Overview:

There are numerous deceptive sales and reporting tactics credit card processing companies purposely misplace, hide, or perceive in a different way to confuse a merchant. It can be frustrating for a business, especially when you have trust in a bank or processor, to handle transactions such as accepting credit cards and you cannot figure out your credit card processing fees. Why isn’t reporting transparent? Why is it that some credit card processing companies and banks feel the need to use deceptive tactics like this? We will never know the answer. Below, you will find some examples on what to look out for, and how to accurately calculate the credit card processing fees you are charged each month.

Example:

When doing a self audit, you need to understand the “total credit card processing fees” that are debited from your bank account every month. As mentioned above, some merchant service statements say “Fees” but they are not the correct ones, and this is where you need to be careful.

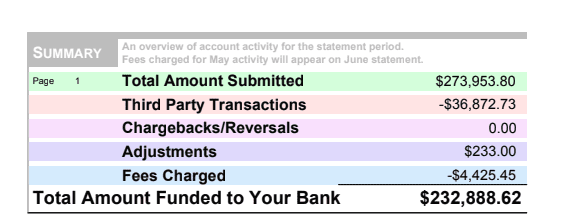

Here is an example: Bank of America is notoriously known for having this miscue in their reporting. The first screen shot below, is the very first thing you see when opening up your Bank of American merchant statements:

Fees Charged are not the actual fees you are charged that given month of the report. They are for the previous months Total Amount Submitted or Total Sales to make things simple.

To find the accurate amount of fees that are debited out of your account, using Bank of America Merchant Services, you need to scroll to the page where it shows Pending Financial Charges and Fees. Here is where you will see Grand Total, which is the correct amount of fees in which your business was charged for that given month of the report.

Why is this an issue?

This causes a problem for a couple reasons. The first, a merchant, from the initial image, would think they are paying 1.86% (Fees Charged/Total Amount Submitted), which is not the case. The true effective rate (Total Fees/Total Sales) in the example above is the Grand Total/Total Amount submitted. It is deceptive, making the merchant believe they are paying less than they actually are. This can have the opposite effect as well, where it makes the merchant believe their credit card processing fees are more than they are.

The second headache this causes for merchants is from a bookkeeping standpoint. If your controller, finance manager, or office admin do not understand how to read the reporting of these statements, they may be miscalculating their reports to upper management. Merchant Cost Consulting has seen this time and time and again with bookkeepers miscalculating the financials of a business because of the misguided merchant statement reporting.

The last reason why this is an issue is because why do processing companies need to make it a point to make the reporting confusing? Just put the total fees next to the total sales and make things easy for your customers. It’s common sense, and as the merchant service provider, you take away one less headache for your clients.

In closing to all this, it would be foolish to believe all reporting is like this. However, it is out there, and it is just one of hundreds of tactics used within merchant services to make things confusing. If you have seen other statements where there are similar deceptive reporting, we would be happy to take a look and review your statements for free!