As we enter the new year, it’s the perfect opportunity to assess what’s going on in the payment processing industry and take a closer look at what’s trending upward.

I’ve narrowed down the top 11 payment trends that will dominate the payments world in 2026.

1. Contactless Payments

Between mobile payments, NFC cards, digital wallets, and other no-touch pay methods, contactless payments have dominated the way we pay for things in person.

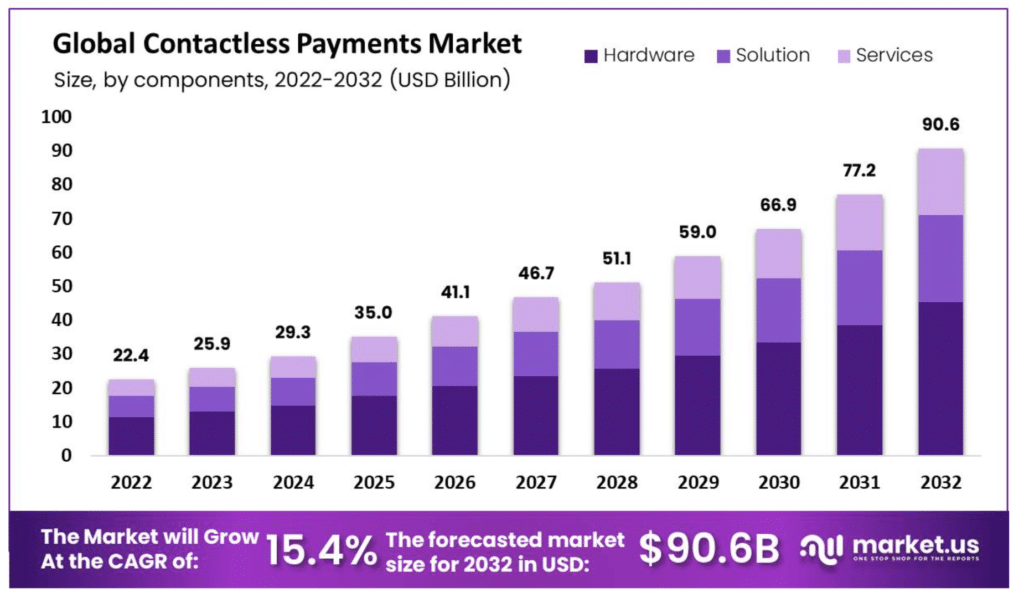

According to Grand View Research, the contactless payment market in the US alone is growing at 18.8% CAGR. Globally, we’re expecting to see a 15.4% CAGR increase in the market for contactless payments—with forecasts expected to surpass $90 billion by 2032.

If you haven’t started accepting contactless payments at your business, check out our guide explaining what you need to know about NFC payments. This will help you keep pace with one of the hottest payment processing trends of the year.

2. “Invisible” Payments

In order to improve the customer experience, merchants have been processing payments behind the scenes. I call these “invisible” payments—although this is not an official terminology.

Merchants are keeping consumer credit cards on file and charging them automatically. This isn’t just for recurring billing or subscriptions, but for all purchases.

For example, when you use a rideshare service like Uber or Lyft, you don’t actually enter your payment details. All you have to do is get in the car. When you buy something from Amazon, your credit card is already saved on file, so you can check out in just a couple of clicks.

The digital checkout process is essentially disappearing. We’re going to see more mobile payments and embedded payment APIs in applications to support this trend going forward.

3. Generational Spending

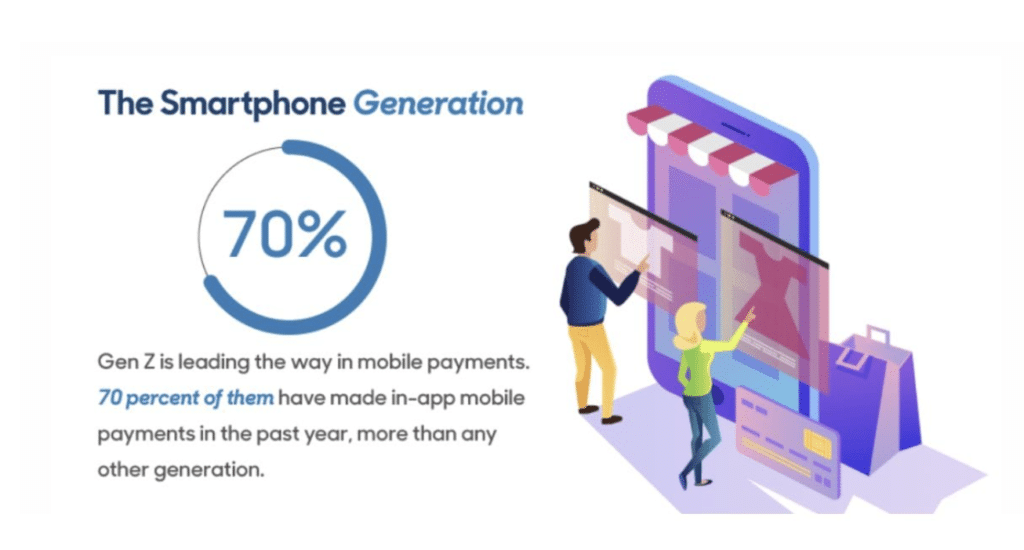

Generation Z—or Gen Z for short—was born between the mid-to-late 1990s and early 2010s. They are the “digital-first” generation, meaning they’ve been using technology from a young age.

According to research by McKinsey & Company, Gen Z accounts for 40% of global consumers. What does this mean? This generation is more likely to accept technology. Their payment preferences differ from previous generations, like Millennials, Gen X, and Boomers.

Gen Z carries very little cash, if any. 70% of Gen Z has made an in-app purchase within the last year.

As Gen Z continues to grow older, enter the job market, and increase their spending power, we’re going to see even more of a shift away from cash in the future.

4. Increased Regulations

New regulations will continue to increase as a way to protect consumers and small businesses alike. I’m referring to legislation like CCPA in California or GDPR and PSD2 in Europe.

Visa has even updated its free trial rules to ensure businesses are being more transparent with customers who sign up for trials. Make sure to keep an eye on these regulations, so your business remains compliant.

5. Cross-Border Ecommerce

Ecommerce makes it possible to sell products and services to people from all over the world. So cross-border ecommerce is on the rise. Merchants are taking advantage of this capability to expand their reach.

The global B2C cross-border ecommerce market is booming—growing at 26.19% CAGR.

This industry is expected to reach 7.9 trillion by 2030, which is up from 785 billion in 2021.

If you’re currently selling online to consumers in different countries, check out our guide on how to increase margins on cross-border sales. This will help you save money on credit card processing fees.

6. Digital Invoicing

The days of paper invoicing and collecting physical checks through the mail are long behind us.

Electronic invoicing, or e-invoicing, has become the modern way to bill customers, especially in the B2B world. Simply put, it’s more convenient for customers to pay with a digital invoice than it is to write a check. By implementing digital invoicing, you’ll also benefit from automation and a quicker receivables collection process.

7. Fraudsters Are Adapting

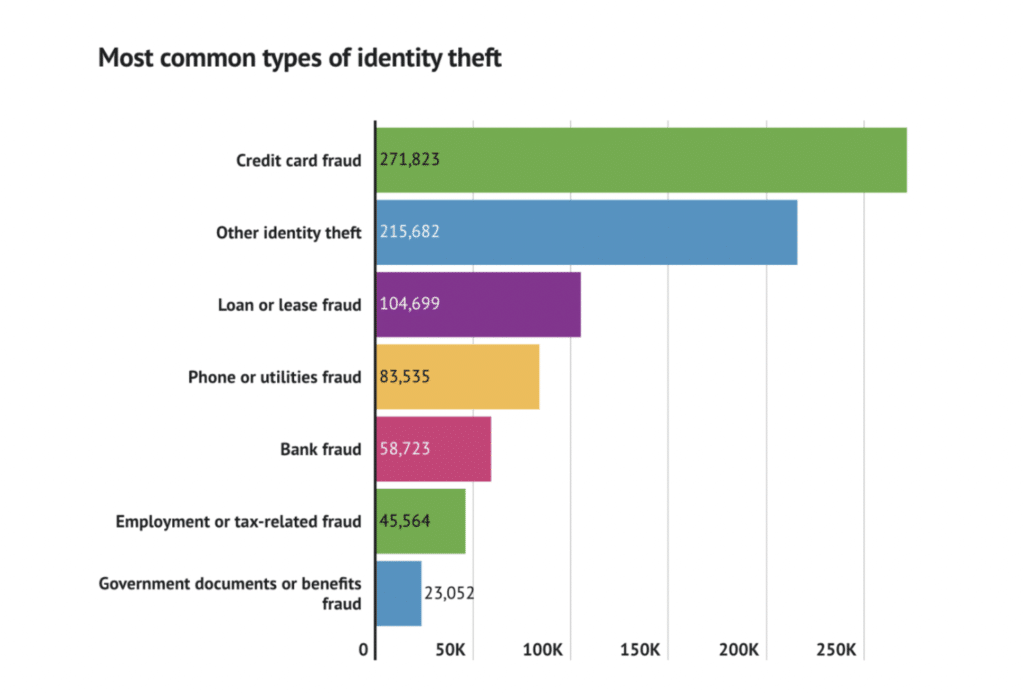

As technology advances, criminals are always looking for new ways to gain an edge. The year isn’t over quite yet, so the data isn’t in. But last year saw 13.5 million cases of identity theft in the US alone. This ranked second globally behind India, which had 27.2 million cases of identity theft.

What’s the most common type of identity theft? Credit card fraud.

As a merchant, you need to be aware of these trends. Make sure you’re doing everything possible to protect yourself and customers from being victims of credit card fraud.

8. Fraud Prevention is More Robust

Piggybacking off of our last point, fraud prevention tactics are also evolving. Merchants are able to use AI technology, address verification, and other fraud scoring methods to combat this epidemic in the payment processing world.

Fraud and chargebacks are expensive for merchants. Aside from the financial burden associated with these transactions, the repercussions can be costly. So make sure you’re taking advantage of the resources at your disposal to prevent fraud.

Additional Reading: Credit Card Fraud Statistics

9. Buy Now Pay Later (BNPL)

We’re definitely seeing in influx of Buy Now Pay Later solutions integrated into purchasing experiences that previously didn’t offer this type of financing.

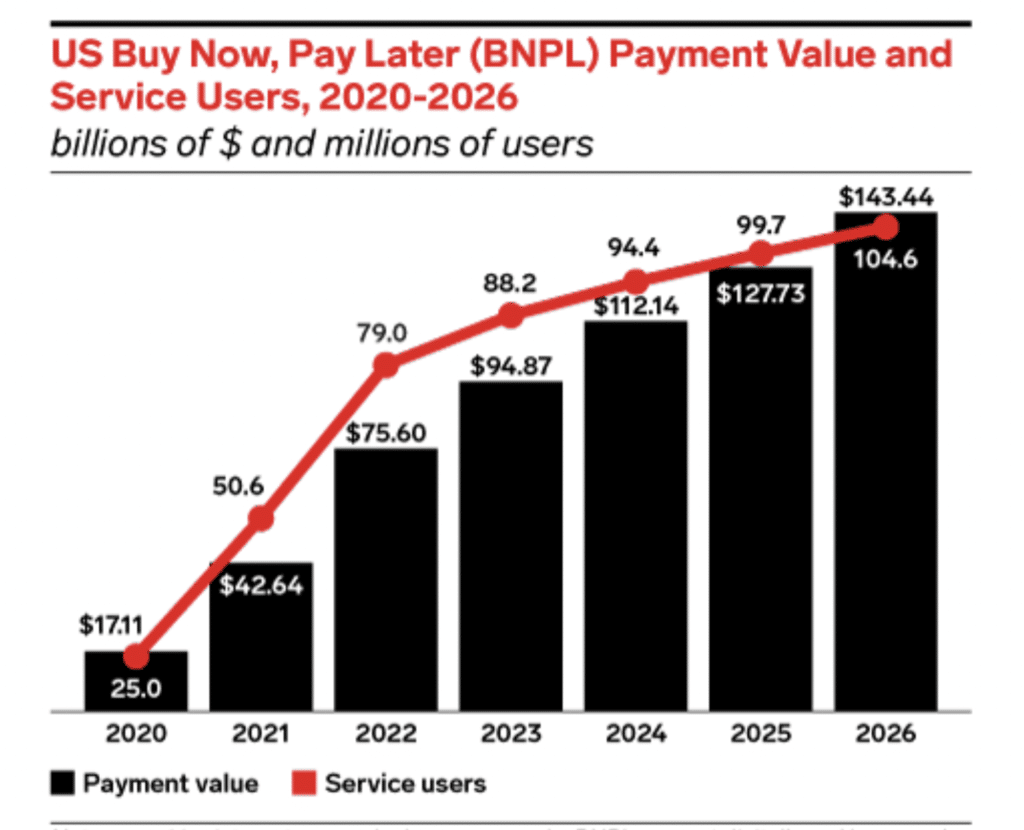

Just look at this trend line, which shows the sharp increase in both BNPL user adoption and transaction value over time.

As you can see from the chart, the US is projected to reach 104.6 million BNPL users for $143.44 billion in payments by 2026.

10. Future-Proof Technology

Outdated technology is no longer acceptable. Whether you’re selling in-person, online, over the phone, or a combination of these methods, everyone must adopt the latest technology in payment processing.

Even small businesses need to upgrade to new systems. Consumers won’t stand for anything less, and you’re putting yourself at risk for non-compliance issues with outdated hardware and software.

11. Simple Payment Stacks

With future-proof technology comes simplicity. So many businesses out there have multiple gateways and acquiring banks.

But today, there are plenty of all-in-one payment solutions. Merchants are able to deal with just one provider, which makes it much easier than juggling multiple accounts. We’ll see these all-in-one payment stacks increase in popularity throughout 2026.

Final Thoughts on Payment Processing Trends

Every business can benefit from keeping an eye on the latest payment processing trends. This information allows you to stay up to date with new updates and technological advancements.

Use this information to learn more about your customers, simplify their experience, and streamline your payment acceptance process.

Make sure to check our blog on a regular basis and subscribe to our monthly newsletter, as we’ll continue providing you with industry news, trends, and updates.