Our team is constantly on the lookout for notices, important messages, and rate updates for all major credit card processing companies. We’ve compiled all of the most recent news to Heartland and shared them below.

But if you’re looking for more than just the quick rate changes, we also have a complete Heartland Payment Systems review that dives deeper into Heartland’s pros, cons, and fees you should look out for.

Heartland is Officially Becoming Global Payments

Heartland was acquired by Global Payments back in 2016, but the processor has maintained its own brand name (even though it’s been part of Global’s umbrella this whole time).

This is officially changing, and Heartland customers are already starting to see the Heartland name be replaced with Global logos on their monthly statements. And by 2026, Heartland branding will also be changed to Global Payments on other platforms.

Here’s a copy of the notice being sent to merchants:

For merchants using Heartland, nothing is really changing here other than the name.

Global Payments has already been in control over your account for years, and they’re been applying the same aggressive pricing tactics and bogus fees that we see elsewhere on Global accounts.

Heartland Annual Reporting Fee

Heartland just announced its that this year’s Annual Reporting Fee will be billed at $245 or $410 per merchant location. Merchants using Heartland will see this fee December 2025 statements.

The fact that the rate isn’t consistent across all merchant accounts proves that it’s a bogus fee.

Last year, we saw Heartland assessing this fee at $245 per location. And this is the first year that we saw found clients being notified of $410 charges. Other businesses are still being kept at the old $245 rate, and there’s no consistency.

Heartland Infrastructure Upgrade Rate Increase (Effective October 2025)

Heartland is notifying customers of a new $450 Infrastructure Upgrade Fee that will be applied to October 2025 statements.

This isn’t the first time we’ve seen this charge, but it’s among the highest rates we’ve seen for a bogus fee that should be removed. But it aligns with everything else Global Payments is doing to rip off their customers. Since Heartland is owned by Global, merchants using Heartland are continuing to see more of these junk fees appear on their accounts.

Heartland Customer Intelligence Suite Rate Increase (Effective August 2025)

Heartland is increasing its Customer Intelligence Suite Fee to $59.95 per month, effective August 1, 2025.

Here’s a copy of the notice we’ve obtained:

Heartland Rate Increase (Effective June 2025)

Heartland just sent a notice to merchants announcing a rate increase that goes into effect for June 2025.

However, the notice itself is frustratingly vague, and doesn’t actually specify the amount of the increase.

Instead, Heartland just says that they will be “increasing processing fees effective June 2025, and the new processing fee will be reflected in the same manner as your existing fee on your merchant statement covering your June processing activity.”

To me, that’s likely indication that Heartland is not applying this rate hike universally across all merchant accounts, and that some businesses will have higher rate increases than others. Rather than tailoring the message to include the rate for each account, Heartland decided to just send out a blanket notice that applies to everyone.

Either way, if you’re using Heartland to accept credit cards, you should contact them ASAP and ask specifically what your new rate will be. Then make sure to monitor your June 2025 statement closely to identify the increase. If you’re having trouble with any of this, just reach out to our team here at MCC for assistance.

Other Heartland Rate Increases and Updates Over the Years

Annual Fee (2024)

Heartland’s Annual Reporting Fee will appear on December statements in the amount of $245 per merchant location.

This fee is (supposedly) to cover reporting costs related to government and payment industry entities.

Rate Increase (Effective October 2024)

Heartland is charging some merchants a one-time 2024 Infrastructure Upgrade Fee of $254 that will appear on October statements.

Furthermore, Heartland just notified its customers of a rate increase at the card network level that goes into effect on October 18, 2024. These changes apply to:

- Visa

- Mastercard

- Discover

- American Express

- PIN Debit Networks

Heartland’s October statements will include the old rates (from 10/1/24 – 10/17/24) and the new rates (10/18/24 – 10/31/24).

According to the notice, these changes are being passed-through to merchants without any markup from Heartland. But be sure to double-check your statements to verify that Heartland isn’t raising your rates. If you need help auditing those statements, contact our team here at MCC for assistance.

Heartland PCI Non-Compliance Fee (Effective May 2023)

Heartland merchants who have not completed their PCI DSS compliance validation by April 30, 2023 have been sent a letter regarding Heartland’s new PCI Non-Compliance fee of $125. Effective May 2023, this fee will be assessed monthly until the merchant has completed and provided Heartland with its PCI DSS compliance validation.

These fees will appear on as a separate line item statements beginning in June 2023, which show the previous month’s activity.

Rate Increase (Effective June 2022)

In a notice sent to merchants, Heartland (Global Payments) notified customers of changes to PIN debit networks that could impact costs. Merchants may see new fees or notice an increase in:

- Card network fees

- Assessment rates

- Switch fees

- Activity fees

- Settlement funding fees

- PCI non-compliance fees

- Network security fees

Heartland (Global Payments) is reminding merchants to carefully review statements to make sure they’re aware of these changes.

Rate Increase (Effective February 1, 2022)

Heartland notified customers of the following STAR Rate Fees going into effect as of 2/1/22:

- Debit Network Pre-Auth Switch Fee — $0.10 (previously $0.0325)

- Debit Network Completion Switch Fee* — $0.10 (previously $0.09)

- Debit Network Completion Switch Fee** — $0.10 (previously $0.0325)

- STAR Administrative Fee — Eliminated (previously $0.01)

*Applies to approvals, reversals, returns, refunds, and voids

**Applies to denials

Rate Increase and Updates (January 1, 2022)

In a notice sent to customers, the following changes are going into effect 1/1/2022:

- A Non-EMV Assessment Fee of 0.65% will apply to card present transactions (including keyed transactions).

- Customers can see these fees under the “HPS Processing Fees” section of their statement.

- Customers who have questions about these fees are advised to contact customer support at 888-963-3600.

- Customers who object to these fees can terminate their agreement without penalty with written notice in accordance with their merchant agreement. The written notice must be sent within 30 days of the first statement date containing the new fees.

Correction Notice: A previous notice from Heartland said that the Non-EMV Assessment Fee would also apply to fallback transactions, contactless payments, and card-not-present (CNP) transactions. This was an error. The fee will only apply to card present transactions, as stated in the first bullet above.

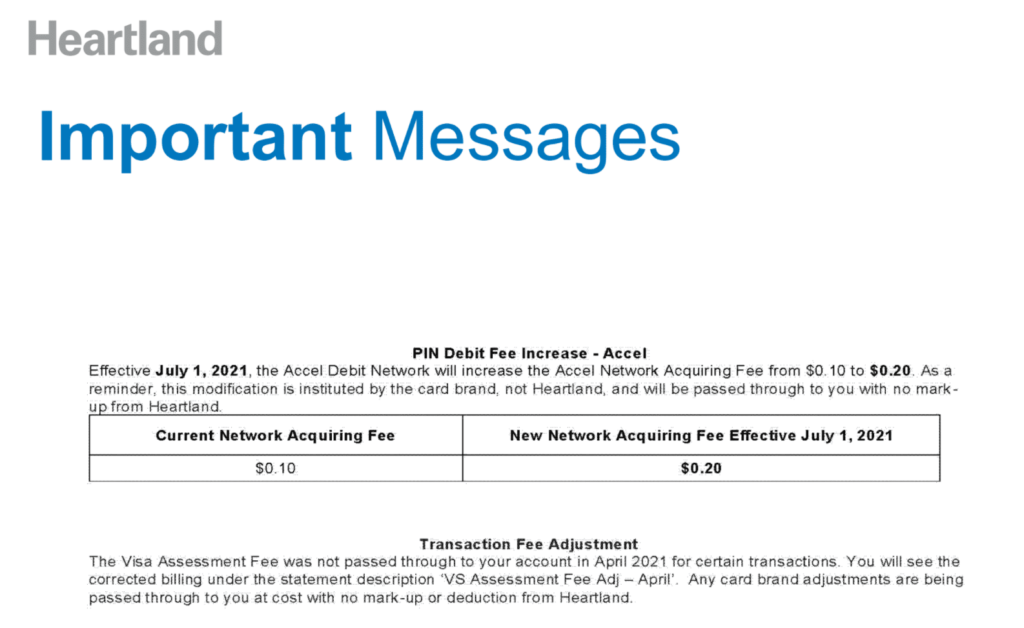

Heartland PIN Debit Increase (Effective July 1, 2021)

If you are a merchant or a business who is using Heartland, now Global Payments, as your credit card processing company, be on the lookout for this credit card processing rate increase which was put into effect for July 1, 2021 by the Accel Debit Network.

This credit card processing fee is a network fee, that has been adjusted by the Accel debit Network. It is not a credit card processing fee increased by Heartland, and will be passed through with no additional mark up from Heartland.

About Heartland Payment Systems

Heartland Payment Systems was initially formed in 1997 to offer payment solutions to small businesses. Today, they’re a Global Payments company offering a wide range of solutions, including:

- Payment processing

- Online payments

- Gift card and loyalty

- Capital services

- Bill pay

- Financial services

- ACH

- Instant deposit

- Point of sale (POS) solutions

- Mobile POS

- POS integrations

- Payroll processing

- HR software

- Lending

Global Payments announced its acquisition of Heartland in 2015. The deal was finalized in April 2016.

Use our ultimate guide to interchange to see how interchange works and see the latest updates from credit card networks and processors.