Operating a business with field service workers is no easy task. Between scheduling appointments, assigning the right technician to the right job, and taking care of your vehicles, there are countless responsibilities to keep track of.

But at the end of the day, your business needs to get paid for the services rendered. Whether you’re in maintenance, sales, IT, delivery, construction, HVAC, electrical, or another skilled labor industry, this statement holds true across the board.

I’m sure you’re no stranger to the idea of invoices going unpaid for weeks or months on end. Trying to collect those payments is a job in itself, and it takes time that you might not have.

Plus, that lack of cash flow can crush your margins. You still need to pay your employees, fill the gas tanks, and keep your lights on.

Fortunately for you, I’ve put together this guide that will help you collect on-time payments in your field service industry. Apply the tips and best practices outlined below, and your problems will be solved.

Collect Payments From the Right Person

The person on-site that your field service workers are interacting with is not necessarily the person who pays the bills. So it’s important to gather the right billing details ahead of time, so your staff knows who to ask for when it’s time to collect the payment.

This simple question can easily be added to your work order intake process. Whether a new job comes in online, over the phone, or through a referral, there are different questions that you need to ask. The client’s name, job address, phone number, job scope, and contact person are all boilerplate questions. Simply add a line to those intake forms about billing.

Without this information, your field service staff will likely just be leaving a paper invoice with whoever is helping them at the job site. Then you need to hope that this gets into the right hands, and then really hope that person ultimately sends a prompt payment. That’s a lot of hoping and not much certainty for payment collection.

But if you know who is responsible for issuing payments ahead of time, your field service staff could potentially even collect payment on-site once the job has been completed.

Use Mobile Payment Solutions

I don’t want to generalize, but lots of field service businesses are stuck using outdated payment collection methods. Don’t get me wrong; some organizations have adopted new technology, but the rest seem to be lagging behind.

The problem with paper invoices and mailed checks is that there are just too many steps in the invoicing process. First, you need to generate a paper invoice. Then you need to print it, address an envelope, lick the envelope, slap on a stamp, and put it in the mailbox. This in itself is an inefficient process, and we’re not even halfway done yet. Next, you need to rely on the recipient opening that letter, pulling out a checkbook, and mailing a check back before it’s processed back on your end by the receivables department. There are literally a dozen steps with this method and too many chances for things to go wrong.

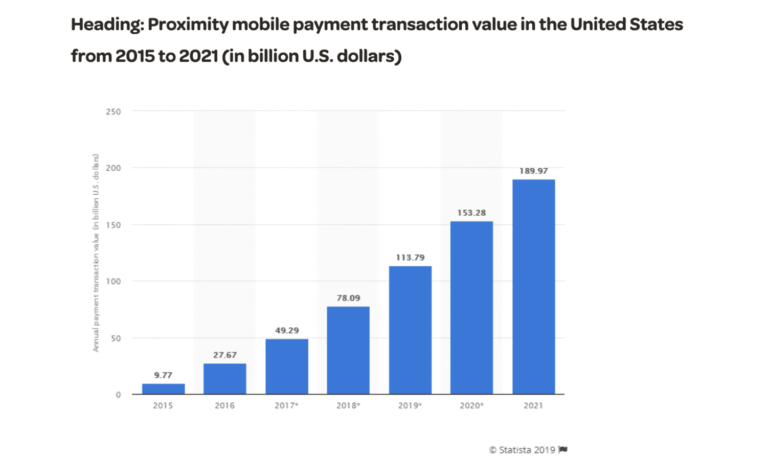

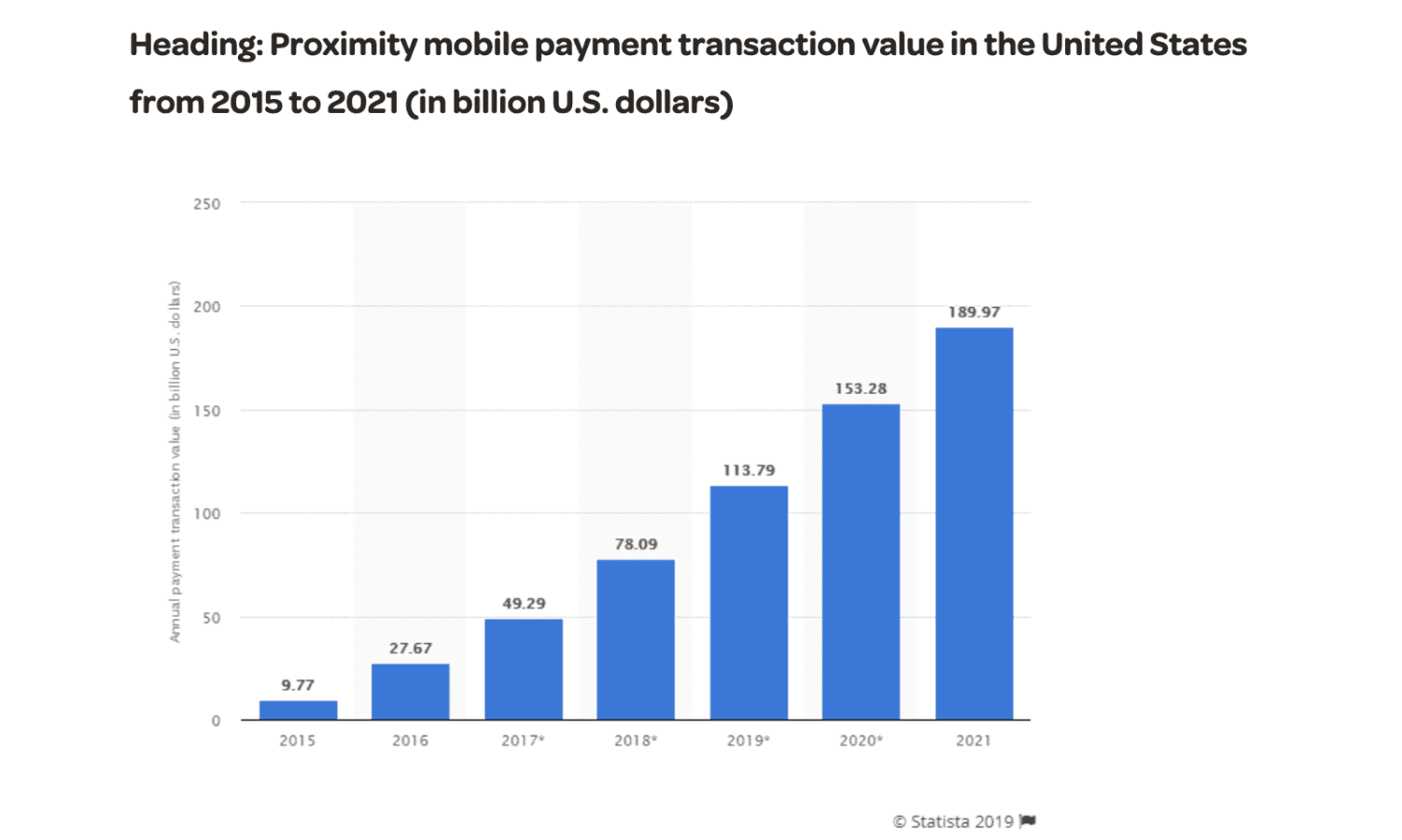

Mobile payment solutions are faster, easier, and more convenient for everyone involved. Take a look at this graph showing how mobile payment transactions are trending upward in the US.

Tablets and smartphones can easily be converted into a mobile card reader. Alternatively, there are dozens of different mobile POS solutions available on the market today.

When a field service technician finishes the job, the client can pay on-site using a credit or debit card. Then a digital receipt with the invoice confirming their payment can be emailed back to them immediately.

No more paper, and your average collection period drops dramatically.

Communicate and Make Yourself Available

Some clients might be hesitant to pay an invoice because they’re afraid you’ll be unreachable if something goes wrong in a week or two. Depending on the scope of the job, they might not be able to assess your work immediately after completion. And what happens if the client discovers a mistake or something that needs to be addressed next month? Where will you be?

It’s important to build trust with your clients and make sure they understand that you’re a reputable business. Establish a clear line of communication with them before, during, and after the services are rendered.

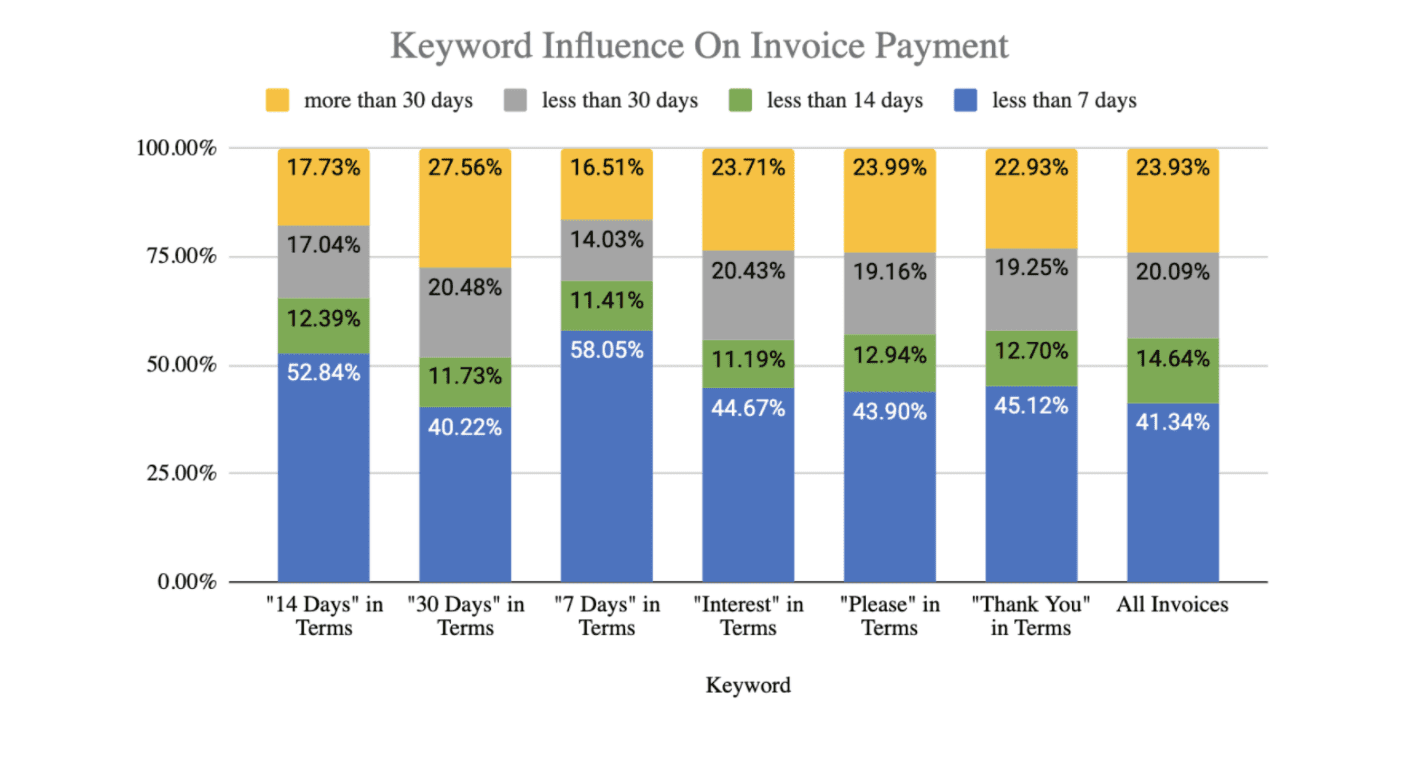

This will make them feel more comfortable about reaching you down the road, and they won’t withhold payment as collateral.Don’t be afraid to ask for prompt payments during this communication as well. As long as it’s done so professionally, people will understand. Take a look at this data from Freshbooks. It shows how certain keywords on an invoice impact how quickly those invoices get paid.

Simplify the Invoice

If someone can’t understand what your invoice says, there’s a good chance they won’t issue payment without asking some questions. This is a mistake that I see all too often in industries with field service workers.

Lots of businesses want to be transparent with their clients. So they add lots of intricate details on the invoice to clearly explain where the charges are coming from. While this makes sense in theory, it can ultimately backfire.

I’ve seen some invoices that are so confusing that it’s hard to even find the balance due. Those complicated bills end up getting shoved into a drawer or pushed to the bottom of a pile.

You can still keep accurate records and be prepared to share them with any client who asks for further explanation. But you don’t need to include a line item for every nail, screw, and gallon of gas used to complete the job.

Final Thoughts

At the end of the day, collecting credit card payments on-site will be the fastest way to get paid for your field service work.

For those of you who are currently set up to process credit cards, you can ask your processor directly for a solution. With that said, make sure your processor isn’t ripping you off and charging outrageous processing fees.

Contact our team here at MCC for a free consultation. We’ll evaluate your credit card processing fees and negotiate rates on your behalf. This will help you keep costs low while you’re getting paid on-time.