If you’re using Global Payments or OpenEdge as your payment processor, you’ve likely noticed lots of questionable charges and line items on your monthly statement.

The OpenEdge Check Fee is one of those charges that we often get lots of questions about (and for good reasons).

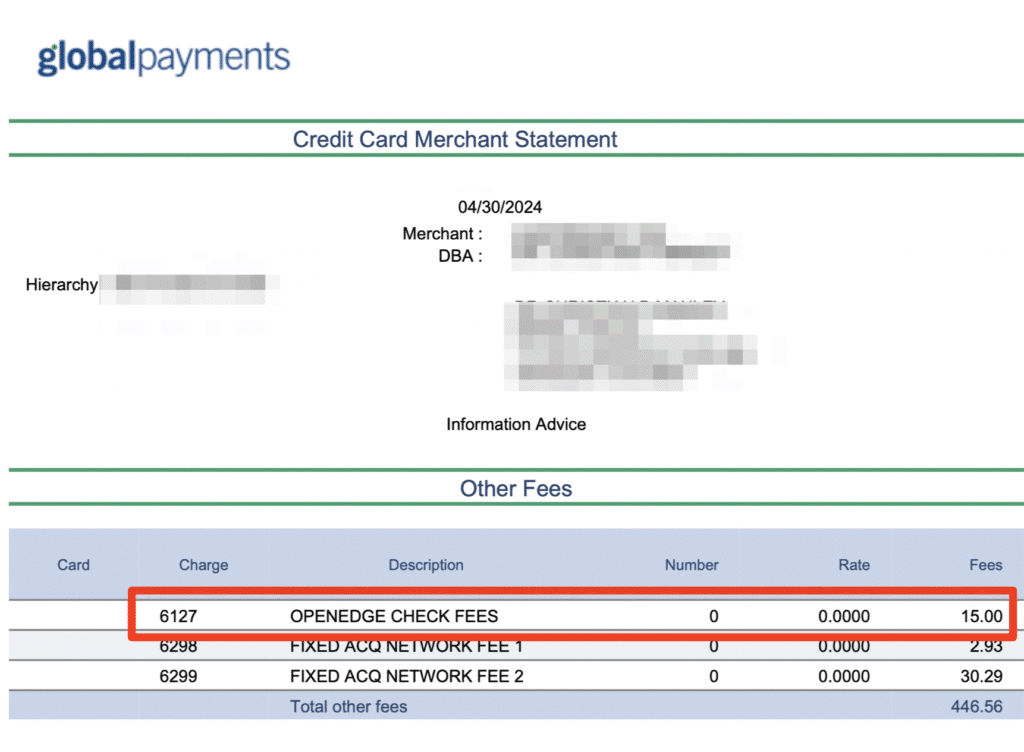

This fee appears as a flat monthly rate with no per-transaction breakdown, and the amount can vary widely from one merchant to another and even from one month to the next.

Is the fee legit? What exactly are you being charged for? Read on to find out.

What Are OpenEdge Check Fees?

OpenEdge Check Fees (code 6127) are monthly charges assessed by Global Payments (formerly OpenEdge) and its subsidiaries for processing check-to-ACH conversions and electronic check payments.

These fees are designed to cover the cost of converting paper checks into digital transactions. But the fee amount is completely arbitrary and inconsistent.

Here’s one of our clients paying a $15 OpenEdge Check Fee:

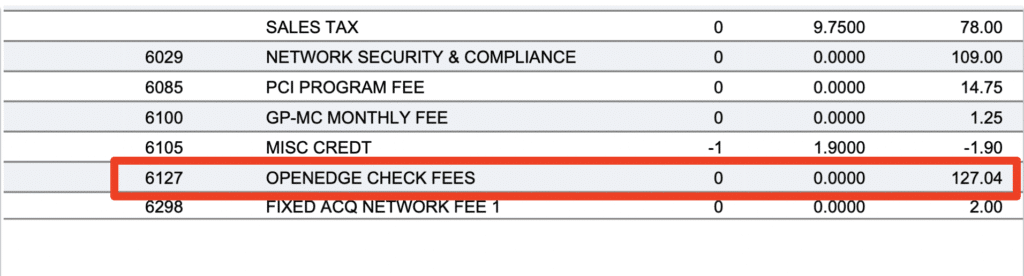

And another client paying $127.04 for the same fee:

Why such a discrepancy?

There’s no clear rate structure or explanation for the difference. There’s no transaction amount, and no detailed breakdown showing what you’re actually paying for.

The Problem With OpenEdge Check Fees

While can’t easily classify this as a pure junk fee (since there’s an actual service being provided), the OpenEdge Check Fee is absolutely an inflated processor markup that can be negotiated.

It’s a fee for the service and not always transaction-based.

Consider these red flags:

- There’s no transparency.

- Your statement just shows a flat fee with zero details about transaction volume or costs.

- Massive inconsistency between similar businesses paying drastically different amounts.

- The processor markup is hidden, and you’re likely paying at least 2-3x the actual cost of the service.

If you’re being charged $100+ per month for a mysterious “check fee” with no breakdown of how that number was being calculated, you’re almost certainly overpaying.

You can do a quick, manual spot check to compare how many checks you need converted to digital transactions. And if there aren’t many, the fees shouldn’t be high.

A Warning Sign of Bigger Issues

It may seem like the OpenEdge Check Fees aren’t anything to lose sleep over. If it’s “sort of legit” and only costs you $100, is it really worth your time trying to get the rate reduced?

Absolutely.

And the OpenEdge Check Fee is often just the tip of the iceberg. It stands out to you because of the way it’s charged. But if Global/OpenEdge is willing to overcharge you on OpenEdge Check Fees, they are almost certainly guaranteed to overcharge you elsewhere on your statement.

Global Payments and OpenEdge are notorious for adding as many junk fees as possible to merchant accounts, including:

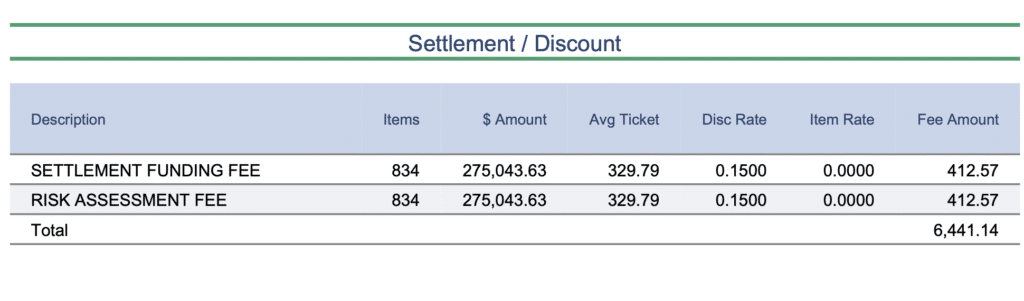

- Settlement Funding Fees

- Risk Assessment Fees

- Analytics Reputation Management Fees

- Network Security & Compliance Fees

- Equipment Rental Charges

Combined, this is likely costing you thousands of dollars.

For our client who paid a $15 OpenEdge Check Fee in the example above, they also paid over $800 in Settlement Funding and Risk Assessment Fees on the same statement.

As for the client who paid $127.04 in OpenEdge Check Fees, they’re also paying over $300 per month in equipment rentals:

For a terminal that likely costs $600 max to just purchase outright.

In addition to adding junk fees and high processor markups to merchant accounts, we’ve caught Global Payments red-handed in multiple instances in other unethical billing practices, like assessment padding.

So don’t assume that a slightly-inflated OpenEdge Check Fee is the only problem with your account.

Read More: Global Payments Outrageous Fees Exposed

Can You Negotiate OpenEdge Check Fees?

Yes, OpenEdge Check Fees are a negotiable processor fee that should be addressed.

We’ve successfully negotiated OpenEdge check fees down by about 50% for our clients. So a $120 monthly fee can typically be reduced to $60 or less with proper negotiation.

This just goes to show how much Global is overcharging you here if they’re willing to just cut a fee in half, and it still leaves them with plenty of margin (trust me, they are still making a solid profit on this fee — even if the rate is reduced).

You might be thinking, “Is it really worth my time to save $60 per month?”

It’s a fair question. But it’s much more than $60 per month. If you’re also able to negotiate the $400 Risk Assessment Fee, $400 Settlement Funding Fee, and $300 equipment rentals, we’re now eclipsing $1,000 in overcharges in just a single month.

At scale, you can easily be saving $10,000+ per year here.

What to Do if You See an OpenEdge Check Fee on Your Statement

If the OpenEdge check fee appears on your merchant statement, do this:

- Check the Amount: Is it over $50 per month? That’s a red flag that you’re being overcharged.

- Look for Patterns: Does the fee fluctuate based on your transaction volume or is completely fixed each month?

- Audit Your Full Statement: Look for other junk fees on your account, anything that doesn’t quite look right, or charges that don’t obviously correspond to a particular transaction or service.

- Negotiate: Using the information at your disposal, contact Global directly and push back to get the fee reduced. If you can get the fee cut by 50% then you’ve done a solid job.

Identifying an OpenEdge Check Fee on your monthly merchant account statement is already a positive step in the right direction because it means you’re actually looking at your charges.

Lots of merchants overlook this fee because there are so many line items and pages to review, that they just quickly glance at them and move on (that’s what Global is hoping for).

Get a Free Statement Analysis

Unfortunately, the average merchant may have a difficult time negotiating with such a powerhouse like Global Payments.

If you ask them to lower your OpenEdge Check Fees, there’s a high probability they’ll flat-out say “no” or that you’re “already getting the best possible deal.”

Here at MCC, we know that those are bold-faced lies because we’ve negotiated with Global Payments hundreds of times on behalf of our clients. And we know that they’re willing to cut the OpenEdge Check Fee by about 50%.

We’ll also be able to identify other fees on your account that are negotiable, and which fees are completely junk and should be removed entirely.

The best part about our service is that we only get paid if you save money. So there’s zero risk in having us take a look.

If you’re seeing OpenEdge Check Fees on your statement, there’s a chance you’re leaving thousands of dollars on the table every month. And our team can fix that.

Get a free audit to find out how much you can save today.

FAQs

What is charge code 6127 on my Global Payments statement?

Global Payments charge code 6127 is a line item descriptor for OpenEdge Check Fees, which is a monthly processing fee tied to ACH payments and electronic checks processed through the OpenEdge platform.

Why are OpenEdge Check Fees so high?

OpenEdge Check Fees vary widely because they are essentially arbitrary processor markups. Global Payments sets these fees based on what they think they can get away with rather than the actual costs associated with providing a service.

Can OpenEdge Check Fees be removed from my account?

Unlike pure junk fees, OpenEdge Check Fees are related to an actual service (check processing). So while they can’t be removed from your account entirely, you can typically negotiate them down by 50% or more.

Is Global Payments the same as OpenEdge?

OpenEdge is a subsidiary of Global Payments. If you were using OpenEdge prior to the merger, Global is now your parent company and your statements likely have the Global logo. Even other subsidiaries of Global Payments onboard merchants to the OpenEdge software, so OpenEdge Check Fees can appear on any of these accounts.

How do I know if I’m being overcharged by Global Payments?

If you see miscellaneous charges like OpenEdge Check Fees, Network Security & Compliance Fees, Analytics Reputation Management Fees, Risk Assessment Fees, and other random charges on your account, it’s a sign that you’re being overcharged by Global Payments. You can have an expert merchant consultant review your statements to know for sure.