Shopping online has been trending upward for years now. New market demands have created an even sharper spike for ecommerce sales in 2020.

Even industries that traditionally have catered toward in-person selling have been forced to shift gears and sell online.

If your business has been able to survive the changing landscape and turbulent waters of the COVID-19 era, congratulations. Adapting to sell online might be the only thing saving you right now.

While the ability to sell online is both positive and profitable for most organizations, there’s something else that needs to be taken into consideration—credit card processing fees.

There is a significant difference between card-present and card-not-present (CNP) transactions; processing fees are at the top of this list.

I’ll explain what you need to know about the rising costs associated with selling online. You can use this guide to ensure your ecommerce sales continue to generate high margins.

Ecommerce Trends

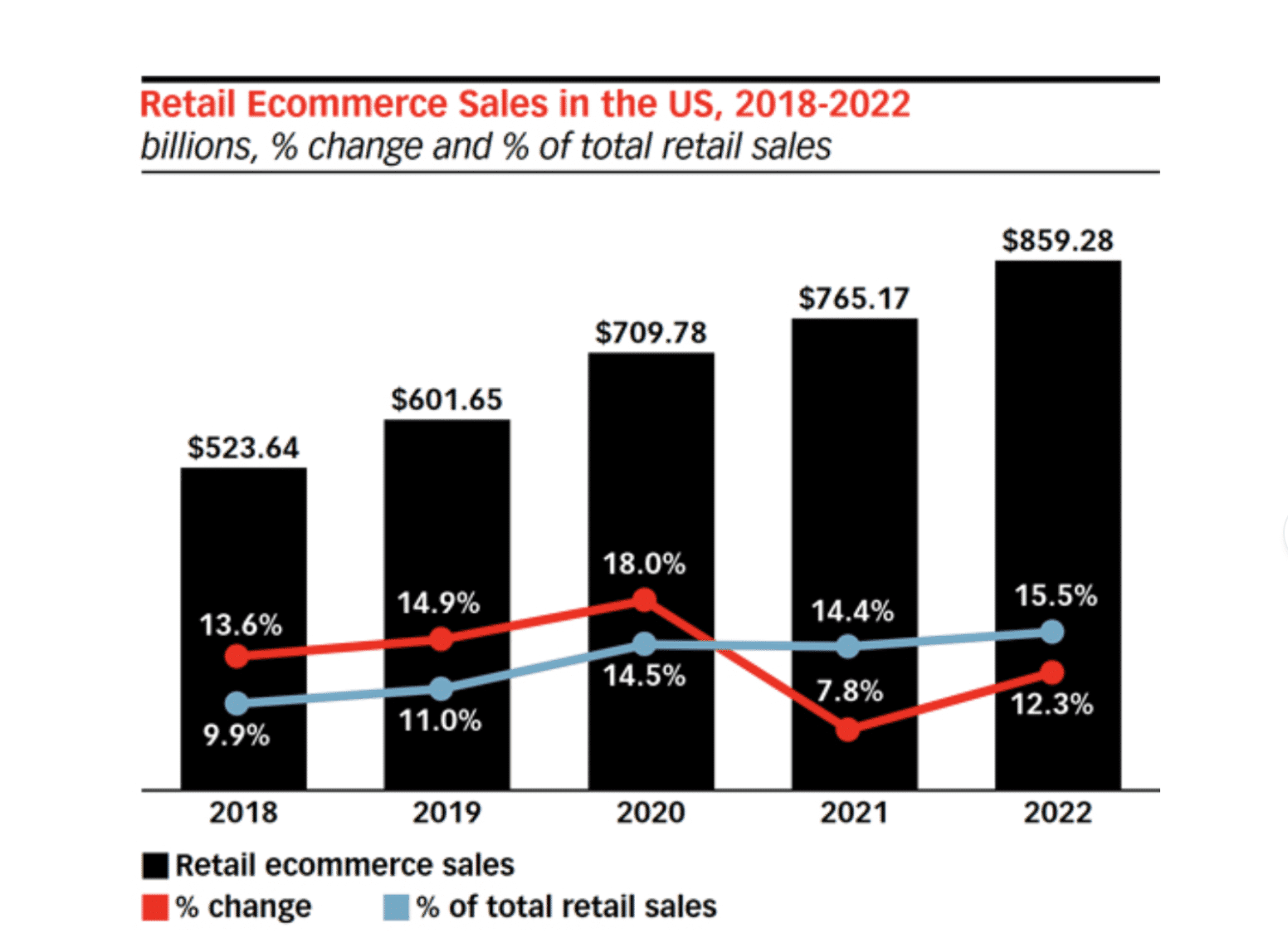

Before we talk about the specifics of ecommerce credit card processing, I want to quickly take a moment to discuss how quickly this industry has been growing.

According to JP Morgan, the United States is the second-largest ecommerce market on earth (behind China). B2C online sales in the US are increasing at a compound annual growth rate of 10%.

Due to COVID-19, we’re seeing specific industries, like retail, grow at a higher rate this year. According to TechCrunch, retail ecommerce sales are poised to increase by 18% in 2020.

Other industries are growing rapidly, as well. Grocery sales are another great example.

In 2019, the US online grocery sales market grew by 22%. But due to COVID-19, the ecommerce grocery market is poised to surge by 40% in 2020. According to a recent survey, more than 50% of US consumers have made an online grocery store purchase in the last 12 months.

What does all of this mean? Businesses that have historically processed transactions in person are now forced to sell online.

In addition to the added logistical costs associated with online sales, businesses are also being assessed higher credit card processing fees for online transactions.

The Costs of Ecommerce Credit Card Transactions

If you’ve been monitoring your credit card sales, you’ve probably realized that your ecommerce transactions cost more money to process than in-store transactions.

The same shirt, shampoo, gallon of milk, or whatever else you’re selling has different transaction fees depending on the purchase method.

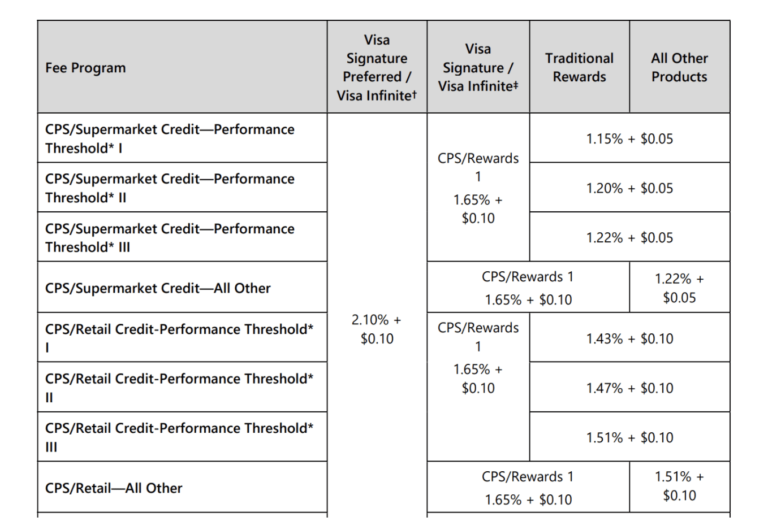

Let’s take a look at some of Visa’s most common interchange fees:

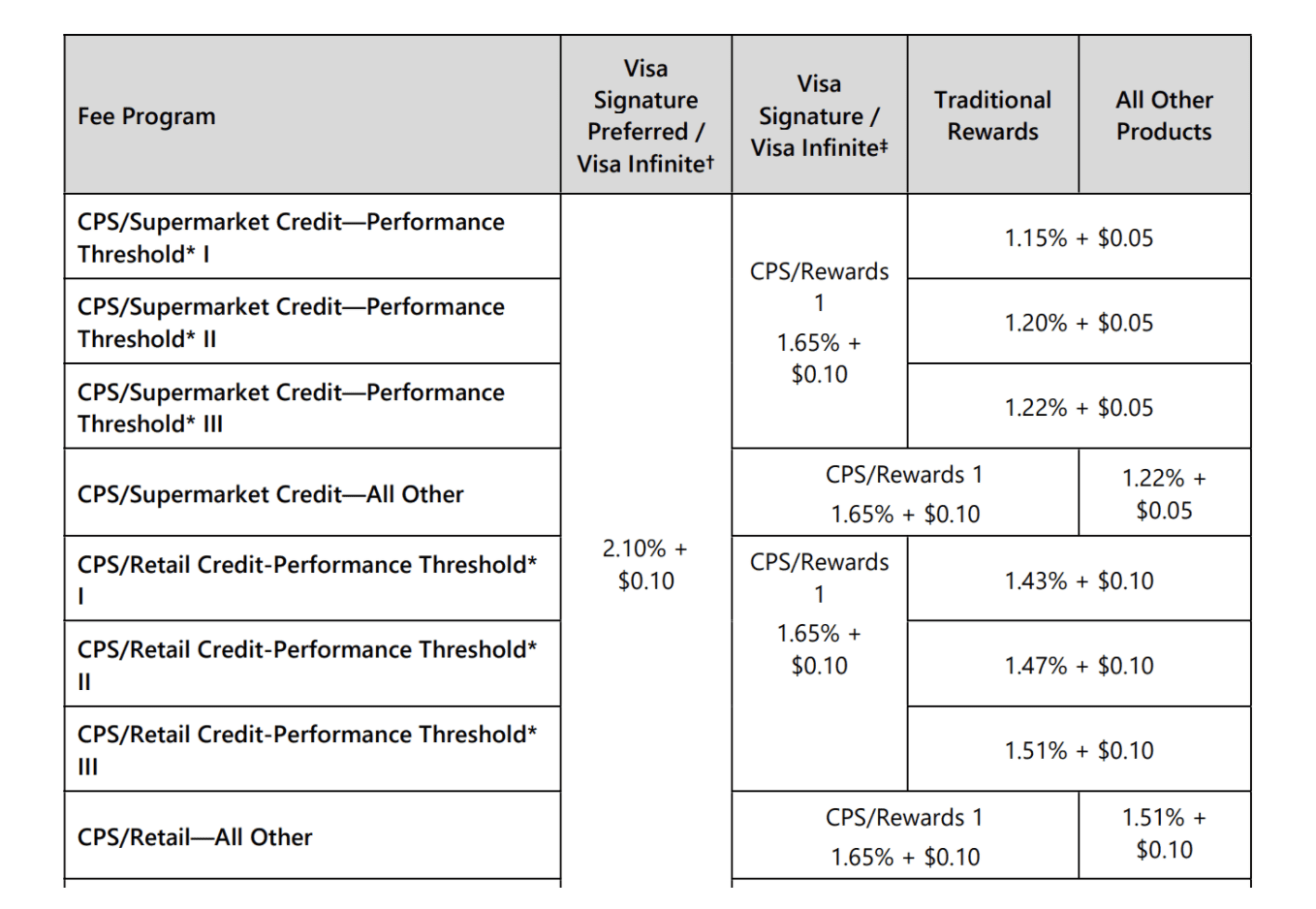

These are the Visa interchange fees for supermarkets and retailers—two categories that have been significantly affected by recent world events.

The rates above represent in-person credit card transactions that are swiped, dipped, or tapped.

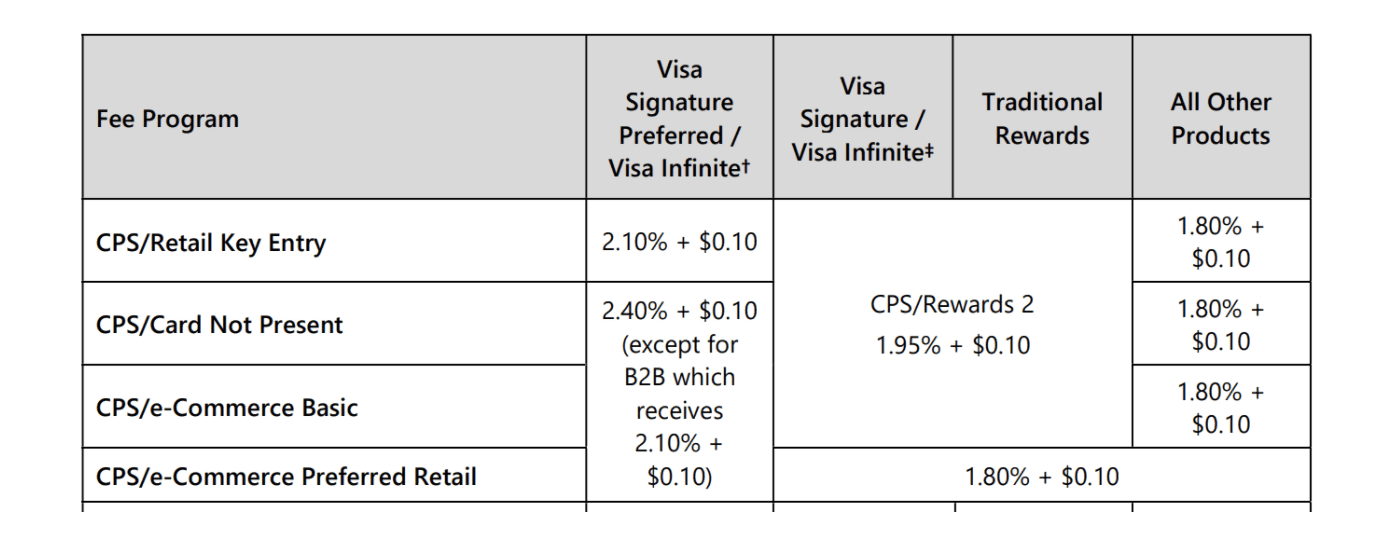

Now, let’s take a look at ecommerce interchange fees for the same types of merchants.

The exact same transactions cost more.

Depending on the card type and fee program, here are just a handful of head-to-head comparisons for in-store vs. CNP or ecommerce transactions:

- 2.10% + $0.10 vs. 2.40% + $0.10

- 1.65% + $0.10 vs. 1.95% + $0.10

- 1.22% + $0.10 vs. 1.80% + $0.10

At a minimum, it likely costs you at least 0.30% more per transaction to process a sale online instead of in-store. While this may not seem like much, it quickly adds up at scale.

For example, let’s say you’re a retailer or supermarket in the Visa CPS Threshold I category, meaning you process a minimum volume of $5.82 billion annually. To keep it simple, let’s round that up to an even $6 billion.

An additional 0.30% in credit card processing would cost you an extra $18 million in credit card processing fees per year.

Why Are Ecommerce Transactions More Expensive?

We’ve already established the fact that online sales are more expensive than in-person transactions—but why?

The simple answer is this; credit card companies have different categories for each transaction. Card present and card-not-present transactions fall into separate categories and therefore have different processing rates.

You can read our complete guide to interchange fees and rates to learn more about how this works.

Credit card networks and processors alike consider in-person transactions to be less risky. With the card physically present at the time of the transaction, the only way the sale would be fraudulent is if the card was stolen.

But with an online sale, there is a higher chance of fraud, and therefore a higher chance of chargebacks.

The added risks associated with fraud and chargebacks are more expensive for everyone involved. So the processing rates are higher to help offset those risks. At the end of the day, these costs are passed to the merchant at the time of the sale.

How to Lower Ecommerce Credit Card Processing Fees?

Unfortunately, interchange rates set by the credit card networks are non-negotiable.

But with that said, you don’t have to be stuck paying high processing fees. The markup imposed by your processor is negotiable. While your ecommerce transactions will still likely be higher than in-person sales, it’s possible to get that rate lowered.

Depending on your sales volume, even fractions of a percentage can result in millions of dollars in savings each year. So it’s definitely worth your time and consideration.

Final Thoughts

It’s more expensive to process ecommerce sales than in-person transactions.

With so many businesses being forced to shift online, the added cost is cutting into profit margins that were already slim to begin with. When you factor in the costs associated with shipping and other components of selling online, costs add up quickly.

However, you can still save money on ecommerce credit card processing. Get a risk-free assessment by our team of experts here at Merchant Cost Consulting. We can negotiate with your processor on your behalf, and help you save money processing online sales.

Whether you’ve been selling online for years or just getting started due to COVID-19, our team can help you get the best possible rates without having to change your processor.