If Shift4 is your payment processor and your business accepts American Express cards, there’s a good chance you’ve got an “Amex Support Fee” on your monthly statement.

Despite what the name suggests, this fee has absolutely nothing to do with American Express or support. It’s a junk fee invented by Shift4 that’s pure markup for your processor, disguised to look like a legitimate card network charge.

So if you spot this fee on your Shift4 statement, read on to learn how to handle it.

What is the Shift4 Amex Support Fee?

The Amex Support Fee is a monthly charge that Shift4 adds to merchant statements. This junk fee is typically listed alongside actual network fees and interchange charges. And it’s itemized on this portion of the statement to look like an official charge from American Express (but it’s not).

How can you tell that it’s a junk fee? The interchange portion is always $0.00.

Here’s what I mean.

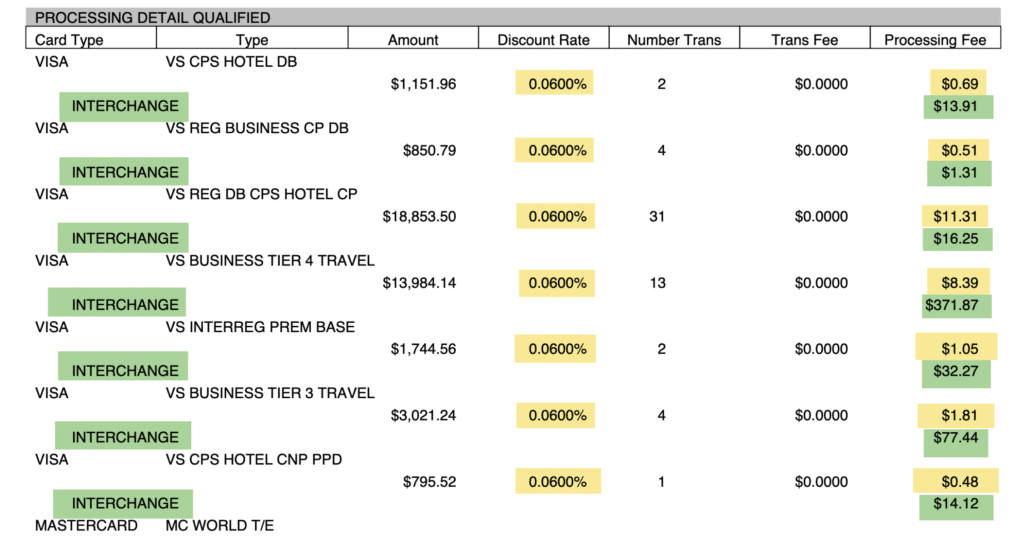

If you look at your Shift4 statement breakdown, you’ll see that each processing fee is broken down into two line items. The top line is Shift4’s markup (discount rate), and the bottom line is from the card network (interchange):

Everything highlighted in yellow here is going to Shift4, and everything highlighted in green goes to the card network.

There are several pages of this on every Shift4 statement, as it’s broken down by interchange category for each card network (and there are dozens of categories).

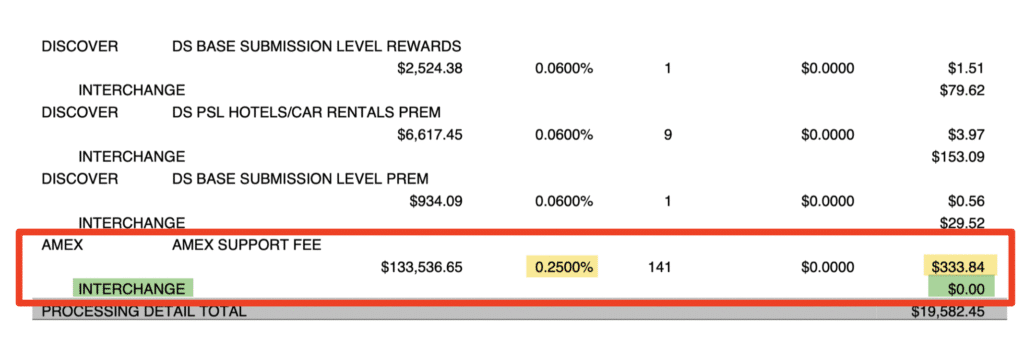

Now look at how this changes when we get to the Amex Support Fee:

This business processed $133,536 in Amex transactions during the month. And Shift4 charged them $333.84 for the Amex Support Fee at a 0.25% rate.

There are still two line items in the processing fee column, but the interchange line is $0.00.

Compare that to every other fee category on this statement. All of the legitimate charges show both a discount rate AND an interchange amount. The Amex Support Fee is the ONLY line item across nearly four pages of processing detail where the interchange is zero.

This tells you everything you need to know. Shift isn’t passing through any actual costs from American Express. They’re just adding extra markup and hoping you won’t notice or question it.

How Much Does the Amex Support Fee Cost?

The Amex Support Fee typically costs 0.25% of total American Express transaction volume. But we’ve seen it vary between 0.20% and 0.30% depending on the merchant (another sign that the fee is garbage, as legitimate card network fees don’t change from business to business).

While 25 basis points may not sound like much, it adds up quickly:

- $50,000 in monthly Amex volume = $125 per month = $1,500 annually

- $100,000 in monthly Amex volume = $250 per month = $3,000 annually

- $133,536 in monthly Amex volume – $334 per month = $4,008 annually

That last example is from the real merchant statement example shown above. They’re paying over $4,000 per year to Shift4 for absolutely nothing.

Why the Amex Support Fee is Deceptive

The biggest problem with the Amex Support Fee isn’t just its high price. It’s how Shift4 presents it in your statement.

By listing the Amex Support Fee alongside legitimate card network charges in the processing detail portion of your statement, Shift4 creates the impression that this is a required fee from American Express.

If you’re glancing through all of these line items, you’ll just see words like “Amex” and “Interchange” and assume it’s a standard fee. But it’s not.

American Express has a unique fee structure.

Businesses processing less than $1 million per year in Amex transactions are on an OptBlue plan (with interchange fees being passed through the processor).

If your annual Amex volume is over $1 million, then you need a direct agreement with American Express. So Shift4 doesn’t get their typical markup on these transactions, and they’ve invented the fee as a way to earn more margin (though we’ve also seen the Amex Support Fee charged on OptBlue accounts via Shift4).

Whether you’re on OptBlue or an Amex direct agreement, there’s no “support fee” that Amex charges to processors. And even if there was, it wouldn’t be anywhere near 0.25% of the transaction volume.

The Amex Support Fee Even Shows Up on Good Deals

Another thing that’s frustrating about this fee is that it often appears on merchant accounts that are otherwise getting competitive rates.

The merchant in the example we highlighted earlier is paying a 0.06% discount rate, which is actually a great deal.

But Shift4 still snuck in this bogus Amex Support fee.

This proves that even if you negotiate a good deal with your processor, they can still add junk fees that inflate your overall processing costs.

You can’t just look at your discount rate and assume everything is fine. You need to scrutinize every line item on your statement because Shift4 (and other processors) will take advantage of any opportunity to pad their margins with hidden charges.

Is the Amex Support Fee Legitimate or Junk?

The Amex Support Fee is a junk fee.

It’s not required by American Express, and it doesn’t correspond to any actual service provided.

The zero interchange amount proves that Shift4 is pocketing the entire charge as pure profit. Even the way Shift4 itemizes statements makes it tough to line up each charge to the corresponding amount.

This fee should be removed from your account.

How to Get the Amex Support Fee Removed From Your Shift4 Account

If you find an Amex Support Fee on your Shift4 statement, here’s what you should do:

- Document Your Overcharges: Review your last 6-12 months of statements to calculate exactly how much you’ve paid in Amex Support Fees.

- Contact Shift4 Directly: Call Shift4 and ask that the fee be removed immediately. Tell them you know it isn’t a legitimate Amex charge and you expect it to be removed from your account.

- Request Reimbursement: Don’t just accept a removal going forward. Push Shift4 to reimburse you for the fees you’ve already paid (which they’ll typically offer in statement credits, if they agree).

You also need to continue monitoring your statements, even after Shift4 agrees to remove the charge.

Unfortunately, you can’t just take the phone rep’s word for this. Even if the fee disappears for a month or two, Shift4 may add it back down the road.

And if you read our Shift4 review, you’ll see real examples of these types of “mistakes” that we’ve caught Shift4 making.

What if Shift4 Won’t Remove the Fee?

Negotiating with Shift4 doesn’t always go smoothly.

Don’t just accept “no” from the first rep you talk to. Ask to speak with a supervisor or an account manager who has the authority to make pricing changes.

You can also let Shift4 know that you’re evaluating other processors, even if you have no intention of switching (we actually don’t recommend switching processors to save money).

If they’re still giving you a tough time, get help from our team here at MCC. We have a long history negotiating with Shift4 on behalf of our clients, and we know exactly which levers to pull to get these fees removed.

You should also keep in mind that many Shift4 contracts include a liquidated damages clause, which makes switching expensive. That’s why we focus on negotiating better terms directly with Shift4 instead of migrating to another provider.

Why This Fee Matters (Even if You’re Getting a Good Rate)

Some of you might be thinking to yourself, “It’s only $100 or $200 a month. Is it really worth fighting over?”

Yes. Absolutely yes.

Here’s why. If Shift4 is willing to add one bogus fee to your account, they’re like charging others. The Amex Support Fee is often just the tip of the iceberg.

Shift4 has already rolled out major rate increases the last two years in a row.

They’ve also started charging “Annual Program Fees” of $99 per location, and “Annual Regulatory Assurance Fees” of $325 per device.

That could easily be over $1,000 right there in bogus charges. And when you factor in the Amex Support Fee, plus other bogus fees, you’re likely paying Shift4 over $5,000 every year in bogus charges.

Do you plan to be in business for the next decade? Do you really want to pay Shift4 over $50k in additional markup with no added value?

You already pay them for a legitimate service. Don’t let them skim even more off the top with made-up fees.

Final Thoughts

Shift4’s Amex support fee is just another example of a processor markup disguised as a network charge.

It doesn’t come from American Express, and there’s no “support” whatsoever. You’re getting nothing in return from this fee, and it should be removed from your statement.

Businesses processing significant Amex volume could be costing you thousands of dollars per year. So call Shift4 ASAP and get it straightened out.

If you need help with this process and navigating these conversations, our team here at MCC is here to help. We’ll audit your statements for free, identify all of the junk fees (not just the Amex Support Fee), and negotiate directly with Shift4 on your behalf to get them removed.

Best of all, you keep everything in place. Same processor, same equipment, same integrations — you’ll just pay less.

Get a free statement audit today to see exactly how much you’re overpaying.