Credit Card Processing Rate Increases: Vantiv-WorldPay-FIS January 2020

This is the beginning of a new era to reveal how credit card processing companies are adding hidden fees, downgrading interchange rates, and implementing surcharges to charge businesses more than they should be.

This credit card processing rate increase series will also showcase card brand changes (Visa, MasterCard, Discover, American Express) that occur throughout the year.

It is strictly educational and comes from Merchant Cost Consulting’s auditing experiences every month of what we see happening in the credit card processing industry.

WorldPay and WorldPay ISO Hidden Fees and Rate Increases

WorldPay

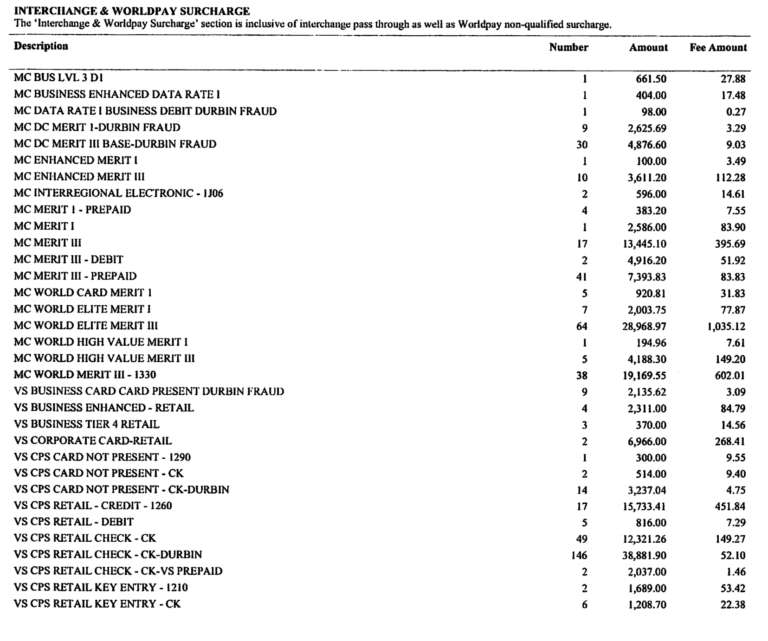

If there is a credit card processing company that is notorious for rate increases or “padding” their interchange fees, it is WorldPay. After some serious scrutiny on how Worldpay asses its credit card processing fees to its merchants, they have finally put a disclaimer recognizing this on their statements:

In short, they are now telling you in a more transparent way that they are passing Interchange fees AS WELL AS their “WorldPay non-qualified surcharges.”

What you need to know is that these non qualified surcharges can vary in amount, and it is very difficult to distinguish how much they are overcharging you without understanding the calculation and the true interchange fee of each card you accept.

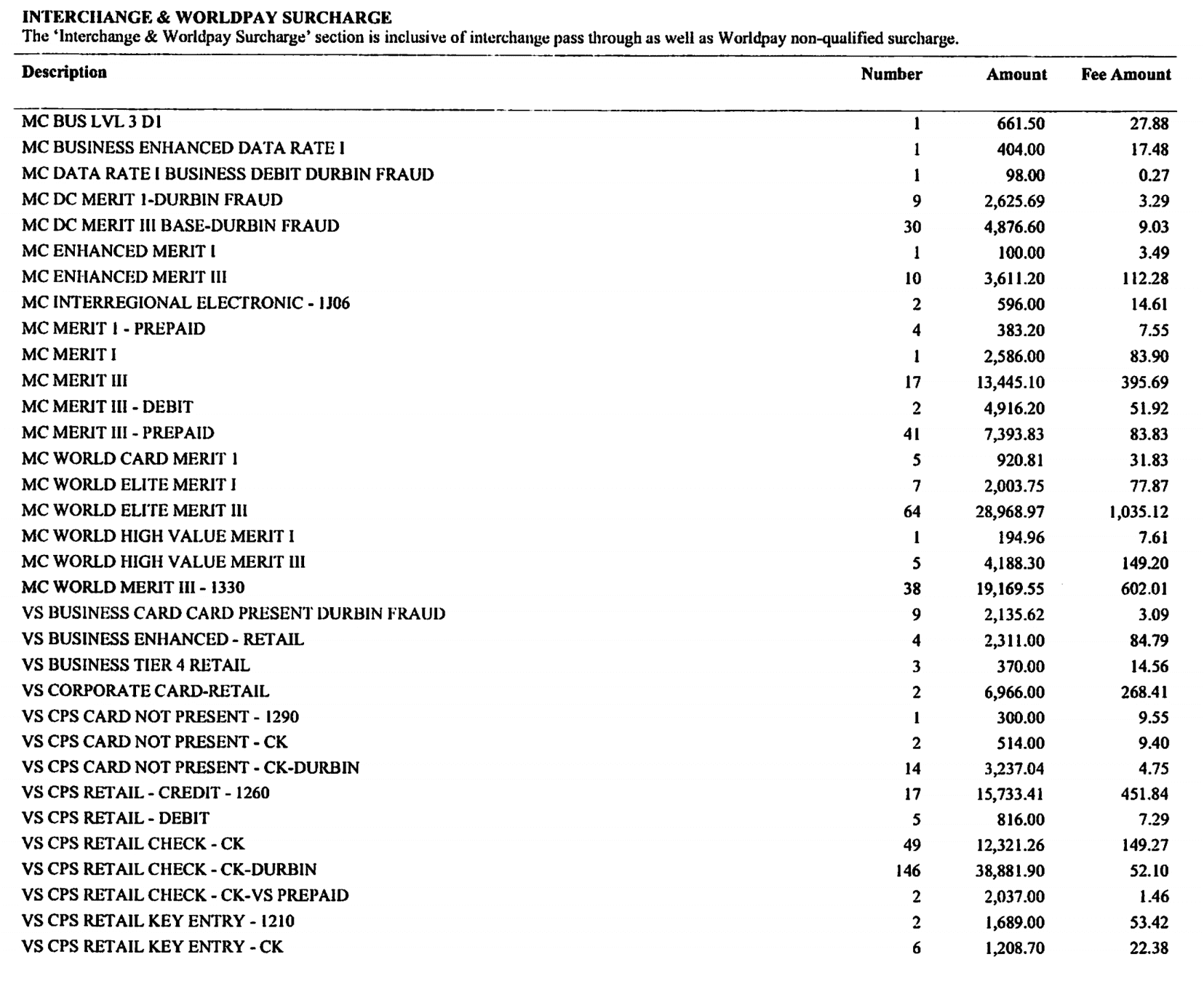

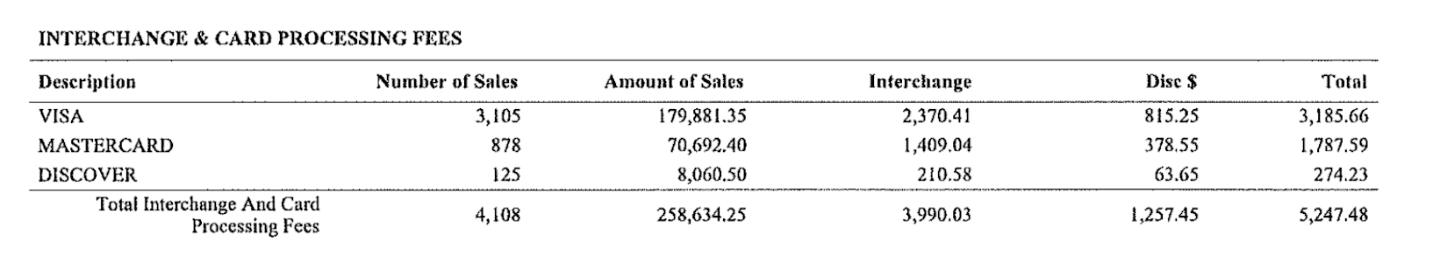

Below you can see how Worldpay lays out their interchange fees:

Our team has seen these surcharges range anywhere from 0.10% up to 1.85% additional to the interchange pass through costs. That is an outrageous amount and completely unacceptable.

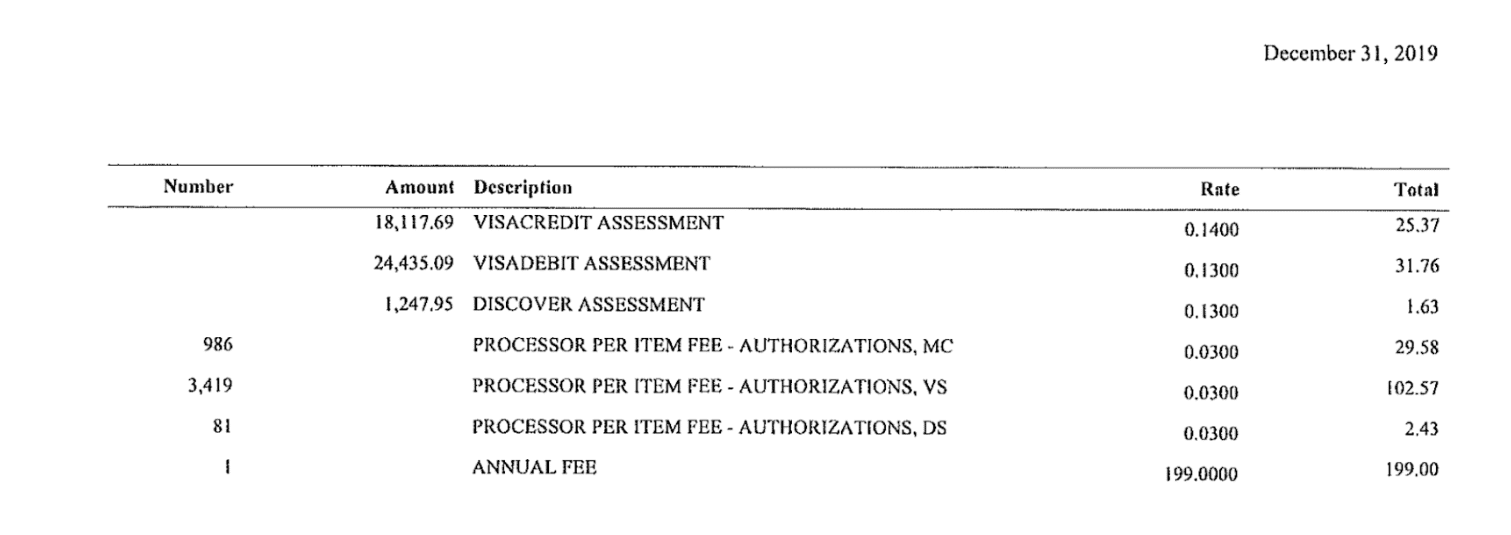

Next up on WorldPay’s agenda, we see they have hit their merchants with a $199 annual fee. As if the rest of the credit card merchant fees they charged were not enough. Be aware of this as there are multiple annual fees for different reasons throughout the year.

WorldPay/NPC

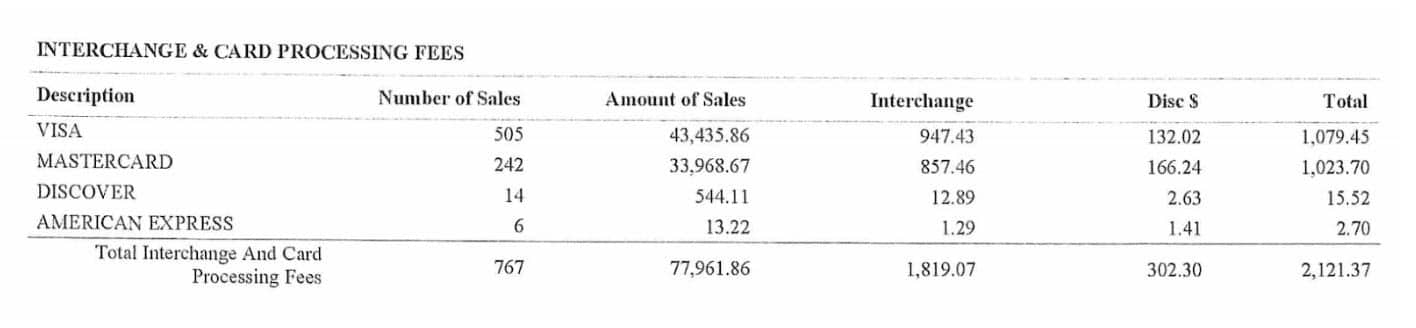

NPC was acquired by WorldPay and has similar reporting to them when it comes to difficulty in understanding the credit card processing rates and fees. You can see below that without running the calculation, it is impossible to see your pricing and the surcharges being added to your account.

Example 1: (Without American Express)

Example 2: (With American Express)

Final Thoughts

Regardless of the payment processor a merchant uses to accept credit cards, there are always credit card merchant fees that can be alleviated, reduced, or refunded. Worldpay/FIS is no exception to this.

You can learn more about payment processing, merchant services, and how credit card processing rates and fee work leveraging our Credit Card Processing Complete Guide.

Take the time to understand your statements, your pricing, and the credit card processing company you are dealing with to get a true understanding of what to look out for.