Ecommerce trends are at an all-time high. We’re living in an era where consumers expect businesses to be online. So regardless of your industry, product, or service offering, you need to have a digital presence with the ability to process online payments.

From traditional B2C retailers to restaurants, dentists, B2B SaaS, legal services, and everything in between, accepting online payments will drive more revenue for your business.

Online payment processing is also convenient for your customers. They don’t have to worry about paying cash or sending paper checks through the mail. In addition to increasing your cash flow and reducing your average receivables time, you’ll also boost customer satisfaction metrics—it’s a win-win for everyone.

Whether you’re interested in collecting online payments for the first time or you’re looking to add new payment options to your website, you’ve come to the right place. I’ve narrowed down the top eight ways to process online payments.

1. Credit Cards and Debit Cards

70% of the US population has a credit card, and 34% of Americans carry at least three different cards. What’s even more interesting is the fact that 87% of Americans have a debit card. So by accepting credit and debit cards online, you’ll be appealing to the vast majority of your customer base.

For the majority of businesses, this will be the most obvious way to process payments online.

With that said, there isn’t just one way to accept credit and debit cards. If you want to take these forms of payment on your website, via email, or through a third-party platform, there are several different options to consider. From traditional payment gateways to ecommerce software, we’ll discuss more of these in greater detail throughout this guide.

It’s also worth noting that you shouldn’t discriminate against certain credit cards. Even though the credit card processing fees may vary from card to card, your organization should allow customers to pay using all major credit cards and debit cards.

2. E-Checks and ACH Transfers

E-Checks and ACH transfers are popular online payment options for B2B payment processing. It’s an easy way for your clients to pay bills online without having to use a credit card.

While e-checks and ACH transfers are two terms that are often used interchangeably, the two aren’t quite the same thing. Lots of e-checks are processed through the Automated Clearing House network (like an ACH transfer). However, paper checks deposited digitally become an e-check, and these do not go through the same ACH process. But in terms of online payments, the two options can be grouped in the same category.

You can review our complete guide to e-checks for payment processing to learn more information about this payment collection method.

3. Mobile Payment Processing

Mobile payments are a fast and easy way for customers to pay for goods online. This is especially true if you have a mobile app or consumers are browsing your site from a smartphone.

New technology allows people to store credit card information on their phones through digital wallets like Apple Pay and Google Pay. This allows them to breeze through your checkout process by using a fingerprint to complete the payment, as opposed to manually entering their credit card information.

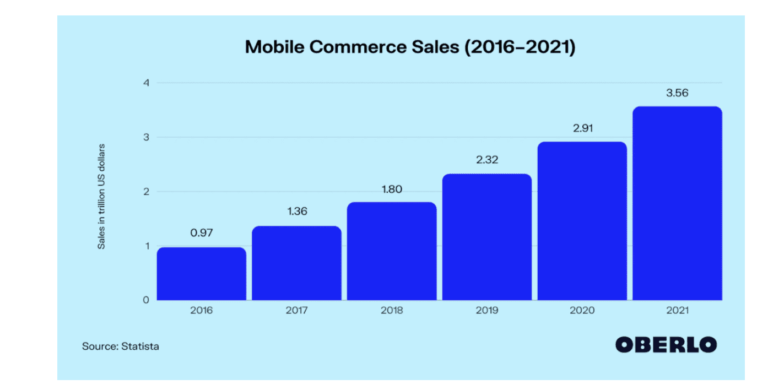

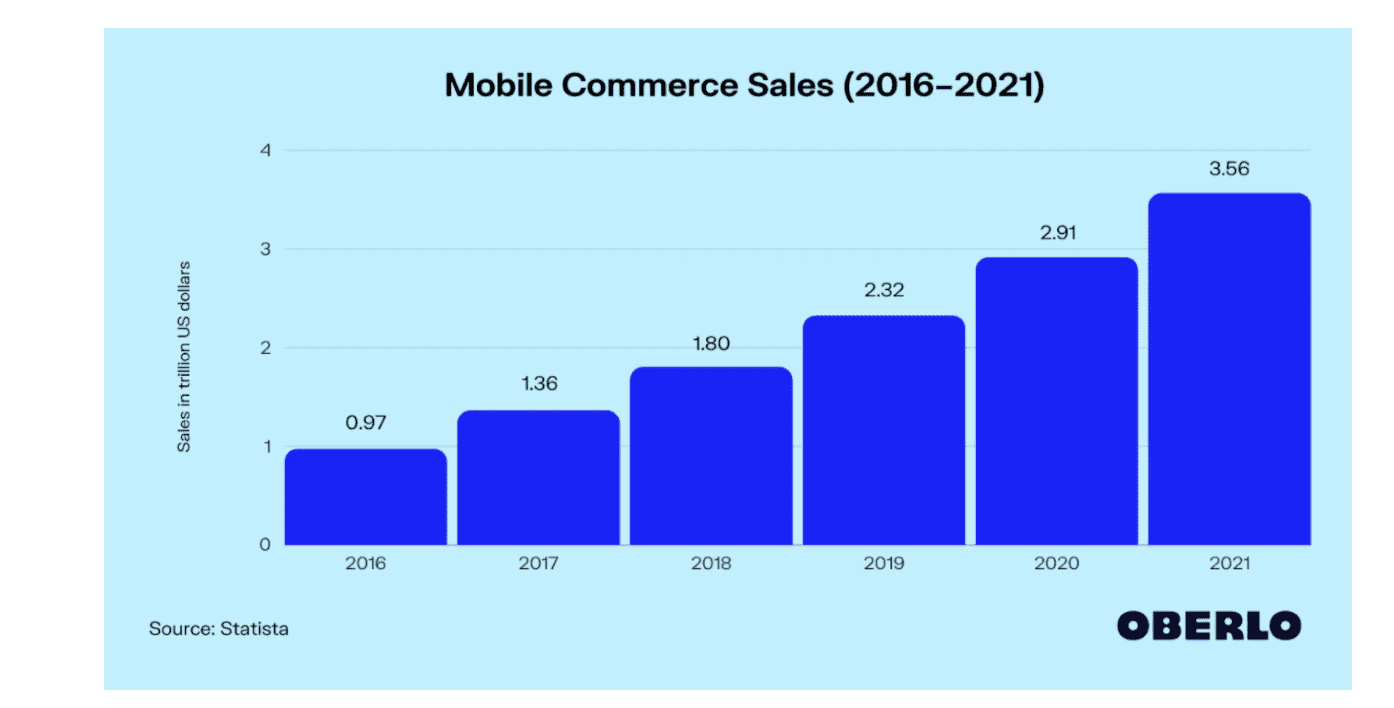

Check out this graph to see how mobile commerce sales have been trending upward over the years:

There’s no sign of this trend slowing down in the foreseeable future, which is why it’s so important to accept mobile payments online.

4. SMS Payment Processing

SMS payment processing isn’t the most conventional way to accept payments online, but it’s still a viable option for certain business types.

As a merchant, you can use an SMS processing system to send your customers digital invoices with a link to pay online. The benefit of this method is that texts have such a higher open rate than emails. So you’ll have an easier time processing payments while reducing your average collection period.

5. Virtual Terminals

Virtual terminals are web-based platforms for collecting payments online. They are most commonly used by businesses that take orders over the phone.

Your customers can provide you with payment details on the phone, and you’ll enter that information into a virtual terminal to process it. These easy-to-use platforms are also ideal for businesses running subscription services or anything that requires recurring billing cycles.

6. Payment Gateways

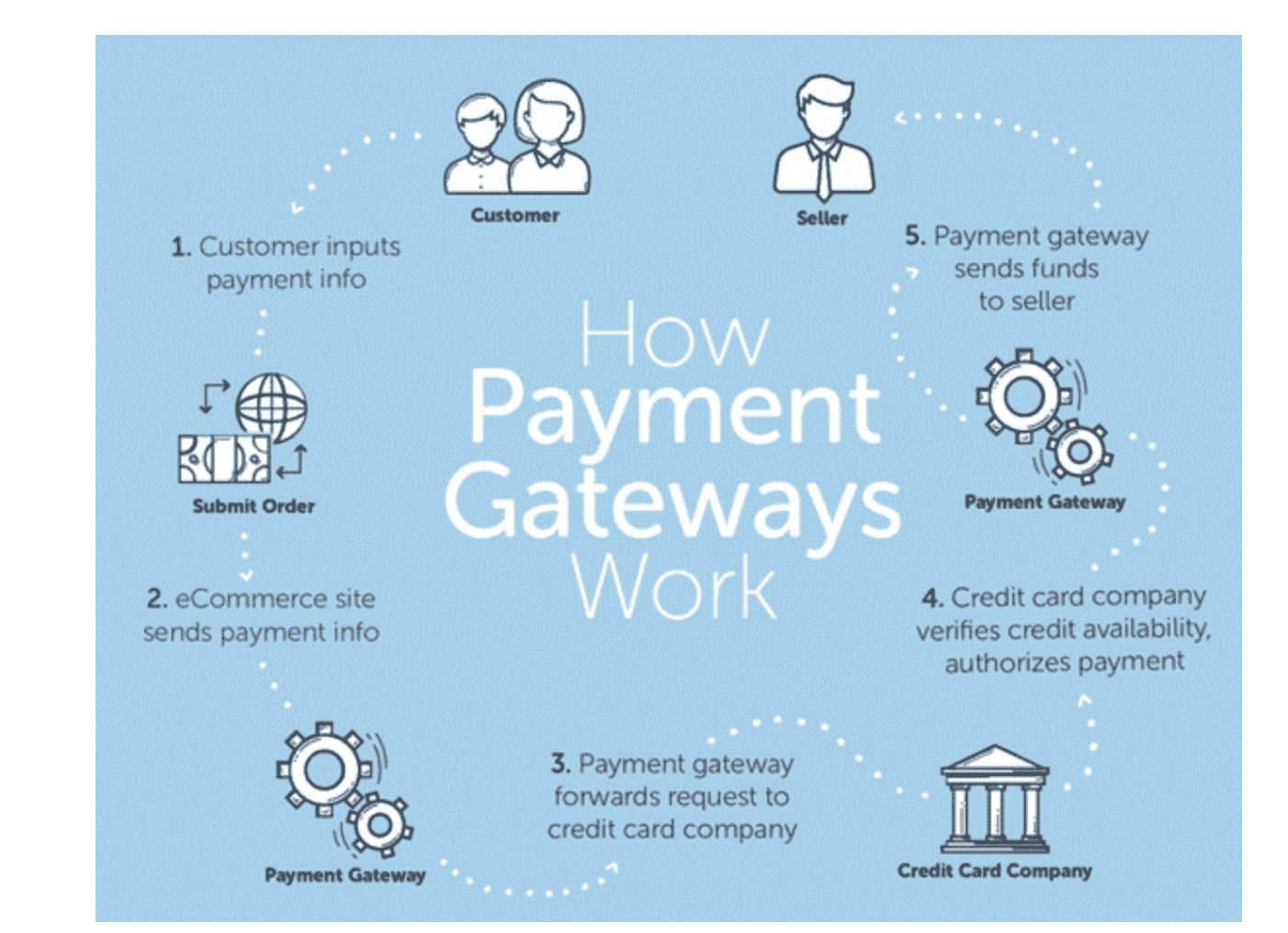

A payment gateway is one of the most popular ways to accept payments online. You can use a third-party plugin or service from your payment processor to process payments on your website using this method.

Payment gateways are commonly used by ecommerce websites. Here’s a visual explanation that shows how a payment gateway works:

Depending on the CMS platform you’re using to run your website, you might not have a built-in payment processing solution. If you fall into this category, you’ll need to add a payment gateway in order to accept credit cards and debit cards.

Popular examples of payment gateways include Authorize.net, PayPal, and Stripe.

7. Ecommerce Shopping Cart Software

Some ecommerce platforms come with payment processing capabilities out-of-the-box.

For example, let’s say you’re using Shopify to power your ecommerce website. Shopify doubles as a payment processor, and you can start collecting payments without a payment gateway or third-party processing solution.

The best part about this type of technology is that it’s convenient and user-friendly. But the downside is the cost. Ecommerce platforms are notorious for charging higher processing rates.

8. Email Invoicing

Email invoicing is popular for B2B merchants. Some of you might already be using this strategy.

However, digital invoices are only effective if the customer can pay online. If you’re forcing them to print the invoice and mail in a physical check, it’s not ideal for anyone. So make sure you’re using a platform that supports online payment processing directly through the email.

That way, recipients can simply click the payment link, enter their payment details, and finalize the payment in a matter of seconds.

Final Thoughts

Online payment processing is a must-have for 2021 and beyond. But with so many options to choose from, it’s important to keep a close eye on costs.

Lots of online payment processing methods can be expensive. Furthermore, credit card companies typically charge higher interchange fees for these types of transactions.

Set up a consultation with our team here at MCC. We’ll make sure you’re not overpaying and let you know how much money you can save on credit card processing for online payments.