After 20 years of litigation, Visa and Mastercard just announced a revised $38 billion settlement with US merchants.

If approved by the courts, the deal would temporarily lower interchange fees and allow merchants to decline certain types of cards within the Visa and Mastercard networks.

On the surface, it sounds like a major win for businesses that have been faced with increased swipe fees over the years. But if you dig a bit deeper, you’ll find that this settlement is more about optics than practical changes.

Let me explain why.

The Updated Visa/Mastercard Settlement Details

The most significant change that caught my attention is that the “honor all cards” rule is effectively being eliminated.

Currently, if your business accepts Visa, you must accept all Visa cards. You can’t pick and choose to decline certain cards (like premium rewards cards) that are more expensive to process. This settlement would change that for the first time.

Highlights of the revised settlement include:

- Visa and Mastercard interchange fees would drop by 0.1% for the next five years.

- This would lower the average interchange rate from 2.35% to 2.25%.

- Standard consumer card rates would be capped at 1.25% for eight years (a 25% reduction).

- Merchants can now choose which card categories to accept within each network.

- Businesses would have fewer restrictions when implementing surcharge fees.

All of this is still subject to court approval, and federal judges have previously rejected other versions of the settlement.

Lower Interchange Rates Will Obviously Benefit Merchants

First and foremost, we have to acknowledge the fact that lowering interchange rates by an average of 10 basis points is a good thing.

And a 1.25% interchange cap on standard consumer credit cards is great.

If you read my blog posts, you know I’m always hammering home the fact that interchange is one of the only non-negotiable components of credit card processing. So getting reduced rates here is huge, and if you combine that with renegotiated terms from your processor, your business could see serious savings.

Is this reduction at the interchange level enough? Probably not.

Especially when you consider the fact that the honor all cards elimination component of the deal feels like smoke and mirrors (more on that later).

I’d rather see Visa and Mastercard lower interchange rates even more with additional caps for a longer stretch of time. We’ll see if the courts agree or think this proposal is fair.

Addressing the “Interchange Gap”

The theory behind letting merchants choose to accept or deny certain card types makes sense on paper. Premium rewards cards have higher interchange rates because the card networks and issuing banks use merchant fees to fund cardholder perks.

That’s why cards like the Chase Sapphire Reserve, airline rewards cards, and hotel-branded credit cards all cost merchants significantly more to process.

To put this into perspective, let’s look at some actual Visa interchange rates.

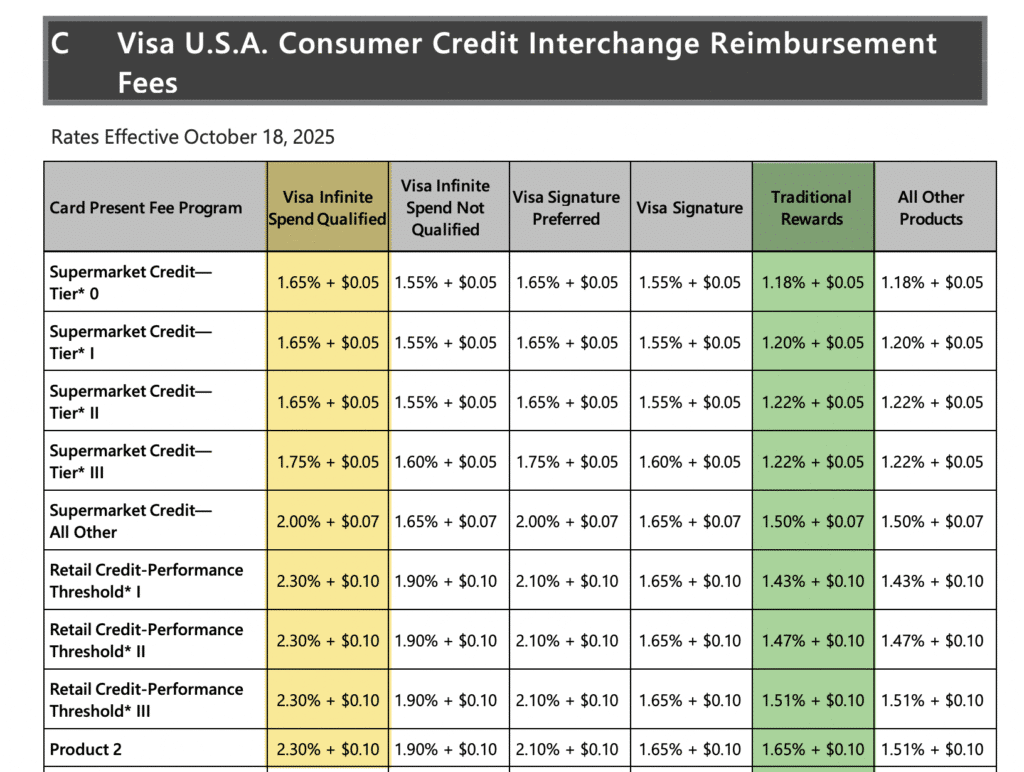

I’ve highlighted two interchange categories: Visa Infinite Spend Qualified and Traditional Rewards.

To add some context, the Chase Sapphire Reserve card ($750 annual fee) falls into the Infinite Spend category, whereas a Chase Freedom Unlimited card (no annual fee) falls into the Traditional bucket.

Look at the massive gap between these interchange rates.

Depending on what type of card a customer pays with, a supermarket might pay 1.18% + $0.05 per transaction or 1.75% + $0.05. A retailer could pay as low as 1.43% + $0.10 or as high as 2.30% + $0.10 per transaction.

That’s a huge difference.

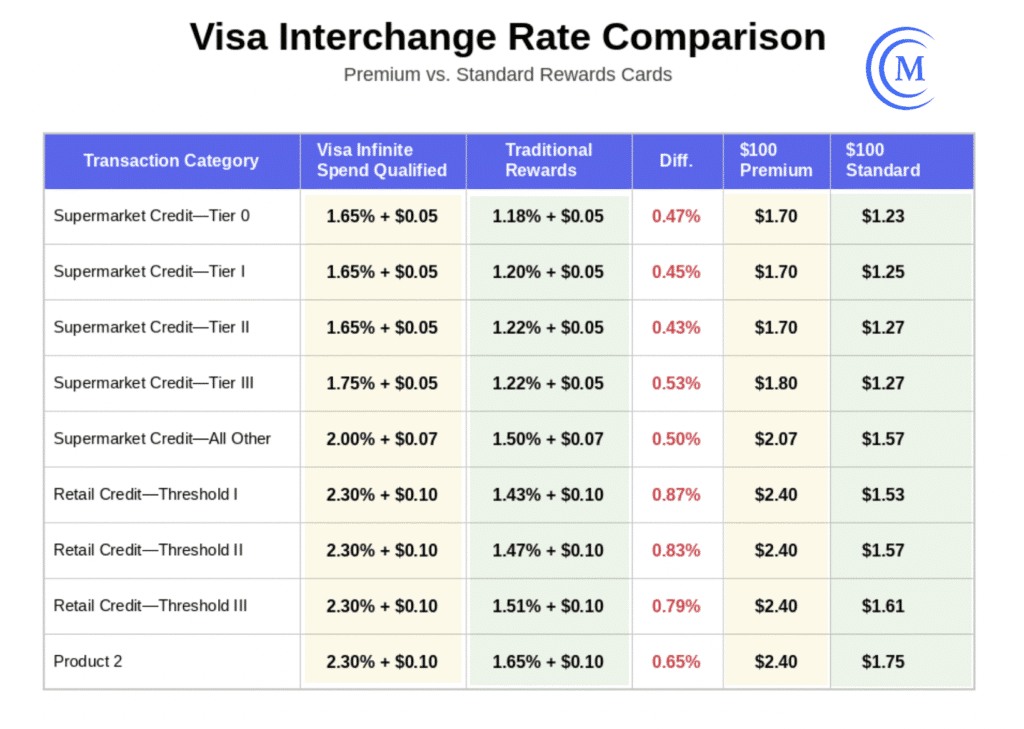

Here’s a more detailed comparison of the cost difference for merchants using the same interchange categories from above:

Just looking at these nine categories, the average interchange difference is 61 basis points between these two card types.

But when you look at all Visa consumer credit interchange categories, the gap widens even more. On average, Infinite Spend Qualified transactions are 67 basis points more expensive than Traditional Rewards.

Mastercard interchange rates follow a similar pattern. World Elite cards average 60 basis points more than Core cards.

Even if we estimate on the low end of the average here and say it’s 60 basis points, that’s $6,000 more per $1 million in sales just at the interchange level. Not including assessment fees, processor markups, and other costs associated with processing.

The Practical Problems That Nobody is Talking About

This latest Visa/Mastercard settlement update has been covered by everyone: WSJ, Reuters, MarketWatch, PYMNTS, USA Today, and dozens more.

But nobody is talking about the major flaws in ending the “honor all cards” mandates.

My biggest issue with this settlement is that I don’t see how any of this can realistically be implemented at the point of sale.

Despite being “allowed” to reject certain types of Visa or Mastercards, here’s why I don’t think businesses can practically implement this change:

Problem #1: Consumers Don’t Know What Type of Cards They Have

According to a recent study, 71% of credit card users in the US have at least one type of rewards card (whether it’s cash back, travel, or something else).

This means that the vast majority of customers are carrying the exact same types of cards that this settlement would allow businesses to decline.

But here’s the thing. Most cardholders have no clue whether they’re holding a “standard” consumer card or a “premium rewards” card. They just know it’s a Visa or Mastercard, and maybe that they earn rewards.

- When a customer hands you their card or taps to pay, how exactly are you supposed to identify which category it falls into?

- Is the cashier supposed to examine the card to determine if it’s a Visa Signature Preferred card or just a plain Visa?

- What about when customers tap-to-pay using their phone or watch for contactless payments?

The settlement proposes that all cards would be grouped into three buckets that merchants could choose to accept, refuse, or surcharge. But identifying those cards at the point of sale (even with just three categories) seems unrealistic.

Problem #2: POS Systems Aren’t Built For This

Even if you want to decline premium cards without having your staff intervene, I don’t know of any existing POS system that’s equipped to handle this type of granular-level card detection and rejection.

The system would have to:

- Identify the specific card category in real-time.

- Cross-reference it against your specific merchant acceptance policy.

- Decline an otherwise valid, active card.

- Communicate to the customer why the card was declined.

This is not a simple software update. It’s a total restructuring of how payment terminals work.

And who’s going to pay for that? Merchants (of course).

Problem #3: The Customer Experience Would Be a Disaster

Let’s say that you’re actually able to overcome the first two hurdles and automatically implement declines of certain card types at the credit card terminal. Picture this scenario:

Your customer taps their card to pay, and gets a message saying “DECLINED – Card type not accepted.”

The customer might say something along the lines of, “What? This is a Visa. You accept Visa.” To which an employee replies, “We accept some Visa cards. But not premium rewards.”

Best case scenario, the customer won’t argue further and pulls out another card to pay (hopefully not another premium rewards card).

Now multiply this across hundreds or thousands of transactions at your business every day. It’s impossible for businesses to manage. And it might even cost them customers who don’t want to deal with this type of nonsense.

Problem #4: The Surcharge Alternative is Equally Messy

The proposed settlement also gives merchants more flexibility to surcharge. More specifically, they’d have the ability to surcharge up to 3% and potentially surcharge differently based on the card category.

But surcharging is already complicated (and that’s why we don’t recommend it).

Multiple states ban it entirely, other states have lower caps, there are varying disclosure requirements by location, and certain surcharges can’t exceed the merchant’s cost of acceptance.

Implementing category-based surcharging would be absurd.

Are you going to charge 1.5% for standard cards but 2.5% for premium cards? How would that even work at the terminal?

Certain laws also require you to display the total prices, including surcharge fees, before checkout. Is your price list or menu going to have a cash price, and then three different prices for every product or service that you sell?

Problem #5: Rewards Cards Would Lose All Value

Think about this from the cardholder’s perspective for a minute.

Imagine paying $795 per year for a Chase Sapphire Reserve card, only to have it rejected at checkout. Or constantly hit with surcharges.

The whole point of paying such a steep annual fee for these types of cards is so you can earn rewards. But you can’t earn rewards without spending money on the cards.

It would break the entire credit card rewards system.

Or maybe those customers would just sign up for an American Express rewards card instead. Since Amex isn’t part of the settlement, businesses can’t choose to reject certain types of those cards, and now we’re back to square one.

Why Visa and Mastercard Are Fine With This

Everything that’s happening with this new settlement proposal can basically be grouped into two categories:

- Interchange rates are being lowered and capped in some categories.

- “Honor all cards” is ending, supposedly giving merchants more flexibility.

But even with the reduced interchange rates, it doesn’t offset the rate increases we’ve seen over the last decade. We’re basically just resetting a year or two, where rates were already higher than they were in years past.

According to a Nilson Report cited by the Wall Street Journal, merchants paid $83 billion in interchange fees to card issuers in 2024. That’s up 71% from 2019.

This stems from higher fees paired with the explosion in rewards card usage amongst consumers and the shift away from cash. It also makes interchange fees one of the fastest-growing expense categories for US merchants.

When Judge Margo Brodie rejected the 2024 version of the settlement offer, she specifically criticized the honor all cards rules.

So I think Visa and Mastercard added these new provisions to appease the court, knowing it would be near impossible to practically implement these types of changes at the point of sale.

This deal is a win for the card networks because nothing really changes on their end. Interchange rates will still be higher than they were years ago, and merchants will still likely be accepting and treating all cards equally (even though they don’t “have” to).

Final Thoughts

This is a breaking story, and everything is still subject to court approval. So I’ll share updates as they become available. Though I’m honestly surprised that more people are talking about the flaws with this proposal.

I obviously like the idea of giving merchants more control over which cards they accept. And in theory, it introduces competition and gives businesses more leverage.

The reality is that category-based acceptance would require:

- Significant infrastructure upgrades to POS systems that would take years to implement.

- Staff training on how to handle confused customers.

- Clear signage and communication about which cards are accepted.

- A willingness to turn away potentially 70% of credit cards.

- Accepting a horrible customer experience.

Even if all of this were possible, I still think it would take a decade or more for this to roll out at scale. By then, the terms of Visa and Mastercard’s settlement would long have expired, giving them the freedom to raise interchange rates again and remove caps.

They’ll drop 0.01% for five years, then likely climb 0.05% in year six. That’s just the reality of the payment processing industry.

As a merchant, you can’t fight interchange or do much about this. Instead, your best chance of getting lower rates is by negotiating directly with your processor.