Breeze is an integrated payment processor owned by OrthoFi/OrthoBanc.

To clarify, OrthoFi is an orthodontic software company, and OrthoBanc is a patient financial management solution for orthodontists. These two companies merged back in 2020, and Breeze is the payment processing division for this merged entity.

But Breeze, OrthoFi, and OrthoBanc are all the same company. This is important to understand because you’ll see all three of these names used on contracts, statements, and communication channels.

Now that we’ve cleared up this common point of confusion, let’s dive straight into our review of Breeze’s payment processing services.

MCC Quick Take on Breeze Payment Processing

Breeze is an industry-specific processing solution. So if you’re not an orthodontist, dentist, or oral surgeon, then you can move on right now—Breeze isn’t for you.

But Breeze is a solid option to consider if you’re in this space and looking for an integrated processor. That’s because Breeze’s technology lets you accept payments directly within your practice management system. It integrates with Dolphin Practice Management and a few others, simplifying the way practices manage patients and get paid under one roof.

Just be forewarned that anytime you’re using an integrated system like this, rates will always be a bit higher. Breeze’s pricing isn’t egregious or anything like that, but it’s definitely not the cheapest processor on the market, either.

Breeze Pricing and Credit Card Processing Rates

Breeze only advertises flat-rate pricing—with rates starting at 2.89% + $0.15 per transaction and ACH transfers starting at $0.95 per transaction.

Breeze says that they don’t have interchange plus pricing. But we know for a fact that they DO offer interchange plus for larger accounts.

The lowest IC+ rate that we’ve seen is 40 bps, which translates to 0.40% per transaction.

This is obviously much cheaper than 2.89% + $0.15 per transaction, and you should try and do everything in your power to structure your contract as an interchange-plus agreement. Just be prepared for some pushback from Breeze. They may not be willing to give you this deal if you’re a small single-location practice that doesn’t have a high processing volume.

Other Important Breeze Pricing Information

Beyond the standard rates, there are a few other things you should be aware of when evaluating Breeze’s pricing for your practice.

First, our team here at MCC has been able to successfully negotiate lower rates for our clients using Breeze or switching to Breeze. To be clear, this is in no way an endorsement of Breeze, and we’re not a Breeze partner or anything like that. But if Breeze isn’t budging off its advertised flat-rate model, then just contact our team, and we’ll take over those negotiations on your behalf.

For example, we recently helped a client get closer to 2.50% + $0.15 for credit card transactions and $0.85 for ACH payments. We helped another client save roughly $32,000 annually by switching from Global Payments to Breeze.

In both of these examples, our clients needed an integrated processing solution with Dolphin software.

There are a few other miscellaneous fees may that be required, including:

- Terminal fees (ranging from $170 to $240 per terminal)

- Token transfer fees (paid to the practice management system, like Dolphin)

- Cancellation fees (to your current processor, if you’re switching to Breeze)

Otherwise, Breeze doesn’t really change a bunch of hidden or bogus fees.

Their markup is already super high because they try to get businesses on a flat-rate plan. So extra fees aren’t really necessary. It varies by contract, but we typically see Breeze committing to things like no setup fees and no PCI compliance fees.

In a recent proposal they sent to us during negotiations on behalf of a client, they actually wrote “no interchange fees” in a bullet list of Breeze’s benefits.

This is honestly hilarious. If you know anything about payments, then you’d know that it’s better to pay the interchange yourself and then just pay a small markup to your processor. So the fact that Breeze is using this as a marketing ploy just speaks volumes to how uninformed most businesses are.

Latest Rate Increases and Fee Changes From Breeze

Effective July 1, 2025, Breeze increased its rates 2.69% + $0.15 per credit card transaction (up from 2.54% + $0.15).

Other changes include:

- $0.10 increase to ACH transactions

- New $95 monthly fee per location

- New $26 activation fee

We were first made aware of these changes from our clients using OrthoFi/OrthoBanc. Read our OrthoFi review for more information.

Breeze vs. Other Payment Processors

How does Breeze stack up against the crowd?

It’s tough to compare Breeze with a direct processor because it’s not an apples-to-apples comparison. If you want the lowest possible rate on the market, Breeze isn’t the answer. You can go with a direct processor and get an interchange-plus plan with a much lower markup.

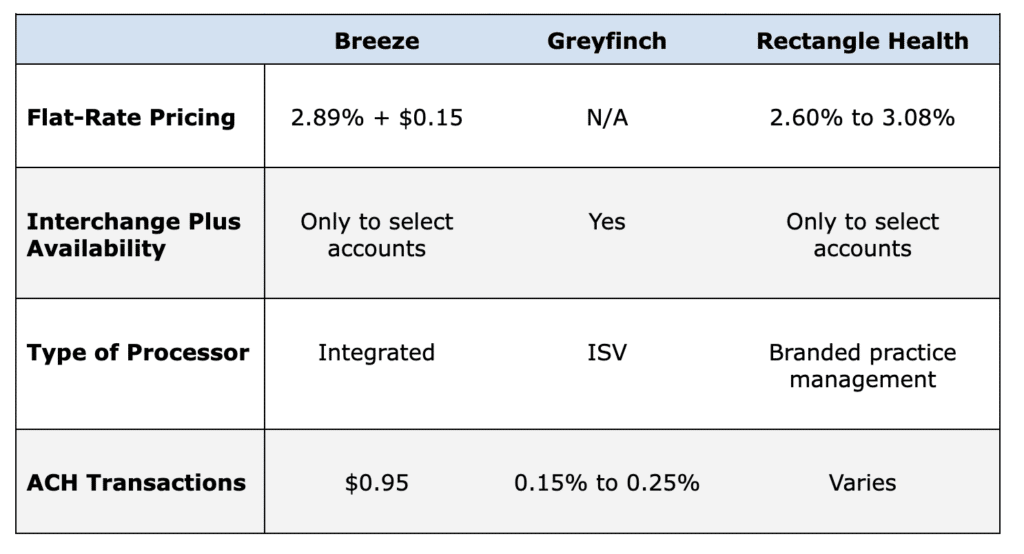

Breeze is all about its integration with practice management software. So if you’re willing to pay a slight premium for a healthcare-specific system, we can compare Breeze to similar solutions—like Greyfinch or Rectangle Health.

Each of these solutions has its pros and cons.

While Greyfinch is the best shot at getting interchange-plus pricing, their ACH rate is much more expensive (since they charge it a percentage of the transaction).

Rectangle Health is better if you want payment processing and practice management from the same provider. Rather than having to integrate your payment system with a third party, they provide both under one roof and rely on Vantiv to handle processing on the backend. However, you’d need to use Rectangle’s payment bridge (for an additional fee) to connect with tools like Dolphin software.

You can read our Greyfinch review and Rectangle Health review for more information about these alternatives.

Should You Switch to Breeze?

We rarely recommend switching payment processors. It’s usually in your best interest to stick with your current provider and negotiate with them directly, especially if you already have integrations in place.

That said, we’ve had some clients switch to Breeze successfully and save tens of thousands.

We recently had a client switch to Breeze because Breeze significantly beat their current rate. But I think this was more a testament to how much they were paying before the switch (over 5%), which any processor could beat.

Should You Terminate Your Contract With Breeze?

If you’re already using Breeze you should probably just stick with them. Yes, your rates will be higher compared to other processors, but this is just the cost of using an integrated solution.

But if you don’t need the integration with your practice management system, then there’s really no reason to continue using Breeze. That’s the whole selling point and benefit of using them.

Termination clauses vary by contract, but typically, Breeze just requires 60 days notice to cancel. This can be a little more complicated if you’re also using OrthoBanc for payment management and collections.

Our Final Thoughts on Breeze’s Payment Processing Solutions

We’ve had a pretty good experience negotiating with Breeze on behalf of our clients. They’re receptive to lowering rates, but they aren’t always willing to give interchange-plus pricing deals to smaller practices.

If they loosen up their requirements for interchange-plus eligibility, it would be much more appealing. That said, the flat-rate structure is fine if you don’t mind paying a premium for the seamless integration with your practice management system.

Just don’t settle for the first price they send you. Keep negotiating and pushing back until you’re offered a lower rate.