Understanding how Apple Pay works and how to use it is essential for consumers and businesses alike. Apple users get a quick and convenient way to pay for goods and services using their Apple devices, and merchants can broaden their payment acceptance methods to accommodate customer preferences.

This guide covers everything you need to know about Apple Pay—including how it works, how to set up Apple Pay, how to use Apple Pay, fees, and how to accept Apple Pay payments as a business.

What is Apple Pay?

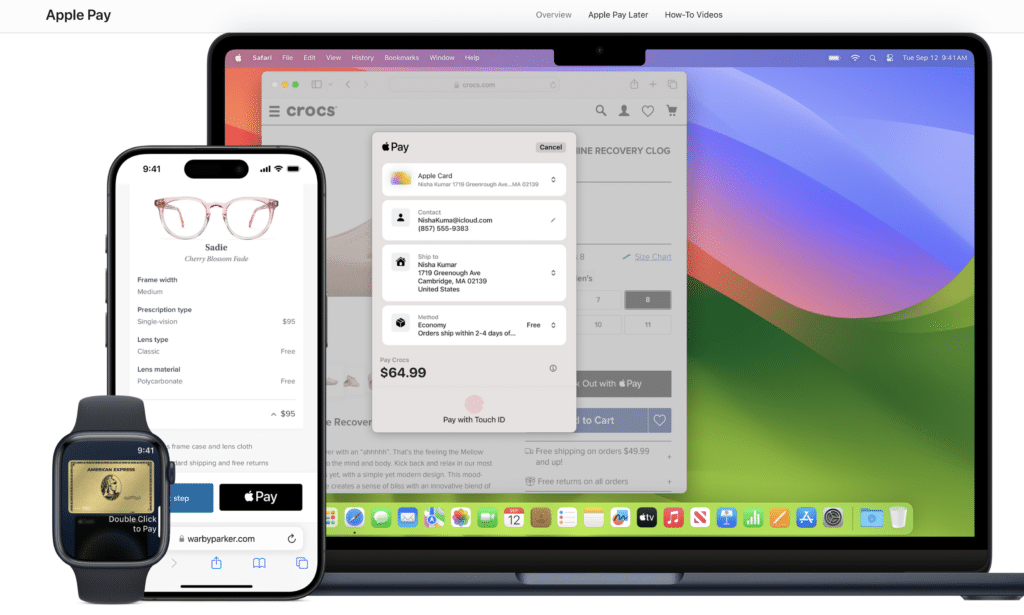

Apple Pay is a mobile wallet that’s natively built into Apple devices. It allows users to add credit, debit, and prepaid cards to their Wallet app on iPhones, Apple Watches, and other compatible Apple devices.

Once payments have been added, Apple Pay operates as a mobile payment service for people to use those saved cards to make payments both in-person, online, and through mobile apps.

Apple Pay can also be used to send money, including Apple Cash, between other Apple users.

How Does Apple Pay Work?

Apple Pay works using the same type of technology as contactless card payments. Once a debit or credit card has been added to the mobile wallet, any compatible Apple device just needs to be held in proximity to an NFC-enabled payment terminal. The customer just needs to verify the payment using their passcode or biometrics confirmation.

Apple Pay works with the following Apple devices:

- iPhones with Face ID

- Most iPhones with Touch ID

- Apple Watches

- Macs with Touch ID

- Macs 2012 or later linked to an Apple Watch or iPhone

- Macs paired with an Apple Magic Keyboard

- iPads with Face ID

- iPads with Touch ID

People can use Apple Pay to complete transactions anywhere that accepts mobile payments or contactless payments. It’s supported for online shopping, marketplaces, and natively through mobile apps. Simply look for the Apple Pay logo at checkout to complete a transaction using Apple Pay.

How to Set Up Apple Pay

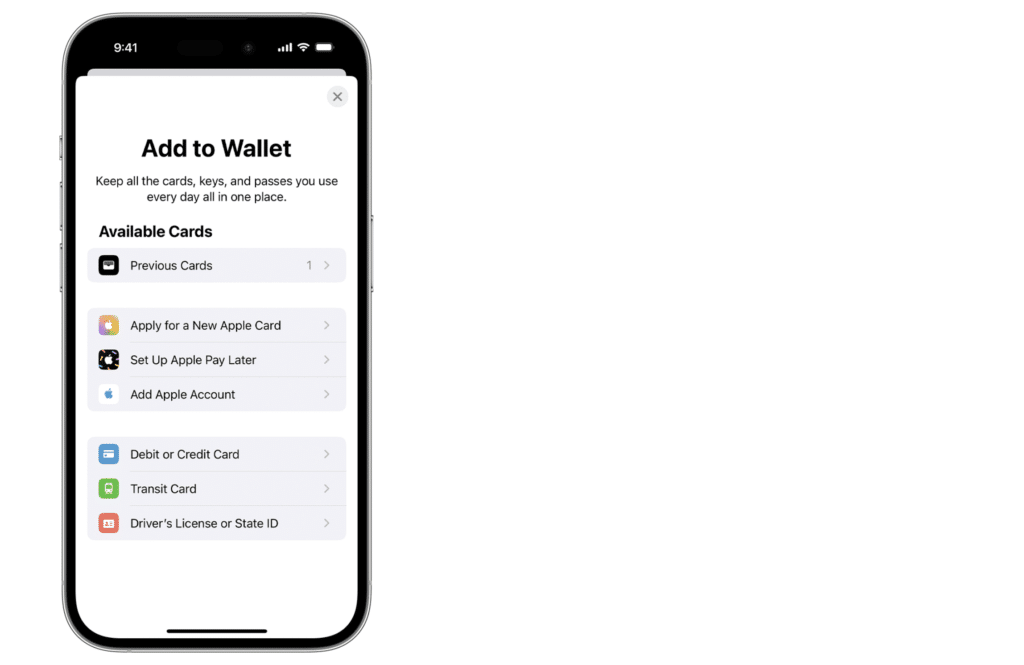

You can set up Apple Pay from any compatible Apple device by following these simple steps:

- Open the Wallet app

- Press the + button to add a new card

- Scan your card (or manually enter the card details)

Then just agree to Apple’s terms and conditions, and you can start using Apple Pay immediately.

You can also add multiple cards and payment options to your Apple Wallet. If you have multiple cards added, you’ll just be prompted to select the card you want to use at checkout (similar to opening a physical wallet and pulling out the card of your choice).

How to Use Apple Pay

As a consumer, using Apple Pay is simple. Here’s a quick overview of what to expect and how to use Apple Pay to pay for goods or services:

- Verify the merchant accepts Apple Pay (look for the contactless payment symbol for in-person payments or the Apple Pay icon for online and mobile payments)

- Open your Wallet app

- Choose the card you want to pay with

- Use your passcode or biometrics (fingerprint or Face ID) to verify the payment

- Place your iPhone or Apple Watch near the terminal (for in-person payments only)

The transaction will be processed the same way as a contactless chip-enabled credit or debit card.

To use Apple Pay for online or mobile payments, simply select the Apple Pay option at checkout. Verify the payment using biometrics or a passcode, and confirm the details to complete the transaction.

How to Accept Apple Pay Payments at Your Business

To accept Apple Pay, businesses must have a payment provider and hardware that’s compatible with contactless payments. If you currently accept credit or debit cards in person and have hardware that’s capable of NFC or tap-to-pay payments, then you’re likely already set up to accept Apple Pay at your business.

To accept Apple Pay online through your ecommerce website or through your mobile app, visit Apple Pay for developers to add the Apple Pay button to your checkout process.

You can also check with your merchant services provider to see if you already have a payment gateway that’s compatible with Apple Pay.

Apple Pay: Common Questions Answered

Our team here at Merchant Cost Consulting gets lots of questions about Apple Pay. Here are a handful of the most common ones I answer regularly, which you can refer to as a quick reference.

Is Apple Pay secure?

Yes, Apple Pay is secure. Nothing is 100% immune to fraud, but in many ways, Apple Pay can be safer than using physical credit cards or debit cards.

Face ID, Touch ID, or passcodes are required to complete the purchase, making it much harder for unauthorized users to complete a transaction—even if they have physical access to an iPhone or Watch with cards added to an Apple Wallet.

Card numbers are not stored on Apple devices or Apple servers, and the cardholder’s identity and card numbers aren’t shared with merchants, either.

Can you use Apple Pay online?

You can use Apple Pay online as long as the merchant or marketplace offers Apple Pay as a payment option. Just look for the Apple Pay logo during checkout to see if it’s an available payment method.

What banks support Apple Pay?

Most major credit cards, debit cards, and banks support Apple Pay. For a full list of participating banks, check this resource from Apple.

What’s the difference between Apple Cash and Apple Pay?

Apple Cash is a way for Apple users to send and receive money between each other. It can be used and accessed through the Wallet app or directly through Messages on an Apple device.

Apple Pay enables users to make contactless payments using credit cards, debit cards, and pre-paid cards added to the Wallet app, including Apple Cash. If someone sends you money with Apple Cash, you’ll have the option to use your Apple Cash if you’re using Apple Pay to buy something from a merchant.

What is Apple Pay Later?

Apple Pay Later is a buy now pay later (BNPL) solution that allows consumers to purchase something now and pay for it in four installments over six weeks without interest or fees. It can be accessed within Apple Pay, and all loans will be organized within the Wallet app.

How much does it cost to accept Apple Pay?

There is no additional fee charged by Apple for businesses to accept Apple Pay. The cost is based on the transaction fees imposed by the card network and merchant services provider, which vary from business to business.

For online payments, Apple Pay is generally processed as a card-not-present (CNP) transaction. While these fees are typically higher than an in-person transaction, they wouldn’t be any different than if a customer used a credit card to pay for something online.

Read More: Card Present vs. Card-Not-Present Transactions

Apple Pay Alternatives

To help give you a better understanding of Apple Pay and how it works, we’ll quickly compare it to some popular alternatives on the market:

- Google Pay: Google Pay essentially has the same functionality as Apple Pay, but for Android devices instead of Apple. You can add credit or debit cards through the app, and then use it to pay for items when checking out in-person or online.

- Venmo: While Venmo does have features for businesses, it’s more commonly used for sending and receiving money between people. This can best be compared to the Apple Cash feature of Apple Pay.

- PayPal: PayPal can be used to send money between people, and it can also be used as a payment acceptance method for businesses. Similar to Apple Pay, merchants can add the PayPal button to their website or app during the checkout process as an alternative payment method.

- Zelle: Zelle is only compatible with specific banks. It’s made for sending and receiving money between friends and family and often works instantly as a direct debit from a bank account. Zelle does not charge a fee, but some banks do.

Apple Pay is somewhat unique in the sense that it combines the P2P money-transfer features of Venmo or Zelle with the business payment acceptance features of PayPal and Google Pay.

Final Thoughts on Apple Pay

As a consumer, Apple Pay can be a quick and convenient way to pay for things when you’re shopping both in-person or online. Rather than having to carry all of your physical cards with you or manually enter your card details during an ecommerce checkout, you can use Apple Pay as a safe and secure alternative.

Most businesses should offer Apple Pay at checkout simply because it provides customers with additional payment options. It reduces friction at the point of sale and allows consumers more options—helping to ensure they’re able to pay with whatever their preferred method might be.

Apple Pay controls a whopping 92% of the digital wallet market share in the US. It’s projected that more than 23% of Americans will be using Apple Pay by 2026 (currently about 19%).

As a merchant, these types of figures can’t be overlooked. So if you’re not currently accepting Apple Pay, it’s something you should probably be considering in the near future.