Fortis is a smaller payment processor compared to market alternatives. They tend to serve B2B companies and businesses seeking an integrated payment solution, particularly for accounting system integrations.

They’ve really expanded over the past few years—acquiring SmartPay, expanding into Canada, and acquiring MerchantE’s NetSuite payments division.

Whether you’re considering Fortis as your payment processor or you’re currently using Fortis and want to know if you’re getting a good deal, this review is for you. You’ll get our insider take on the pros and cons of Fortis, including pricing and fees to watch out for.

MCC Quick Take on Fortis

Fortis ultimately leverages its robust software and ERP partnerships to scale and provide payment processing services to larger businesses.

They operate as a super ISO and a PayFac. We noticed that they rely heavily on Fiserv to process transactions on the backend on a lot of their accounts, but there are definitely others. They’re a registered ISO of Wells Fargo, US Bancorp, Elavon, PNC, and more.

We typically don’t see price gouging or anything too egregious. But like most processors, Fortis does have some bogus fees.

What We Like About Fortis

- Interchange-plus pricing is available.

- ERP and accounting integrations with systems like Acumatica, Sage, and NetSuite.

- Solid customer service and support.

Where Fortis Falls Short

- Some garbage fees that should be removed from statements.

- Sales reps try to sell membership-style pricing on certain accounts.

- Custom setups for integrated and embedded payments cost extra.

Overall, Fortis’s biggest strength is its accounting system integrations and powerful technology. Not every provider supports embedded payments within enterprise-grade ERP software.

But for smaller businesses and companies seeking a straightforward payment solution, Fortis isn’t necessary. You can get better rates and simpler setups elsewhere that would better fit your needs.

Fortis Pricing and Credit Card Processing Rates

It’s always in your best interest to get an interchange-plus pricing contract whenever possible. Fortis offers IC+ structures, but it may not be the first pitch you hear from a sales rep when you’re inquiring about a new account.

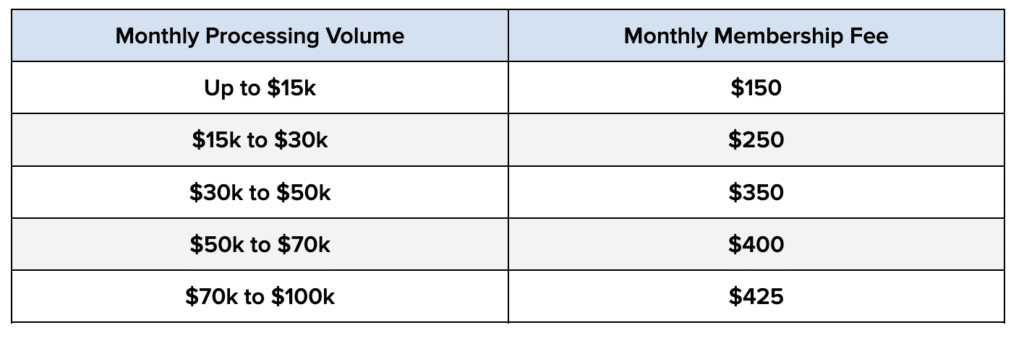

That’s because Fortis also has a membership fee program, where you pay a fixed monthly rate based on your processing volume.

Here’s how it works:

The monthly membership fee increases by $25 for each $25k increment over $100k in a given month ($450 for $100k to $125k, $475k for $125k to $150k, and so on).

It’s relatively simple, and businesses like that it’s easy to understand. And while this is far from the worst membership-style setup we’ve seen, I still think it’s better and cheaper, in the long run, to get on an interchange-plus plan.

With the interchange-plus setup, you pay the wholesale rate set by the card networks plus a markup on each transaction (the markup is Fortis’s cut).

Whereas on the membership plan, the wholesale rates set by the card networks are passed through without a markup. Instead, Fortis profits from the membership fee and other fees they add to your account.

Other Fortis Fees to Look Out For

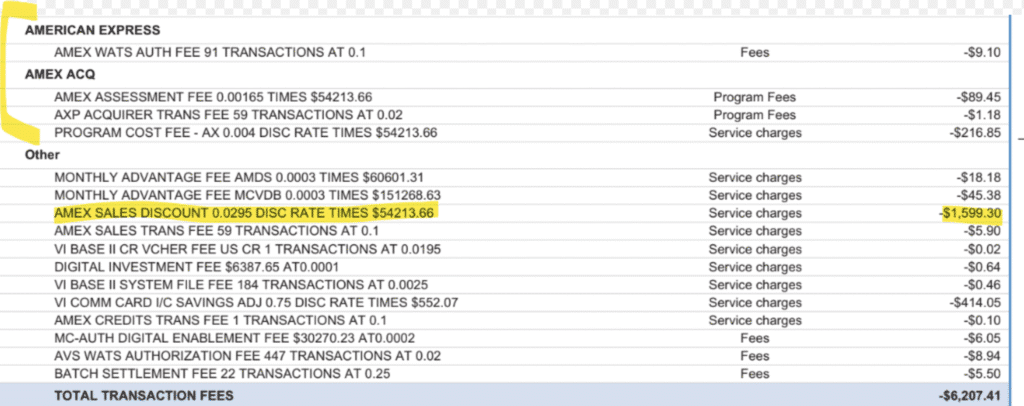

One thing to keep a close eye on with Fortis is how they’re handling your American Express processing volume. On multiple occasions, we’ve caught Fortis charging higher-than-normal service fees on a merchant’s total Amex volume.

Let’s look at an example from a real statement so you can see what I mean:

The Amex Sales Discount Rate of 0.0295 represents about 26% of this merchant’s total fees for the statement. It’s a $1,599 charge that deserves closer inspection.

Basically, Fortis is charging this merchant 2.95% to process American Express transactions.

That would be high in itself, but what makes it worse is that they’re also charging an Amex program fee and passing through Amex assessment fees.

2.95% per transaction is closer to what we see charged on expensive flat-rate pricing models. If the merchant was on a flat-rate model (which they’re not), then we wouldn’t see any of the Amex assessments or interchange rates passed through.

Fortis is marking up the Amex fees here twice—first at a 0.40% program fee and then again at a 2.95% discount rate.

40 basis points is more than enough of a markup on Amex transactions, and the additional 2.95% fee should be eliminated altogether.

Latest Fortis Updates and Noteworthy News

Last year, Fortis acquired MerchantE’s NetSuite division. MerchantE had been an embedded NetSuite partner for over 20 years, and this acquisition aligns with Fortis’s angle of providing integrated payment technology within accounting and ERP systems for larger businesses.

It comes on the heels of Fortis acquiring SmartPay the previous year.

So I’ll be curious to see if Fortis makes another big move soon—which would make it three consecutive years of major moves and acquisitions.

Should You Switch to Fortis?

If you’re already set up with another payment processor, you probably shouldn’t be switching to Fortis. You’re better off negotiating a better deal directly with your current processor.

The only reason to consider Fortis is if you need an embedded solution that your current provider can’t handle. But this only applies to larger organizations needing a complex integration for an ERP solution or enterprise-level accounting tool.

Should You Terminate Your Fortis Merchant Agreement?

No, terminating your merchant agreement with Fortis is not a good idea.

If you’re using Fortis, it’s likely you have some type of integration or embedded payments setup. So switching providers now would derail your existing operations and be a major headache. Your next processor may not even be able to provide the same setup and embedded integration that you currently have.

Just stick with Fortis and try to get a better rate.

Our Final Thoughts on Fortis

Fortis is an above-average payment processor.

They’re not extremely popular or widely used outside of ERP and accounting integrations for larger B2B businesses, but they’re a solid option to consider for these use cases.

Just go with an IC+ plan instead of the membership-style setup, and be cautious of how Fortis handles your Amex transactions. Don’t fall victim to double-dipping and additional markups that aren’t necessary or warranted.

For those of you who are currently using Fortis, there’s a good chance you can save money by negotiating. Let our team here at MCC audit your statements for free to identify any cost-saving opportunities. If we find any inflated rates or bogus fees, we’ll work on your behalf directly with Fortis to lower your rates—so you can save money without switching providers or changing your operations.