Chargebacks have become somewhat of an epidemic for merchants. Consumers across all industries contact their credit card companies to initiate payment reversals for various reasons.

While some of these chargeback reasons can be justified, many are done so incorrectly.

Unfortunately, even chargebacks that were filed at no fault of your own can be harmful to your business. More often than not, the credit card companies side with their cardholders—leaving merchants out to dry with chargeback fees and other costs associated with each occurrence.

But many false and fraudulent chargebacks can be prevented. In some cases, just making sure the customer understands your policies can help prevent chargebacks. In other instances, you should be taking steps to prevent intentional fraud.

Regardless of your credit card chargeback reasons, these transactions can be expensive for merchants. They result in higher overhead, extra fees, and can even damage relationships with your processor. In extreme cases, you could be barred from accepting certain types of credit cards if you don’t get a handle on your chargebacks.

Fighting chargebacks typically isn’t a winning strategy. So your best option is to prevent them from happening altogether.

1. Leverage Fraud Scoring

The first thing you need to do is develop a fraud scoring method. This practice will allow you to identify certain triggers that signal a potentially fraudulent transaction. Then you can deny that transaction from happening in the first place.

For example, let’s say you have an ecommerce website. If someone tries to buy something that’s 10x higher than your average order value and get it shipped to Somalia, using a US credit card, it’s probably a fraudulent transaction.

2. Use 3D Secure

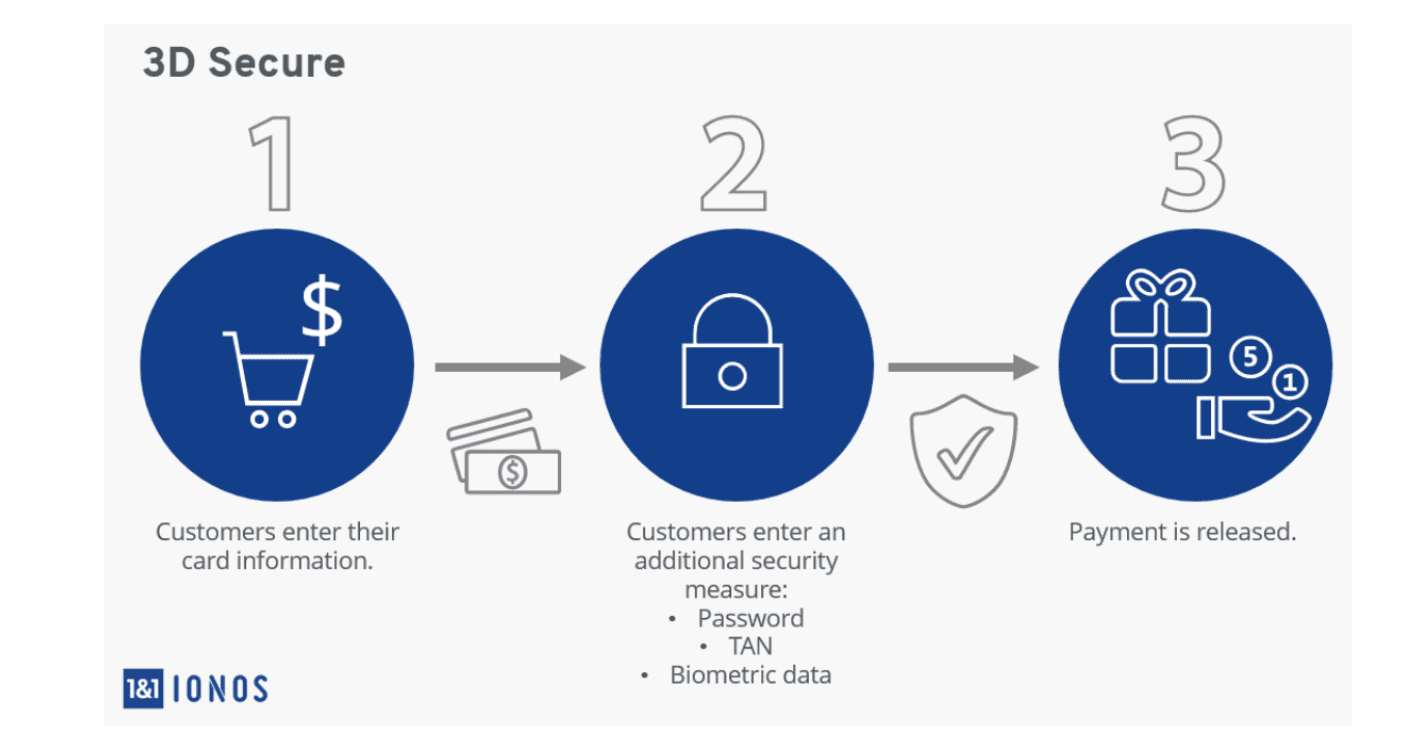

Some of you may or may not know about 3D Secure payments. In short, 3D Secure adds an extra layer of fraud protection to transactions. Customers will have to take an extra step to authenticate the transaction, typically with a password or code associated with the card.

By adding 3D Secure to your purchase process, it’s much more difficult for cardholders to claim that they didn’t approve or authorize the transaction.

3. Get an AVS (Address Verification Service)

Address verification services—better known as AVS—compare the billing information provided by the cardholder against the billing information that’s on-file with the customer’s issuing bank. If there’s a discrepancy between these two addresses, the transaction can be denied for potential fraud.

4. Provide Exceptional Customer Service

It’s common for unhappy customers to file a chargeback as opposed to dealing directly with the business providing the products or services. For example, if you don’t have a customer-friendly return policy, buyers might dispute the charge instead of returning products directly to your business.

But if you can offer customers the support they need to manage returns, defective products, or other potential issues, then they can work out any problems directly with you—as opposed to going through a third party (the credit card company).

5. Always Communicate

This piggybacks off our last point. Communication is a crucial component of success in all aspects of your business.

Let the customer know if a product has shipped. Notify them when it has been delivered. In some cases, consumers could file a chargeback for an ecommerce product that’s en route because it’s taking too long to arrive. This can easily be avoided by enhancing your communication practices.

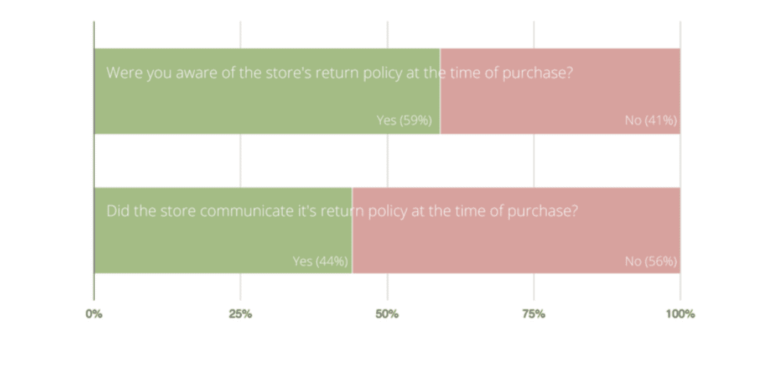

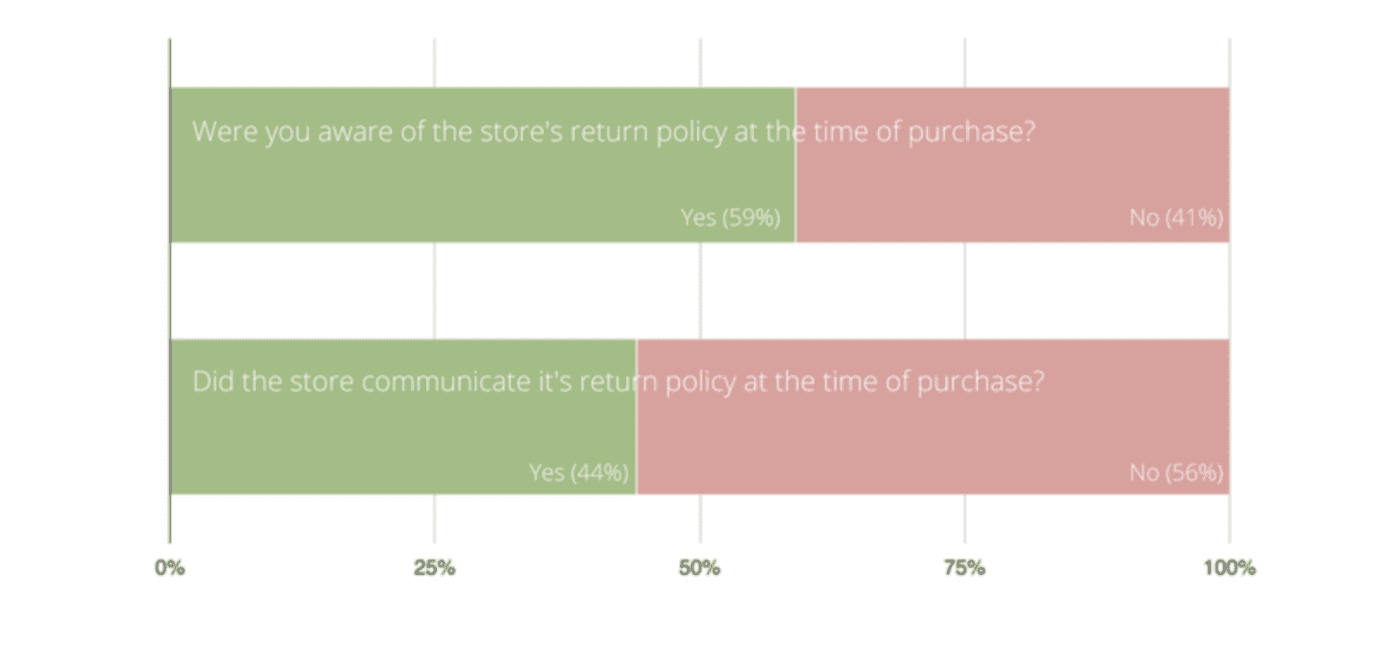

More than half of all customers were not told about a store’s return policy at the time of their purchases.

This lack of communication can lead directly to false and fraudulent chargebacks.

6. Create a Blacklist

There will always be people out there looking to take advantage of certain situations. Some customers know that their credit card company will back them if they file a chargeback.

So if you’ve been burned by friendly fraud once or twice from the same customer, don’t let that happen again. Create a blacklist and ban them from doing business with you moving forward.

7. Confirm Deliveries

Delivery confirmation does more than just enhance the communication between you and your customers (described earlier). This can also help you down the road if a customer files a dispute claiming they never received the order.

Make sure your orders all have a verifiable tracking number with delivery confirmation.

8. Monitor Your Transactions

Aside from fraud scoring, you should always conduct periodic reviews of purchases. Narrow your focus to the purchases that turned into a chargeback. Were there any similarities between those situations?

You might be able to find patterns that can prevent chargebacks moving forward. For example, if 90% of your chargebacks were related to a defective product, you might have a problem with your quality control, return policy, or product warranty.

9. Update Your Billing Descriptor

Your billing descriptor should clearly indicate your company’s name and address. If a cardholder is reviewing their credit card statement and doesn’t recognize the name of a business, they might immediately file a dispute.

People use their credit cards for nearly everything. So you can’t expect them to remember the exact purchase amount at your business a month after the transaction.

If your business name is “The Taco Stand,” and your billing descriptor is “NTC Holdings LLC,” you could have problems with chargebacks.

10. Ask For Help

Still having problems preventing chargebacks? You can always consult with an expert in the payment processing industry.

Our team here at Merchant Cost Consulting can help you save money on your credit card processing costs. As a result, this can help you balance out the costs associated with chargebacks.

Final Thoughts

Your chargeback rate may never drop to 0%. But with that said, there are definitely ways that you can prevent chargebacks from occurring.

By leveraging the ten tips and best practices explained in this guide, you’ll be able to save money and avoid chargebacks from happening in the first place. In many cases, these are simple measures that can be implemented right away.

Additional Reading:

- Visa Chargeback Reason Codes Explained

- Mastercard Chargeback Reason Codes Explained

- American Express Chargeback Reason Codes Explained

- Discover Chargeback Reason Codes Explained