Bad credit can impact your ability to get a loan or a line of credit. But does your credit history matter when you’re applying for a merchant account?

Whether you’re thinking of applying for a new merchant account, you’re awaiting the results of an application, or you’re looking for answers after a rejection, this guide has you covered.

We’ll explain how your personal credit history plays a role in the merchant account approval process and how to navigate your merchant account with bad credit or lack of credit history.

Key Takeways:

- Personal credit scores are part of the underwriting process when you apply for a merchant account.

- Processors use this to assess your overall risk level.

- There’s no minimum credit score required for merchant account approvals.

- Your processing rates likely won’t be affected by your credit score, unless you need a high-risk merchant account.

Does Personal Credit Matter in Merchant Account Applications?

Yes, your personal credit matters when you’re applying for a merchant account. Poor credit or lack of credit history can impact your ability to accept credit cards and debit cards.

While your credit score matters for getting a merchant account, it doesn’t have the same impact as it would on a loan application or line of credit.

Why Your Personal Credit Matters for a Merchant Account?

It may not seem obvious, a merchant account is similar to a line of credit. Merchant accounts don’t work the same way as a conventional loan, but the merchant account provider still deposits funds into your account on credit.

When a customer uses a credit card to buy something from a business, they haven’t actually paid for it yet. The card-issuing bank transfers the customer’s funds on credit into the acquiring bank’s merchant account before it’s ultimately deposited into the business bank account.

But if the customer decides to return an item or files a chargeback for the goods or services, the merchant account provider must recoup those funds from the business. If the funds in the merchant’s account are insufficient, the acquiring bank or merchant account provider must reimburse the cardholder’s bank out of their own pocket.

From there, it’s up to the processor to get their money back from the business, which is why merchant account providers want to ensure they’re working with merchants who have good credit.

Ultimately, if a business owner has bad credit, the merchant account provider may perceive the application as a high-risk account—and potentially reject the merchant account application.

How Good Does Credit Score Need to be For Merchant Account Approval?

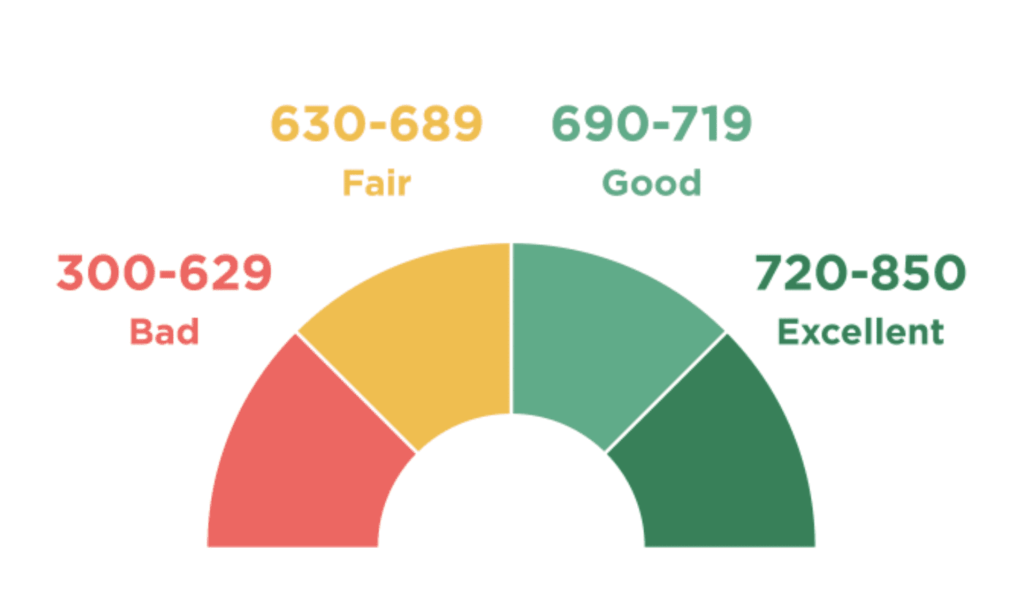

Generally speaking, if you have a credit score above 600 or 630, then you should get approved for a merchant account. There’s no magic number that’s used industry-wide, and the exact credit score needed will vary based on each merchant account provider’s underwriting process.

However, it’s worth noting that you do not need to have a perfect credit score or excellent credit to get approved for a merchant account. In many cases, an average credit score or even a fair credit score will be fine.

Your personal credit is just one of many factors that a processor’s underwriting team will use to evaluate a merchant account application. This means that a poor credit score alone won’t automatically lead to a rejected application. Conversely, a high credit score isn’t an automatic approval either.

Other factors that influence merchant account approvals include:

- Chargeback rates

- Decline rates

- Industry

- Tax liens

- Bank statements

- Active collections

- Estimated sales volume

- Time in business

- Active bankruptcies

- Lack of credit history

So even if you have a below-average personal credit score, you can still get approved for a merchant account if everything else is in order.

Does Personal Credit Score Affect Credit Card Processing Rates and Fees?

Your personal credit score typically does not impact your credit card processing rates and fees, unless you’re required to get a high-risk merchant account (then your rates will be higher).

Lower credit scores can also impact the way your merchant account is set up—even if the actual transaction rates aren’t affected.

For example, a business owner with poor credit may have to agree to certain stipulations to get approved for a merchant account. Common stipulations might be a rolling reserve or an ACH delay.

Both of these scenarios would result in less money coming into the merchant’s bank account after settling credit card batches. But a processor may require these stipulations to lower the risks associated with working with someone who has bad credit.

In some cases, merchants with bad credit may need to apply for a high-risk merchant account. If that’s the case, high-risk merchant accounts tend to have higher processing fees than traditional merchant accounts. But a poor credit score alone usually isn’t enough of a reason to go this route. There may be other factors, in addition to personal credit history, that require a business to get high-risk credit card processing.

Can You Lose a Merchant Account With Bad Credit?

Your personal credit will not cause you to lose an active merchant account. So if you’ve already been approved for a merchant account, but something happens afterward that lowers your credit score, you won’t have to worry about being dropped by your merchant account provider.

Instead, your processor will use your history with them to determine whether or not to keep your account active.

For example, you could lose a merchant account if you have excessive chargeback rates, high card declined rates, or lots of fraud cases.

If the processor has issues collecting money from you after a chargeback or a return, it could ultimately cause them to drop your account.

How to Get a Merchant Account With Bad Credit

Having bad credit doesn’t mean you can’t get a merchant account. There are several different ways to get approved for a merchant account with bad credit, and we’ll cover each of them in greater detail below.

Rolling Reserve

A rolling reserve holds a certain percentage of your credit card sales in an account before it’s released to your bank account. This isn’t ideal for merchants, as you’re not getting paid out the full amount of your sales.

We recommend avoiding rolling reserves at all costs. But in some cases, it may be a necessary evil for the privilege to accept credit cards.

If you’re forced to get a rolling reserve, try to negotiate it to expire or decrease after you’ve proven to be a non-risk. For example, if your processor wants to lock you into an 18-month rolling reserve at 10% of gross sales, try to see if they’ll do it for 12 months or drop the percentage to 5% after the first six months.

ACH Delay

An ACH delay, also known as funds on hold, is a temporary hold on electric deposits from a merchant account to a business checking account.

In simple terms, you’re not getting your money right away.

ACHs delays are extremely restrictive on businesses, as they can create serious cash flow problems. They’re typically much worse than a rolling reserve, and you should avoid funds on hold contracts whenever possible.

Co-Signers

Having someone with good credit cosign a merchant account application with you can be enough to put a processor at ease. Just be aware co-signer will also be on the hook for any funds owed to the processor if there are insufficient funds in the company’s bank account.

The exact rules for who can cosign a merchant account application vary by processor.

Some merchant account providers will only accept co-signers who have a stake in the business. While others are more lenient and accept cosigns from spouses or family members.

Sufficient Documentation

If bad credit is the only factor that’s making an underwriter question your approval, you might be able to win them over by providing sufficient documents about why you have bad credit.

For example, some people have a low credit score for a number of reasons—and many of them aren’t actually tied to creditworthiness.

Let’s say you moved out of an apartment, and for some reason, a utility bill didn’t get paid on your last month at the residence. But the utility company never contacted you, and after 24 months of delinquency, the unpaid bill went to collections. You knew nothing about this, but all of a sudden, your credit score drops significantly—all over a $120 electric bill from years ago.

Even if you settle that claim with the utility company and get them to remove the bad remark from your credit profile, it can still take months or even years for your credit score to recover.

Or maybe you were the victim of identity theft, and a fraudster purchased a car in your name but never made a payment. This is something that could happen to anyone, and it’s no fault of your own.

If you explain these types of situations to the processor and provide all the right supporting documents to back up your story, there’s a chance they’ll look the other way at a bad credit score and approve your account without any stipulations.

High-Risk Credit Card Processing

If you’re perceived as a high-risk merchant, for having bad credit or for another reason, you can still get a merchant account through a high-risk processor.

There are merchant services providers that specialize in high-risk processing, and they’re willing to accept merchants with bad credit.

While a bad credit score alone may not be the only reason to consider a high-risk processor, you may have to go this route if you have poor credit and also operate in a high-risk industry.

Third-Party Payment Processors

Instead of applying for a traditional merchant account, you can find a payment facilitator (PayFac) to accept credit cards and debit cards for your business.

Third-party processors let businesses process payments without having to set up a merchant account from an acquiring bank.

The overall processing costs are higher if you use a payment facilitator. But this is a common path for small businesses and startups that don’t have a credit history. There’s virtually no underwriting process to use these types of services, and you can start accepting payments immediately.

Final Thoughts

Your personal credit history can impact whether or not you get approved for a merchant account. But it’s not the only factor that’s considered, and it’s not weighed as heavily as it would be for a traditional loan application.

You won’t lose your merchant account if your credit score drops after you’ve been approved, and your credit history likely won’t impact your processing rates.

If you’re worried about your bad credit score or lack of personal credit history, there are still plenty of ways to get approved for a merchant account. Just follow the tips and strategies that we covered in this guide.