More than 90,000 merchants in Canada accept American Express. This is just a fraction of the 10.6 million businesses in the US accepting Amex—but it aligns with Amex’s market share amongst Canadians.

According to Statista, American Express has a 4% market share in Canada’s payment card brand industry. To put that into perspective, Visa controls 58% of the Canadian market, and Mastercard controls the remaining 38%.

Of the Canadian companies that do accept American Express, many of which are doing so through the Amex OptBlue program.

This guide covers everything you need to know about Amex OptBlue in Canada, including how it works and the processing rates you’ll pay for different types of transactions.

How to Accept Amex in Canada

There are two ways for businesses to accept American Express cards in Canada.

- Through a direct agreement with American Express

- Through a participating payment processor via the Amex OptBlue program

With a direct agreement, American Express handles all of the settlement services. Merchants pay a discount rate based on a percentage of the purchase for each transaction without going through a third-party processor.

With the Amex OptBlue program, businesses can accept Amex cards through a payment processor. And American Express charges a wholesale discount rate to the processor.

The biggest difference between these two programs is who sets the pricing.

If you have a direct agreement with American Express, then Amex has 100% control over the rate. But if you’re part of the OptBlue program, your payment processor sets the total pricing for each transaction.

Who is Eligible For Amex OptBlue in Canada

American Express OptBlue is designed for smaller businesses. Rather than having to set up a direct agreement with Amex, they can simply accept Amex-branded cards through a payment processor.

To be eligible for Amex OptBlue in Canada, businesses must process less than $1 million in American Express transactions annually.

Merchants must also go through one of the following participating payment processors that offer Amex OptBlue processing in Canada:

- Fiserv

- Global Payments

- Chase Paymentech

- Elavon

- TD Merchant Services

- Moneris Solutions

You’ll need to confirm your eligibility with one of these processors before you can start accepting American Express via the OptBlue program.

American Express OptBlue Wholesale Discount Rates in Canada

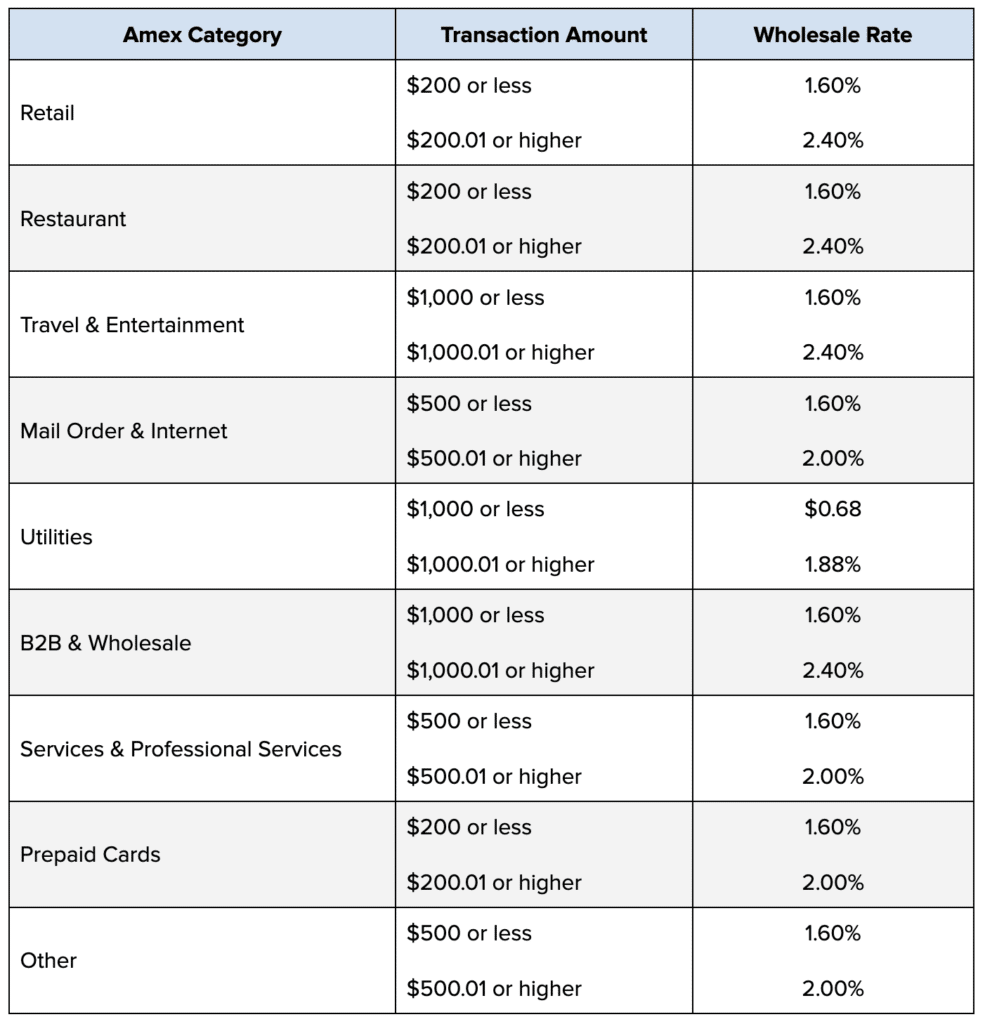

The tables below show the wholesale rates that Amex charges payment processors for different categories in the OptBlue program. These rates are very straightforward—falling into one of 15 possible categories, and often depend on the transaction amount.

Amex OptBlue Rates in Canada — Based on Transaction Amount and Category

For the nine categories shown below, the wholesale rate varies based on the transaction amount. With the exception of the utilities category (where it’s a fixed $0.68 fee for transactions of $1,000 or less), the wholesale rate is higher for more expensive transactions.

This is a bit unusual, as normally card networks offer lower interchange rates for high-ticket transactions. But this is not the case with Amex OptBlue in Canada.

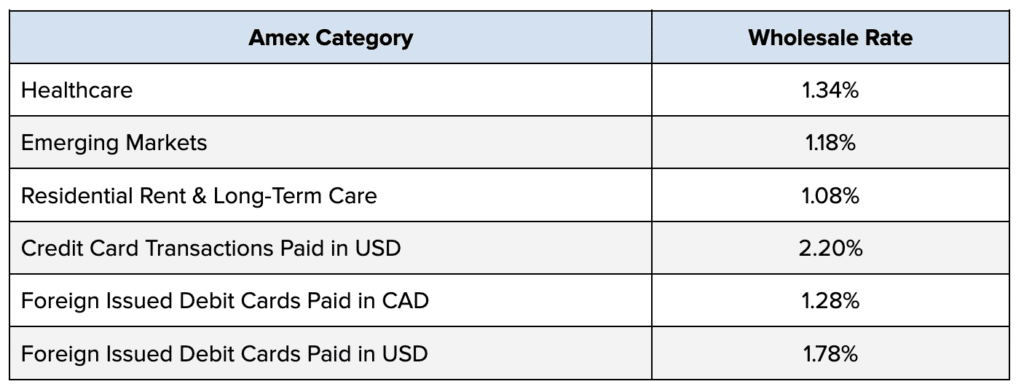

Amex OptBlue Rates in Canada — Based on Category Only

For the remaining six categories, the wholesale OptBlue rate is the same for all transaction amounts.

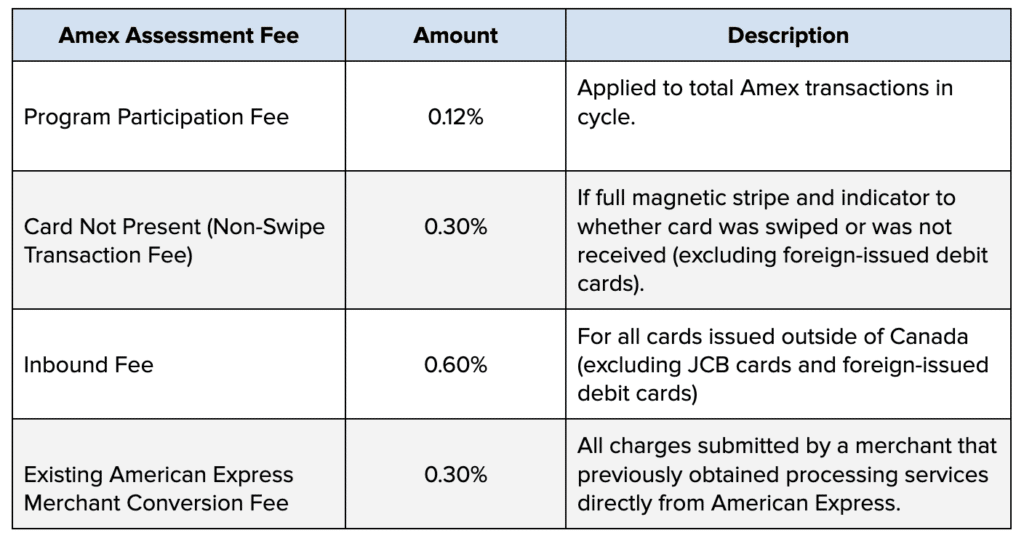

Amex OptBlue Network Assessment Fees in Canada

In addition to the transaction-based wholesale rates, American Express also charges network assessment fees. These assessments are charged as a percentage of total transaction volume for particular transactions—including a 0.12% assessment charged on total Amex transactions in a cycle.

American Express assessments in Canada are even simpler than Amex assessment fees for US merchants.

Why It’s So Important to Know the Wholesale Rates Charged by American Express

I know what some of you are thinking. The payment processor ultimately sets the final rates for merchants on the Amex OptBlue program in Canada—so who cares about the wholesale rates? There’s nothing I can do about it, right?

Yes and no.

Yes—your processor will ultimately set the final rates you pay for all American Express transactions if you’re part of the OptBlue program. But there IS something you can do about those rates.

Payment processors are definitely entitled to a markup for the services that they’re providing you. So you’ll always pay more than the wholesale rates imposed by American Express.

However, you shouldn’t just blindly accept the rates your processor is charging you. Compare the Amex rates on your statements to the wholesale rates in this guide. Then subtract the difference between the rate you’re paying and the rates Amex is charging your processor. That number is the profit your processor is making off of your Amex transactions.

For example, let’s say you’re in the healthcare space. Amex charges your processor 1.34% for all transactions—regardless of the amount.

If you audit your statements to find that your processor is charging you 3% for all Amex transactions, that means they’re making a 1.66% profit on all of those transactions.

That’s bogus. We’ve seen interchange markups as low as 0.05% + $0.05 per transaction.

So if your processor is marking up your transactions significantly higher than that amount, you can definitely negotiate with them to get a lower rate.

Furthermore, network assessments should never be marked up. So I strongly recommend comparing your Amex assessment fees to the third chart in this guide to see if your processor is doing something unethical.

We have a guide that quickly shows you how to spot padded assessment fees on your statements that you can use as a reference.