It’s no secret that the world has gone digital. As a result, virtual payment processing has become a must-have feature for businesses across every industry.

More and more Americans are using credit cards and debit cards to pay for goods and services on a daily basis. But their preferences and the way they use those has changed significantly over the past several years.

Ready to adapt and prepare for payment acceptance of the future? You’ve come to the right place.

This guide will explain everything you need to know about virtual payment processing, including some easy methods for you to implement.

What is Virtual Payment Processing?

Virtual payment processing allows consumers to pay for products or services electronically, with no physical contact. This means that credit cards or debit cards won’t be touching any terminal via swipe, dip, or tap to process payments.

Don’t confuse virtual payment processing with a virtual terminal. While a virtual terminal can be a form of virtual payment processing (we’ll get to that later), the two terms are not synonymous.

Industry leaders in the US virtual payments market include popular tech companies like PayPal, Venmo, Zelle, Square Cash, Apple Pay, Google Pay, and Samsung Pay.

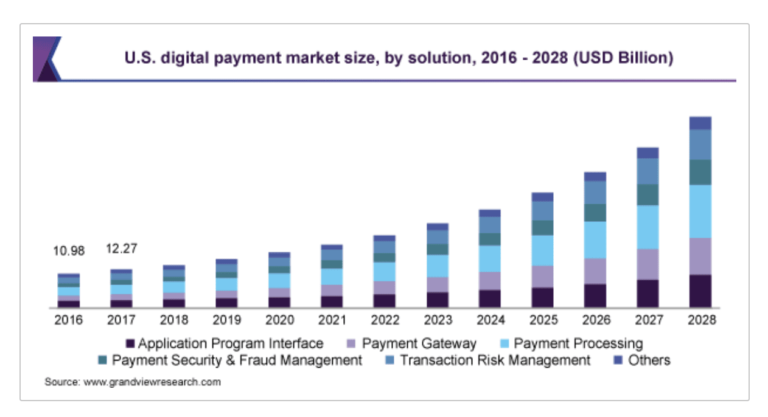

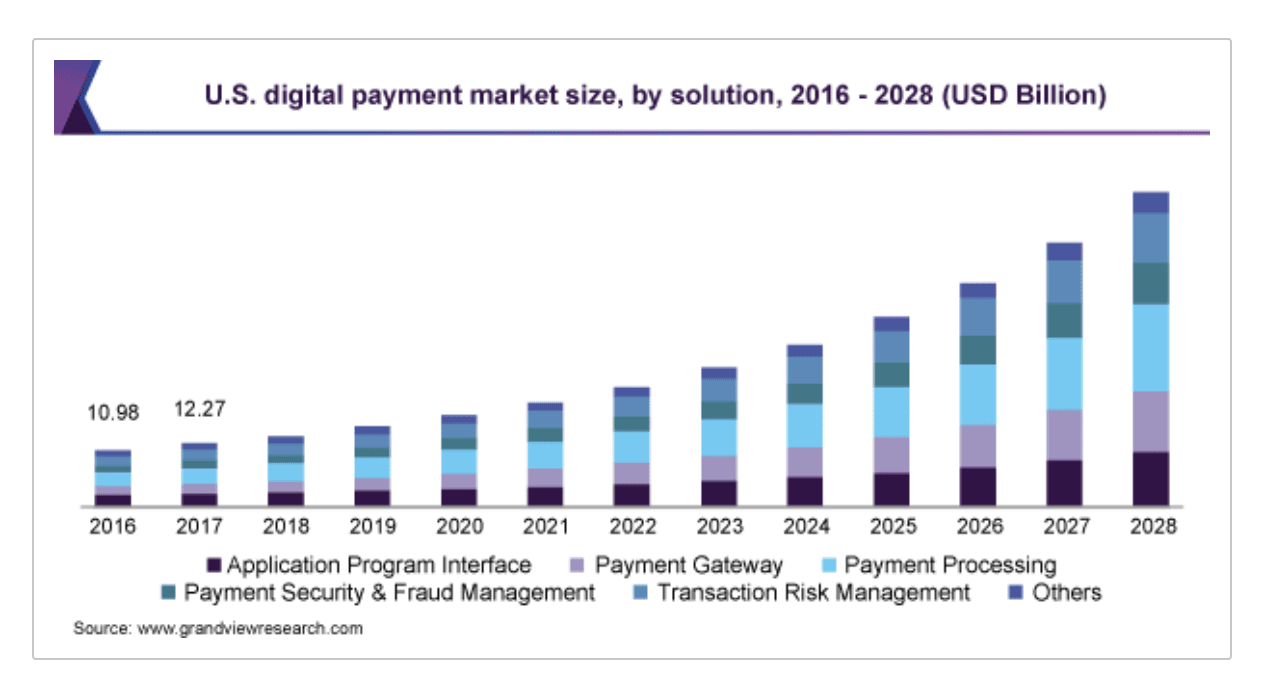

According to Grand View Research, the global digital payment market is expected to grow at a CAGR of 19.14% from 2021 through 2028. Here’s a visual representation of that growth in the US:

As you can see from the graph, payment processing, payment gateways, and APIs make up a big chunk of this market share. This is additional proof of the importance of accepting virtual payments.

How to Process Virtual Payments: 4 Easy Ways

Now it’s time to get into the specifics. How exactly can you apply virtual payment processing to your business? Here’s an overview of the four easiest methods:

1. Add a Virtual Shopping Cart to Your Website

Ecommerce shopping carts, or online shopping carts, make it easy for consumers to buy online through your website via multiple platforms. Ecommerce carts work on desktop computers, laptops, tablets, and mobile sites as well.

The best online shopping carts include a full scope of various ecommerce features and functions. These come in all different shapes and sizes.

For example, you could use an ecommerce platform with a built-in payment processing feature. Or you can add a third-party plugin or extension that supports ecommerce transactions.

Shopify is a great example of this. It’s an all-in-one solution for creating an ecommerce site, and they also offer built-in payment processing. Just know that the rates will be a bit higher if you use Shopify to process your card transactions. Fortunately, Shopify supports over 100+ different payment gateways, including Authorize.net, PayPal, Amazon Pay, Google Checkout, and more.

If your business already offers credit card acceptance, look to your merchant account provider for a solution before shopping around for an alternative.

2. Get a Virtual Terminal

A virtual terminal is another non-physical way to process credit card transactions. Most payment service providers offer virtual terminals as an integrated solution with your payment platform.

With a virtual terminal, there’s no hardware required to accept payments. Everything is entered through an online interface, virtually (hence the name).

Virtual terminals are non-customer facing. It’s all handled on the backend of your operation, and they work really well for phone payments. That’s why virtual terminals are so popular for restaurants, delivery services, and subscription services. We even see them used by doctors, dentists, lawyers, and mechanics that accept credit card payments over the phone.

Virtual terminals allow you to process payments from anywhere. They’re an efficient alternative to manually entering card details into a POS terminal for each virtual transaction. This is a more secure way to store credit card data as well.

3. Text2Pay (Text to Pay)

If you’re not familiar with Text2Pay, it’s exactly what it sounds like. You can use it to process payments via SMS text messages.

This virtual payment processing option is ideal for merchants who send out client invoices. Text2Pay works better than email because the recipient is more likely to see and open the message immediately. If that customer already has credit card information stored on their smartphone, they’ll be able to complete the transaction in just a few taps.

While Text2Pay is commonly used in recurring billing scenarios, it can also be used to collect one-off payments. For example, a doctor or dentist could use Text2Pay for billing patients after an appointment rather than sending them a bill in the mail.

For more information, check out our complete guide on Text2Pay for contactless payments.

4. Contactless Mobile Payments

Better known as “tap to pay,” mobile payment processing has surged in popularity over the years.

Users can enter their credit card information just once into a virtual wallet, and then they can use that card for virtual payments moving forward—without actually having the card in hand. This means that you can even use virtual payment processing for in-person transactions.

You just need an NFC card reader, and your customers can pay with this method.

Additional Reading: NFC Credit Card Processing Payments

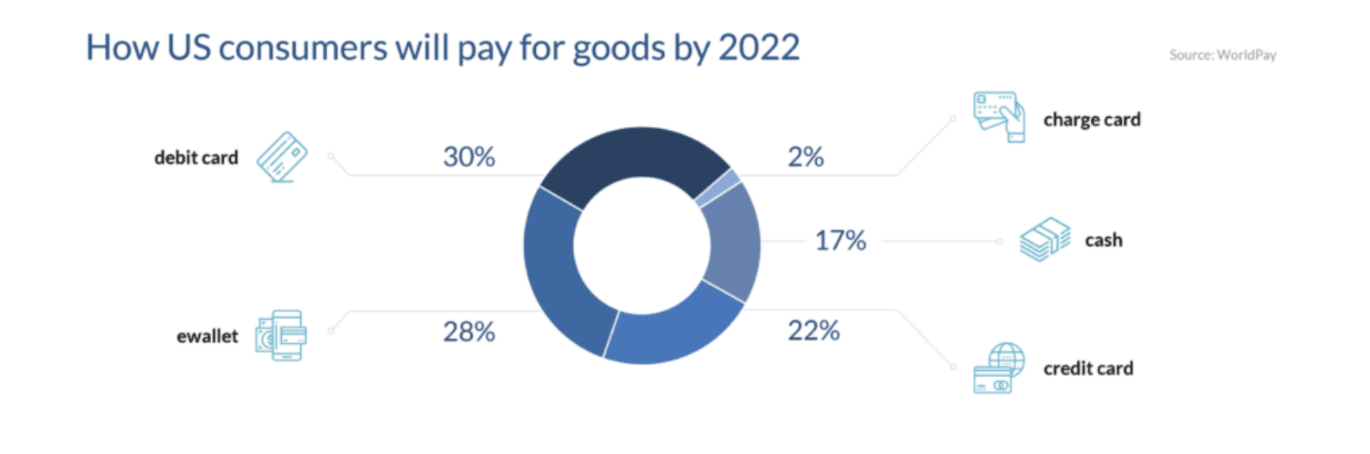

By 2022, it’s expected that 28% of US consumers will pay for goods using an e-wallet.

As this payment method grows in popularity, it’s important for your business to adapt accordingly.

Mobile payments have also breached the wearables market. Consumers can tap to pay using an e-wallet on smartwatches and fitness devices with the help of Apple Pay, Google Pay, Android Pay, and Fitbit Pay. All of these use NFC technology.

Final Thoughts

Virtual payment processing isn’t a fad. It’s trending upward and here to stay for the foreseeable future.

Having a single credit card terminal on your retail counter that only accepts swipe cards is no longer enough to be successful. Many consumers don’t carry a physical wallet or credit card on them anymore. They expect merchants to accept their payment through a smartphone or watch. Otherwise, they’ll just go somewhere else or order it online.

Worried about the cost associated with virtual payment processing? Contact our team at Merchant Cost Consulting. One of our experts will help ensure you get the lowest possible rate without switching payment processors.