Chargebacks occur when a customer disputes a credit card charge directly with the card network or issuing bank.

In many cases, cardholders file disputes because they have fallen victim to fraud. But it’s also common for consumers to file chargebacks for legitimate purchases.

This is concerning and frustrating for merchants, especially for chargebacks that fall into that second category. We created this guide to help you fight chargebacks and prevent them from happening in the first place.

What Causes Chargebacks?

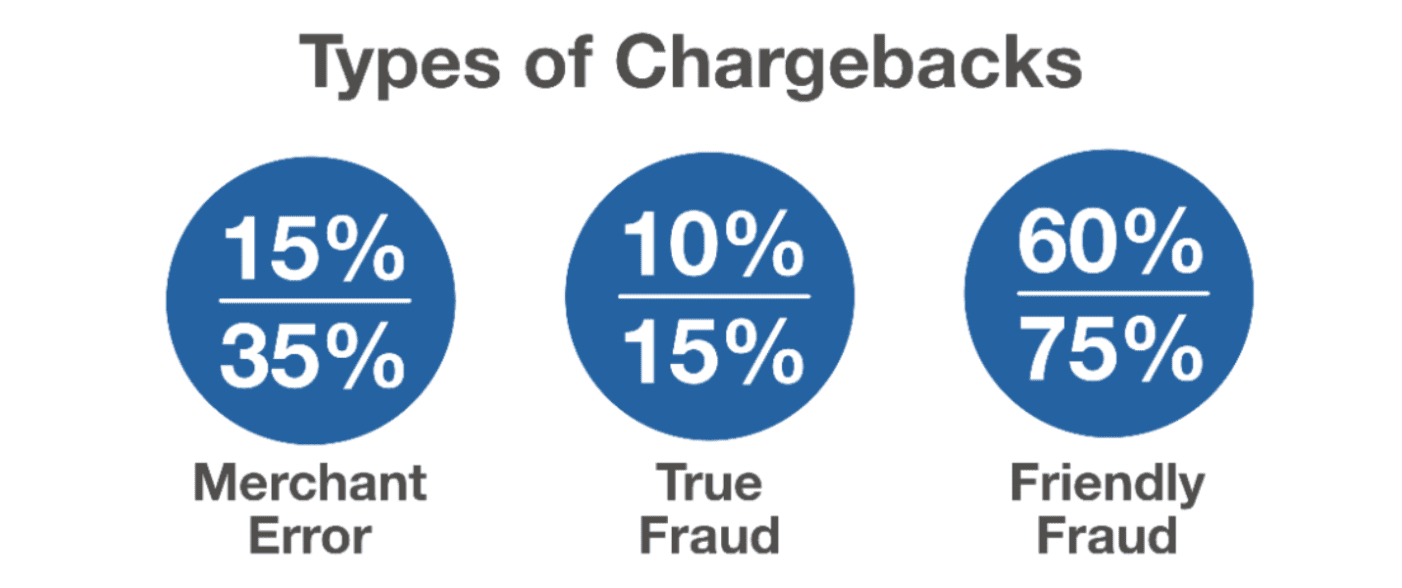

Why do chargebacks happen? There are dozens of potential reasons why a cardholder would file a chargeback. But for the most part, these can fall into three main categories:

- Fraud — Purchase made with a stolen card or card information.

- Friendly fraud — Cardholder receives product or service but still disputes the charge.

- Merchant error — Merchant double-charged cardholder, entered wrong info, etc.

Friendly fraud is the most concerning aspect of a chargeback. A recent study suggests that 86% of all chargebacks are likely cases of friendly fraud. Friendly fraud is increasing by 41% every two years.

What are some examples of friendly fraud?

Cardholders might file chargebacks if they forget about the purchase, they’re unhappy with the product, they don’t recognize the merchant’s name on the statement, or the item can’t be returned.

Why Are Chargebacks Bad For Business?

For starters, chargebacks are expensive. By the end of 2020, it’s estimated that friendly fraud will cost merchants over $25 billion.

Not only is the merchant losing out on the money earned from the sale, but they’re also losing the COGS, and will incur chargeback fees from the issuing bank. Chargeback fees typically cost $20 to $100 per occurrence.

In addition to the extra costs associated with chargebacks, a high chargeback rate could put you into a high-risk merchant category. Your processing company could drop your account, which would revoke your ability to accept credit cards. Even if your account isn’t terminated, chargebacks could lead to higher processing rates and withheld funds.

How to Fight Chargebacks

Studies show that 80% of merchants are disputing illegitimate chargebacks. Unfortunately, this has been a losing battle.

Just 18% of those fighting back say they win the majority of disputes. The win rate does jump to 60% for friendly fraud, which is encouraging.

So how can you win a chargeback dispute? Follow the tips I’ve identified below.

Respond Quickly

When it comes to fighting chargebacks, time is of the essence. Acting quickly will increase your chances of winning.

The credit card company will provide you with deadlines for a response within the notice. Make sure that you mark those deadlines on your calendar and set alerts or reminders. If you don’t act within the required time frame, you won’t have any recourse.

Responding early also reduces the risk of bottlenecks in the process.

Contact the Customer

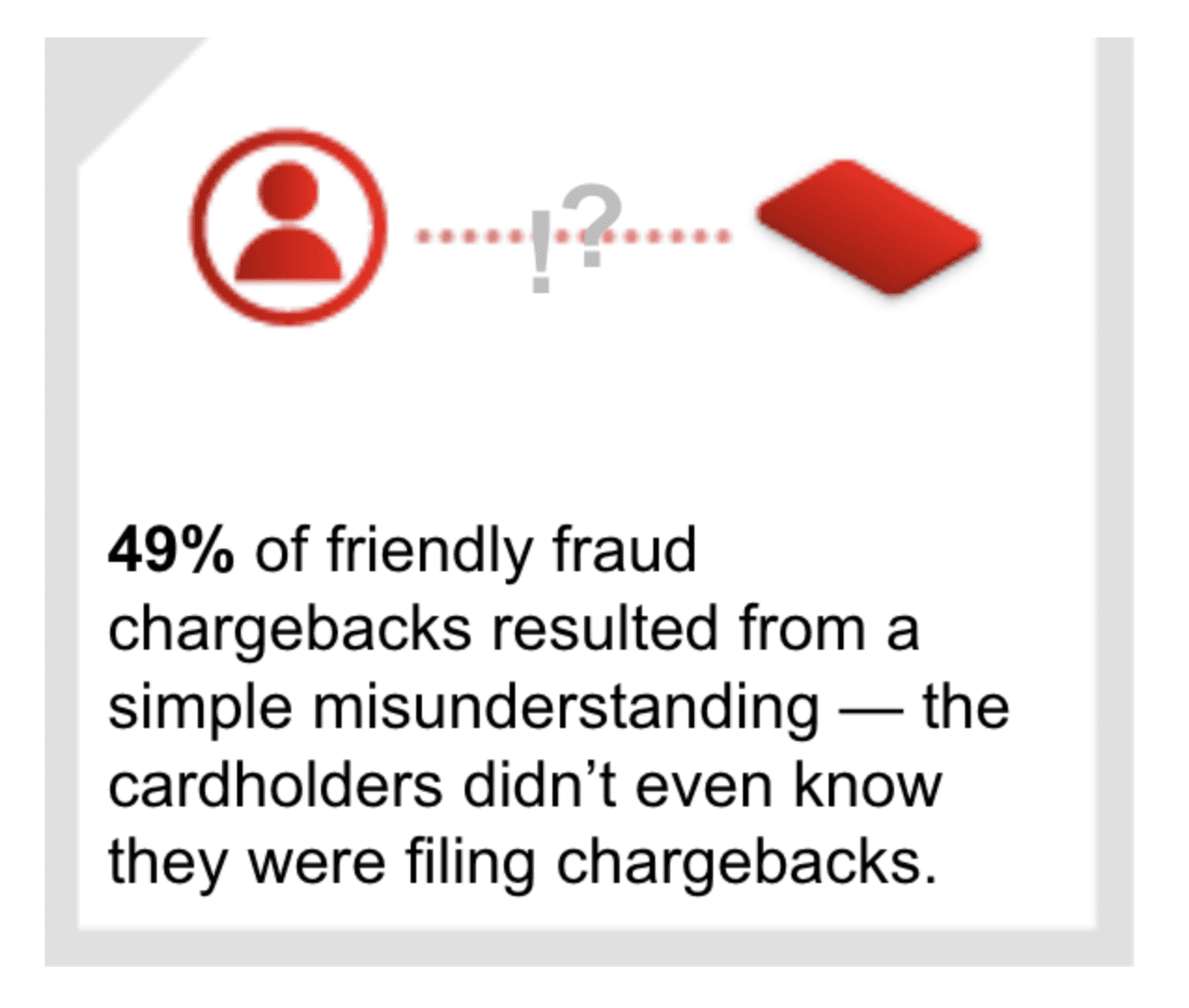

Reach out to the customer directly to see why the charge was disputed. In many cases, there could just be a miscommunication. Roughly half of all friendly fraud chargebacks were the result of cardholders not realizing they were even filing a chargeback.

If you can resolve this issue with the customer, by replacing the product, issuing a refund, or some alternative, it’s much better than having a chargeback on your record.

Document Everything

Make sure you clearly document your communication with the customer. Locate all of the other information associated with the case as well.

Do you have proof that the customer actually received the product? Go back and find screenshots of email communication with shipping updates, tracking information, and delivery confirmation.

If the transaction was made in-person, see if you can locate a signed receipt. For those of you having trouble tracking down documentation, you can ask your processor. It’s always better to have more documentation, as opposed to less, when fighting a chargeback.

How to Prevent Chargebacks

Since fighting chargebacks is usually a losing battle, it’s in your best interest to prevent them from occurring in the first place. Here’s what you need to do.

Review Chargeback History

Look at previous chargebacks that have been filed. Do you see a common pattern? If the vast majority of chargebacks fall into one particular category, then you should take steps to tighten up in that area.

For example, are customers filing chargebacks because it’s easier than a return? Update your return policy and make it more customer-friendly.

Upgrade Your Technology

All payment processing technology is not created equally. Some hardware and software will not only help you prevent fraud, but it will also reduce your liability.

For example, if you’re not using EMV compliant technology, basically any transaction could be disputed by a customer. You wouldn’t win any of those disputes.

Update Merchant Account

As we briefly mentioned earlier, one of the common reasons why cardholders file chargebacks is because they don’t recognize the name on their credit card statement.

If you have a restaurant called John’s Crab Shack and the charge appears as “JCS Holdings LLC” on the statement, it could be confusing your customers.

The exact name of your business, website, and phone number should be available. Contact your processor to make sure your descriptors are accurate.

Verify the Identity of Cardholders

For in-person sales, verify the cardholder’s identity by asking for a photo ID. While you won’t have this luxury online, you can still reduce your chances of fraud with an AVS (address verification service).

These extra steps will help reduce the risk of fraud, in case the shopper is using a stolen credit card or stolen credit card information.

Train Your Staff

Your point of sale staff can help prevent chargebacks by reducing the risk of fraudulent charges. Make sure everyone has been properly trained on fraud prevention tactics.

It’s important that everyone knows how to properly work the payment processing technology that you’re using. Even something as simple as conveying your friendly return policy during the sales process could prevent a customer from filing a chargeback.

Final Thoughts

If you’re getting chargebacks, there are certain steps you can take to fight against them. But unfortunately, the chargeback process heavily favors the cardholder. That’s why it’s so important for you to prevent chargebacks from occurring in the first place.

You can use the tips and best practices that I’ve outlined in this guide to do both.