The terms “chargebacks” and “returns” are often used interchangeably. However, these two events are very different from each other.

Neither are great for businesses, but chargebacks are significantly worse. So if you’re getting lots of chargebacks and treating them the same as a refund, it’s costing you extra money and potentially damaging your merchant account.

I created this guide to clarify the differences between chargebacks and refunds once and for all.

What is a Chargeback?

Chargebacks are essentially a forced payment reversal. The chargeback comes directly from the card network or issuing bank, without the merchant’s permission. In fact, merchants may not even be aware of a chargeback occurring until after it happens.

For example, let’s say you sell a product or service to a customer who is unsatisfied. Rather than calling you directly to resolve the problem, the customer calls the credit card company. The issuing bank files a chargeback on behalf of the customer, withdrawing funds from the merchant’s accounting and giving the money back to the cardholder.

From here, the merchant has two options—accept the chargeback or fight it.

Check out these eye-opening facts about chargebacks.

Why is this so important?

Chargebacks are terrible for businesses. Not only are you losing the cost of goods sold (COGS) and other expenses associated with the transaction, but you’re also not getting the product back. Furthermore, there are chargeback fees imposed by your processor. Too many chargebacks can put you in poor standing with your merchant account. In extreme scenarios, you could lose the ability to process certain credit cards.

What qualifies as a reason for customers to file a chargeback? The list is long and depends on the card network. Check out these guides for more information:

- Visa Chargeback Reason Codes Explained

- Mastercard Chargeback Reason Codes Explained

- Discover Chargeback Reason Codes Explained

- American Express Chargeback Reason Codes Explained

The chargeback process is designed to protect the cardholder. So even if you dispute a chargeback (as a merchant), the chances of you winning are slim.

What is a Refund?

Refunds are much more straightforward. Even though all businesses hate refunding money, it’s something that you’re likely dealing with on a regular basis.

With a refund, the customer gets their money back directly from the merchant. Card networks and issuing banks are not involved with this process.

Sometimes the merchant will receive the goods back to initiate a refund—a return. In these instances, the merchant might be able to re-sell the returned product, which can help salvage the situation.

Refunds can happen for various reasons. But at the end of the day, it typically comes down to customer satisfaction. For one reason or another, the customer isn’t happy and wants their money back.

Differences Between Chargebacks and Refunds

There is really only one similarity between chargebacks and refunds—the customer gets their money back. Beyond that, these two instances are very different.

Here is a quick summary that highlights the differences:

- Chargebacks are out of the merchant’s control. Refunds are issued by the merchant.

- Chargebacks come with extra fees and penalties; refunds do not.

- Goods are sometimes returned to the merchant with a refund. This is not a requirement for chargebacks.

- Too many chargebacks can damage the merchant’s relationship with card networks.

- Merchants have the ability to fight a chargeback.

Cardholders don’t really care how it happens, but they just want to get their money back. Typically they choose the path of least resistance to get there, whether it be as a chargeback or refund.

Managing Chargebacks and Refunds

In a perfect world, you won’t be dealing with any chargebacks or refunds. But that’s a fantasy planet that none of us are living in.

The reality is this—customers will be unhappy sometimes. In these cases, it’s definitely in your best interest to offer a refund instead of going through the chargeback process. So how can you make this happen? Try these tips and best practices below.

Fraud Prevention

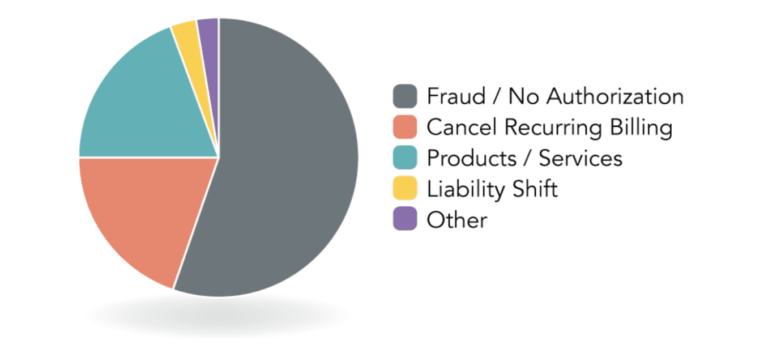

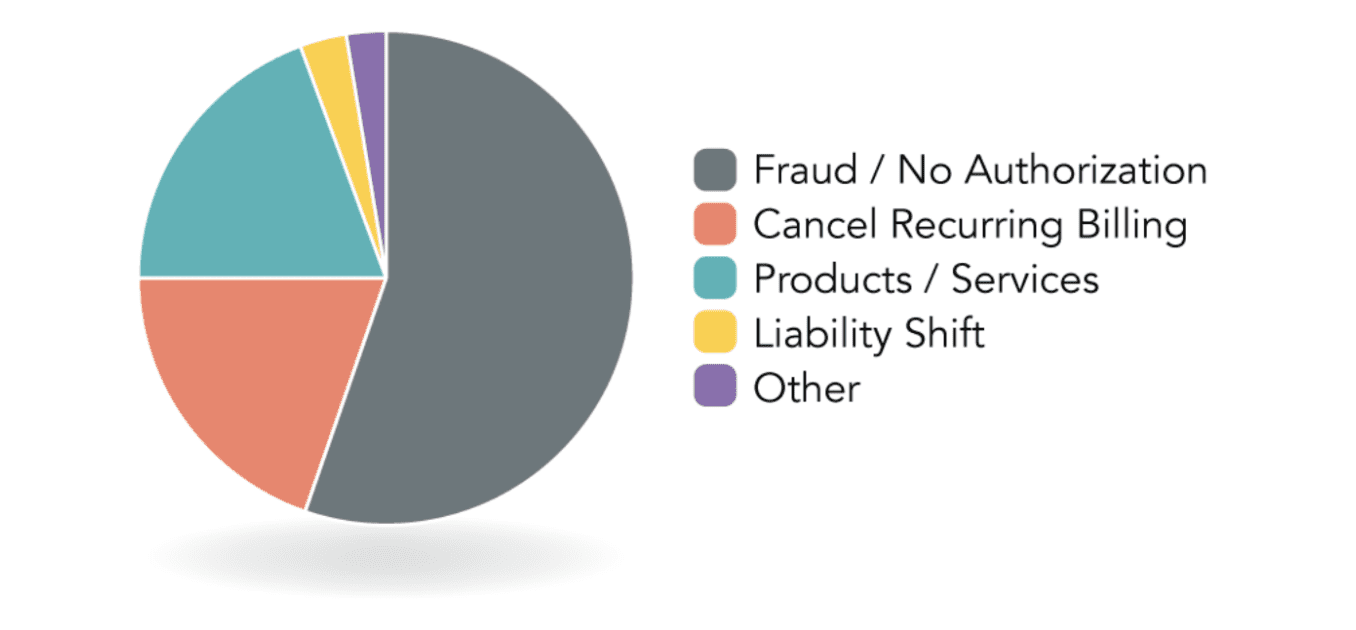

According to a recent study, fraud accounts for 52% of all chargeback reason codes.

But if you have proper fraud scoring and fraud prevention tactics in place, it will reduce your chances of processing fraudulent transactions—therefore lowering your chargeback rate.

Return Policy

You need to implement a customer-friendly return policy. As previously mentioned, if a customer wants to get their money back, they’ll find a way to do it. Cardholders understand that credit card companies have their backs. So if your return policy is too strict, customers will go over your head and just dispute the charge.

For the cardholder, chargebacks are so easy. Disputing a charge is as simple as making a call or clicking a few buttons in an app.

Returns usually involve a bit more work. If you aren’t offering free returns and you’re making customers jump through hoops to get the product back to you, it’s going to increase your chargeback rate.

I know it sounds counter-intuitive, but you shouldn’t be discouraging returns. Make sure your entire staff and customer service team understands this statement. Returns and refunds are better than chargebacks.

Quality and Communication

Sometimes customers file chargebacks because the product or service is not what they were expecting. This is especially true for ecommerce transactions.

Make sure you have plenty of high-quality images that clearly display the product from multiple angles. Consider adding video demonstrations to your product pages as well. The product descriptions need to be accurate as not to deceive potential buyers.

If a cardholder feels like they’ve been taken advantage of, they won’t bother trying to return the item or ask for a refund. They’ll go straight to the credit card company to dispute the charge.

Final Thoughts

Chargebacks and refunds are both unfortunate realities of doing business. You’ll likely never eliminate both of them.

However, refunds are definitely the lesser of two evils. So if a customer wants a refund, it’s in your best interest to accommodate them. Otherwise, you run the risk of a forced payment reversal that’s completely out of your hands.

Are your chargeback fees adding up? Looking for ways to save money on credit card processing? Contact our team here at Merchant Cost Consulting, and we’ll help you out.