Credit Card Processing Rate Increases: North American Bancard January 2020

This is the beginning of a new era to reveal how credit card processing companies are adding hidden fees, downgrading interchange rates, and implementing surcharges to charge businesses more than they should be.

This credit card processing rate increase series will also showcase card brand changes (Visa, MasterCard, Discover, American Express) that occur throughout the year.

It is strictly educational and comes from Merchant Cost Consulting’s auditing experiences every month of what we see happening in the credit card processing industry.

North American Bancard Hidden Fees and Rate Increases

North American Bancard

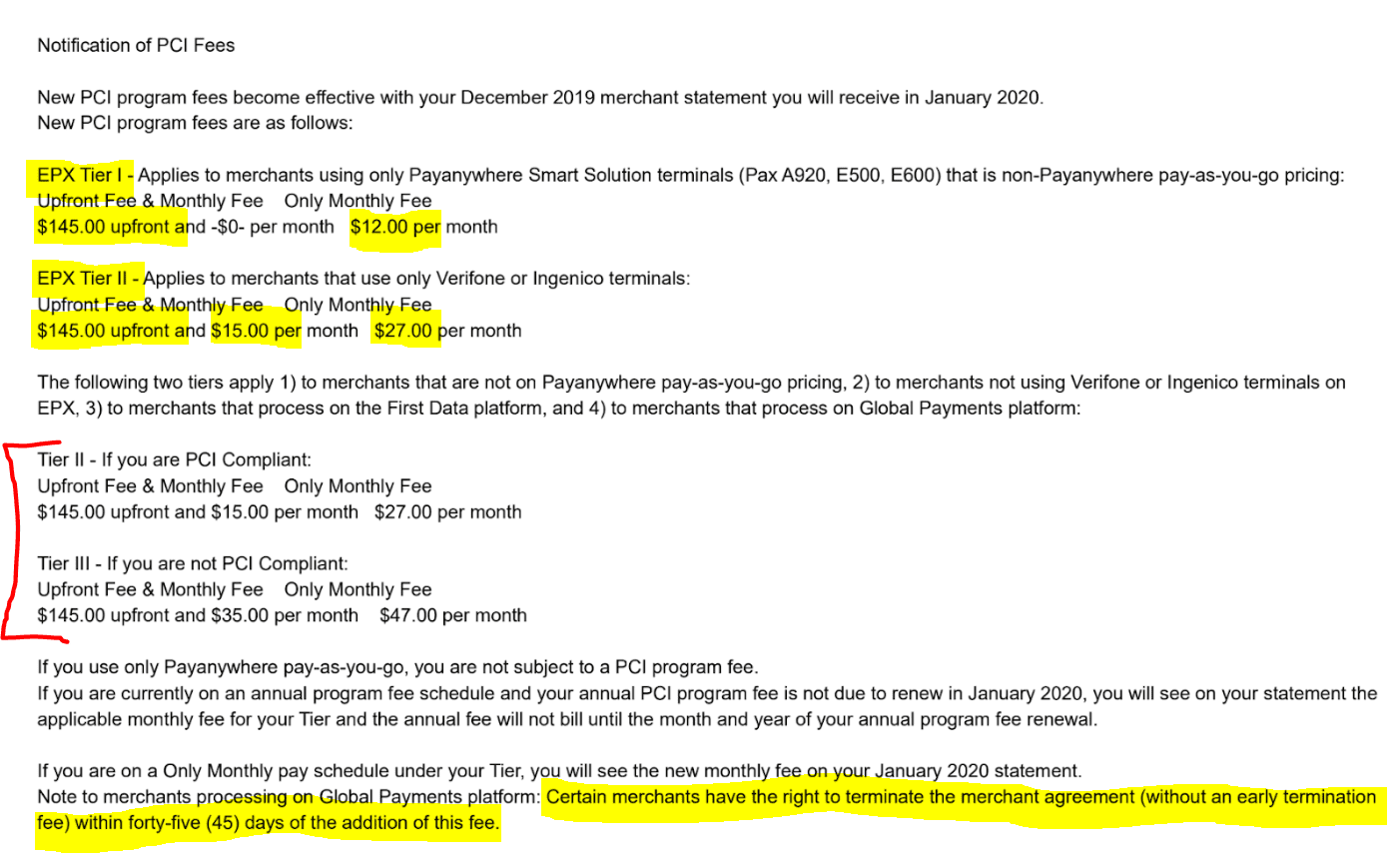

The first thing merchants should be aware about starting in 2020 is North American Bancard’s increase to their PCI compliance fees.

We all know how tedious, timing consuming, and how much of a racket these credit card processing fees can but, but the increase to North American’s PCI is some of the largest increases we have seen this year. Take a look:

Here is the breakdown in laymen’s terms:

- EPX Tier 1 – IF you use the following terminals (PAX A920, E500, E600) you will be charged $145.00 and an additional $12.00 per month.

- EPX Tier 2 – IF you use any type of Verifone or Ingenico terminal you will be charged $145.00 and an additional $42.00 per month

Because North American Bancard is a “Super ISO” and puts merchants through multiple payment processors, there are additional details and rate increases that apply to the following merchants in regards to PCI:

- Merchants that do not have “Pay-as-you-go Pricing”

- Merchants not using EPX with Verifone and Ingenico terminals

- Merchants that process on First Data’s platform

- Merchants that process on Global’s platform

Note: Pending the type of business and which sales office set you up with processing will dictate all of the above criteria. Call and ask your representative which category you fall under to get a better understanding as they need to disclose this information.

Once you determine the above criteria, here are the last 2 final PCI increase tiers that follow:

- Tier 2 – If you ARE PCI Compliant already, you will be charged $145.00 and an additional $42.00 per month, which does not make sense if you are already compliant..

- Tier 3 – If you are NOT PCI Compliant, you will be charged $145.00 and an additional $82.00 per month.

Regardless of what pricing you have or equipment you use, your PCI compliance fees are increasing significantly leveraging North American Bancard’s services.

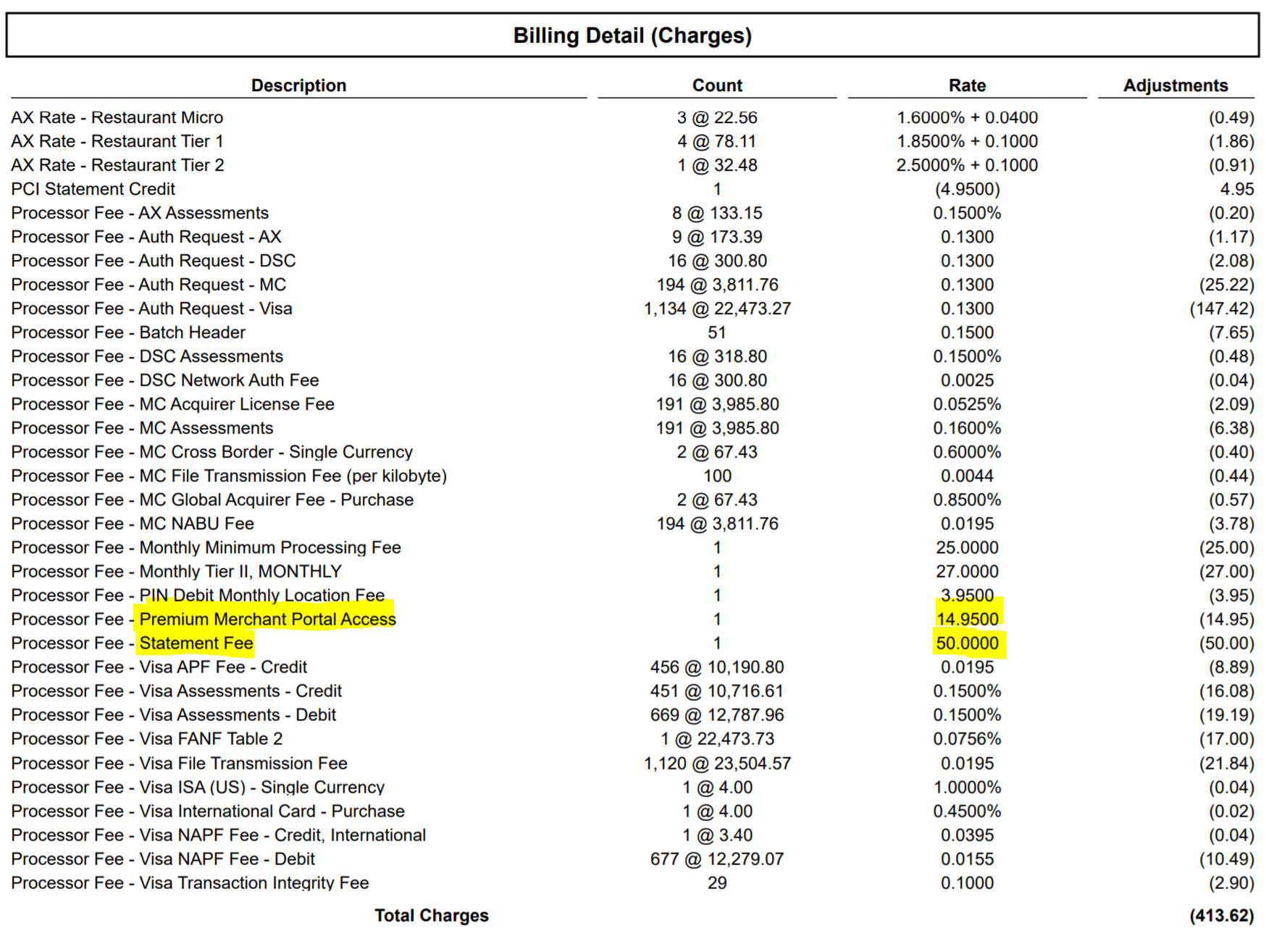

Next up, we have the miscellaneous credit card processing fees.

Here we see a statement fee, which should be no more than $10.00/month MAX, but here is being charged at $50.00 per month. $50.00! This merchant does not even get their statements in the mail.. which leads me to the next credit card processing fee…

This merchant in conjunction with their $50.00 statement fee, has a “Premium Merchant Portal Access” fee of $14.95. This online portal is suppose to house your online statements. If you are charging a merchant $15.00/month for the portal, there is no need to charge a statement fee, let alone $50.00 worth. Unacceptable.

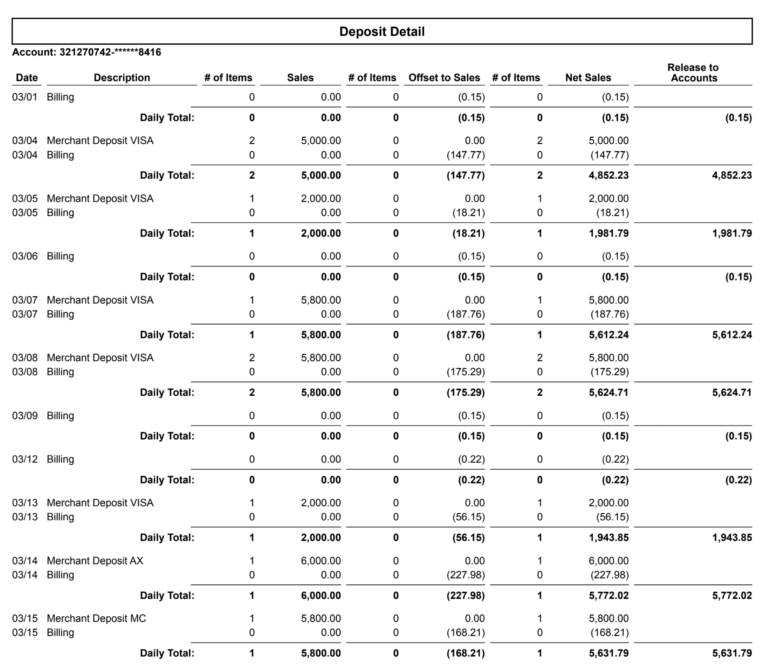

The last credit card merchant fee we wanted to shed some light on was how North American Bancard showcases its reporting to their merchants.

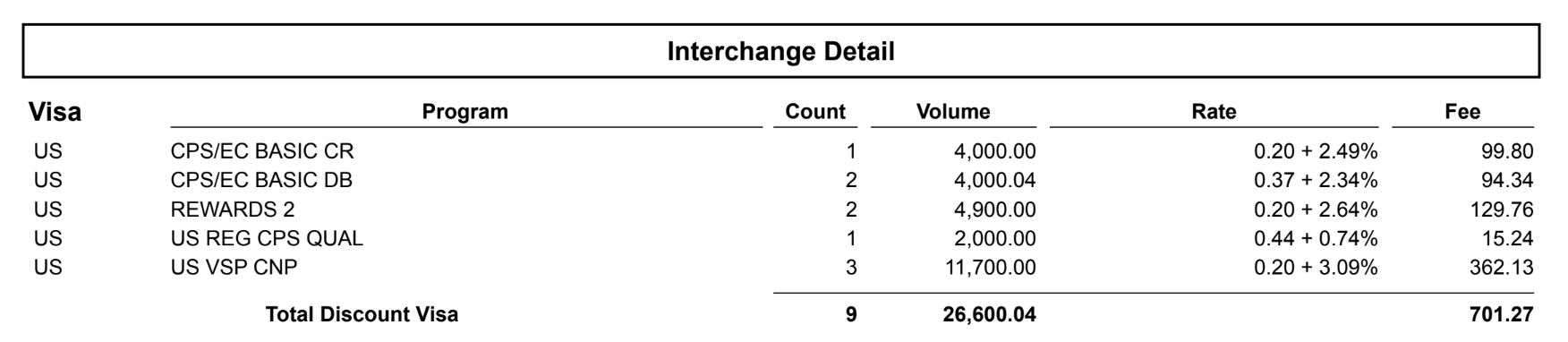

Like other payment processors and credit card processing companies, some do not clearly state the rates and fees for the merchant. They instead blend it all together with the interchange costs making it difficult to distinguish what you are actually paying. See an example below:

The true cost of the cards taken by this merchant are not listed out but rather listed and then blended with the service mark up cost of North American Bancard.

There are many reasons as to why payment processors and credit card processing companies do this, the main one being the less the merchant knows, the better.

Final Thoughts

Regardless of the payment processor a merchant uses to accept credit cards, there are always credit card merchant fees that can be alleviated, reduced, or refunded. North American Bancard is no exception to this.

You can learn more about payment processing, merchant services, and how credit card processing rates and fee work leveraging our Credit Card Processing Complete Guide.

Take the time to understand your statements, your pricing, and the credit card processing company you are dealing with to get a true understanding of what to look out for.