Credit card processing companies come in all different shapes and sizes. Like any product or service, some are undoubtedly better than others.

But if you’re business is new to accepting credit cards, it can be challenging to differentiate the good from the bad. That’s why we created this guide.

The following ten credit card processing features must be evaluated as you’re comparing credit card processing platforms and narrowing down your options. By the end of this guide, you’ll have a clearer vision of what you need.

1. Mobile Credit Card Processing

Mobile support has become a must-have feature in the world of modern credit card processing. In this case, the term “mobile” has multiple meanings.

For some businesses, mobile credit card processing is necessary as they need to accept credit cards on the go. Food trucks are a great example of this. But mobility has its place inside traditional brick and mortar locations as well. The same concept applies; you can accept payments from anywhere—whether it be within your retail space, on the sidewalk, or at the table of a restaurant, mobile credit card processing has tons of possibilities.

Accepting payments from smartphones, wearables, e-wallets, and other cardless transactions would fall into this category as well.

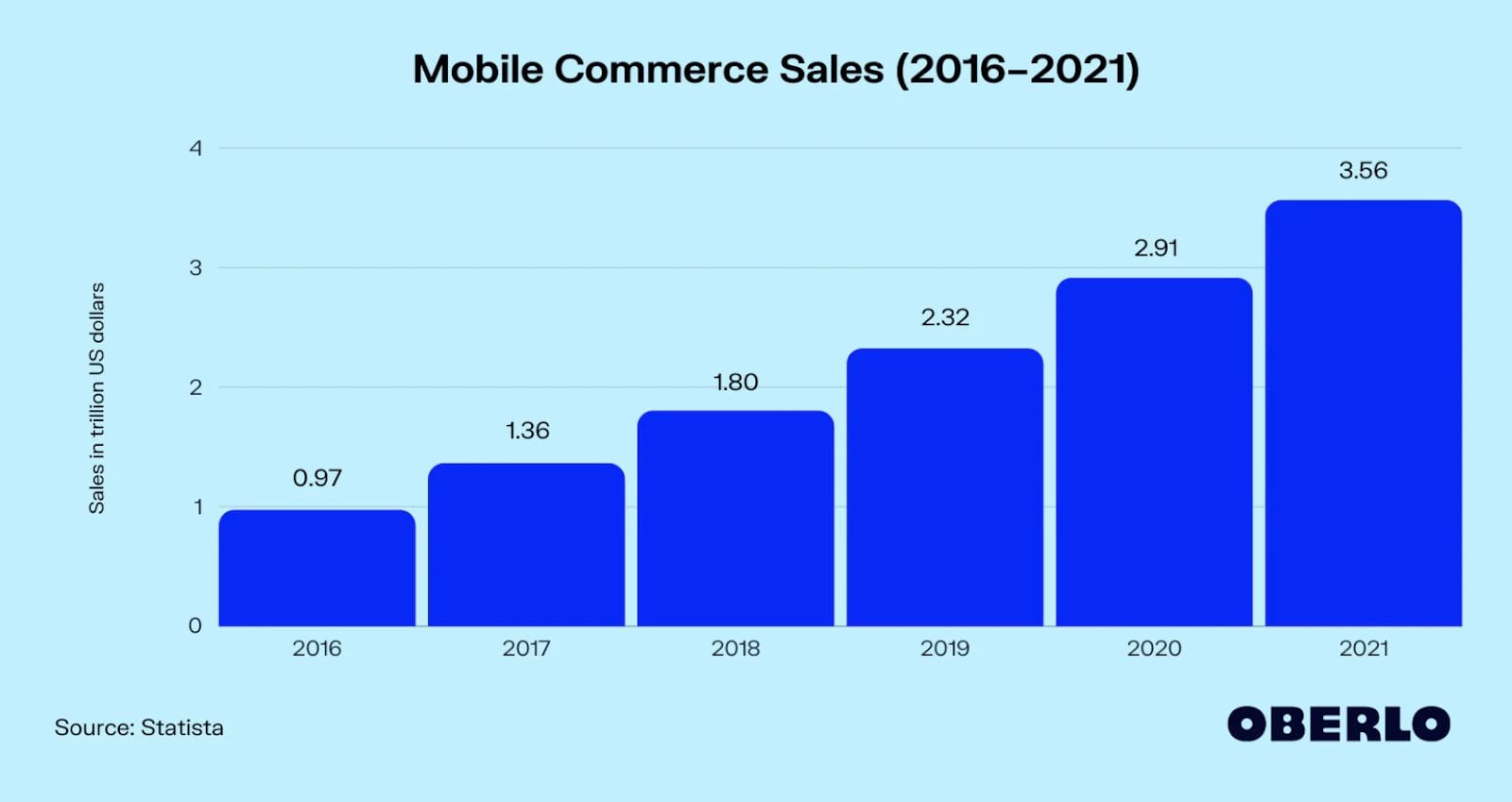

Just look at this graph to see how much mobile commerce has grown over the years.

As this trend continues moving forward, all businesses must adopt mobile to stay relevant.

2. Integrations

The best credit card processing platforms integrate with other business tools that you’re already using. This allows you to accept credit cards while reducing the amount of busy work that needs to be done on the administrative side.

For example, integrations streamline your reconciliation process and can sync transactions directly to your accounting software. Not only is this more efficient, but it also reduces the chances of making manual errors.

3. Lower Credit Card Processing Costs

Obviously, the cost will be a major consideration as you’re making any business decision. But it’s really important to keep in mind with something like credit card processing.

It’s not like a one-time cost that you’re overpaying for, and you can move on with your life. Credit card processing companies charge you a percentage of each transaction.

You’ll need to pay interchange fees, assessments, markup costs, and other credit card processing fees as well. Some credit card processing companies try to upsell you or hit you with unnecessary charges for your terminal or PCI compliance.

Other credit card processing companies give you the bait and switch. They’ll promise $0 down or free setup fees, then price-gouge you down the road with ongoing fees and charges.

Check out our complete guide to credit card processing fees to learn more about how all of this works.

If you’re already using a credit card processing company and feel like you’re overpaying, contact our team for a free consultation. We can save you money on credit card processing fees without having to switch providers.

4. Multichannel Credit Card Processing

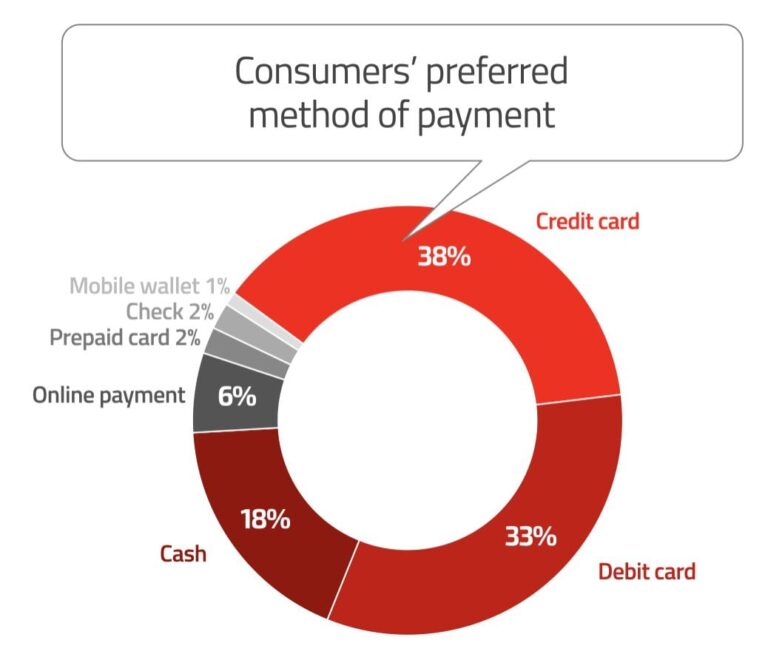

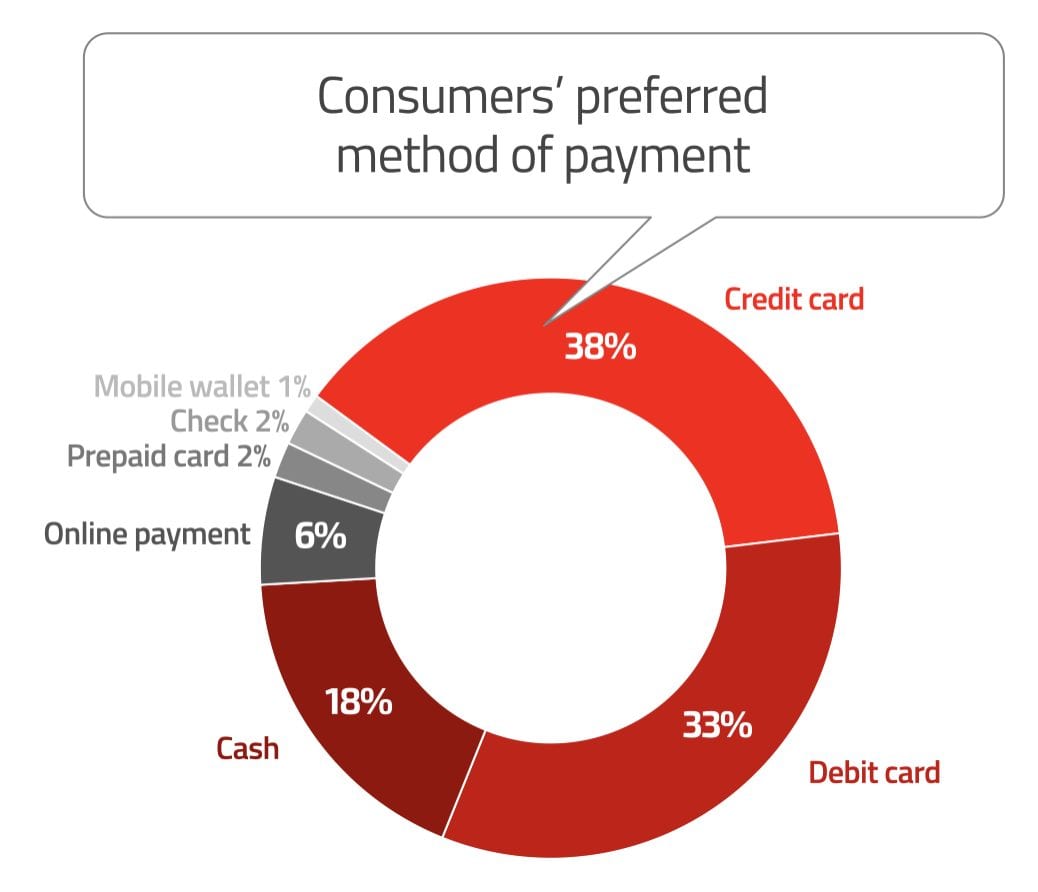

This feature gives your customers options. It’s important because everyone has different preferences for how they pay for goods and services.

In addition to different card brands, you’ll also need to consider credit vs. debit transactions. Look for a provider that lets you accept payments at a POS terminal, online, over the phone, and more.

ACH payments, e-wallets, e-checks for payment processing—the list goes on and on.

5. Simplicity

Have you ever tried to buy something from a business, whether it be in-store or online, and the process is just ridiculously slow and complicated?

We all have. Don’t let that be your business.

The checkout process should be smooth for both the customer and the employee who is facilitating the transaction. It should also be easy for you to settle transactions, view reports, and do whatever you need without opening up a 500-page training manual.

From the initial implementation through upgrades and day-to-day use, your credit card processing platform should be hassle-free.

6. Security

Every business that accepts credit cards must prioritize security. You’re accepting sensitive cardholder information and need to remain PCI compliant.

The best credit card processing platforms have built-in PCI compliance and security features. So you won’t have to do anything extra, and you can rest easy knowing that your business is compliant.

You shouldn’t have to pay extra for this either. Check out our guide on PCI compliance fees to learn more.

7. Data Analytics and Reporting Features

Modern credit card processing solutions offer robust reporting and data analytics. This gives you valuable insights into how your company is performing.

Visual reports on charts and graphs can help you pinpoint your busiest days of the week and even narrow down your busiest hours.

This makes it easier for you to measure the effectiveness of your specials, loyalty programs, promotions, and more. All of this allows you to make smarter data-driven business decisions.

8. Fraud Detection

In addition to security and PCI compliance, you should look for a credit card processing platform that helps you detect and prevent fraud.

Fraudulent transactions can be extremely costly. Not only do you lose the COGS and the payment amount, but it can also come with chargeback fees and penalties. Too much fraud can even move you into a high-risk category, where it will be more expensive for you to process transactions moving forward.

If your credit card processing company has built-in fraud detection features, like fraud scoring, it will make your life much easier.

9. Transparency and Honesty

Believe it or not, lots of credit card processing sales representatives are not very honest. This is something that we see every day when we’re negotiating with credit card processing companies on behalf of our clients.

If something sounds too good to be true, it usually is. Lots of credit card processing companies like to avoid mentioning all of the “hidden” fees and extra costs you’ll be paying once they lock you into a contract.

Go with your gut, and know what questions to ask your payment processor to get a feel for how honest they are.

10. Reliability

Downtime can crush your ability to generate sales. If a machine goes down, the majority of your customers probably don’t have enough cash on them to pay.

Not only is this a major inconvenience, but it damages your reputation.

Things happen. But when something goes wrong, you want a credit card processing company that will be able to fix the problem day or night. If there’s a problem with your restaurant’s credit card processing platform at 10 pm on a Friday night, waiting for support to help you 9 am Monday morning is not an option. Can you afford to go an entire weekend without accepting credit cards?

Final Thoughts

These features should help you narrow down your list as you’re evaluating different processors.

For those of you who still have questions or need help negotiating your contract, contact our team here at Merchant Cost Consulting. We’re happy to help steer you in the right direction.