Credit Card Processing Rate Increases March 2020

This is the beginning of a new era to reveal how credit card processing companies are adding hidden fees, downgrading interchange rates, and implementing surcharges to charge businesses more than they should be.

This credit card processing rate increase series will also showcase card brand changes (Visa, MasterCard, Discover, American Express) that occur throughout the year.

It is strictly educational and comes from Merchant Cost Consulting’s auditing experiences every month of what we see happening in the credit card processing industry.

Credit Card Processing Hidden Fees and Rate Increases

TSYS

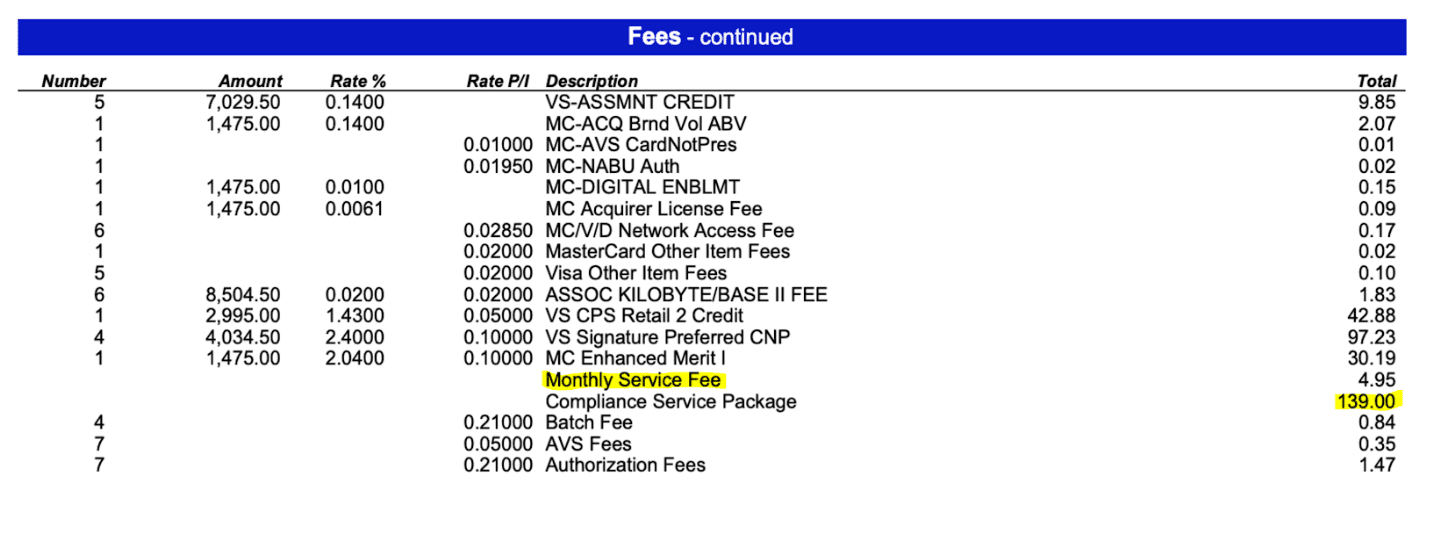

There are monthly fees and then there are more monthly fees, they always seem to be endless when it comes to credit card processing. For TSYS, the monthly fees just continue to get worse.

Below for the month of March, TSYS is charging a “monthly service fee” of $139.00. Can you imagine that? As if their processing fees were not enough. What constitutes for an increase in a monthly fee from $10 to $139? We are not quite sure either.

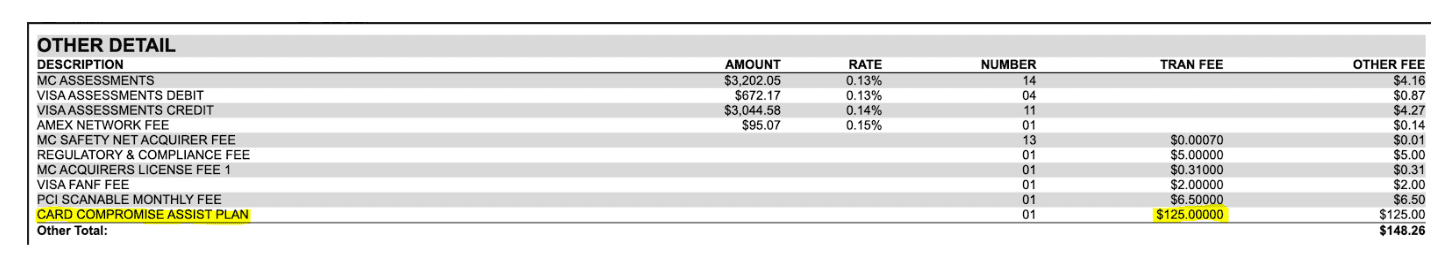

To follow up their large monthly service fee, TSYS is also charging a $125.00 “Card Compromise Assist Plan” which they will tell you helps fight fraud should chargebacks occur etc. But merchants do not even understand how this works, what it covers, and most of them never signed up for this auto enrollment fee nor would they even use it.

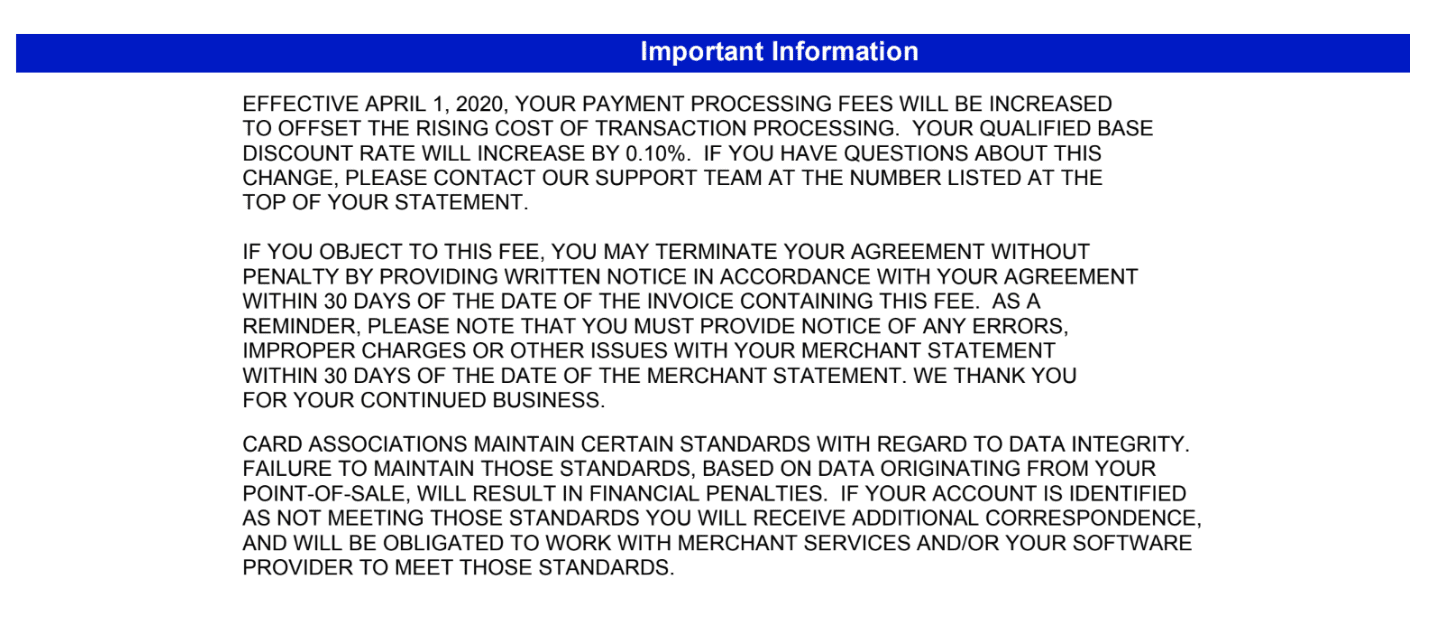

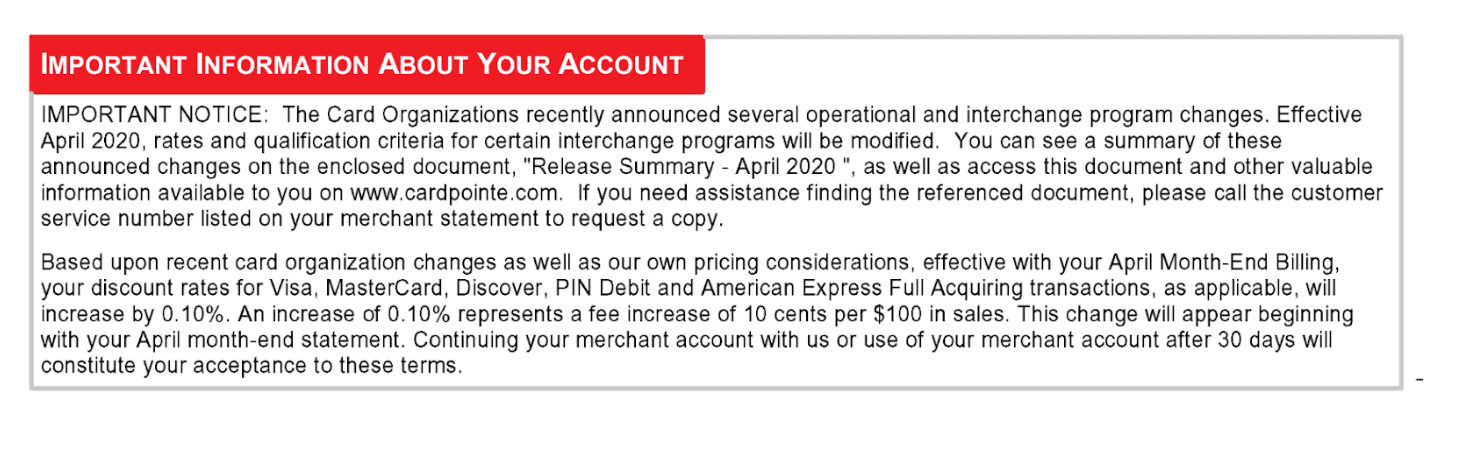

Last up on the month of March for TSYS berating of their merchants, we see a notice that they are increasing the “discount rate” of their merchants by 0.10%.

For a small business business, it will not break the bank but for a business that is doing $100k/month for example in sales volume, its an extra $100.00/month, in addition to what you were already paying. You would think they covered this in their increased monthly fees, but I guess it was not enough.

This credit card processing rate increase goes into effect April 1st, 2020 and gives a merchant the ability to cancel their service with TSYS without penalty within 30 days of the date of invoice containing this fee.

Elavon

Next up we have Elavon and boy have their rate increases been substantial. Below is a before and after picture of a merchant that compares February 2020 to March 2020. The credit card processing rate increase is eye opening and shows what Elavon truly values:

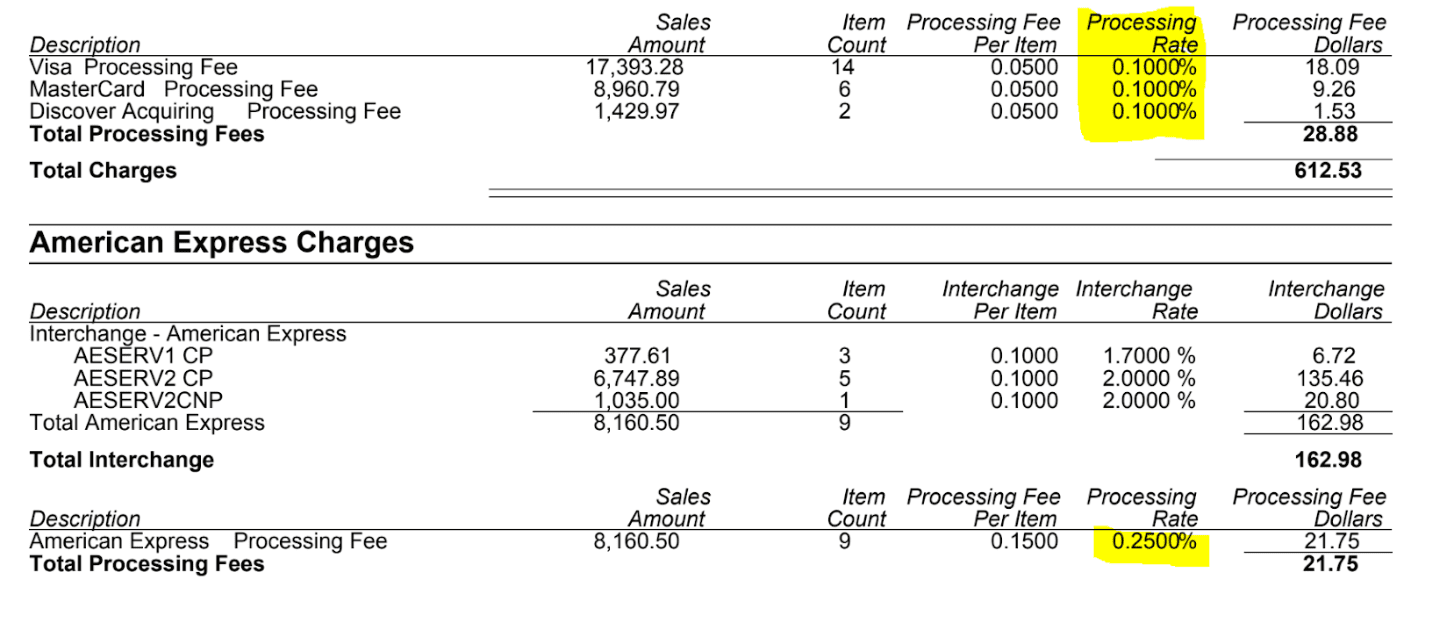

February 2020

You can see above that this merchant was paying 0.10% on their “discount” rate for Visa, Mastercard, and Discover, and $0.05/transaction, which is competitive. They also were paying 0.25% and $0.15/transaction, which is to be expected but also competitive.

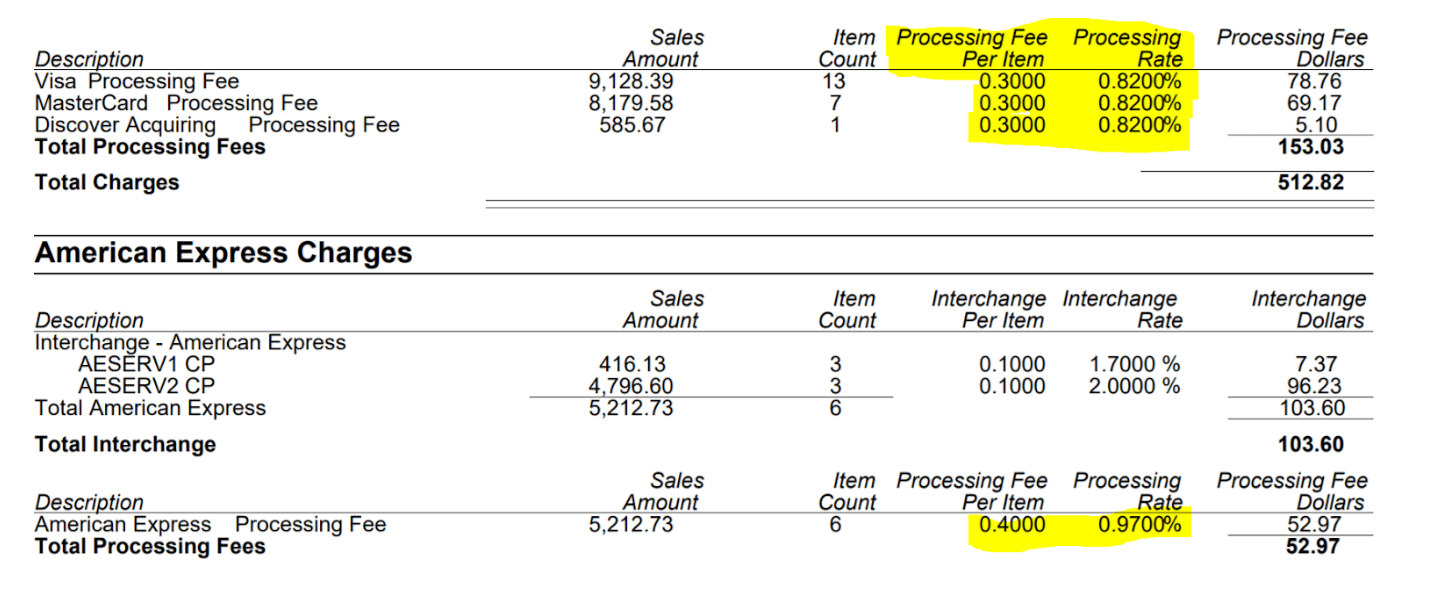

However, after just 30 days, Elavon decided they were not making enough money on this account and decides to increase this merchant’s pricing. The results are shocking:

Highlighted in yellow, you can see that Elavon increased this merchants processing fees for Visa, MC, and Discover from 0.10% up to 0.82%, more than an 800% increase on the percentage and $0.25 more on every transaction. It’s jaw dropping and unacceptable.

For American Express, its almost a 400% increase from 0.25% to 0.97% and 3x the increase on the per transaction fee from $0.15 increased to $0.40. If you are processing with Elavon as your merchant service provider, make sure to fine comb through your statements.

First Data/CardConnect/PaySafe

The next statement findings we will share come from First Data back-end platforms, which in layman’s terms mean the processing company is just using First Data to process the payments for these specific merchants.

First up is Paysafe.

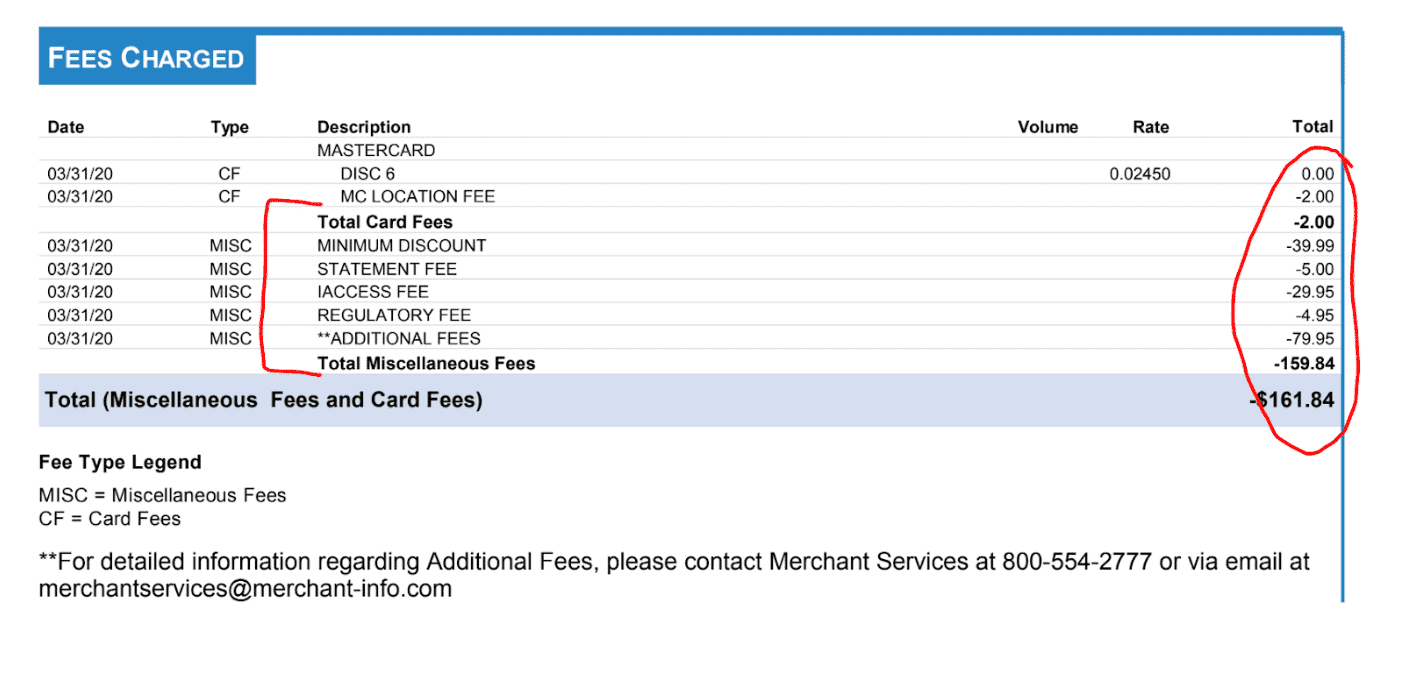

The credit card processing fees above were charged to a merchant without them processing a single penny during the month. With that said, these fees are real and should be known that they will be charged regardless if a merchant processes sales volume or not, but the amount each fee charged is unacceptable.

Other than the statement fee and the regulatory fee, the rest of them should not be that expensive. Not to mention the “Additional Fee” section where PaySafe is not listing what the fees are for. It’s a very expensive and deceptive way to showcase pricing.

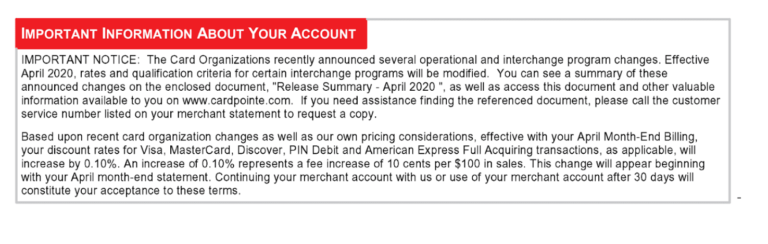

Next up, we have Card Connect. Like TSYS, they are also increasing their “Discount Fee” by 0.10%.

For a small business it will not break the bank but for a business that is doing $100k/month for example in sales volume, its an extra $100.00/month, in addition to what you were already paying.

Final Thoughts

Regardless of the payment processor a merchant uses to accept credit cards, there are always credit card merchant fees that can be alleviated, reduced, or refunded.

You can learn more about payment processing, merchant services, and how credit card processing rates and fee work leveraging our Credit Card Processing Complete Guide.

Take the time to understand your statements, your pricing, and the credit card processing company you are dealing with to get a true understanding of what to look out for.