Some of you have probably used ACH at one time or another in your personal life. But what about for payment acceptance in your B2B?

For those of you who want to give your business customers the opportunity to pay for goods and services via ACH transfer, you’ve come to the right place. We’ll break down what you need to know about accepting ACH payments for B2Bs.

What is an ACH Payment?

Let’s quickly start with the basics. ACH stands for “automated clearing house.” This is a network that facilitates electronic payments and money transfers.

ACH is simply a way to move money between two banks without using paper checks, cash, credit card networks, or wire transfers. In short, it’s a bank-to-bank electronic transaction. In many cases, ACH transfers are done domestically. However, you can also use ACH to transfer funds internationally between two accounts.

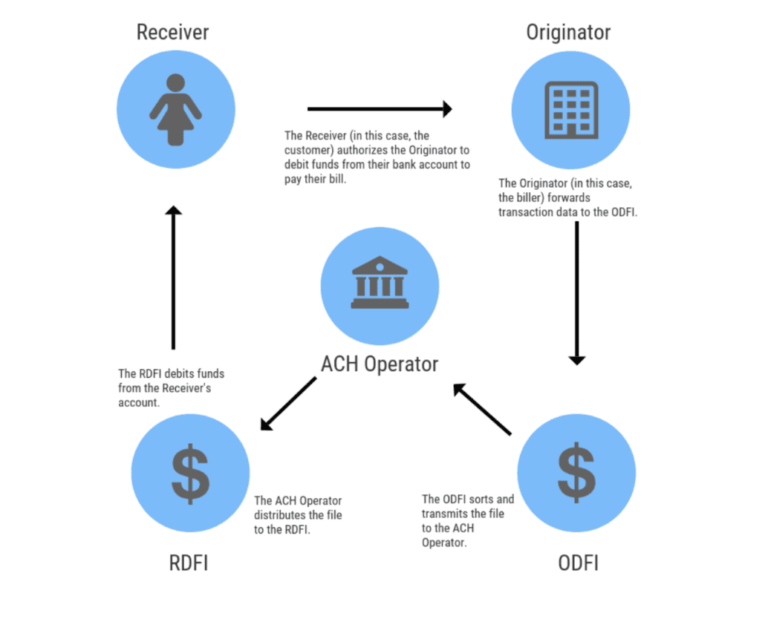

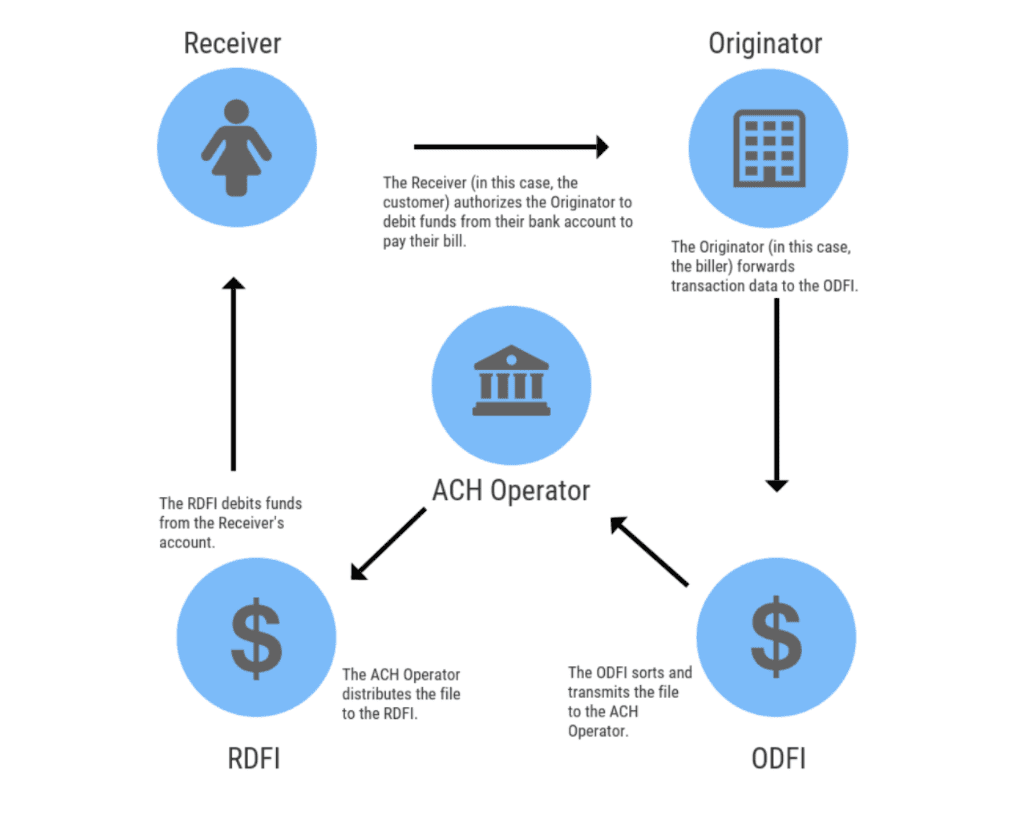

Here’s a visual explanation that shows how ACH transactions work for bill payments.

ACH Payments vs. eChecks

ACH payments and e-checks are often confused with each other, but they are two different things. So I just want to take a moment to quickly explain the differences between them.

The simple difference—e-checks are basically just digital versions of paper checks. For example, a paper check that’s deposited remotely through a mobile device or check capture software becomes an e-check when it’s deposited.

We have a complete guide on e-checks for payment processing that you can review for more information on the subject.

ACH transfers don’t follow the same procedure as check settlements. This process is completely automated and settled 3x daily during working bank days.

One of the reasons why ACH payments and e-checks are confused with each other is because merchants can convert e-checks into ACH transactions. While this is typically called an “electronic funds transfer” the technical practice used by processors involves an ACH debit.

But it’s important to understand the ACH and e-checks are two very different things.

Benefits of ACH Payment Processing For B2Bs

Should your B2B start accepting ACH payments? Let’s take a look at the advantages of using this payment processing method.

Low Cost

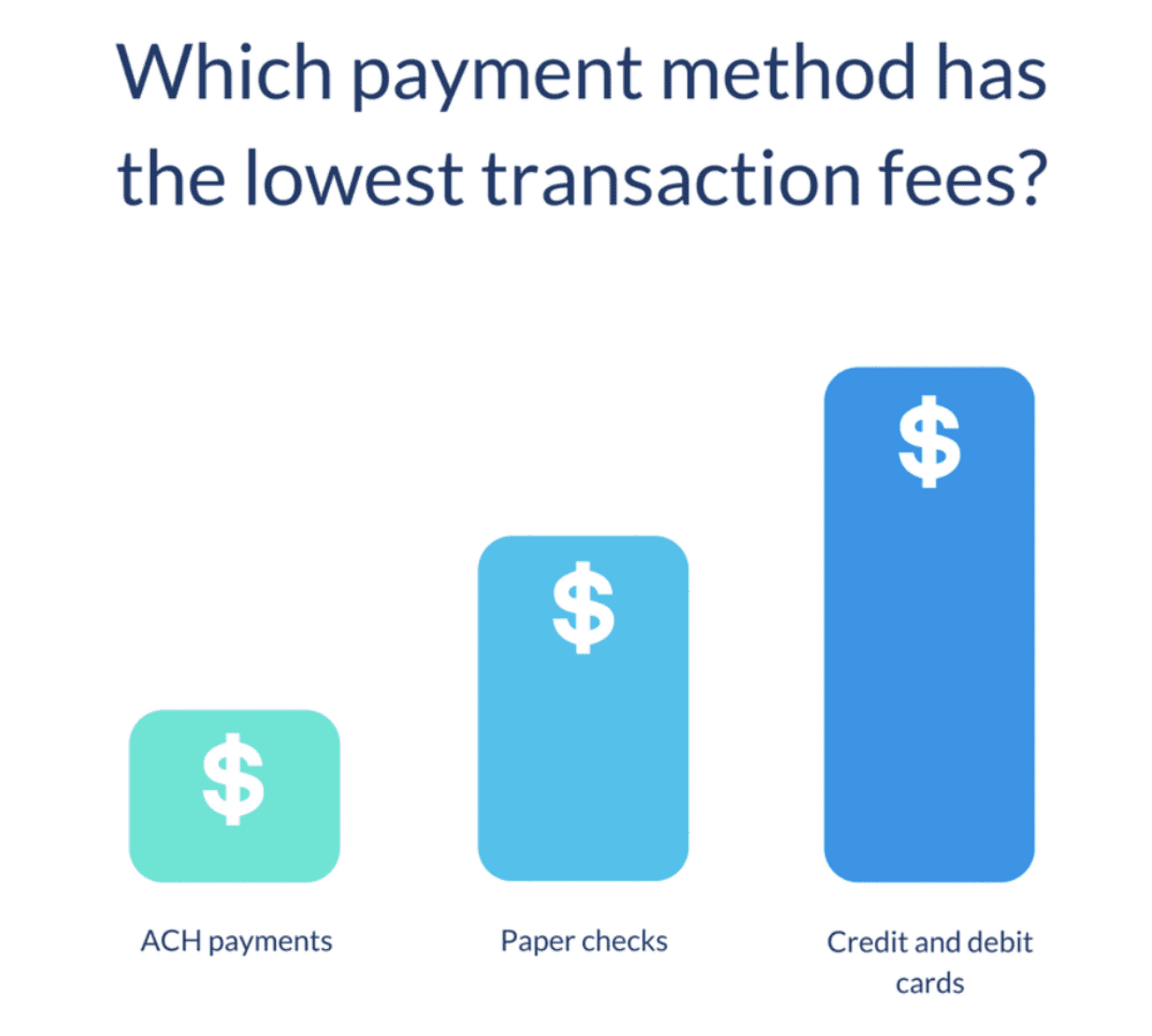

ACH acceptance is affordable. The exact rates obviously depend on your processor and plan, but overall, it’s cheaper than credit card processing.

In fact, ACH transfers usually offer the lowest transaction fees (aside from cash).

Even debit cards have to go through a special processing network, making them subject to the same types of fees as traditional credit cards. So if you’re comparing ACH side-by-side with credit and debit transactions, ACH is much more cost-effective.

Fast Funding

Since ACH transactions are settled three times per day, you could potentially receive an ACH payment on the same day it was paid.

With that said, most businesses don’t receive those funds on the same day. The funding time varies by each individual bank—they have control over the final payout schedule. Expedited payments and same-day funding are typically subject to extra fees.

However, the ACH payment process today is definitely faster than it was years ago.

Transaction Status

Since ACH transfers are 100% electronic, it’s easy to check the status of a transaction in real-time.

You’ll know right away if the transfer bounced or declined. As a result, you could potentially stop a shipment or halt work on a project until you’re paid. This transparency makes it easy for you to contact your customers as fast as possible if there’s a problem with the payment they sent. This is significantly faster than the transaction status involved with a mailed check, for example.

Recurring Payments

ACH transfers are a great option for collecting recurring payments. Your customers can set up an ACH debit one time and never have to worry about it again.

This process allows you to always receive on-time payments without having to send reminders or past-due collections.

Less Risk For Chargebacks and Reversals

Since ACH transfers involve additional information upfront to set up, there isn’t as much liability compared side-by-side with credit card processing. So you won’t have to worry about processing fraudulent transactions as much.

Furthermore, customers usually only have about 90 days to dispute ACH payments compared to 120 days for some credit card networks.

The rules for an ACH reversal (chargeback) are also stricter than credit card chargeback rules. In fact, there are just three reasons why a customer can initiate an ACH reversal:

- The transaction was not authorized, or authorization was revoked.

- The transaction was processed on a date earlier than the authorization date.

- The transaction amount is different than the authorized amount.

Aside from these three unique circumstances, customers can’t initiate a reversal simply because they weren’t happy with the product or services received.

Expanded Reach

Not every customer of yours will have a credit card. Some companies either can’t get approved or just choose not to have one. In these cases, debit cards or handwritten checks are usually their preferred payment method.

But as we explained before, ACH payments are cheaper and faster to process.

This gives you the opportunity to reach business customers that don’t have credit cards. Since most ACH payment service providers don’t charge the customer any fees for this transaction type, it shouldn’t be too hard to convince your clients to get on board.

Easy Approval

Not every merchant is able to accept credit cards. If your B2B is struggling to find a processor to facilitate your transactions, you might not have any other way to get paid electronically.

It’s common for high-risk merchants to use ACH transfers as an alternative to credit card processing until they can get approved.

Final Thoughts

ACH transfers are an excellent way for B2Bs to process payments.

I’m not suggesting that you should stop accepting credit cards and debit cards. But you should definitely consider adding ACH as an option for your clients as well—for all of the reasons described above.

Looking for other ways to save money on credit card processing? Contact us here at Merchant Cost Consulting, and we’ll help you out.