In the world of credit card processing, the terms “credit card processor” and “acquiring bank” are sometimes used interchangeably. But when this happens, it’s not always done correctly.

While some acquiring banks are also credit card processors, not every processor doubles as an acquiring bank.

If this concept is confusing to you at all, you’ve come to the right place. As an expert in this space, I created this guide to clear up any misconceptions about two pivotal financial institutions required to process credit card transactions—processors and acquiring banks.

What is a Credit Card Processor?

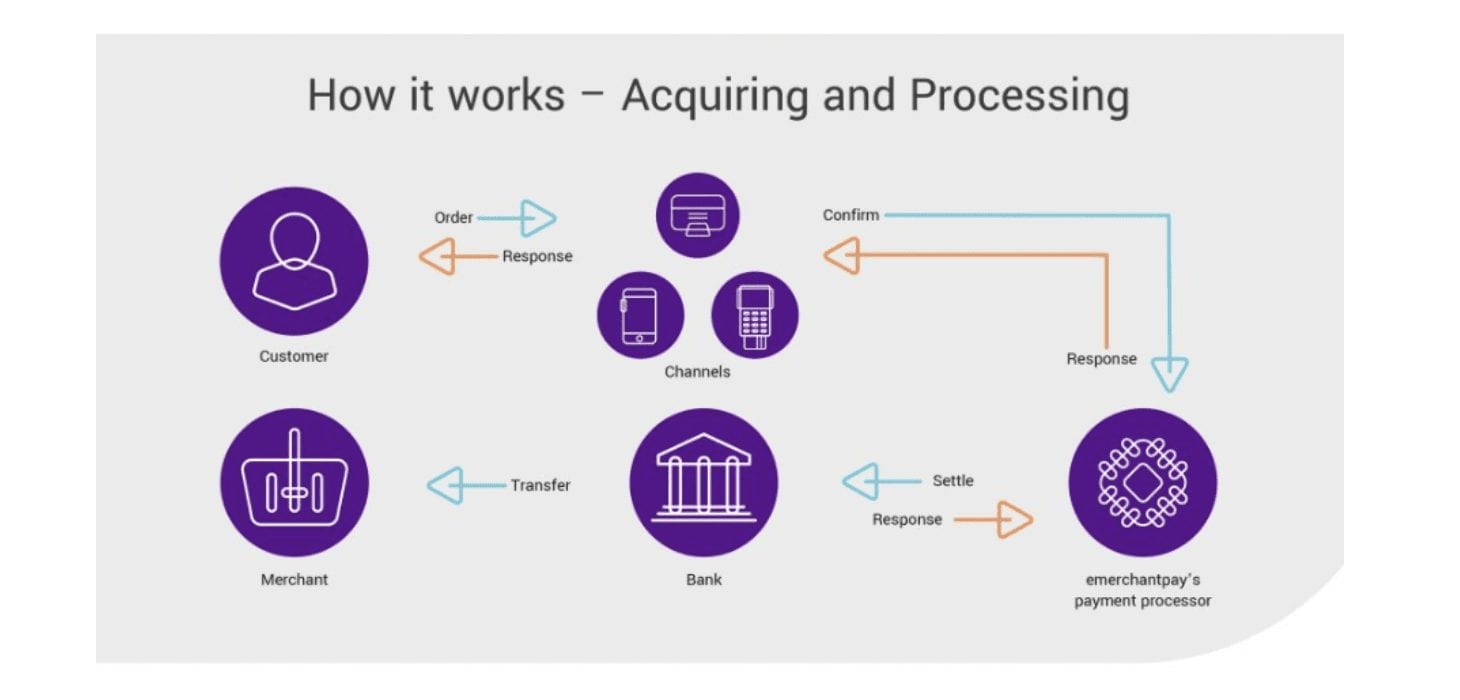

Credit card processors, also known as merchant account providers, payment processors, or just processors, act as a middleman between the merchant and other financial institutions involved in a transaction.

Processors can come in all different shapes and sizes. This third-party could be a direct processor, or an ISO (independent sales organization). Some processing companies will provide merchants with the equipment required to facilitate transactions. They can also assist with data security solutions, PCI compliance, customer support, and a wide range of other related services.

What is an Acquiring Bank?

An acquirer also known as the merchant acquirer or acquiring bank, is the merchant’s bank. This bank or financial institution maintains the merchant’s account, which is required for businesses to accept credit cards.

Acquiring banks settle transactions for merchants into the account that they maintain. In some instances, the credit card processor and the acquiring bank are one and the same—meaning they handle all roles for the merchant, including. They authorize transactions, accept card payments, debit card payments, and provide merchant acquiring services.

Acquirers are licensed members of credit card networks, such as Visa and Mastercard. Acquiring banks help approve the sale each time a merchant processes a debit or credit card transaction.

Credit Card Acquirer vs. Processor: What’s the Difference Between Credit Card Processors and Acquiring Banks?

There are some instances when one financial institution fulfills the role of the processor and acquirer. In those situations, there isn’t a difference between the two.

But for the purposes of this guide, we’re operating under the assumption that the processor and acquirer are two completely separate parties. I’ll highlight some of the factors related to credit card processing and explain how the roles are different for each one.

Relationship With Merchant

Payment service providers, merchant acquirers, and payment facilitators all have unique relationships with merchants.

Credit card processors typically have a more direct role with the merchant. That’s why they are also known as merchant account providers.

These are the people who are constantly calling you about switching to a new account provider. When you started accepting credit cards, you were likely sold a solution from a credit card processor.

You won’t have as much contact with the acquiring bank. You might not even have a specific point of contact at that institution. While the credit card processor has a closer relationship with the merchant in terms of communication, processors don’t always have the merchants’ best interest in mind.

Software and Hardware

In most cases, any software and hardware required to facilitate card transactions will come from the processor. They can provide anything from card terminals to POS systems, payment gateways, and virtual terminals.

A payment facilitator or processor will also be responsible for connecting you to the payment gateway, which is required for authorizations. Make sure your payment service provider supports online payment processing for your merchant accounts.

Card Networks and Issuing Banks

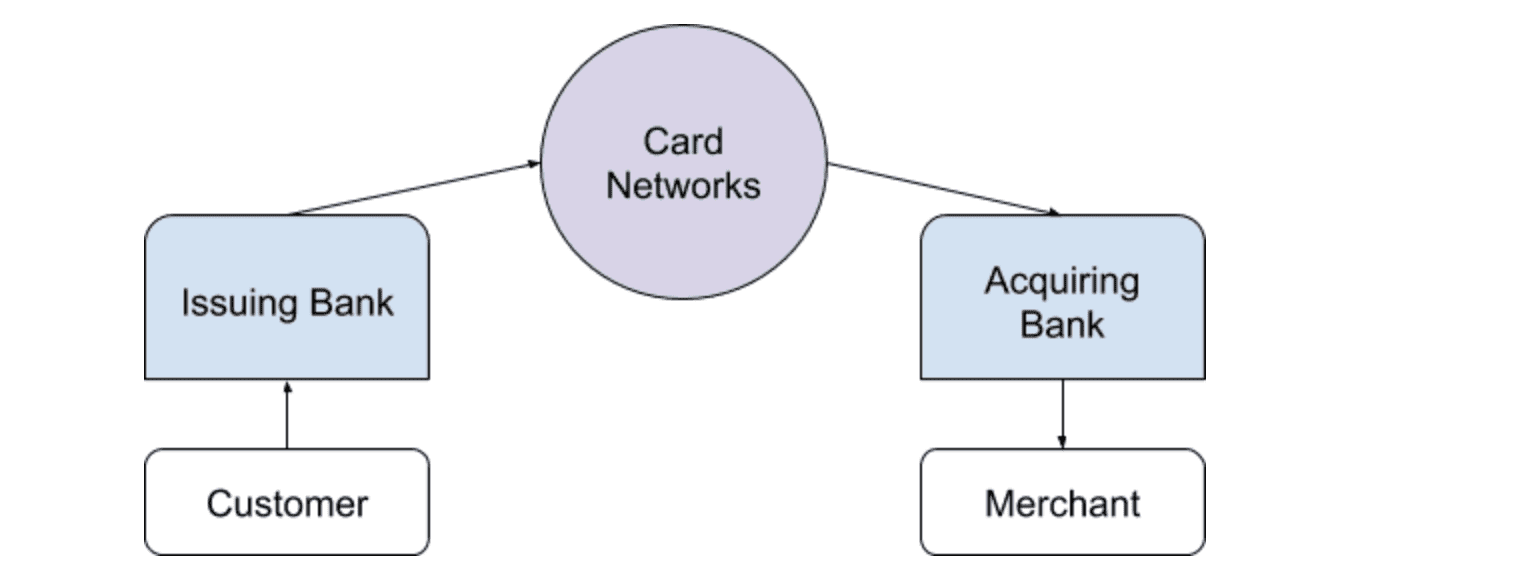

The acquiring bank acts as a middleman between for the merchant when it comes to card networks and issuing banks. An issuing bank is the cardholder’s bank. The card network provides the actual card and consumer services to the cardholder.

Technically speaking, the cardholder does not pay the merchant directly, even though the card was dipped or swiped at the merchant’s terminal. Behind the scenes, the issuing bank pays the acquiring bank, which ultimately leads to the business getting paid in the merchant’s bank account. But the transaction is processed by the processor (hence the name).

Security

The lion’s share of card data security is handled by the processor. Since the processor is responsible for providing hardware and software to the merchant, they subsequently maintain responsibility for keeping the security up to date.

With that said, acquiring banks still must maintain strong security best practices. They handle sensitive cardholder data and other information as well. However, any security for the acquiring bank is separate from the merchant.

Acquiring banks manage security on their own, and don’t necessarily provide anything to the merchants.

At the end of the day, it’s always the merchant’s responsibility to make sure that their own security is compliant and up to date. For example, if you’re using outdated hardware or software, it’s not the processor’s fault if you have a breach. It’s your job to make sure you’re getting the right equipment.

Chargebacks

When a customer disputes a charge with their credit card company, it gets reviewed by the issuing bank. In turn, that dispute gets passed along to the acquiring bank. When this happens, the acquiring bank will relay the message to the merchant.

When the merchant replies, the response is sent back to the acquirer, who passes it back to the issuing bank, and so on. A lot more goes into this, but it’s a basic example to show you the role played by an acquiring bank during a dispute or chargeback process. Acquirers play a more prominent role than the payment processor does in these situations.

Final Thoughts on Acquirers and Processors

The duties of an acquiring bank and credit card processor are both unique.

At times, one financial institution can perform both duties. There are other instances where payment processors have contracts with acquiring banks to work together while maintaining separate roles.

Use this guide as a quick resource to highlight the major differences between processors and acquiring banks. If you have any other questions or need further clarification, feel free to reach out and let us know.