To say that COVID-19 has changed the way we do business would be a drastic understatement. Every industry has been impacted in one way or another.

The credit card processing industry is no exception.

Any merchant accepting credit cards, whether online, in-person or both, needs to be aware of how coronavirus will change the credit card processing landscape. From credit card networks to merchant service providers, there’s quite a bit of change on the horizon.

Some of these changes are short-term. Others will be here for good. Continue below to learn more about the top ways coronavirus has changed credit card processing.

#1: Leniency From Payment Processors

It’s no secret that the vast majority of businesses have been struggling over the past few months. Some industries were definitely hit harder than others.

Between the mandated shutdowns, new social distancing regulations, and change in consumer shopping behavior, so many businesses are struggling to survive.

Fortunately, your payment processor understands what you’re going through. Many of them are offering ways to help merchants fight through these difficult times. Remember, your payment processor can’t make money if you go out of business. So it’s in their best interest for you to be successful.

Now is an excellent time to revisit your processing rates. Depending on your sales volume, this could save you tens of thousands of dollars per year. I’m sure most of you could use that extra cash right now.

Contact our team here at Merchant Cost Consulting. Our experts can negotiate the processing fees on your behalf.

#2: Postponed Fee Changes

Before the COVID-19 outbreak, the credit card processing industry was set to undergo significant changes. Visa and Mastercard originally planned on changing their interchange fees during April of 2020.

But with everything going on, it didn’t seem appropriate to do so (especially since lots of those rates were increasing).

Both card networks decided to push back those changes until July. But now it looks like this will be pushed back even further, until April 2021. Furthermore, gas stations initially had an October 2020 deadline to upgrade pumps with EMV-compliant technology. That’s also been pushed back.

Here’s a look at a recent update from Visa’s website:

While these delays won’t last forever, it’s on hold for now.

#3: Low Interest Rates

Do you use credit cards to make business purchases? I’m sure most of you do. As a cardholder, COVID-19 can bring some relief to your purchasing needs.

Card issuers and banks are stepping up to help provide aid to business customers.

Many of these banks are slashing interest rates or even waiving interest fees altogether for a short period of time. Some issuers are letting businesses skip payments without penalty as well.

If your bank or credit card hasn’t directly rolled out a general statement or new policy here, it’s worth contacting them directly. By explaining how you’ve been affected by COVID-19, there’s a good chance that they’ll help you work through things. You could qualify for a better rate than when you initially applied for your business credit cards, and the issuer might be open to changing it for you.

#4: Cash Payments Trending Down

Consumers are doing everything they can to stay safe during these crazy times. Everyone has become more conscious and self-aware about what they touch in public.

Limiting contact has been a significant point of emphasis by health experts. So consumers are thinking twice about reaching for cash to pay for goods and services in-person.

As a merchant, you need to be prepared for this shift. While I’m assuming that the majority of you already accept credit cards in one form or another, you must prepare to do that scale. Expect whatever percent of your sales revenue from cash to steadily decline for the remainder of the year.

In some cases, you might need to upgrade your credit card processing equipment to accommodate the increase in usage. Smaller retail shops might need to go from one terminal to two. Larger businesses might need to go from ten to twenty.

#5: Contactless Payments Trending Up

Consumers are doing more than just moving away from cash. They’re opting for contactless payment methods as well.

Even with an EMV-compliant chip-reader, customers are still forced to touch most terminals during the checkout process. But contactless-enabled tap cards and mobile payments eliminate this problem.

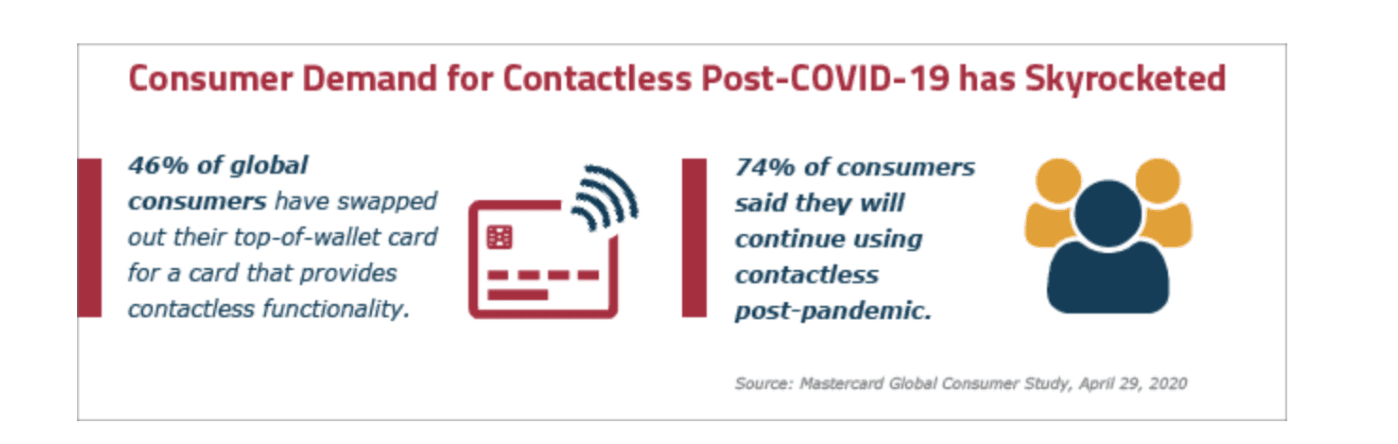

Contactless payments were already trending up before the coronavirus pandemic. While some consumers in the US were hesitant to adopt, the recent events have helped change their minds.

The demand for contactless payment methods is at an all-time high.

27% of small businesses in the US reported an increase in contactless payments during COVID-19. Big Brands, like Costco, have been pushing for contactless payments in its warehouses. As a result, Costco saw a 60% increase in contactless payment usage in March 2020, compared to the previous year.

In addition to tap-to-pay credit cards, mobile wallets are also trending upward.

As a merchant, you must be able to adapt quickly to these trends. Failure to do so can be detrimental to your business. If customers don’t feel safe while they’re shopping, it could keep them from coming back in the future.

#6: Online Processors

The lockdowns due to COVID-19 have forced businesses to get creative. More and more businesses are finding ways to shift online, even if they haven’t done so in the past.

If it’s your first time using an online processor, it’s important to understand the fee structures for credit card processing. These are typically different from processing payments in-person with a physical terminal. In most cases, it’s more expensive to process payments online.

Final Thoughts

COVID-19 has affected all of us—even the credit card processing industry.

As a merchant, you need to understand how these changes impact your business. As of right now, these are the top six ways that you’ll be affected. But keep checking back as we continue to come out with new updates in this ever-changing landscape.