Credit card processing can be expensive for merchants in every industry, especially for businesses operating on tight margins.

Despite high processing fees, accepting credit cards is an absolute must for modern businesses.

Some merchants attempt to offset processing fees in the form of a surcharge, which passes the costs to the customer. Cash discounting is a similar solution, but not quite the same.

If you’re confused about the differences between credit card surcharges and cash discount programs, you’ve come to the right place. And trust me, the difference is important, as mistakenly applying one over the other could land your business in legal trouble.

What is Credit Card Surcharging?

Surcharging occurs when a merchant adds a small fee to the transaction to cover the costs associated with credit card processing. Credit card surcharges are typically charged as a percentage of the transaction (around 3%), and are paid by the customer for the convenience of using a credit card.

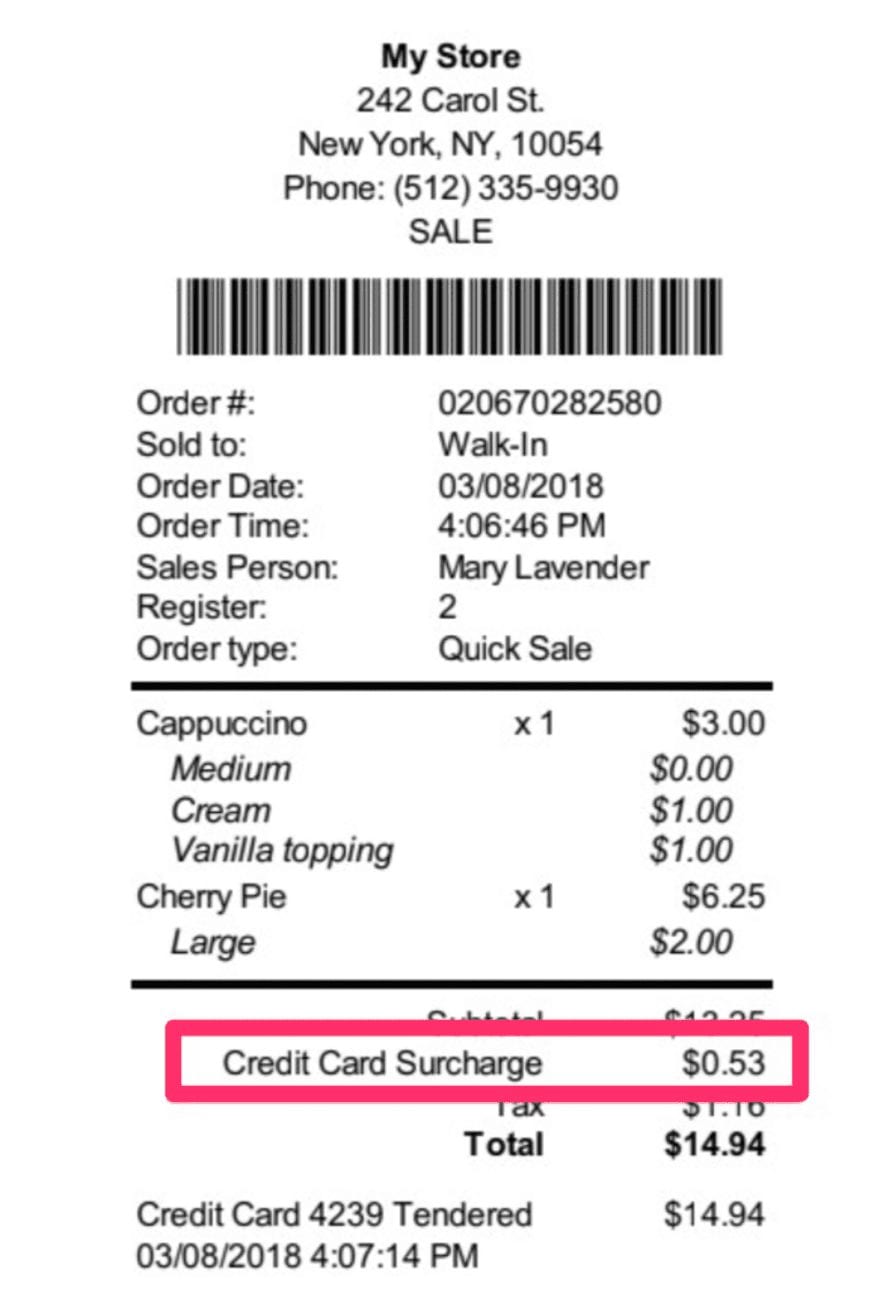

Here’s an example of what a surcharge looks like on a customer receipt.

Surcharge fees can only be applied to credit card transactions (it’s illegal to surcharge debit cards).

Exact rules vary by location, and every card association and credit card processing company has different guidelines for applying surcharges. But in general, you’ll need to keep the following in mind if you want to implement a surcharge properly:

- Surcharges can’t legally exceed 4% of the transaction amount (federal law).

- You need to disclose all surcharge fees prior to the transaction (it can’t be a surprise to the customer).

- Notices should be posted at the point of entrance, point of sale, pricing lists, and on your website.

- All surcharges should be listed as a separate line item on receipts.

- Cards and customers must get equal treatment, meaning you can’t pick and choose to implement a surcharge based on the customer or card brand (it’s either all or nothing).

To me, disclosure is the most important part of implementing surcharges. Some merchants try to be deceptive and label the surcharge as a “service fee” or “convenience fee.” I’ve even seen merchants call it a “non-cash adjustment.”

If you’re charging extra for credit card transactions, it’s a surcharge.

What is a Cash Discount?

A cash discount is exactly what it sounds like. Your listed prices are for credit card transactions, and you offer a discount for customers paying with cash.

Basically, you’re giving customers an incentive to save some money by paying with cash.

In doing so, you’re taking the credit card processor out of the transaction, and eliminating credit card merchant fees. However, some cash discounts are offered at a higher percentage than what the credit card would be. I’ve seen some cash discount programs start at 5% and even go as high as 10%.

So are you saving money with a cash discount program? Yes and no. You’re saving money on credit card processing, but the cost of the sale will be less. However, you’ll have the money immediately and won’t have to worry about funding from your processor.

What’s the Difference Between Surcharging and Cash Discounts?

The difference between surcharges and cash discounts is that a surcharge adds a fee, and a cash discount does not. With surcharging, you’re adding a fee to the transaction. With a cash discount, the merchant discounts the advertised sales price for cash payments.

Surcharging is much more regulated by credit card companies, state law, and federal restrictions as well. Setting up a cash discount program is a bit easier since you won’t need to worry about any prior authorization.

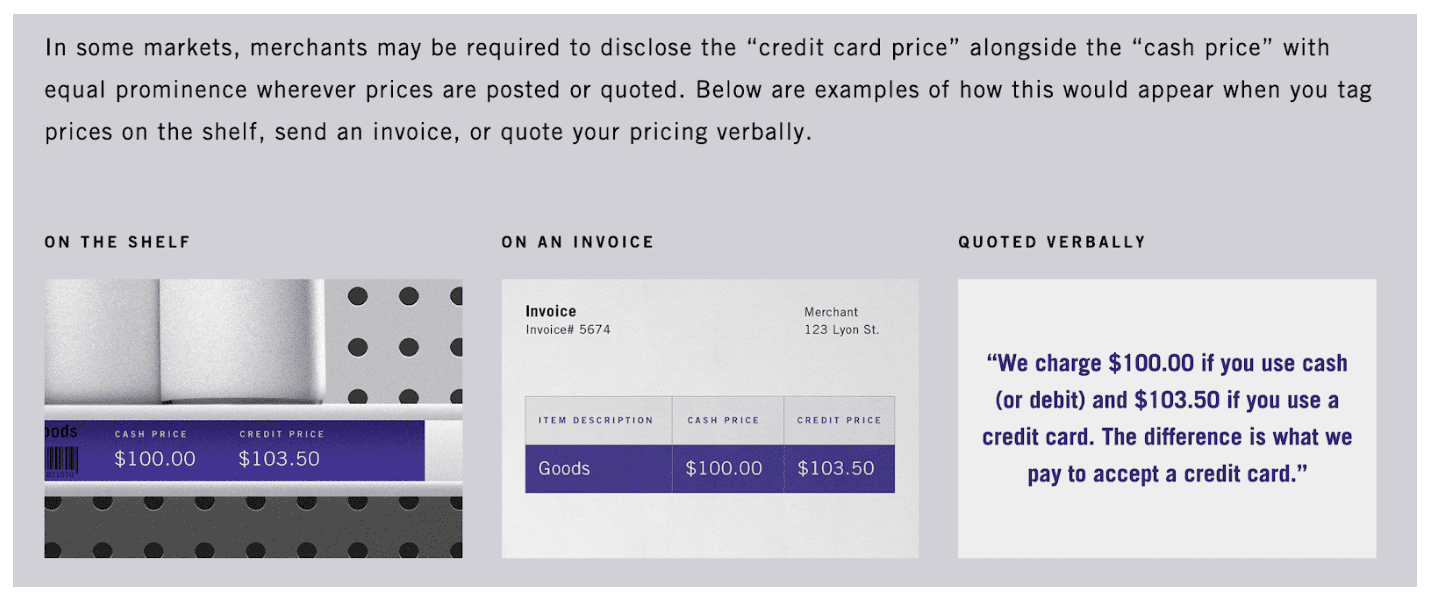

A dual pricing disclosure is required in some jurisdictions.

Always check with your state Attorney General or a lawyer if you’re unsure about the regulations in your area. But it’s generally in your best interest to err on the side of caution.

Are Cash Discounts Legal?

Yes, cash discounts are legal. According to the Durbin Amendment (part of the Dodd-Frank Wall Street Reform and Protection Act of 2010), cash discounts are legal in all 50 states.

These discounts are permitted as an incentive for customers to pay in cash.

Are Surcharges Legal?

Credit card surcharges are legal at the federal level, as long as they don’t exceed 4% of the transaction amount and follow property disclosure requirements (including FTC guidelines).

Surcharges are banned in three states (Connecticut, Maine, and Massachusetts). But several other states have unique rules about credit card surcharge fees, ranging from disclosure requirements to maximum allowable surcharges.

Read More: Credit Card Surcharge Laws by State

Should You Implement Surcharges and Cash Discounts?

For starters, if you live in a state where surcharging is banned, no—you should not implement surcharges. Furthermore, I don’t recommend surcharging unless you have a full understanding of the legal requirements in your state, as well as the provisions in your payment processing agreement.

Failure to comply could terminate your merchant account, and potentially damage your relationship with card associations.

Imagine not being able to accept Visa cards because you tried to save 3% of a transaction? To me, it’s not worth the risk.

Cash discounts are easier in terms of regulations, but they can leave a bad taste in the mouths of your customers. In a study of 2,000 Americans, 50% of people say they carry cash less than half of the time they go out. Of those carrying cash, 76% say they have less than $50 on hand.

A customer who prefers to pay with their card may not be happy that others can save money with cash, especially if they don’t have enough cash on hand to cover the transaction.

Final Thoughts on Cash Discounts vs. Surcharging

Most merchants view them the cash discounts and surcharges the same way, as methods to avoid paying credit card processing fees. However, that’s about the only thing that cash discounts and surcharges have in common.

Many businesses are tempted to implement a cash discount program or start surcharging transactions to save money on credit card processing. But overall, it’s a messy solution, and not really worth it in my opinion. If you’re thinking about doing either, check with your processor, card associations, and state laws before you do anything.

Before moving forward with this program, do your homework.

First and foremost, you need to make sure that surcharging is legal in your state. Even if it’s legal, double-check if your state has any unique clauses that you need to follow.

If you’re going the cash discount route, make sure you’re not masking it as a surcharge. The simplest way to remember this is that a surcharge increases the transaction amount, while a cash discount lowers the advertised price.

But there’s a much easier way to save money on credit card processing fees. You can lower your processing rates without having to worry about a surcharge or cash discount.

Contact us here at Merchant Cost Consulting to find out how much money your business can save on credit card processing without having to switch merchant service providers.