Cayan has been acquired and is no longer accepting new customers. So this review is specifically written for merchants currently using Cayan.

Based on our insider knowledge, we’ll highlight the fees you need to look out for and take a closer look at Cayan statements to identify other cost-saving opportunities.

Our Insider Take on Cayan

Originally launched in 1998 as Merchant Warehouse, this payment processor officially rebranded as Cayan in 2015. Three years later, Cayan was acquired by TSYS in 2018—just in time for TSYS to be acquired by Global Payments in 2019.

This string of rebranding and acquisitions ultimately left many businesses by the wayside and paying more than they should to accept card payments.

- Cayan’s account management is virtually nonexistent.

- Essentially, TSYS is just making a profit off of Cayan’s book of business.

- We typically see Cayan’s discount rates high over the interchange rate.

- If you need customer service, you’ll go through Global Payments support.

- But if your rates are high, Global’s support team is pretty good about getting you on a more competitive plan—mainly because Cayan doesn’t have many integrations involved.

Cayan Pricing and Payment Processing Rates

Cayan offers interchange-plus pricing, which is good news. Unfortunately, these rates aren’t very competitive—and are noticeably higher above interchange compared to other processors.

Exact rates vary from business to business. It generally depends on when you initially got onboarded, and it’s likely you’ve been hit by all of the subsequent TSYS increases since the acquisition.

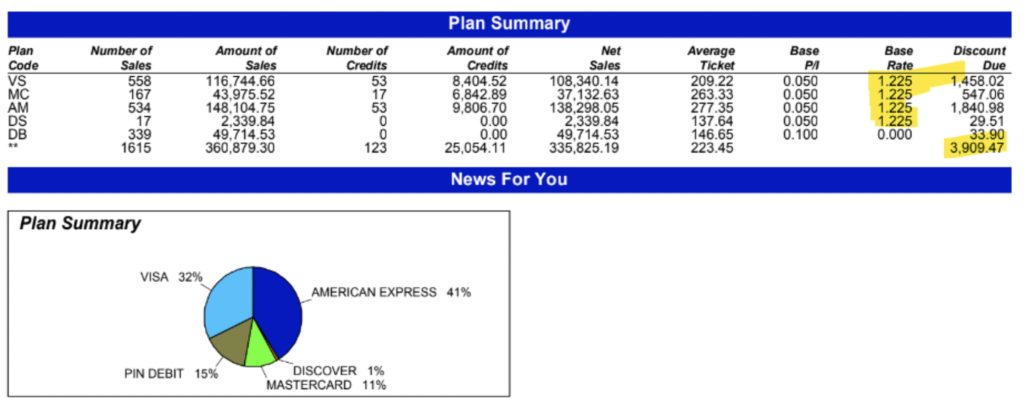

The bulk of Cayan’s transactional fees come from two components that you’ll see on your statement:

- Base Rate — Your discount rate as a percentage of the transaction (the markup paid directly to Cayan).

- Base P/I — Fixed dollar amount charged for each transaction.

Again, we’ve seen these rates all over the place when we’re auditing statements for our clients.

We’ve seen them as low as 0.10% per transaction. But they can range anywhere from 0.20% + $0.10 per transaction to 0.95% + $0.00.

Here’s one of the highest rates we’ve seen on a Cayan statement—1.225% + $0.05 per transaction:

The $0.05 Base P/I per transaction isn’t bad at all.

But the Base Rate of 1.225% is outrageous—especially considering we’ve seen this as low as 0.10%. This is more than 10x higher!

Cayan Fees to Look Out For

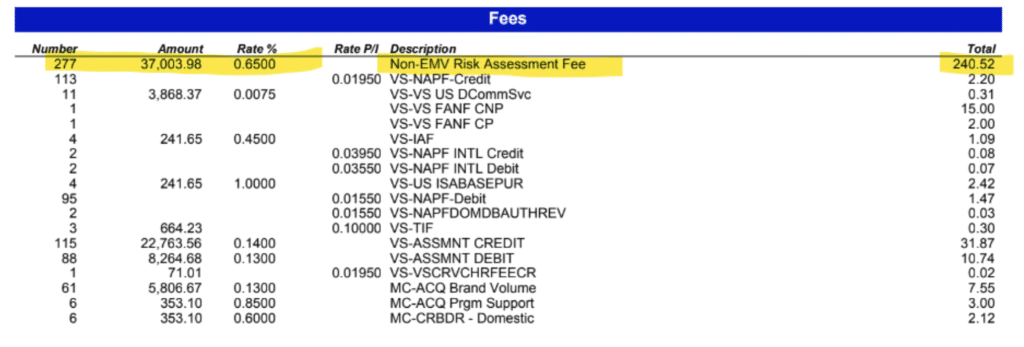

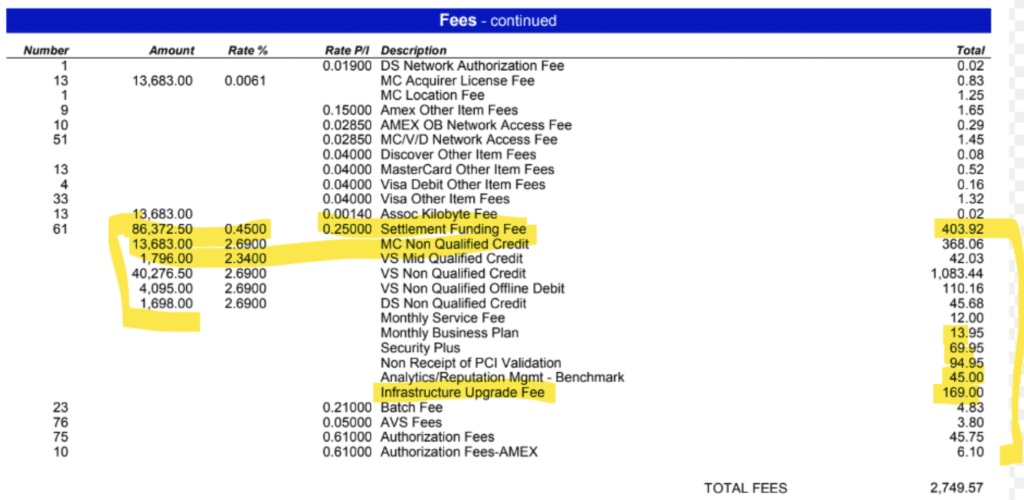

Beyond transactional fees, Cayan typically has a laundry list of additional charges added to the “Fees” section of the statement. These miscellaneous and mostly bogus charges are mixed in with all of the assessment fees from the card networks.

So you’ll need to sift through these line by line to identify which ones are legit and which ones can potentially be removed.

These are some of the most common fees we’ve seen on Cayan statements so far this year:

- Non EMV Risk Assessment Fee — 0.65%

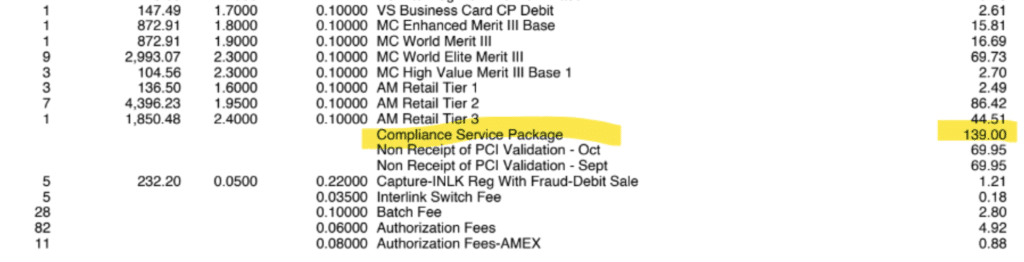

- Compliance Service Package — $139 per month

- Settlement Funding Fee — 0.45% + $0.25

- Infrastructure Upgrade Fee — $169 per month

- Analytics and Reputation Management Fee — $45 per month

- Non Receipt of PCI Validation — $94.95 per month

- Security Plus Fee — $69.95 per month

- Monthly Service Fee — $12 per month

- Monthly Business Plan — $13.95 per month

Let’s look at a few screenshots from Cayan statements so you can see these fees for yourself. Here’s the Non EMV Risk Assessment:

Here’s the Compliance Service Package:

And here’s the bulk of the rest:

Similar to Cayan’s markups, these fees can fluctuate based on the merchant. For example, we’ve seen the Monthly Service Fee as low as $4.95 and the Security Plus Fee as low as $14.95.

So it really just depends on your specific account.

But regardless of the amount, there’s a good chance you can get the bulk of these fees removed or at least reduced if you put in some effort and negotiate.

Audit Your Statements and Watch Out For Massive Rate Increases

Even if you were once paying low or reasonable rates with Cayan, don’t expect those low rates to last forever.

We have a client that recently experienced a huge rate increase over the course of just a few months—and I have the statements to prove it.

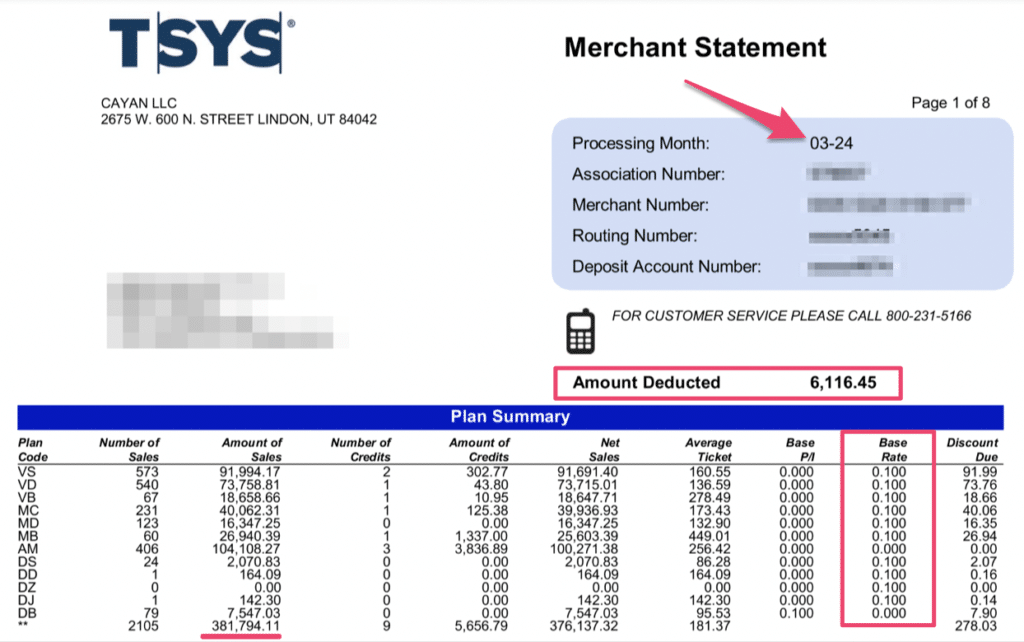

Here’s a look at what they were paying in March 2024:

The base rate was 0.10%, which is actually a pretty good deal.

Once you factor in all of the other pass-through fees from the card network and miscellaneous fees from Cayan, they ended up paying $6,116 in total fees on $381,794 in sales—making their effective rate 1.60% for March 2024.

Again, not bad at all.

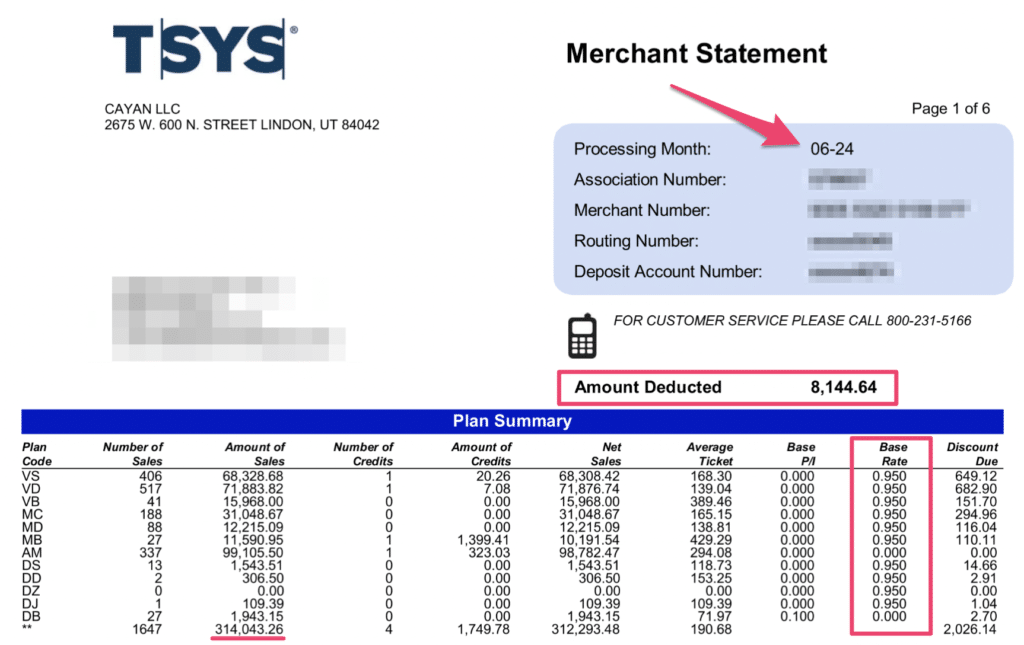

Now let’s fast forward to June of 2024:

Right away, you can see something is wrong here—before you even run the numbers.

The same exact merchant paid over $2,000 more in fees in June compared to March, even though their total sales were roughly $68,000 less. How is that possible?

Upon closer inspection, we can see that the base rate jumped from 0.10% to 0.95% in just three months. That’s nearly a 10x increase, which is shockingly high.

This increase brought the merchant’s effective rate up nearly a full percentage point higher—to 2.59% (up from 1.60%).

The takeaway? You need to monitor and audit your statements every month.

If you’re just quickly glancing at these, Cayan (aka TSYS) could be raising your rates right under your nose. And if you just sit back and do nothing, you’ll end up overpaying to accept card payments.

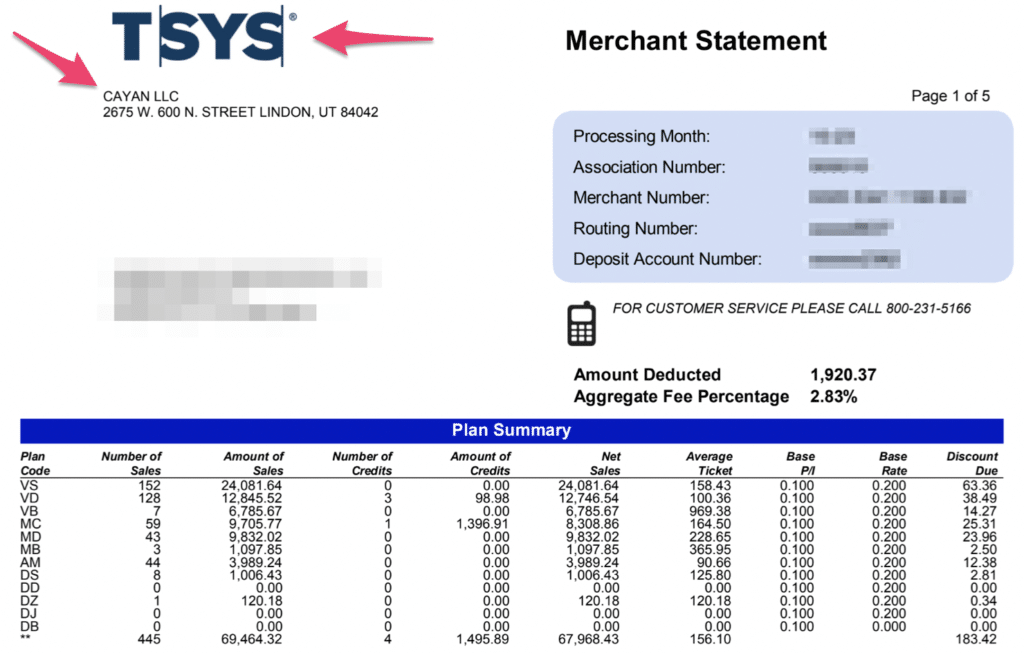

All Cayan Accounts Are Now Run by TSYS

TSYS acquired Cayan in 2018.

And even though TSYS has since been acquired by Global Payments, it still operates under its own branding as a subsidiary of Global.

So if you signed up for Cayan prior to its 2018 acquisition, your monthly statements should all say TSYS by now. But you’ll still see Cayan LLC in the header.

Aside from this small Cayan print in the header, the rest of your statement and reporting will look nearly identical to a TSYS statement.

There’s No Active Account Management—So You’ll Need to Reach Out to Customer Service to Negotiate Your Rates

Cayan is a huge profit booster for TSYS.

That’s because they’re just leaving those accounts alone and raising rates every so often. But nobody is actively working on those accounts or spending much time with them.

In fact, Cayan doesn’t even have its own customer support anymore. If you need help and reach out to customer service, you’ll be routed straight to Global Payments (which is the parent company of TSYS).

The Global Payments support team is actually pretty good. And since Cayan doesn’t have too many integrations involved, they can typically take care of you and get you on a better plan.

If You’ve Done Nothing Since Cayan Rebranded and Got Acquired, You’re Probably Overpaying

Your rates aren’t magically going to drop if you just sit back and passively do nothing.

While there’s a good chance you’re overpaying right now, a simple phone call could do wonders for you.

Reach out to Global and push back. This actually isn’t the worst spot for you to be in because they have an incentive to keep your business. Your account is highly profitable, so they should be willing to negotiate.

That said, they won’t necessarily lower your rates on the first attempt. Let us know if you need some help with this, as our team has tons of experience negotiating with Global Payments (which is who you’ll be dealing with if you want to lower your Cayan rates). You can check out this review and statement audit to see some real-life examples of what I’m referring to.

Our Final Thoughts on Cayan

While the Cayan brand is mostly defunct and no longer accepting new customers, merchants who were previously onboarded through Cayan are now getting their payment processing services through TSYS.

If you fall into this category, it’s safe to assume you’re overpaying. We typically see Cayan accounts with markups significantly higher than interchange rate.

And in the rare cases where merchants were getting reasonable rates, we’ve seen massive increases on those accounts so far this year.

Fortunately for you, those rates aren’t set in stone. You can just contact the Global Payments customer service team (currently handling Cayan support) to negotiate a better plan. If you need any assistance with this, our team here at MCC can help you out.