The credit card processing industry is unique in the sense that so many businesses have no idea what they’re actually paying for.

Monthly merchant statements group thousands of transactions across hundreds of different line items. Only a small percentage of merchants actually go through each one line-by-line, and even fewer understand what they’re reading.

Your payment processor could make this easier for you. But they don’t. And that decision is 100% intentional.

Why? Payment processors don’t want you to understand your statements.

We’ve all become so used to opaque pricing, hidden fees, and vague reporting. So in the rare instance where we see a truly transparent statement, it’s refreshing but also frustrating because transparency should be the norm for everyone.

Why Payment Processors Benefit From Confusion

At the end of the day, your credit card processor just wants to make as much money as possible. By obscuring your statements and making them difficult to read, it means your processor can:

- Add extra fees that will likely go unnoticed.

- Bury markups alongside legitimate interchange fees and assessments.

- Make it look like you’re paying less than you actually are.

- Increase your rates without you realizing it.

- Reduce the chances that you push back against anything.

How can you call and complain about a bogus charge on your statement if you can’t spot it in the first place?

The trickiest part here is that 90-95% of the fees on your statement are legitimate. So finding the garbage fees amongst the rest is literally like searching for a needle in a haystack. Especially when the names of the fees are intentionally designed to make you think they’re necessary.

What’s crazy is that basically every single processor on the market does this.

And they could absolutely make things easier on you if they wanted to. Some of the statements are laughably confusing.

These are massive companies that process trillions of dollars across billions of transactions. But you’re telling me they can’t put together a legible statement that’s easy to understand?

What True Transparency Actually Looks Like

Anyone should be able to look at a merchant statement, and within 30 seconds determine:

- Exactly how much they paid in total processing fees.

- How much of that was mandatory interchange fees, assessments, and network fees.

- How much money went directly to their processor.

I work with really smart business owners who have fancy degrees and run multi-million dollar operations. But they can’t find these three pieces of information on their merchant statements because their processors intentionally make it near impossible.

The information is all there. It’s just not transparent.

Here’s how every merchant statement should be presented:

- All processor markups are clearly separated from network fees.

- You know exactly what you’re paying per transaction.

- There’s an itemized breakdown of all interchange fees and assessments.

- Total columns accurately reflect your true processing costs.

- Everything for the current billing period is shown on the same statement.

But it’s extremely rare for all of these things to happen. It’s a bit shocking when you think about it because it’s not like we’re asking for anything crazy.

And did you notice that I didn’t say anything about bogus fees or inflated rates?

In terms of transparency, your processor can charge you as much as they want and add dozens of miscellaneous charges that are pure markups. I just want them to put those fees in their own category.

Transparent vs. Non-Transparent Comparison and Examples

The vast majority of people reading this right now are going to be shocked when they see a transparent statement because it’s surprisingly simple. Your processor can do this, they’re just choosing not to.

Let’s look at real examples of each so you can see the difference.

Transparent Example — Processor Fees Are Completely Separate From Interchange Fees and Network Fees

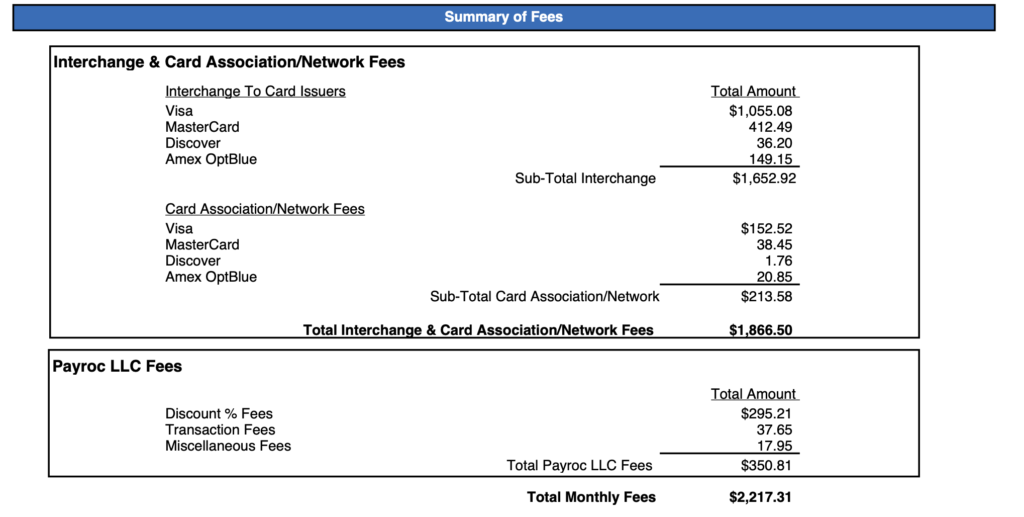

I wish every statement had a summary of fees that looked like this:

Even if you’ve never seen a merchant statement before, I can show you this and you can clearly tell me how much money was paid directly to the processor, and how much went to issuers and card networks in the form of interchange and assessments.

- $1,866.50 in interchange/association fees

- $350.81 in processor markups

- $2,217.31 in total fees

The reason why this information is so important is because only the processor markups are negotiable. It shows how much your processor is actually making on your account.

Non-Transparent Example — Processor Fees Deceptively Hidden in Summary Totals

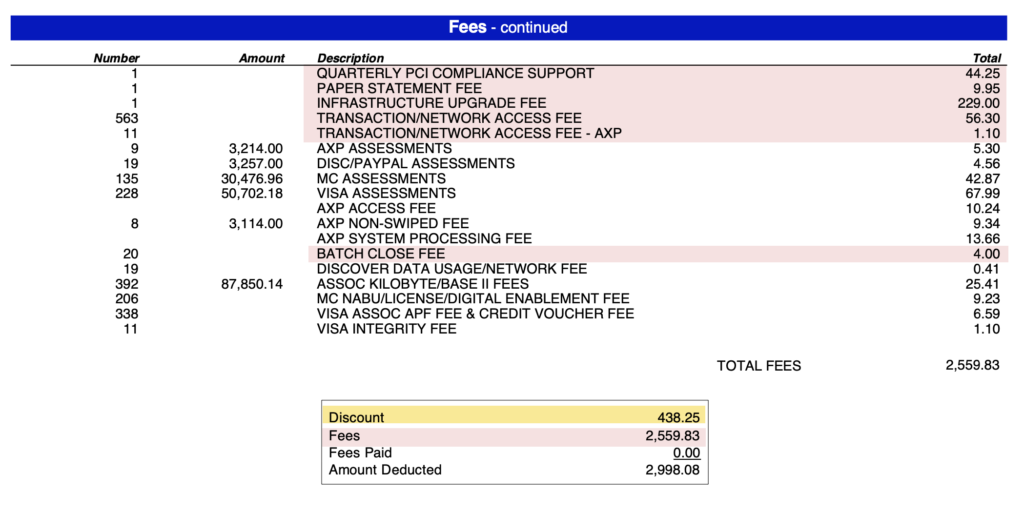

Some processors don’t even include a total of fees by category (like the transparent example from above). But what’s arguably worse than omitting that information is presenting it in a way that’s misleading to merchants.

Here’s what I mean:

At first glance, the summary at the bottom of this statement makes it look like this merchant only paid $438.25 in processor markups.

That’s just the discount rate paid per transaction to the processor.

But other markups are bundled in the “Fees” total, which includes interchange, assessments, card network fees, and additional fees charged by the processor.

Non-Transparent Example — Vague “Other Fees” on Statements

This is another classic way that processors confuse merchants.

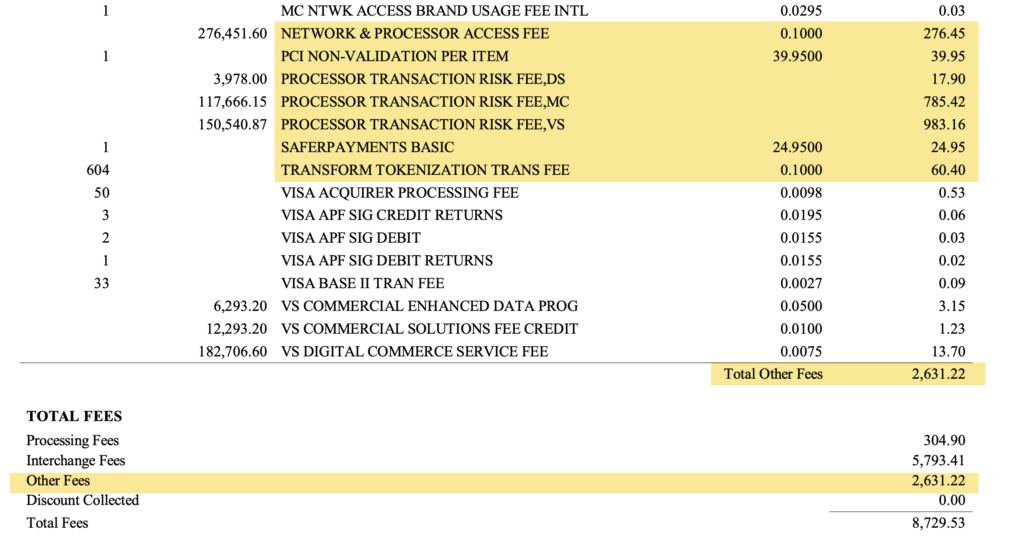

It’s similar to the example above in the sense that the discount rate is separate to make it seem like you’re paying less. But interchange also has its own total, and a new “other fees” category is added:

Again, at first glance here the merchant can easily assume that only $304.90 of the $8,729.53 in total fees is going to their processor.

“Processing Fees” is clearly marked as its own category, and interchange is separate, too.

But what’s that $2,631.22 in Other Fees?

Big surprise. It’s a mix of network fees and extra markups to your processor (some of which I highlighted above).

Over $2,100 of the $2,631 in Other Fees is going to your processor. So why aren’t they included in your processing fees? They’re hoping you don’t catch it and assume the charges are mandatory.

Non-Transparent Example — Deceptively Low Effective Rates

Your effective rate is one of the most important pieces of information when assessing your processing fees because it accounts for your total costs. It’s the fastest way to tell if you’re getting a good deal and one of the best ways to track your rates over time.

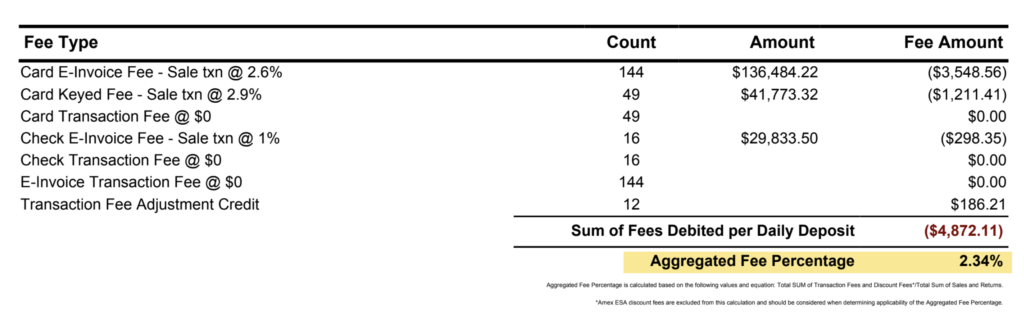

Some statements have misleading information that merchants assume is their effective rate, like this:

If you received a statement like this, it’s reasonable to assume that your effective rate is 2.34% because that’s literally what’s printed below the total.

The problem is that this percentage accounts for electronic checks and ACH payments that are charged substantially less than credit cards. Including those numbers in the total inaccurately skews the effective rate lower.

I’ve seen instances of this where the true effective rate is actually 3x higher than the aggregate amount listed on the statement.

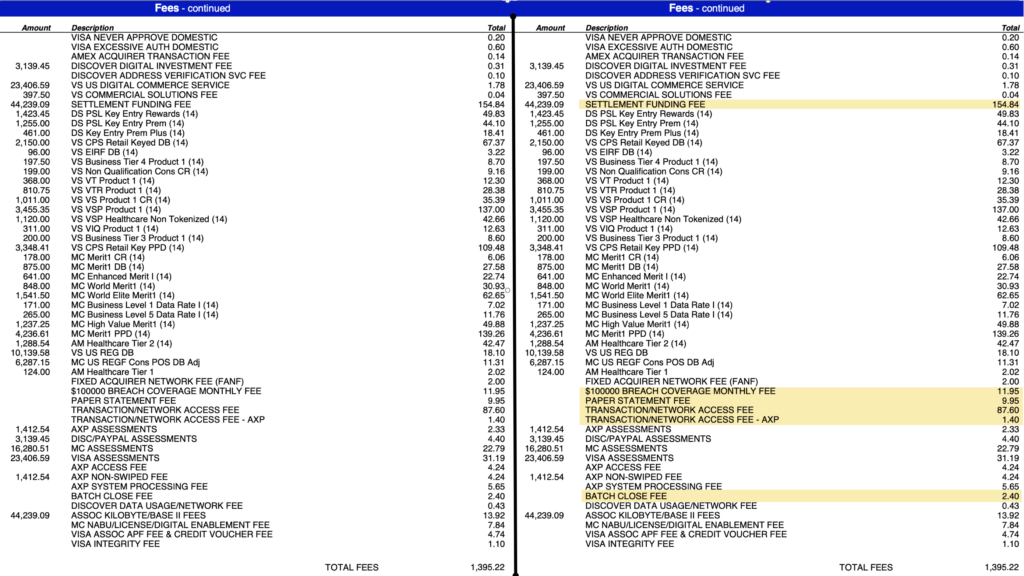

Non-Transparent Example — Processor Markups Buried Amongst Card Network Fees

So many processors randomly itemize interchange fees and assessments without any logical order. You’ll get a handful of Visa interchange rates followed by some Mastercard assessments, then more Visa, Discover sprinkled here and there, etc.

And buried in those hundreds of line items are processor markups.

This is the exact same statement shown twice.

The left side is how it looks normally, and on the right, I highlighted a handful of processor markups.

Over $260 in processor markups are hidden on this page alone, and there are dozens of pages in this statement.

Your processor will tell you that all of their fees are clearly shown on the statement. Yes, those fees are there. But is it clear? Absolutely not.

The only way to spot them is by going through each line, which most merchants aren’t going to do.

How Much Non-Transparency Actually Costs Merchants

As you can see, there are far more examples of non-transparency than there are transparent statements.

This lack of transparency translates to real dollars being sucked from your bottom line. Every single month.

How much? It depends on your volume. But in just those handful of examples from above I highlighted multiple instances of over $2,000+ in processor markups hidden on statements.

So that’s over $20,000 per year from those examples alone.

But I’d argue that the true costs are far higher.

What might be $20,000 this year can easily become $30,000 or $40,000 the following year as processors continue adding new fees and hidden markups to your statements. Plus the existing fees there will continue to increase over time.

At minimum, I’d say that the average business is paying an extra 1% in processing fees every month simply because their statements aren’t transparent.

That’s $10k for every $1 million in card payments you accept.

How to Spot Non-Transparent Pricing

If you’re not sure whether your processor is being transparent or not with their pricing, here are some red flags to look for:

- Pages of itemized line items without clear categories.

- Interchange fees and assessments that aren’t organized by network.

- No clear breakdown of what you’re paying per transaction.

- Summary totals with vague names like “Fees” or “Other Fees.”

- Processor markups spotted alongside card network fees.

These are all signs that your processor isn’t being very transparent with how they’re presenting information to you.

Some processors are more egregious than others. For example, I conducted a statement audit on one provider that requires you to have three months of statements to find what you’re actually paying. The current month’s reporting is based on transactions from two months prior, which is honestly absurd.

Other providers just send you a spreadsheet-style report that feels like it’s decades old, and even more challenging to read.

Final Thoughts

It’s one thing if your processor is going to charge you high rates and bogus fees. But they should at least be transparent about it.

Simply including those fees on your statement is not enough in my opinion.

Not if you have to dig through hundreds of line items to spot them. And not if those fees are deceptively categorized in a way that makes it look like you’re paying less than they actually are.

Most businesses spend about ten seconds looking at their merchant statements for the key numbers. Processors know this. So they intentionally make them challenging to read, and create summary totals that don’t tell the full story.

If your processor is doing this (and there’s a good chance they are), you’re likely overpaying by thousands of dollars every month and don’t even know it.

True transparency is rare in payment processing. But it’s arguably the most valuable yet overlooked factor of getting a fair rate.