As always, our team here at MCC aims to keep our readers informed about the latest news in the payments space—particularly when it comes to fee changes and interchange rate increases.

We just caught wind of a new rate increase from Lightspeed. Read on for the details.

New Lightspeed Monthly Fee For Third-Party Processing

Lightspeed will begin charging merchants $400 per month for using a non-Lightspeed payment solution.

Merchants can switch to Lightspeed Payments within 30 days of receiving this notice to avoid the $400 fee. But this requires a completely new application for a merchant account (which is not something we recommend).

To sweeten the deal and encourage merchants to switch, Lightspeed is offering contract buyouts to cover early termination fees (with exceptions), free replacement hardware, and on-site tech support during the transition.

We rarely recommend switching merchant services providers. It’s almost always cheaper to negotiate costs with your current provider than switching. So just because you received this notice, it doesn’t mean you need to make a rash decision and switch. You can contact our team here at MCC if you need any guidance.

New Lightspeed Rate Increase

Effective August 30, 2024, Lightspeed increased its payment processing rates to the following:

- 2.4% + $0.10 per transaction for card present transactions

- 2.9% + $0.30 per transaction for card not present (CNP) transactions

According to Lightspeed, the increase is to “maintain the quality of their services” and “keep up with rising costs.”

The notice also referenced the fact that Lightspeed has made continuous improvements over the past that bring even more value to merchants. But it sounds like they’re just looking for ways to justify the rate hike.

About Lightspeed

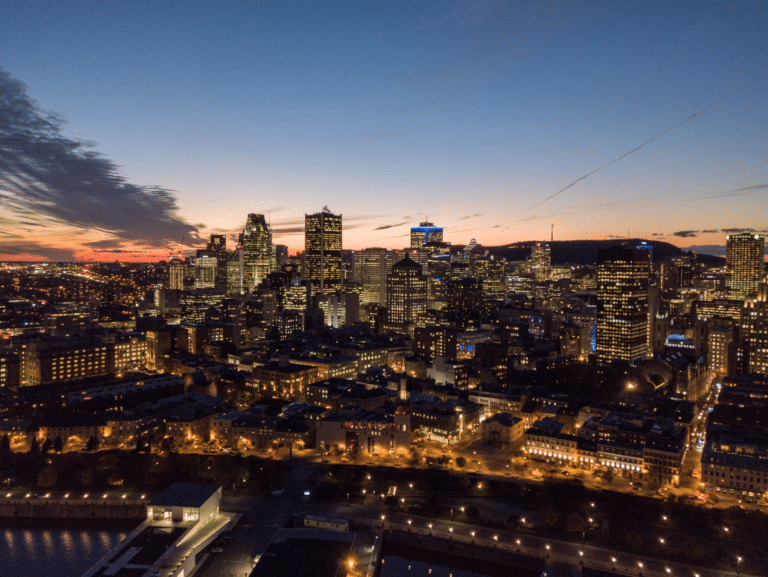

Lightspeed is a Canadian payment processor and POS provider. Founded in 2005 with a primary focus on brick-and-mortar retail and ecommerce, the company expanded into the restaurant space in 2014.

More than 165,000 locations in 100+ countries rely on Lightspeed for payment processing—and they process over $90.7 billion in transaction volume per year.

Lightspeed operates on a subscription-based model—providing software and hardware in addition to backend processing.

In addition to working with retailers and restaurants, Lightspeed recently started providing software in the golf space. This includes a digital tee sheet, accounting, and more.

Beyond payment processing also provides solutions for inventory management, marketing, kitchen display systems, and other related services.