If you’ve spotted a Global VPN Fee on your merchant statement, you have a good reason to question it. This is a junk fee from your processor that you should try to eliminate from your account.

While the fee itself may not seem expensive at first glance, it’s a red flag that your processor is likely charging you other bogus fees that could be costing you thousands.

What is the Global VPN Fee on Merchant Processing Statements?

The Global VPN Fee is an extra charge imposed by Global Payments. It typically appears on statements alongside transactions marked as “VPN W/AVS” (which can be a legitimate charge).

Address Verification Service (AVS) fees are tied to fraud prevention tools that match the customer’s billing address to the address on file with the credit card company. The card networks charge a very minimal fee for this service.

But the Global VPN Fee is a way for Global Payments to add another markup on top of the actual cost of AVS transactions. They’re hoping you’ll see it on your statement and assume it’s a necessary charge.

How Much Does the Global VPN Fee Cost?

Like many of the random fees invented by Global Payments, the Global VPN Fee is totally subjective and the rate itself varies widely from merchant to merchant with no consistency whatsoever.

We’ve seen this fee billed at:

- $0.10 per transaction

- $0.25 per transaction

- $1.12 per transaction

That’s right. One business is paying $0.10 while another business is paying over 11x more for the exact same fee.

Real Examples of the Global VPN Fee

Let’s look closer at real merchant statements being charged a Global VPN Fee. This can help you identify the fee on your own statements while also highlighting how subjective the fee is.

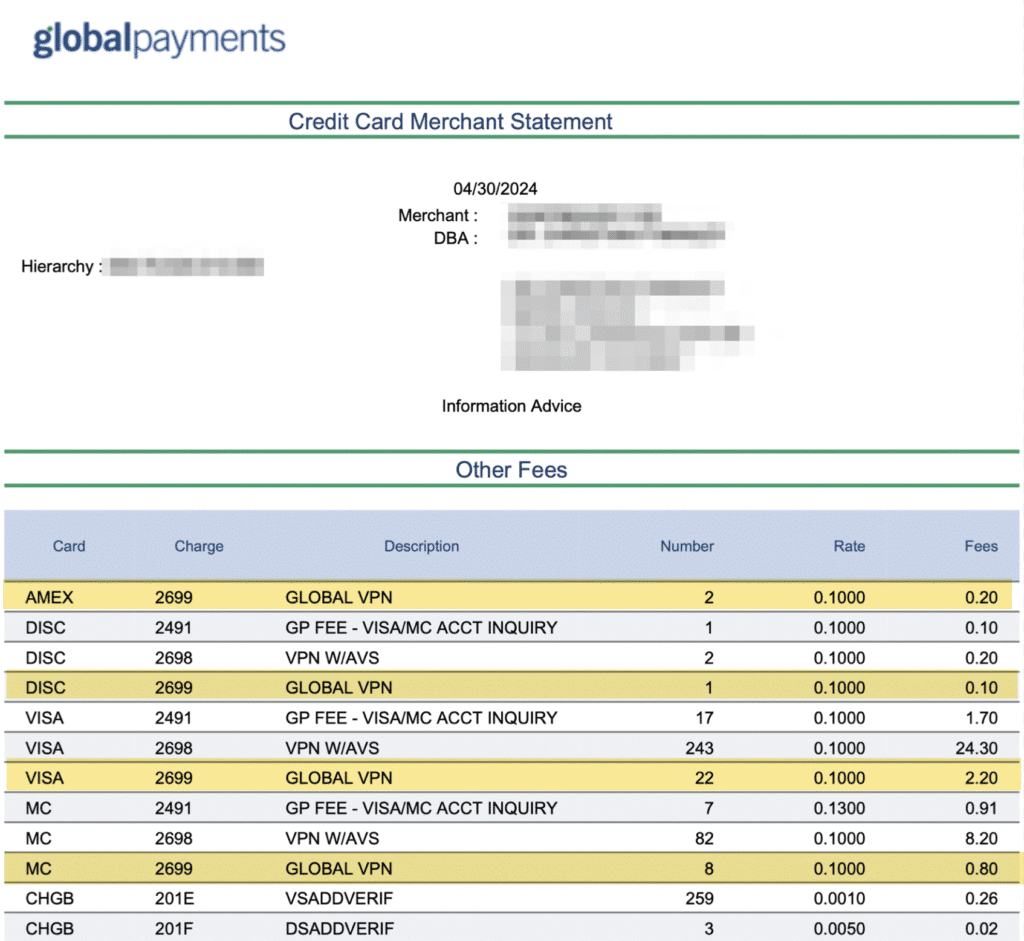

Example 1: $0.10 Per Transaction

This is one of the lowest rates we’ve seen for the Global VPN Fee:

As you can see, it’s directly below the VPN W/AVS fee for each card network, and the rate is the same for both charges.

While $0.10 may not sound like much, it’s important to keep in mind that the card networks typically charge around $0.01 per transaction for address verification services. So in this case, it looks like Global is inflating the card network’s AVS Fee and then charging a separate Global VPN Fee for a phantom service on a select number of transactions.

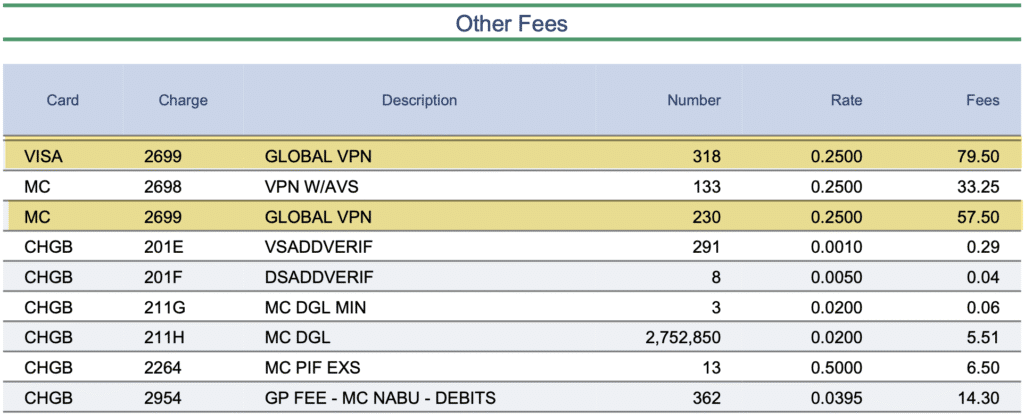

Example 2: $0.25 Per Transaction

Now let’s look at a merchant being charged $0.25 per transaction for the Global VPN Fee (2.5x more than the first example for the exact same service).

It’s the same story here as the first statement.

Global Payments is charging a Global VPN Fee for all four card networks (Discover and Amex are on the previous page), alongside VPN W/AVS transactions billed at the same rate.

At $0.25 per transaction, that’s an extra $250 per 1,000 transactions that are subject to this fee. If you have 1,000 of these triggered in a month, that’s an extra $3,000 annually for this one junk fee.

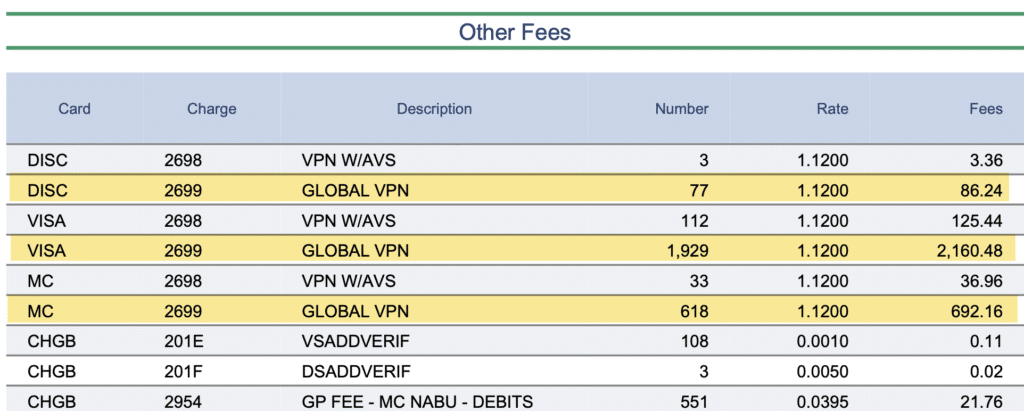

Example 3: $1.12 Per Transaction (Absurdly High)

This third example is almost hard to believe. This merchant was charged $1.12 per transaction for the Global VPN Fee.

It’s the same merchant we talked about in our article exposing Global Payments outrageous fees (they were paying over $10,000 per month in Settlement Funding Fees).

When Global finds a business they can take advantage of, apparently they don’t hold back.

At 1,000 transactions per month, this fee would cost $13,440 annually, which is more than $12,000 per year in additional costs compared to the business in Example 1 — for the exact same service.

This particular merchant has over 2,500 Global VPN charges in a single month, which translates to over $33,500+ per year in this fee alone.

The fact that Global would charge one merchant $0.10 and another $1.12 for identical services proves that this pricing is totally arbitrary.

Is the Global VPN Fee Legit or Junk?

The Global VPN Fee is a junk fee.

While the AVS itself is a legitimate fraud prevention tool, the fees charged by the card networks are minimal (just pennies per transaction). Global Payments has taken a real service and used it as an excuse to add inflated markups that go straight into their pocket.

The inconsistent pricing is the first red flag of a junk fee. If this were a legitimate pass-through fee, every merchant would be charged the same thing.

Instead, Global charges whatever they think they can get away with. Testing different price points for different merchants.

And the fact that the transaction counts don’t always align with the VPN W/AVS is also questionable. It’s unclear what you’re being charged for here.

Why the Global VPN Fee is Inflated and Deceptive

Look, I recognize that I’m particularly critical of Global Payments for their billing tactics. If they want to charge you an extra $0.01 or $0.02 per transaction as their own markup for some AVS or VPN-related services, that’s fine. Processors need to make money.

But that’s not what they’re doing. These fees are not reasonable.

Mastercard’s AVS Fee is $0.01 for card-not-present transactions and $0.005 for card-present transactions. Visa eliminated its standalone AVS fee in October 2023 (it was previously just $0.001 per transaction) and rolled it into their Digital Commerce Service Fee.

So when Global charges you $0.10 for a “VPN W/AVS” and then another $0.10 for a Global VPN Fee, they’re marking up the actual AVS cost by 10-20 times.

And when they charge $0.25 or $1.12, the markup becomes even more absurd.

Who Charges the Global VPN Fee?

We’ve found the Global VPN Fee on statements from Global Payments, as well as its various subsidiaries, including:

- Global Payments Integrated

- TSYS

- Heartland Payment Systems

- OpenEdge

- EVO Payments

Since Global has acquired numerous processors over the years, this fee can show up across any of those brands. So if you’re using any of these providers, you need to keep an eye out for this fee.

Regardless of the processor, it almost always appears as “Global VPN” on your statement.

Why the Global VPN Fee is a Major Red Flag

The biggest problem with the Global VPN Fee is that it’s likely just the tip of the iceberg.

The merchant we found paying a $1.12 per transaction Global VPN Fee. They were also paying a $10k Settlement Funding Fee and a $6k Risk Assessment Fee — all in the same month.

That extra $16k in junk fees makes the $1.12 Global VPN Fee look like peanuts. But they’re all excessive charges.

This is why it’s so important to scrutinize even smaller charges that don’t seem right. If your processor is willing to add one bogus charge to your account, there’s a high probability that they’re willing to overcharge you elsewhere.

And when the processor in question is Global Payments, that’s pretty much always going to be the case. We’ve even caught Global padding assessment fees, which is one of the most unethical and deceptive billing tactics that a processor can apply.

What to do if You Find a Global VPN Fee on Your Statement

If you find a Global VPN Fee on your statement, you need to take immediate action.

First, review your last several months of statements to see how long you’ve been charged this fee and calculate your total overpayments. Then contact Global Payments directly and demand the fee be removed and refunded.

Global will likely push back and try to justify the charge. Don’t accept their excuses. The fee is inflated and negotiable, and you have every right to challenge it.

If they’re unwilling to work with you, continue escalating the situation. Call different reps, send emails to multiple departments, and make it clear that you’re not willing to be overcharged.

You can also work with our team here at MCC for assistance. We’ve successfully negotiated these types of fees for our clients, and we know exactly how to deal with Global Payments in these situations.

In addition to the Global VPN Fee, we’ll also identify any other overcharges on your account and get those fixed as well. Best of all, you can keep your processor and everything else in place (you’ll just pay less).

Get a free audit to find out how much you can save today.