Friendly fraud is one of the biggest challenges faced by businesses today. With eCommerce trending upward in recent years, friendly fraud has become a growing concern for larger organizations.

What exactly is friendly fraud?

It occurs when a consumer disputes a legitimate transaction with their credit card company. This ultimately results in a credit card chargeback to the merchant.

We call this friendly fraud because, in most cases, the consumer doesn’t realize what they’re doing is fraudulent. For example, if they are unsatisfied with an online purchase, they simply dispute the charge as opposed to returning it to the merchant.

While this “friendly” type of fraud isn’t always malicious in intent, it’s still damaging for merchants.

As the CFO, you need to make sure that your organization has policies in order to prevent friendly fraud. If you take the right steps and document everything correctly, you can also fight against any friendly fraud disputes.

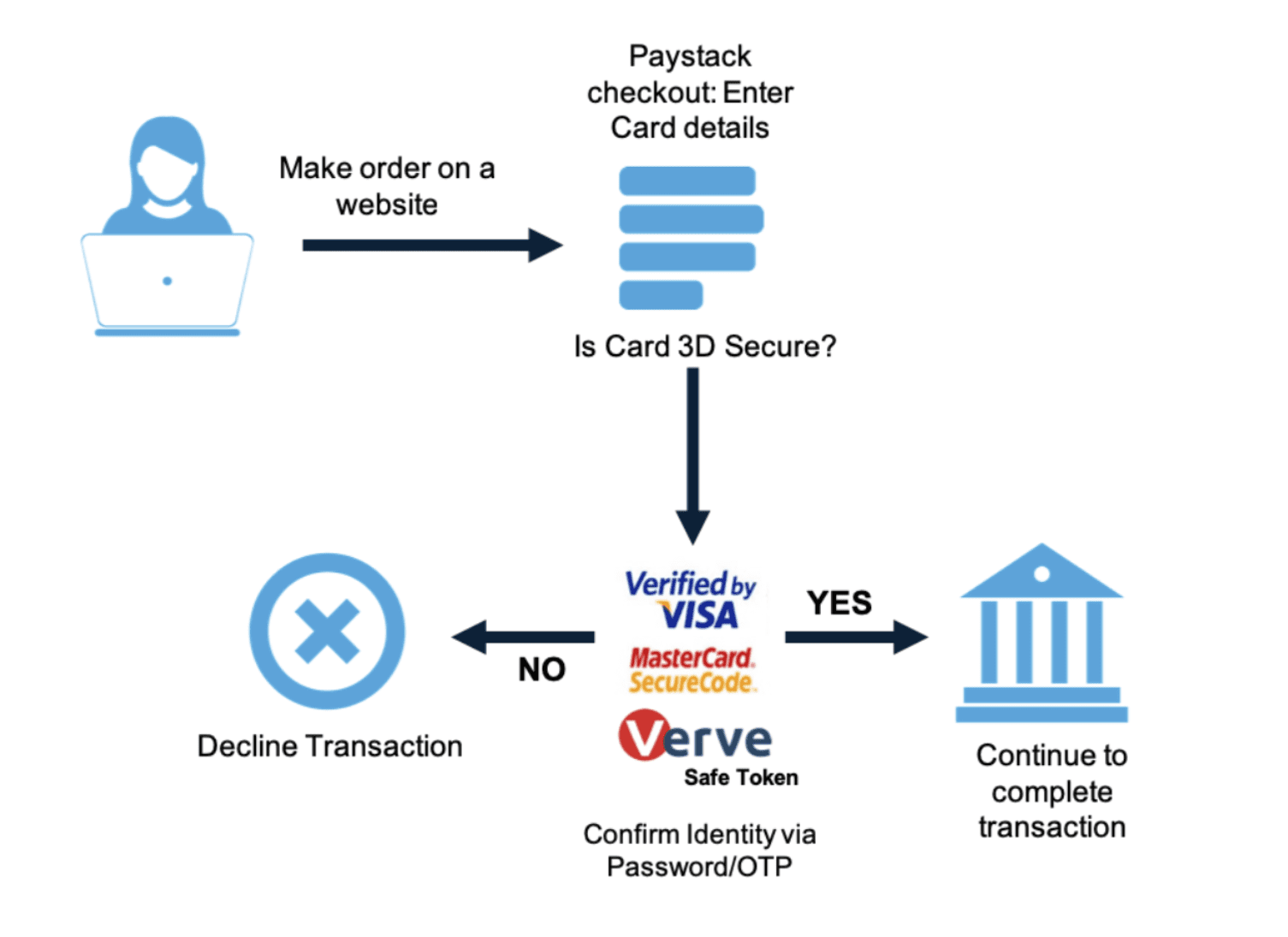

Payer Authentication Programs

Examples of payer authentication programs include Verified by Visa and Mastercard SecureCode. These programs can help merchants reduce losses from chargebacks caused by friendly fraud.

Your participation in one of these programs can shift the liability from you and your acquiring bank to the issuing bank.

Consumers can still commit friendly fraud. However, you won’t be liable for the chargeback as the merchant; the issuing bank is held responsible.

Here’s a visual representation that explains how a payer authentication program (also known as 3D secure) works.

A cardholder who goes through this process will have a much more difficult time claiming that the charge on their card was fraudulent. That’s because they have to go through an added verification process by a third-party.

CVV/CVV2

CVV stands for card verification value. It’s also abbreviated as CVV2.

This is the three or four-digit number on the front or back of a credit card. For Visa, Mastercard, and Discover, the CVV is on the back of the card by the signature line. For American Express cards, the CVV is located on the front of the card, above the last digits of the card number.

Card verification values are used in card-not-present transactions to verify that the customer actually has the card in their possession.

By requesting the CVV in an online or phone order placed on a virtual terminal, it adds an extra layer of security to the checkout process.

Customers disputing a transaction that required a CVV will have a difficult time claiming they didn’t make the purchase unless the card was lost or stolen.

BIN Blocking

Some credit card processors maintain a database of account numbers that are frequently associated with friendly fraud. BIN stands for a bank identification number. As the name implies, BIN blocking uses that number to block transactions associated with accounts on this database.

Alternatively, you can set up a similar system on your own by simply blacklisting customers who frequently file chargebacks.

While we’d like to assume that the majority of friendly fraud cases are actually “friendly,” that’s not always the case. There will always be some bad apples out there looking to take advantage of the system.

For example, some consumers will file chargebacks simply because they know that their credit card company will get their money back. If the same customer has filed a chargeback against your business at least two or three times, you could add them to a blacklist if those chargebacks were filed under false pretenses.

This can be a risky move. You’re essentially telling that customer that they are “banned,” and you no longer want their business. That’s never an easy thing to do, but it might be a necessary measure to fight against friendly fraud.

Product Shipping Requirements

Always use an address verification system (AVS) for online transactions. This system will verify the billing address of the credit card, which adds an extra layer of protection to the transaction.

The shipping and address and billing address should match as well. However, there are certain situations where this won’t be the case. If the billing address and shipping address are unmatched, you should have a fraud scoring method in place to determine if the transaction should be canceled.

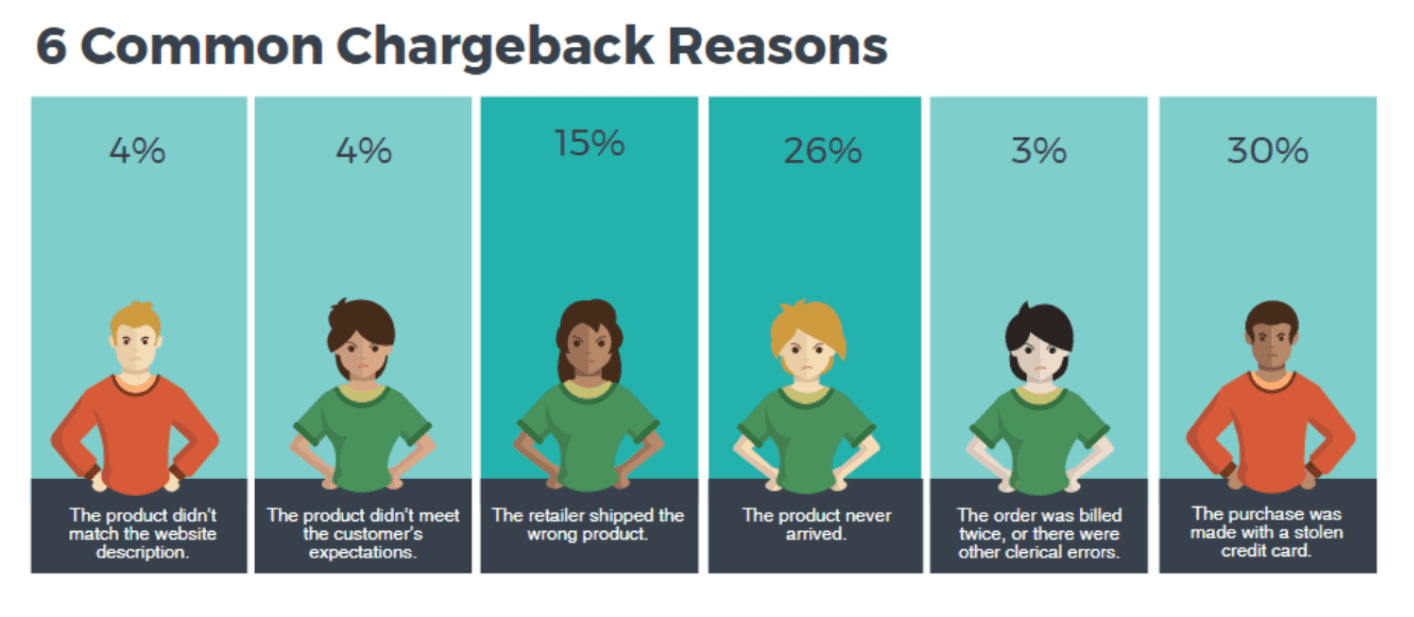

Customers claiming that a product never arrived is the one of the most common reasons for filing a chargeback.

To fight friendly fraud, consider using a delivery service that will require the customer to sign for the package upon delivery.

If an order is shipped to the billing address associated with the credit card and you have the cardholder’s signature on a delivery receipt at that address, it will be very difficult for that customer to dispute the transaction, claiming that the order was unauthorized or never received.

Descriptors

The billing descriptor is what your company appears as on the cardholder’s credit card statement for a transaction.

Some consumers dispute charges for names that they don’t recognize, not realizing that they actually made the purchase—they just don’t recognize the descriptor.

For example, let’s say your company’s name John’s Electronics Store. If the descriptor appears on the cardholder’s statement as something like JES Holdings California, they could dispute it, claiming that the charge was unauthorized.

To prevent this from happening, make sure that the descriptor matches your business name.

Customer Service

Sometimes your customer service could be the cause of friendly fraud at your business.

If you have a strict return policy, charge customers for returns, or make the process complicated, some people will just dispute the charge with their credit card company because it’s more convenient. This is especially true for online orders.

By having a customer-friendly return policy and easy access to helpful customer service, you can fight against friendly fraud from occurring in the first place.

Conclusion

More and more companies are falling victim to friendly fraud. This has become a regular occurrence for large eCommerce stores.

Fortunately, there are ways you can fight against it. As the CFO, you can take steps not only to fight chargebacks after they occur, but you can prevent transactions that would ultimately lead to friendly fraud.