If you’re using Global Payments to process credit cards for your business, then you need to monitor your statements closely for certain fees.

These charges can cost you thousands of dollars every month in overages that you don’t always need to pay. And despite their official-sounding names, these are just processor markups that can either be negotiated or eliminated altogether.

1. Settlement Funding Fees

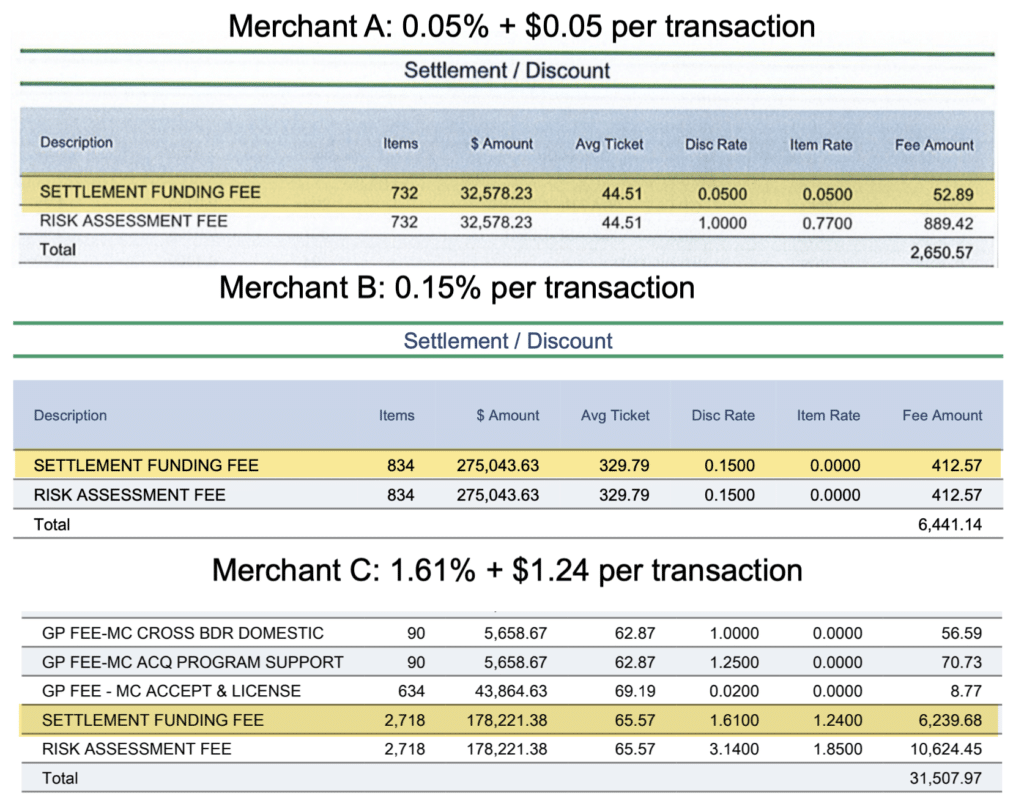

Global’s Settlement Funding Fee is charged on your total payment volume for the entire month. The rate itself is arbitrary, and we’ve seen everything from a low percentage plus fixed dollar amount (0.05% to $0.05) to percentage-only (0.15%, 0.40%, etc.), and in one crazy case, 1.61% + $1.24 per transaction.

Here are a few examples so you can see how widely the rates vary across different merchant accounts:

Depending on how your Global sales rep decided to set up your account, this could be costing you anywhere from $50 to $400 per month, or over $6,200 in a single month.

I’ll admit that the third example is extreme. But even if Global is charging you 0.40% here on your total transaction volume, that’s an extra $4,000 in merchant fees per million in card processing.

2. Risk Assessment Fees

Risk Assessment Fees are also charged on your total Global monthly volume. Similar to the Settlement Funding Fee, the amount varies per account, and it has nothing to do with the merchant’s actual risk of fraud or chargebacks.

If you look back to the 3 examples above, you’ll see a Risk Assessment Fee charged directly below each Settlement Funding Fee:

- Merchant A: 1.00% + $0.77 per transaction

- Merchant B: 0.15% + $0.00 per transaction

- Merchant C: 3.14% + $1.85 per transaction

This resulted in an $889, $412, and $10,600, respectively, in additional monthly charges.

Alone, this is obviously a lot. But think about how much extra you’re paying when it’s combined with those settlement funding charges. Here’s what that additional markup looks like for those three merchants:

- 1.05% + $0.82 per transaction

- 0.30% + $0.00 per transaction

- 4.75% + $3.09 per transaction

Think you’re getting a good deal from Global Payments with a 0.10% + $0.10 discount rate? Think again.

Your markup is actually 1.15% + $0.92 per transaction. And that’s if we use the cheapest of the three examples.

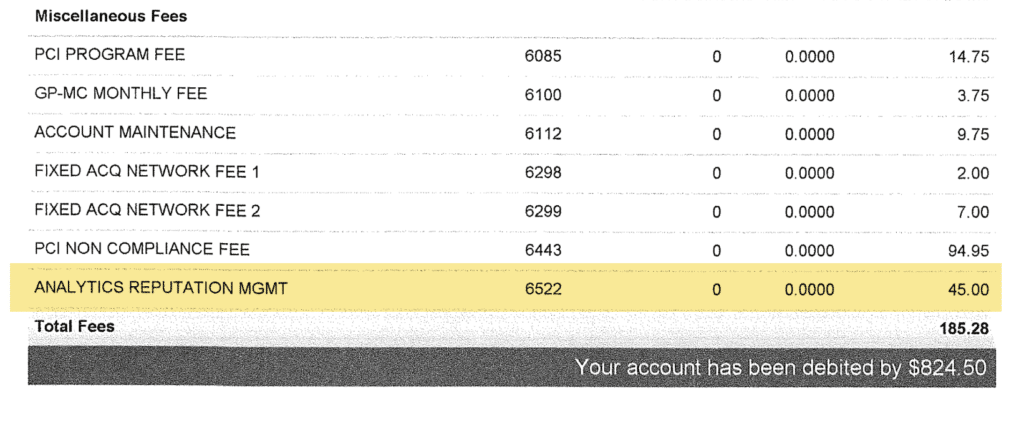

3. Analytics Reputation Management Fees

The Analytics Reputation Management Fee from Global Payments is a flat monthly fee, usually around $45 per month. Here’s an example from one of our clients using Global:

While this may not seem like something to lose sleep over, it’s still over $500 every year for a phantom service.

And when you combine it with other miscellaneous fees that you’re being charged, it likely means several thousand dollars in overages being charged to your account.

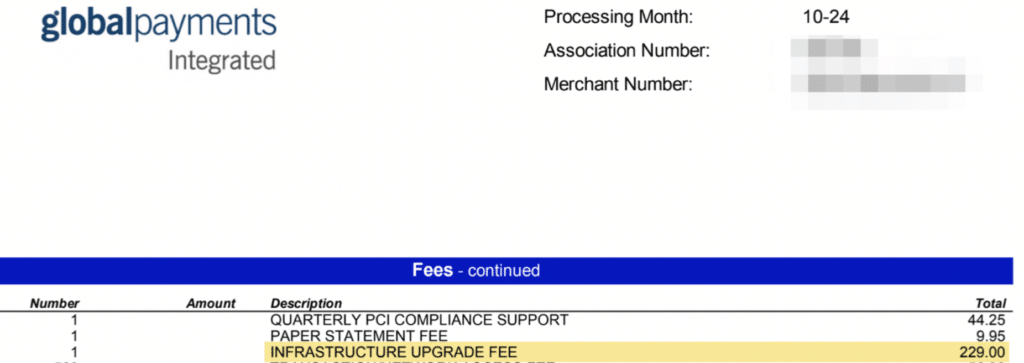

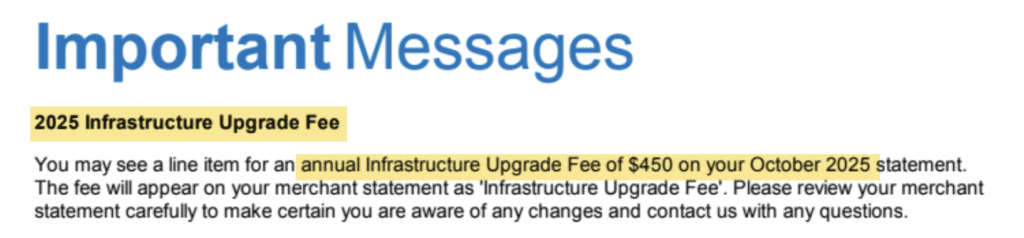

4. Infrastructure Upgrade Fees

Global’s Infrastructure Upgrade Fee is just an annual fee disguised with a fancier name. This is one that’s charged across all Global subsidiaries (TSYS, Heartland, Cayan, etc.), and the amount increases every year.

They typically appear on accounts in Q4, as early as October but always before the end of the year.Here’s a $229 Infrastructure Upgrade Fee charged in October 2024:

Again, you may not think $229 seems like much.

But one year later, that fee jumped to $450 in October 2025:

This was just $169 a few years ago, and it nearly doubled from 2024 to 2025.

There’s no telling what the fee will be in 2026, but my guess is that it will increase again (why would Global suddenly stop their rapid annual fee rate hikes now?).

Here’s arguably the worst part about this charge. Literally nothing is changing for you as a merchant in terms of how you’re processing payments. You didn’t get any type of upgrade here, and you shouldn’t have to pay for any supposed “upgrades” that Global might be doing internally.

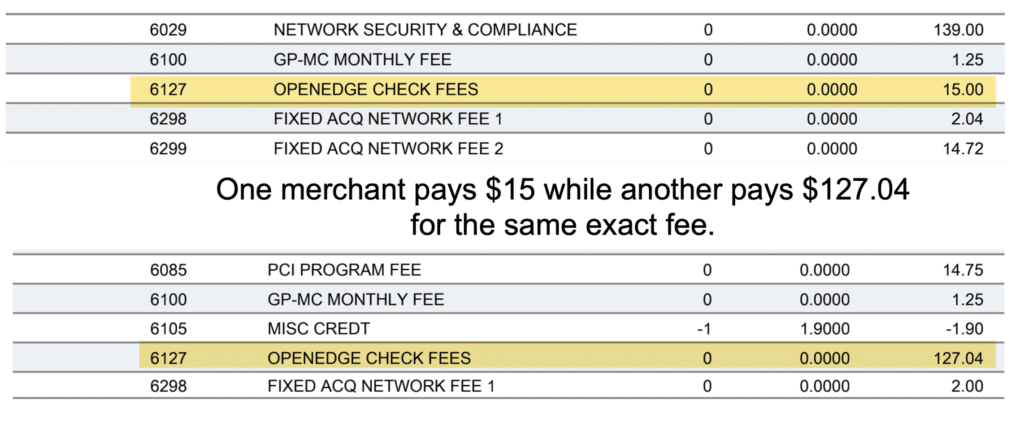

5. OpenEdge Check Fees

If your business accepts ACH payments or electronic checks through Global Payments, they’ll charge you an OpenEdge Check Fee for the conversion.

Unlike the other fees we’ve covered so far, this one is legitimate and tied to a specific service.

But the reason why you need to keep an eye out for this fee is because the rate is negotiable. And we’ve found several instances where Global was charging much more than they should be.

Look at the difference between these two merchant account statements:

We’re typically able to cut this rate in half for our clients when we’re negotiating with Global on their behalf.

But you can use that $15 fee as a reasonable point of reference when you’re comparing your own statements.

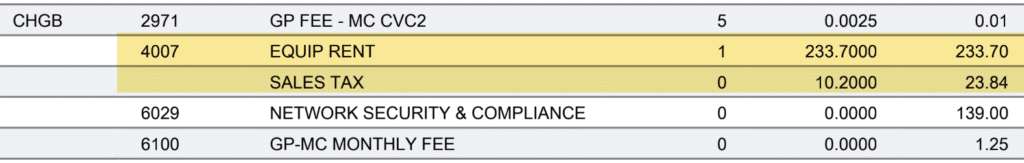

6. Equipment Rental Fees

Equipment rentals are also service-based, meaning you’re actually getting something in return for what you’re paying for. In this case, it’s usually a terminal to accept card payments in person.

While equipment rental fees aren’t technically “junk” fees, they’re still super easy to avoid, and they’re likely costing you much more than you realize. Let’s break this down.

Here’s an example from one of our clients leasing a terminal from Global Payments:

They’re paying $233.70 per month, plus $23.84 in taxes, for a grand total of $257.54 in monthly terminal rental fees.

A single piece of equipment costs this merchant over $3,000 per year to lease.

Now let’s look at another Global client that purchased their equipment outright:

They paid $799.99 + $78 in taxes one time ($878 total upfront).

That’s the same amount that the first merchant is paying over just 3 months in rental fees.

And since most terminal leases run for 36 months, that’s the difference of over $9,000 in rental fees vs. less than $900 to buy.

It’s crazy how much processors overcharge for leases. When the lease is up, you own nothing. You either have to continue renting or you’re forced to purchase something.

We find that lots of Global sales reps talk merchants into leases because they pitch things like “free maintenance” and “free upgrades.” But I’ve got news for you. Your terminals don’t need any maintenance. And even if they did, it would still be cheaper to just replace what you own than pay absorbent rental fees every month.

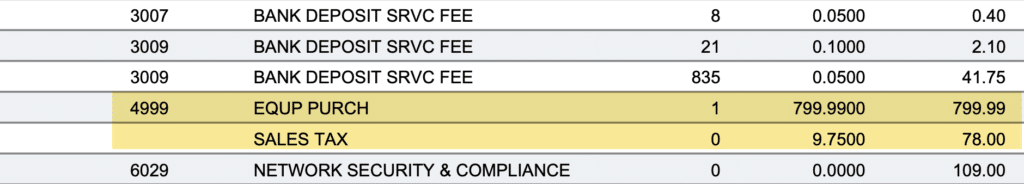

7. Global VPN Fees

Global VPN Fees are typically associated with Address Verification Services (AVS) imposed by the card networks for fraud prevention.

Card networks like Visa and Mastercard charge up to $0.01 per transaction for this, but it’s usually a fraction of a cent for card-present transactions. Either way, it’s marginal, and not a big deal.

But Global Payments charges their own “Global VPN” fee as an additional markup on top of the card network fees. And similar to all the other fees we’ve covered so far, this one varies drastically depending on the merchant account we’re looking at:

It’s the same pattern we’ve been seeing all along. Three different businesses, three drastically different rates for the same service.

Merchant B is paying 2.5x more than Merchant A. Merchant C is paying 4x more than Merchant B, and a whopping 11x more than Merchant A.

You literally can’t make this up.

I get that payment processing rates are customized to each business. But not for this type of charge. If the fee was tied to a legitimate service, then it would be the same across the board. Maybe some slight variance (like $0.05 vs. $0.06 or $0.10).

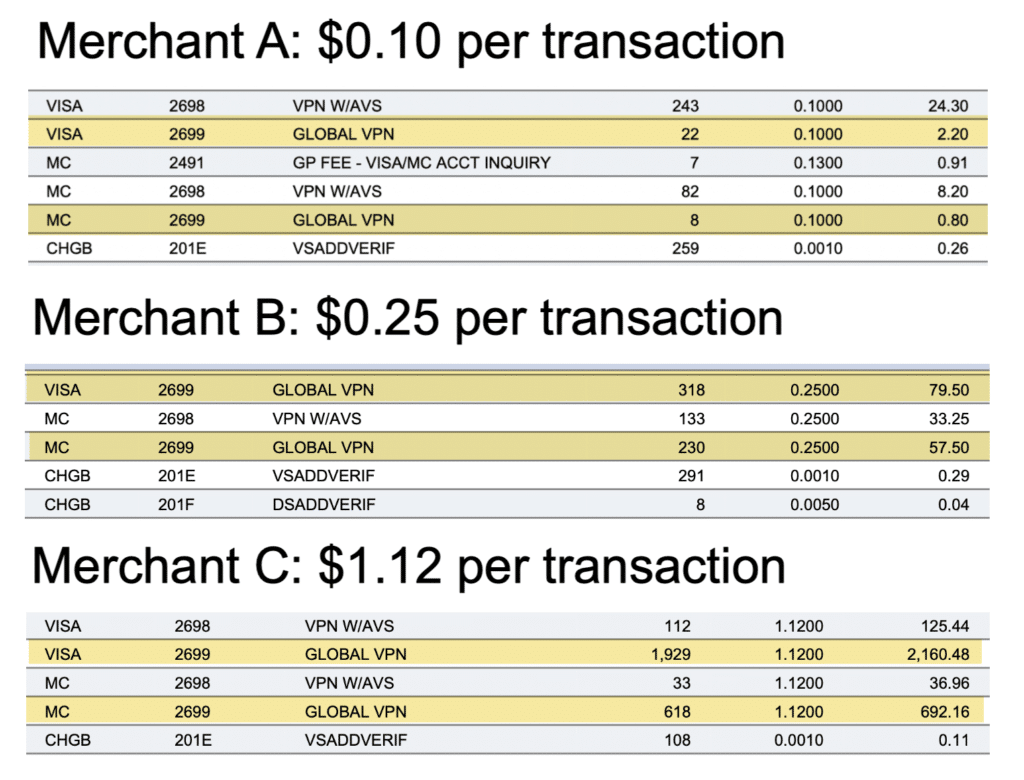

8. Network Security & Compliance Fees

Payment processors absolutely love using the term “compliance” in their fee names because it gives merchants the impression that it’s some sort of mandatory fee by an industry-governing body.

That’s not the case here.

Global’s Network Security & Compliance Fee is just another monthly charge used to inflate their margins.

Think about it for a second. Shouldn’t your processor have a secure payments network? Of course they do. That’s not a separate charge.

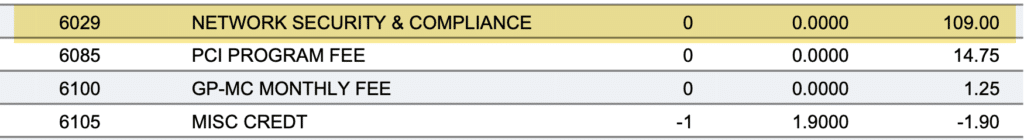

Here’s an example of a merchant paying $109 per month for this:

That’s $1,300 per year for what exactly? A secure network or some type of compliance charge?

Look directly below the line item I highlighted, and you’ll see that Global is also charging this merchant a $14.75 PCI Program Fee. More compliance charges…

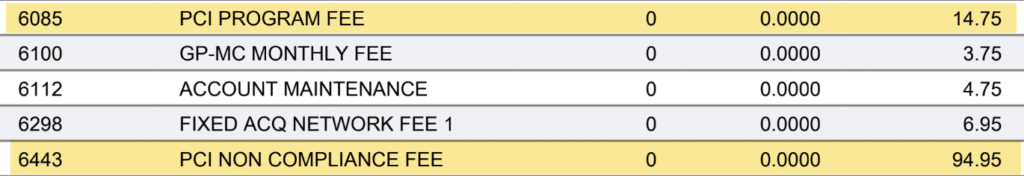

Now let’s look at a different Global merchant that’s NOT being charged the Network Security & Compliance Fee:

They’re still being charged the same $14.75 PCI Program Fee, and they’re ALSO being charged a $94.95 PCI Non-Compliance Fee.

How can this merchant be paying for a PCI program, yet still be non-compliant?

In both scenarios, Global is still charging over $100 per month whether the merchant is PCI compliant or not.

Even the compliant merchant is hit with an additional Network Security & Compliance Fee to make up for the fact that they can’t be charged for non-compliance.

How These Extra Fees Can Cost You Thousands

In isolation, these fees from Global Payments may not seem like much. $45 here, $95 there, or an extra 0.10% on your transaction volume. But combined, they add up to literally thousands of dollars every month.

That’s the whole point.

Let’s look at a reasonable scenario, and I’ll even use the cheapest of these fees as an example.

Say your discount rate per transaction is 0.05% + $0.05 per transaction, which is an amazing deal for Global, and something that’s probably unattainable for most merchants.

Now factor in:

- 0.05% + $0.05 per transaction Settlement Funding Fee

- 0.15% per transaction Risk Assessment Fee

- $0.10 per transaction Global VPN Fee

Your rate is actually 0.25% + $0.15 per transaction.

If you’re processing $5 million per year on 50,000 transactions, that’s $20,000 in merchant fees going straight to Global. That’s 8x higher than the $2,500 you thought you’d be paying based on your advertised rate of 0.05% + $0.05.

And that doesn’t even include:

- $45 per month Analytics Reputation Management Fee

- $109 per month Network Security & Compliance Fee

- $233 per month Equipment Rental Fee

- $450 per year Infrastructure Upgrade Fee

That’s another $5,000 per year. So we’re up to $25,000 vs. $2,500.

10x more than the advertised rate.

For most merchants, it’s significantly more than this. Because remember, I used the cheapest possible rates here from the examples. This could easily be double or triple had I used even the middle-of-the-pack rates.

What to Do If You Spot These on Your Global Payments Statements

Alright, so we’ve established that you could easily be paying $20,000 to $25,000 or more in extra fees from Global Payments. So what?

These fees aren’t mandatory, and you can 100% do something about it.

Pick up the phone. Send an email. Contact Global ASAP and start negotiating.

Let them know that you’ve educated yourself on these fees, and know that the majority can either be removed from your statement altogether. Or at the very least, reduced significantly.

Be specific. Use the examples I called out in this guide. Show them the proof you have that they’re charging other businesses less than what they’re charging you.

Trust me, you have a lot more leverage here than you realize because Global doesn’t want to lose your business.

And if you need help with any of this, reach out to my team here at MCC for assistance and we’ll give you a free statement audit. You don’t have to switch processors or change anything to avoid these fees from Global Payments.

Final Thoughts

If you see any of these fees on your Global Payments merchant account statement, I can basically guarantee that you’re overpaying on credit card processing.

How much you’re overpaying depends on how many of these fees are being added to your account, and what rate you’re being charged. As you can see from the examples we covered, I can’t even guess what those rates might be without looking at your statements.

From there, you’ve got two choices. You can either accept that your processor is overcharging you. Or you can do something about it by pushing back and negotiating better terms.