your bottom line is being impacted.

Doing nothing can be an expensive mistake, especially if you’re processing Level 2 and Level 3 data on commercial Visa transactions. You need to verify your CEDP status ASAP to ensure you’re eligible for discounted rates. This is the single biggest change to the industry in October 2025.

You should also be planning ahead for the April 2026 sunset of Level 2 data and ensure you’re set up to properly capture and submit high quality Level 3 data on those particular transactions.

Need Help Navigating These Changes?

If you’re unsure how these updates will impact your specific business, reach out to our team here at MCC for help. We’ll audit your statements and identify exactly where you stand based on these changes.

Plus, we’ll look for other hidden fees, inflated rates, and bogus markups that your processor might be passing along to your account.

Contact us today for a free consultation to save money on credit card processing without switching providers.