Wireless credit card processing is a must when a fast and smooth checkout experience is top priority for a business.

Surveys show that 84% of consumers say the checkout experience plays an important role in where they shop which directly correlates to an efficient wireless credit card processing experience. 39% of consumers said they’ve walked out of a store without making a purchase due to long lines. An additional 56% of those surveyed said they’d be willing to switch stores if the checkout experience was better.

Think about that for a second. Customers willing to buy your goods and services could walk away and go elsewhere if the checkout procedure isn’t optimized.

That’s why wireless credit card processing is so important.

Wireless payment technology gives merchants the ability to handle credit cards, debit cards, and other payments as quickly as possible without compromising security. The transaction process is significantly faster compared to landline processing, and you have the ability to process credit card payments from anywhere.

Ready to improve your checkout process? This guide will walk you through wireless credit card processing and how it works.

How Wireless Payment Processing Works

The term “wireless credit card processing” is fairly broad. It can apply to physical credit cards as well as smart cards, key fobs, and even smartphones or wearables using NFC (near field communication) technology. Methods like Apple Pay, Google Pay, Samsung Pay, and other bank apps that support contactless credit card processing payments can also be used in conjunction with wireless credit card processing.

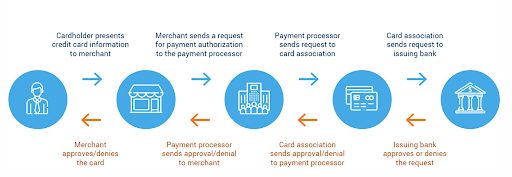

Here’s a step-by-step explanation of how it works:

- The consumer’s credit card is swiped, dipped, or tapped into a wireless credit card machine. The terminal connects to a radio tower (similar to cell phone technology) and securely sends the purchase amount to a merchant service provider.

- The credit card processing company sends that transaction information to the issuing bank to see if the card is valid and confirm that the amount requested is available.

- The issuing bank sends back an “approved” or “declined” message to the MSP.

- The transaction is routed back to the credit card terminal for the merchant to see.

- When the day is over, the merchant will settle the terminal batches from the day. Once settled, the funds get transferred from the issuing bank to the merchant account.

This image from Payment Depot is a great way to visualize how this process works:

Steps one through four typically happen in less than ten seconds. The exact time depends on your hardware, network, and coverage.

Wireless Credit Card Processing vs. Mobile Credit Card Processing: What’s the Difference?

Wireless credit card processing and mobile credit card processing are commonly associated with each other. While the two terms might sound similar, they’re actually not interchangeable.

Wireless credit card processing refers to the hardware and process associated with the transaction. You need to have a credit card terminal with a keypad and display screen. That terminal is connected to a wireless network that facilitates the steps in the section above. Wireless credit card processing can be handled without a physical hookup to phone lines or internet connections—hence the name.

You can use a wireless credit card machine to accept credit and debit cards at a wide range of locations. As long as the terminal is connected to a wireless network, then it will work.

That’s why wireless credit card processing is so common in industries where payments are accepted on the go. Delivery services, taxi driving, on-site repairs, and other instances where credit card terminals need to work without a wired connection are all examples.

Mobile credit card processing is a little different. Typically mobile payments refer to the method in which the consumer pays for the transaction.

For example, let’s say a customer has a mobile wallet. Their credit card information is stored on a smartphone or smartwatch, and they pay for a transaction using Apple Pay. That’s an example of mobile credit card processing.

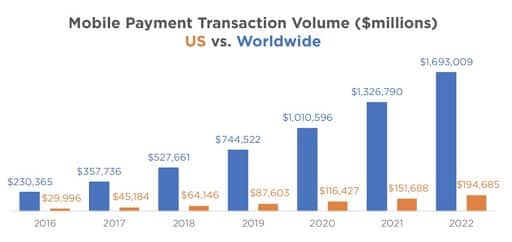

Check out this graph to show how mobile transaction rates have been trending upward worldwide:

That’s why it’s so important for merchants to accept mobile payments for credit card processing.

So you can set up wireless credit card processing, and your customers could use a mobile payment method on your terminal. But that’s not a requirement, and the two different types of technology don’t have to go hand-in-hand. They are separate and different.

Benefits of Wireless Credit Card Processing

Is wireless credit card processing right for your business? For many businesses, the answer is yes.

The great part about wireless credit card processing is the speed. You don’t have to rely on dial-up networks, wires, or landlines to process the transaction. You’ll still get the same security benefits without all the headaches associated with wires.

If you’re running a small business that currently uses a landline to process credit card transactions, I’m sure you know what I’m referring to. Every once in a while, a card just won’t go through, and the person working at your register needs to “play with the wires” a little bit for everything to work. That’s not very professional, and it slows down your checkout process.

Other top benefits of wireless credit card processing include:

- No wires, phone lines, or direct internet connection required

- Terminals work in traditional retail settings and for payments on-the-go

- Allows you to accept credit and debit cards from anywhere in your store

- Lightweight and compact terminals compared to bulky POS systems

- Can still accept swipe, chip, and mobile payments

Wireless credit card processing is great because it can accommodate merchants of all sizes. Whether you’re running a small brick-and-mortar retail shop, a restaurant chain, or need a way to process credit card processing payments from a food truck or trade show, wireless credit card processing is ideal. But it’s reliant on a strong network connection to work well.

Final Thoughts

Remember that nightmare scenario I painted for you back at the beginning of this guide? Customers walking out of your store or shopping elsewhere because the checkout process was too slow or inconvenient.

You can get that out of your head when you start using wireless credit card processing.

If you’re worried about the fees associated with this transition, contact our team here at Merchant Cost Consulting. We’ll make sure you’re getting the lowest possible rates on credit card processing without having to change your credit card processing company.