The widespread acceptance of credit and debit cards has changed how we process payments. Cash represents just 16% of all in-person transactions, meaning plastic and digital wallets have penetrated far and beyond the ecommerce space.

But with roughly 17.45 billion credit, debit, and prepaid cards in circulation worldwide, the opportunity for fraudsters to take advantage of this trend has never been higher.

It’s crucial for merchants to understand the scope of credit card fraud, both here in the US and on a global scale. Knowing the impact of credit card fraud and identity theft will make it easier for you to protect your business and ensure you’re processing secure transactions.

This is the ultimate resource for credit card fraud stats, with 35+ mind-blowing credit card fraud facts that we identified, analyzed, and explained.

Key Credit Card Fraud Statistics (2026)

- 46% of global credit card fraud happens in the US

- Credit card fraud worldwide will reach $43 billion in 2026

- 48% of consumers say it’s the merchant’s responsibility to protect them from fraud

- 55% of fraudulent credit and debit card transactions are less than $100

- Every 14 seconds, a person in the US falls victim to identity theft

- 150 million Americans will be victims of credit card fraud this year

35+ Credit Card Fraud Statistics You Need to Know in 2026

These are the top 35+ credit card fraud and identity stats that merchants and consumers need to know:

1. Credit card fraud attempts are rising 46% YoY

With credit card transactions continuing to rise, the number of attempted fraud transactions are rising with it. Research suggests that fraud attempts with credit cards are rising 46% year-over-year.

2. Ecommerce credit card fraud in the US is up 140%

Online sellers are a primary target for fraudsters. In the US alone, there has been a 140% increase in credit card fraud attacks against ecommerce merchants in the past three years.

3. 46% of global credit card fraud occurs in the US

While credit card fraud and identity theft is an issue worldwide, it’s most common in the United States. In fact, nearly half of credit card fraud loss worldwide comes from the US.

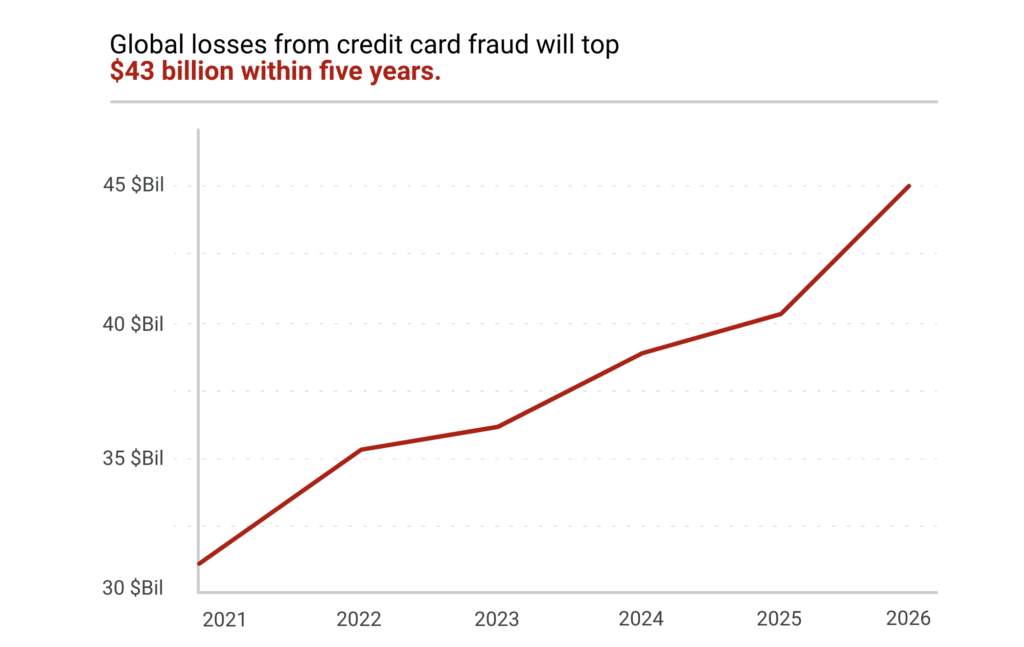

4. Global credit card fraud will reach $43 billion in 2026

According to recent projections, it’s estimated that total losses from credit card fraud worldwide will eclipse $43 billion within the next few years. This figure is up from $9.84 billion back in 2011 and $32.4 billion in 2021. If the projections are accurate, that’s roughly a 4.5x increase over 15 years.

5. Up to 80% of all credit cards in circulation have been compromised

Studies suggest that as many as eight in ten credit cards that are currently issued have already been compromised by some sort of hack or data breach.

6. Debit cards represent 17% of fraud cases

Debit card fraud is less common than credit card fraud. In a study of fraud cases where the payment method was identified, just 17% of those cases were tied to a debit card—which resulted in $117 million lost in a single year.

7. Credit card fraud is the leading type of identity theft

For four of the past five years, credit card fraud has been the most common type of identity theft in the United States.

8. Card-not-present fraud represents 65% of fraud losses

CNP (card-not-present) fraud makes up 65% of all credit card fraud losses. That’s because CNP transactions are less secure than transactions with physically present cards. This includes ecommerce transactions, phone transactions, and manually entered cards.

9. Credit card fraud is the fastest-growing type of identity theft

Credit card fraud is just one of the many forms of identity theft—but it’s the fastest crowing. The unauthorized opening of a new credit card account is increasing by 88% year-over-year.

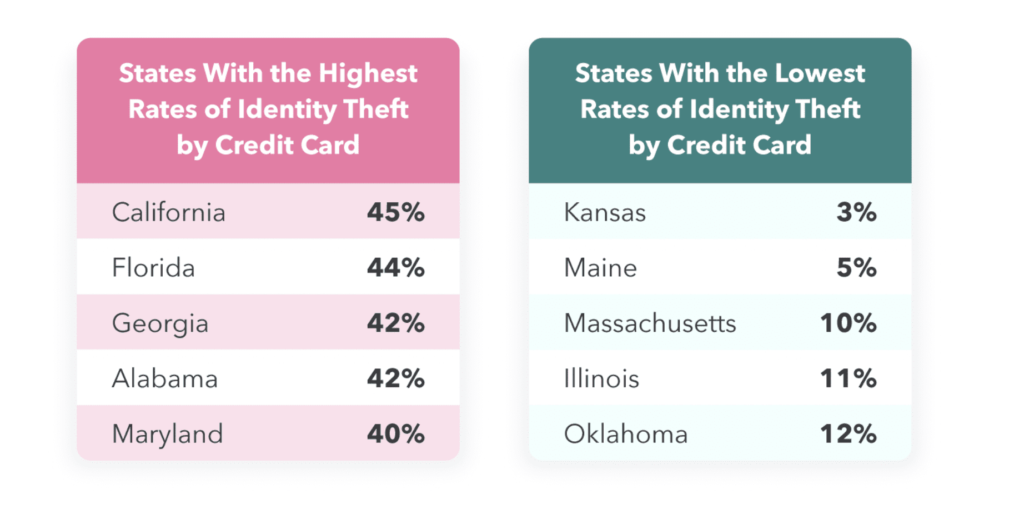

10. California has the highest rate of credit card theft in the US

The rate of identity theft via credit card is highest in California, at 45%. In addition to having the highest percentage of credit card fraud, California also has the most reports of credit card identity theft compared to all other states in the US.

Florida has the second-highest credit card fraud rate in the US, at 44%. Georgia, Alabama, and Maryland close out the top five at 42%, 42%, and 40%, respectively. The states with the fewest cases of credit card identity theft are Kansas, Maine, Massachusetts, Illinois, and Oklahoma.

11. People between the ages of 30-39 reported the most cases of credit card identity theft

Nearly 111,000 credit card fraud cases last year were reported by cardholders between the ages of 30 and 39.

12. People ages 80 and higher have the fewest reported cases of card fraud

On the flip side, just over 2,000 people over the age of 80 reported credit card fraud in the same year.

13. Credit card fraud in the US will reached $12.5 billion

It’s projected that credit card fraud losses in the United States alone will eclipsed $12.5 billion in 2025.

14. One in three consumers commit friendly fraud

About 33% of consumers unknowingly commit friendly fraud when they claim products are bad or haven’t arrived. Rather than going directly to the retailer for a refund, they filed a chargeback with their credit card companies—therefore, committing friendly fraud.

15. It costs less than $5 for fraudsters to purchase stolen card information

According to a recent study, the cost of a stolen credit card on the dark web costs less than $5. Additional information, including the victim’s social security number and birthday, can cost up to $100.

16. About 20% of the world’s population has fallen victim to a compromised record

Over 1.6 billion records have been hacked or breached in the last 15 years. That’s just over 20% of the 7.8 billion people in the world.

17. 10% of people in the US are victims of identity theft annually

If you live in the United States, you have a one in ten chance of falling victim to identity theft this year.

18. 48% of consumers say it’s the merchant’s responsibility to protect them from fraud

Nearly half of all consumers believe that online sellers should be responsible for protecting them from fraudulent credit card transactions. 32% say it should be the bank’s responsibility, and just 18% of consumers think the responsibility of fraud prevention should fall on their own shoulders.

Additional Reading: Who Pays For Credit Card Fraud?

19. 80% of credit card fraud offenders in the US are male

In a recent report of credit card fraud cases, authorities found that 80% of the fraudsters in the US were men.

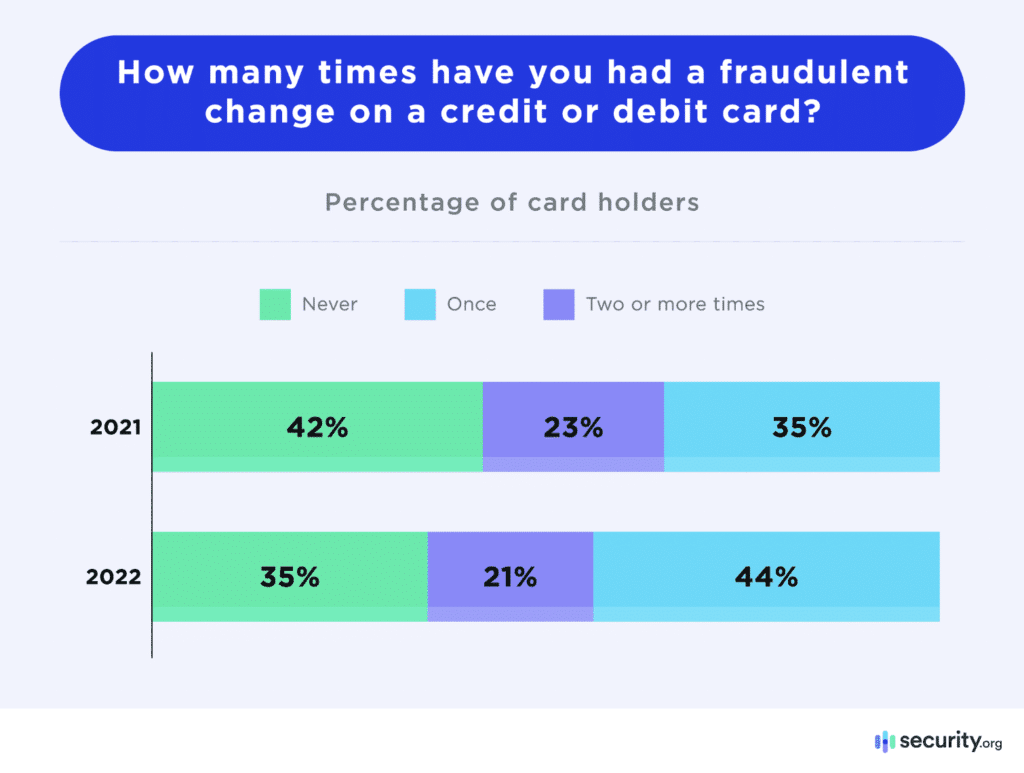

20. Over 20% of cardholders have fallen victim to credit or debit card fraud two or more times

Many credit card fraud victims have been affected more than once. In fact, last year alone, 21% of cardholders had two or more fraudulent charges on their credit or debit cards. This percentage is down slightly from 23% the previous year.

21. $79 is the median charge of credit card fraud

Currently, the median charge of a fraudulent card transaction is $79. This is up 27% from a median of $62 the previous year.

22. 55% of fraudulent card transactions are less than $100

Here’s a breakdown of the average fraudulent transaction:

- Less than $50 — 33%

- $50 to $99 — 22%

- $100 to $299 — 24%

- $300 to $999 — 15%

- $1,000 or more — $6%

23. The average credit card fraud case reported to police is $400

Just one in ten credit card fraud victims report the incident to police. Of those reports, the average fraudulent charge was $400.

24. Someone falls victim to identity theft in the US every 14 seconds

With more than 9 million Americans who have had their identity stolen, there’s a new victim of fraud in the US every 14 seconds.

25. Global credit card fraud losses will reach $397.4 billion within ten years

There’s no sign of credit card fraud being eliminated. Globally, the total losses will reach nearly $400 billion within the next decade.

26. Just 75% of US merchants are EMV compliant

EMV compliance helps protect cardholder data and facilitate safe transactions. However, just three in four stores in the US have adopted EMV technology—even though the EMV liability shift went into effect back in 2015.

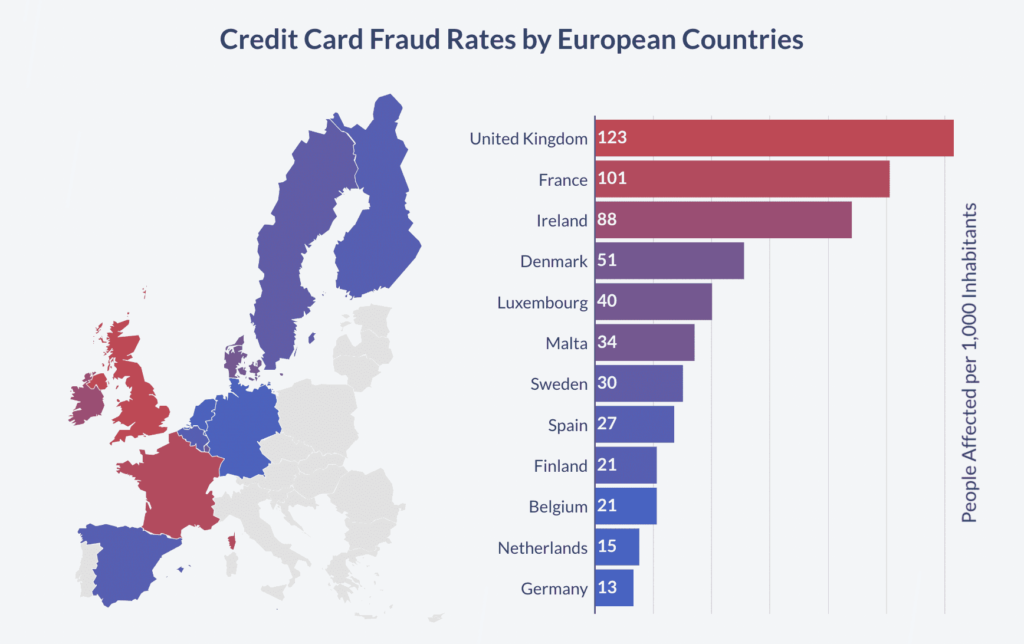

27. The UK has the highest rate of credit card fraud in Europe

In the United Kingdom, 123 of every 1,000 inhabitants are affected by credit card fraud. This is the highest rate in Europe and represents €10,414 in losses per every 1,000 citizens and €556 million total last year.

28. The largest credit card breach in history compromised 160 million cards

In 2009, the Heartland Systems breach resulted in 160 million card records being stolen. This impacted major brands like JetBlue, JCPenney, and more.

Here are the top five biggest credit card breaches in history:

- Heartland (2009) — 160 million cards

- Capital One (2019) — 106 million cards

- TJX (2006) — 94 million cards

- TRW/Sears (1984) — 90 million cards

- Home Depot (2014) — 56 million cards

29. Cyberattacks are the leading cause of data breaches

Last year, there were 1,613 reported cyber attacks that resulted in 188,900,415 people impacted—which was the leading case of data breaches. These attacks include phishing, malware, ransomware, and unsecured cloud accounts.

This compares to just 179 cases of human or system error and 51 cases of physical breaches.

30. 150 million Americans fell victim to credit card fraud last year

There will be 150 million citizens in the US affected by credit card fraud last year, and 40% of those cases will be tied to new credit card accounts.

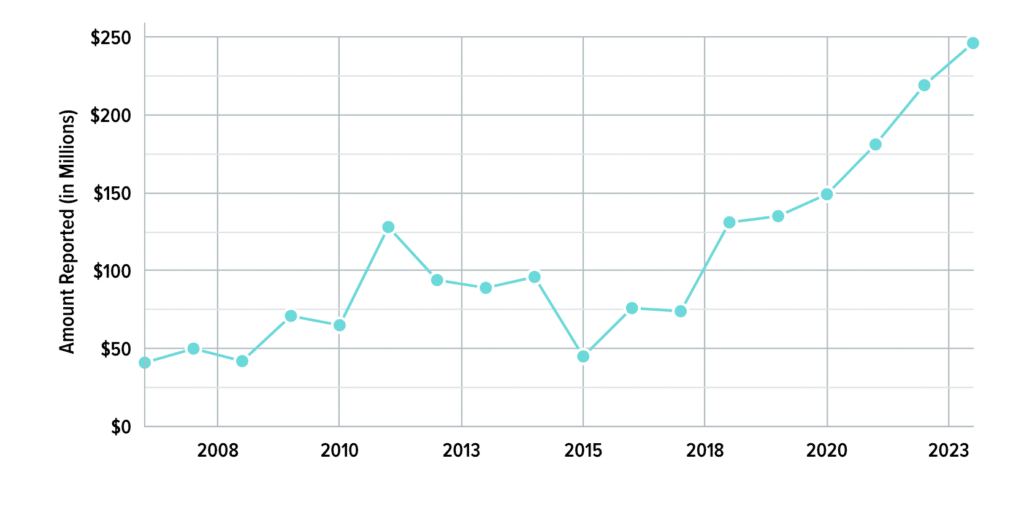

31. The total value of credit card fraud is up 12% YoY

According to WalletHub, the total value of credit card fraud jumped 12% in the last year. This is a slightly lower yearly jump, which was at 21% between the previous two years. But as you can see from the chart, there’s a huge spike in credit card fraud from over the last six years.

32. 65% of all credit and debit card holders have fallen victim to fraud

Roughly 65% of all people who have a credit card or debit card have been victims of fraud at least one time in their lives.

33. 22% of people do not review their credit card statements

Research suggests that 78% of people do look at their monthly credit card statements. But that leaves 22% of people who don’t review statements—making it even harder for them to catch potentially fraudulent or unauthorized charges.

34. 38% of cardholders with alerts enabled were notified within minutes of an attempted fraudulent transaction

About 59% of credit card users activate alerts related to fraud and transactions. When enabled, roughly 38% of them were notified within minutes about attempted fraud, and an additional 46% were notified within hours.

35. Every $1 lost in online fraud costs merchants $3.75

Businesses lose more than just the sale amount in a fraud case. In fact, it costs merchants $3.75 for every $1 of fraud charged to their company.

Final Thoughts on Credit Card Fraud

Some of these credit card fraud and identity theft statistics are shocking, to say the least. As a merchant, you must take steps to secure your transaction environments and protect cardholder data.

While credit card fraud is increasingly common, it doesn’t make it any less frustrating for victims, and a breach on your business can have detrimental effects on your brand’s reputation.

We update this page on a regular basis, so keep checking back for new stats and updated figures.