Early EMV technology has been around for more than two decades. However, the rollout of EMV chip cards and terminals didn’t migrate to the United States until 2012.

Over the last several years, EMV has slowly become the new-norm in credit card processing.

At first, the transition was a bit messy. There was a mix of consumers unable to use their chip cards at terminals lacking the proper technology, and merchants asking consumers to dip cards that did not yet have chips embedded. I’ve never seen longer lines at the grocery store.

While things have definitely been better over the last few years, the deployment of EMV processing has been inconsistent for vendors across the country.

I know plenty of merchants who have become EMV-compliant, but still have lots of questions about the technology works. That’s what inspired me to write this guide.

I’ll explain everything you need to know about processing EMV chip cards at a merchant.

What Does EMV Stand For?

EMV is an acronym, which stands for Europay, Mastercard, and Visa. These were the big names that joined forces back in the 1990s to work on the EMV initiatives across the globe.

Discover, American Express, Union Pay, and JCB eventually joined them, to form what is now known as EMVCo.

It’s worth noting that EMVCo does much more than set initiatives for EMV chip cards. The organization also sets the standards for a wide range of payment technology and software, like 3D secure authentication.

Purpose of EMV in the United States

The technology associated with EMV chip cards was long overdue. Magstripe technology dates back roughly 50 years, so EMV cards were developed to make credit card processing more secure.

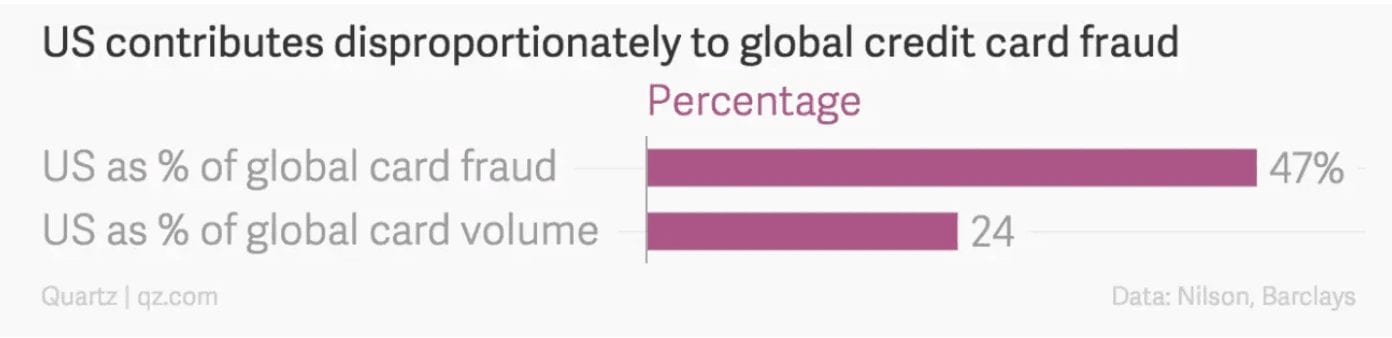

Back in 2015 (when EMV was still relatively new to the US), nearly half of global credit card fraud occurred in the United States.

This is largely disproportionate, considering the US processes just 24% of the global credit card volume. In short, the United States was a huge target for hackers, thieves, and cybercriminals.

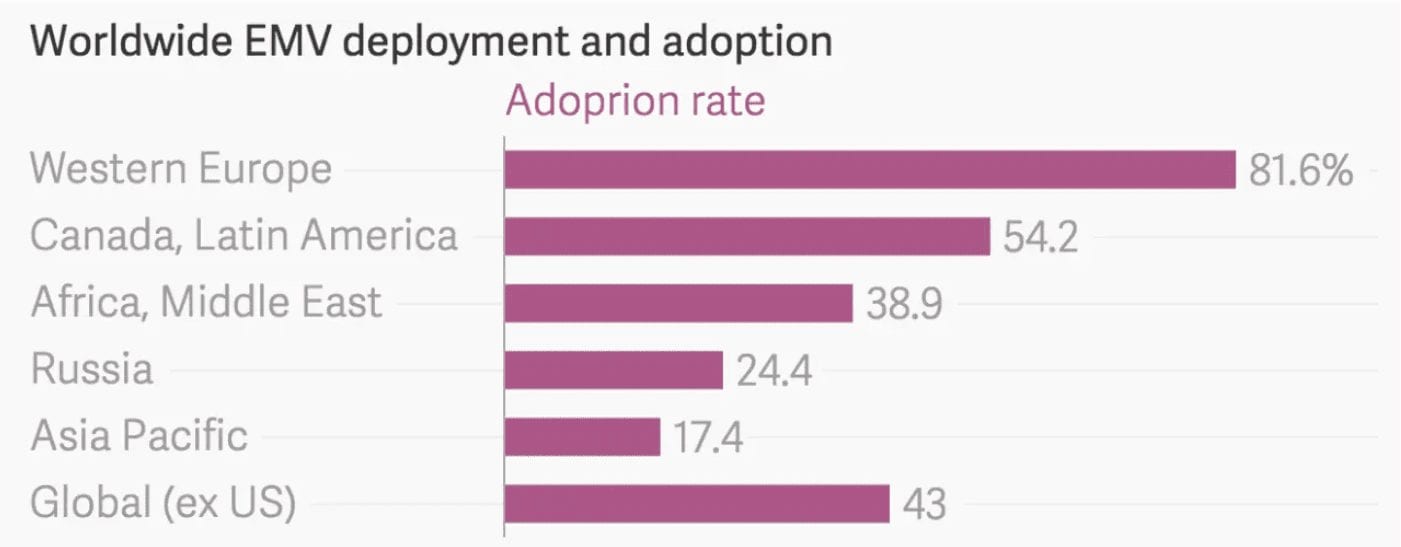

The rest of the world had already adopted EMV-compliance and were experiencing drastic improvements as a result.

For example, the UK started its EMV rollout back in 2003. The switch to EMV led to a 70% reduction in credit card fraud over the next ten years.

Data breaches from big names like Target, Home Depot, and Staples compromised more than 100 million customer records.

Essentially, the US was playing catch-up to the rest of the world when it came to credit card security. EMV chip cards were issued to protect consumers and merchants from fraud.

In Europe, EMV chip transactions are typically accompanied by a PIN. Here in the US, merchants have historically required customers to sign a receipt to validate a credit card transaction.

However, those signatures aren’t very legitimate. Most merchants don’t actually compare the signature on a receipt to the one on the back of the credit card, making it easy for thieves to forge a name. Plus, the majority of customers just quickly scribble on the paper or screen, as opposed to writing their actual signature.

In 2018, the major credit card companies realized how pointless this was, and decided that merchants no longer needed to collect signatures for EMV transactions.

Is an EMV Chip Card More Secure?

Lots of merchants and consumers wonder if EMV technology is actually more secure than its magstripe counterpart. The answer—absolutely.

While EMV chip cards are not entirely bulletproof, they are much safer than the magnetic stripe technology that was initially developed in the early 1970s.

The reason why these transactions are more secure is because of the EMV chip itself. It’s a computer that dynamically authenticates card transactions.

An EMV chip encrypts the transaction data when it’s communicated with the card reader. This data is unique to each transaction, which means it can’t be used again if it were captured by a thief.

Magstripes keep static data on credit cards. So the cardholder’s name, account number, and expiration date are always present during the transaction. This makes it easy for a criminal to intercept the information and use it to make fraudulent charges.

In short, it’s harder for thieves to gain access to credit card data when a card is dipped (chip) as opposed to swiped (magstripe).

EMV Compliance

What is EMV compliance?

Basically, merchants are considered EMV-compliant if they process credit card transactions with software and hardware that support EMV chip cards.

What happens if you aren’t EMV compliant?

Contrary to popular belief, merchants are not breaking any laws if they don’t accept EMV chip cards. But as of 2015, liability has shifted to the merchant if they don’t update their equipment with EMV standards.

So when a card is swiped instead of dipped, the merchant assumes full risk of the transaction. This means you’re subject to chargeback fees, in addition to the cost of the sale and cost of goods sold.

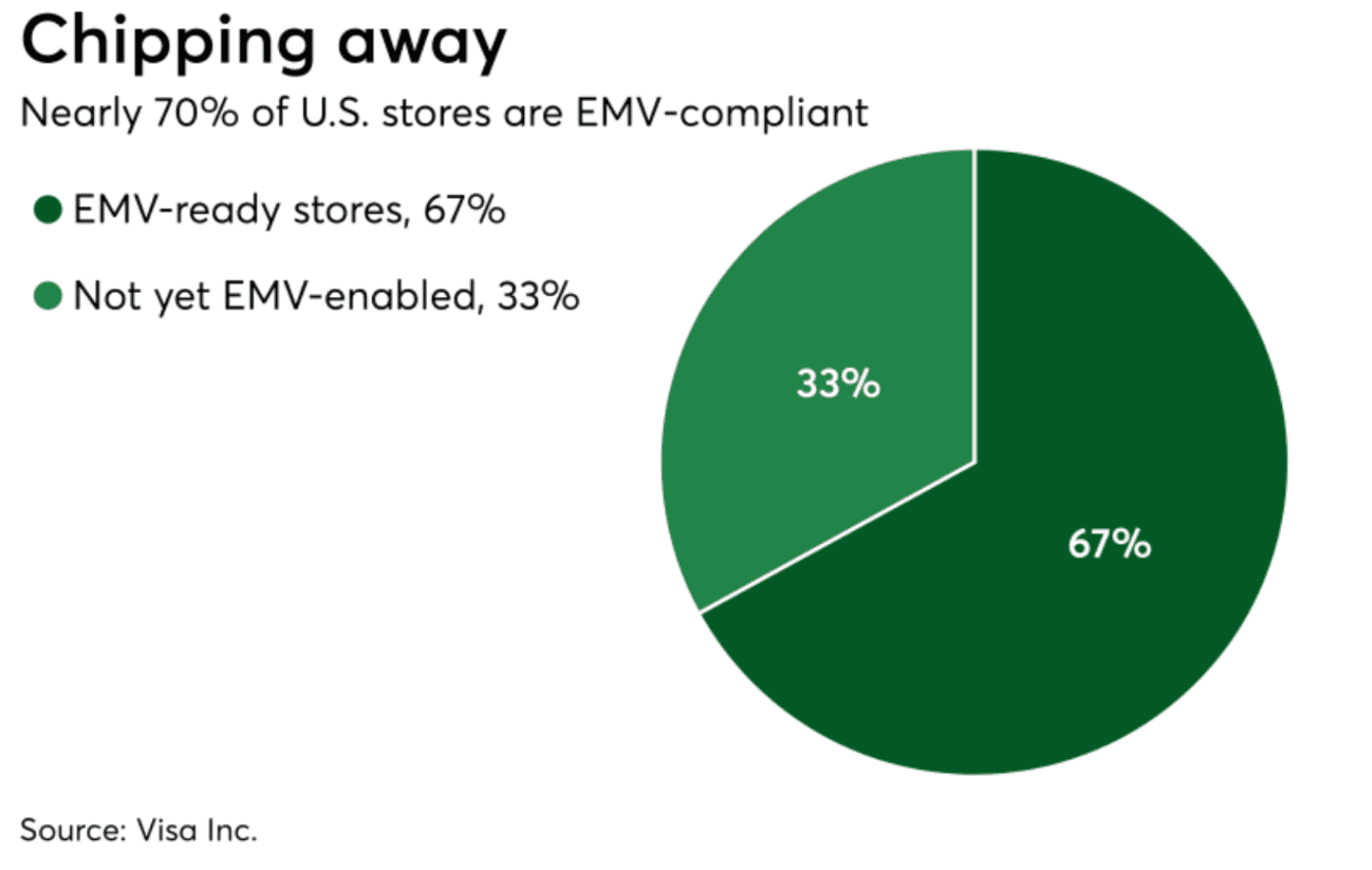

Roughly two-thirds of stores in the US are now EMV-compliant.

While this is definitely an improvement and shift in the right direction, it’s not nearly as close to 100% as it should be.

Accepting EMV Chip Cards

Do you need to accept EMV chip cards?

Technically, no. As we just discussed, failing to become EMV compliant is not illegal. But just know that you’re using outdated technology that puts your customers at risk, and increases your liability as a merchant.

How do you accept EMV chip cards?

For those of you who haven’t made the switch to EMV just yet, it’s not too late to start accepting EMV payments. If your POS system has built-in payment processing, contact your POS provider to get your hardware updated. You’ll need to make sure your software is EMV compliant as well.

If your terminal is not linked to your POS system, you just need new hardware. You can get this directly from your payment processor, or whoever issued your existing card reader in the first place.

EMV Payment Processing Costs

How much does EMV cost?

The only cost associated with accepting EMV chip cards is your initial investment. Once you update your terminals and software, there is no additional fee.

Your credit card processing rates will remain the same, whether a card is dipped or swiped.

Final Thoughts

Every business should be accepting EMV chip cards in 2020. If you haven’t made the switch yet, I strongly suggest you do so immediately.

Accepting EMV cards is not expensive. You’ll just have to pay for the new equipment.

While your credit card processing rates won’t change with EMV transactions, there are other ways to lower your credit card processing fees. Contact us here at Merchant Cost Consulting, and we can negotiate those rates on your behalf.