Credit Card Merchant Contracts and What To Be Aware Of

I know it goes without sayings, and a lot of you may roll your eyes at this next statement, but ALWAYS READ YOUR MERCHANT SERVICE CONTRACTS when it comes to picking a new credit card processing company or renewing an agreement. It sounds silly, but credit card merchant agreements can range anywhere from 12 – 48 pages long and are more in-depth than just those 4 pages they have you sign to begin the process. One main competent you also need to read are the Terms and Conditions (26 pages typically) and what is referenced as the “Program Guide” to accurately understand what exposure you are putting out there for your business or the business you work.

At this point you should know that the credit card processing industry is smoke and mirrors for the most part. There is little transparency on how the credit card merchant fees work, what your business will incur as an expense, and the exact terms of what goes into a credit card merchant agreement. Just because a sales rep tells you something verbally, by no means does that mean its going to be on paper, written, or in the agreement.

Credit card merchant representatives are known to say one thing, but charge you another. Most of the time it is not even their fault, but more they are uneducated about how ALL the rates and fees work, each fee’s purpose, and when you as the merchant may be charged these credit card merchant fees.

All this being said, keep in the back of your mind that credit card merchant providers and credit card merchant agents are still trying to set your rates as high as they can for as long as they can, so make sure to do your homework or re read your current credit card merchant agreement. Below are some details you should be aware of and look out for:

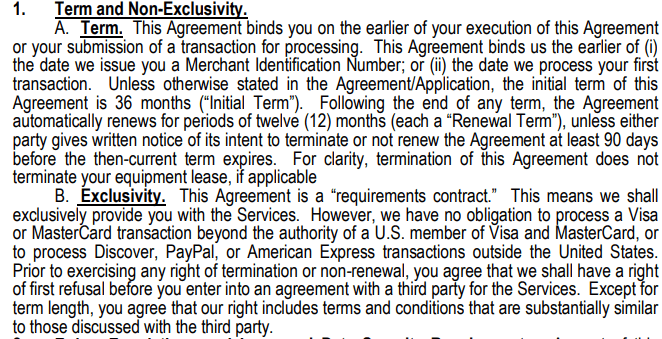

Length of Credit Card Merchant Agreement (Term)

Most merchant service providers or banks want to sign you up for a 36 month commitment, some may even try for longer. Terms like this also come with what is called an “Early Termination Fee” or an “ETF” but more on this later. For example, if you are a retail brick and mortar business, you may get free equipment and in return the processing company will ask for a length of commitment from you to make up the costs of the free equipment. Leasing equipment is a whole different animal, and our recommendation is to NEVER lease equipment, ever. Buying equipment is the most cost effective option, while negotiating the cost of the equipment simultaneously. See example below legally verbiage you may see:

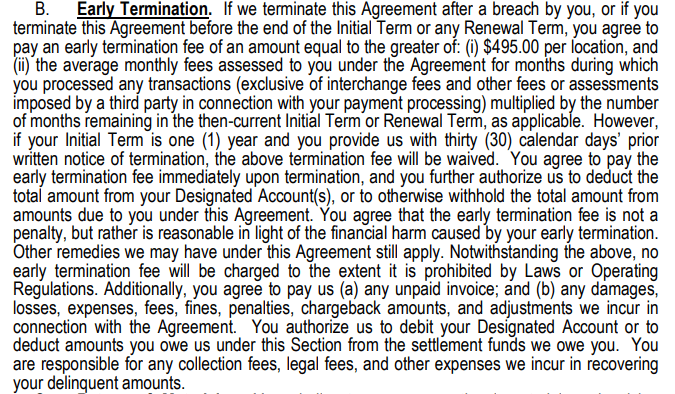

Early Termination Fees

All credit card merchant agreements have ETFs, it is just whether they apply them to your business should you cancel the service. This is something you need to be aware of at all times because each ETF clause is different pending the merchant processor. An average range you would see for this fee is anywhere from $199-799 pending the agreement. See below example:

Liquidated Damages

More concerning and more damaging (pun intended) to a business is a liquidated damages clause. NEVER sign an agreement with a liquidated damages clause as it can be crumbling to a business, and at drastic measures, even put you out of business. One sneaky and deceptive way a credit card merchant processor will mask this clause is to put language into the agreement should you wish to cancel that reads, “The fee for early termination is $500 OR damages, which ever is greater.” If you see “Damages” in any form, turn the other way and cut your losses while you’re ahead.

What exactly are liquidated damages? Liquidated Damages means that should your business cancel your merchant service agreement prior to the end date previously agreed upon, your business would owe the average amount you have paid your merchant service provider for the previous months of engagement, multiplied by the remaining months left on the contact. To give an example, if you paid your merchant provider $5000.00 in fees, on average, and you have 10 months remaining on your contract, you would owe $5000.00 multiplied by 10 months, totaling a cancellation fee of $50,000.00. Not great.. See below examples:

Equipment Leases

Many merchant processors have equipment leases in their terms. As mentioned above, NEVER lease equipment, as the terms are way too long, you over pay in the long run, and you can never break the lease terms these processors create. Most of the time, the leases are for counter-top terminals or Point of Sale systems.

The majority of counter top terminals or POS systems if you buy them range from $150-$1000, but to lease them, credit card merchant providers try to charge you anywhere from $50 – $250/month... You do not need a super calculator to run the numbers and see the difference in costs, but be aware that credit card merchant leases are some of the biggest scams in the industry.

Additional Program Fees or Surcharges

There is always a fine print when it comes to merchant service agreements. A big one that we come across is a clause that allows for additional surcharges to be added to your account, on top of the current pricing your credit card merchant provider has already offered you. Surcharges can be added to your account at any given time, and your credit card processor is the one who determines just how much that surcharge is going to be. See below example:

The fine is print is so important when it comes to credit card merchant fees and terms of agreement. Because the length of the terms are typically so long, everyone thinks its ok to skip over, check mark the box, and move on. But there is a lot more that goes into credit card merchant agreements than meets the eye and it is crucial to have them reviewed prior to engaging with your credit card merchant provider.