Credit card processing statements often have dozens of miscellaneous charges and fees—making it hard to tell which ones are legitimate and which ones aren’t.

Processors don’t typically give you a key or explanation of what these fees mean, either. That’s why so many merchants are left scratching their heads after going through each line item on their statement.

If you have an Acquirer License Fee on your statement and don’t know what it means, you’ve come to the right place. I’ll explain everything you need to know about this charge, including what it’s for, how much it costs, and if it’s legitimate.

What is the Acquirer License Fee?

The Acquirer License Fee is a Mastercard assessment fee that gets passed from the card network (Mastercard) to the merchant via their payment processor.

This assessment fee applies to all Mastercard transactions in a billing cycle. But the rate itself varies for each acquiring bank.

Unlike other assessment fees, this Acquirer License Fee is actually determined based on how much volume your acquirer does with Mastercard—and not based on how much your business processes with Mastercard.

Each processor may have a slightly different way of listing this assessment on your statement. Examples include:

- Mastercard Acquirer License Fee

- MC Acquirers License Fee 1

- MC ALF

- Mastercard ALF

- Mastercard License Volume Fee

- MC License Volume Fee

Basically, any combination or abbreviation of “Mastercard” and “acquirer license” and/or “volume” as a line item on your statement is likely the Acquirer License Fee.

How Much is the Mastercard Acquirer License Fee?

Mastercard doesn’t publicly publish the rates for its Acquirer License Fee—and the exact rate varies based on the specific acquiring bank that’s being used to process transactions for a merchant.

But most of the time, the MC Acquirer License Fee ranges from 0.005% to 0.02% on the merchant’s total Mastercard volume.

Let’s look at some real examples of this fee charged to different merchants so you can see what it looks like on a statement and how the rate varies.

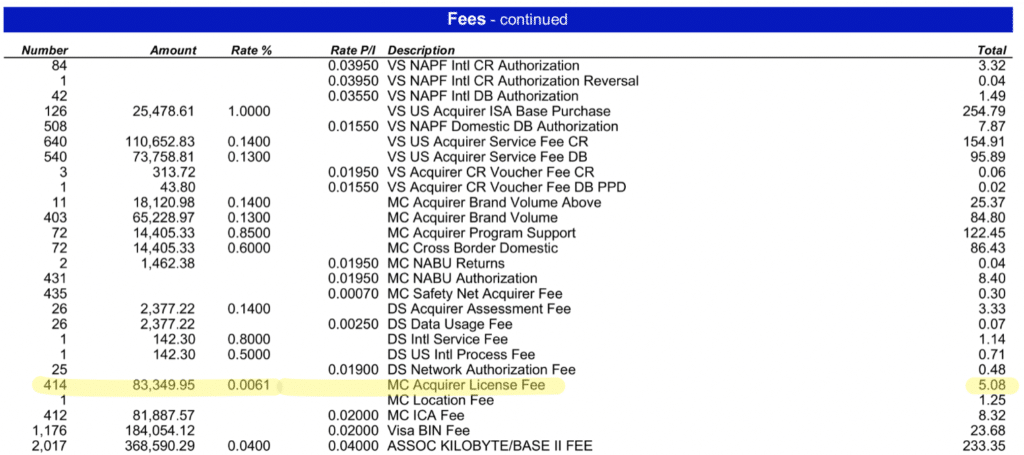

TSYS and Cayan Acquirer License Fee — 0.0061%

Here’s an example of the MC Acquirer License Fee taken directly from a TSYS statement. This will look identical if you’re using Cayan (since TSYS owns Cayan).

In this case, the fee is 0.0061% of total Mastercard volume, which is a marginal amount.

As you can see, it comes to just over $5 on over $83,000 in Mastercard sales.

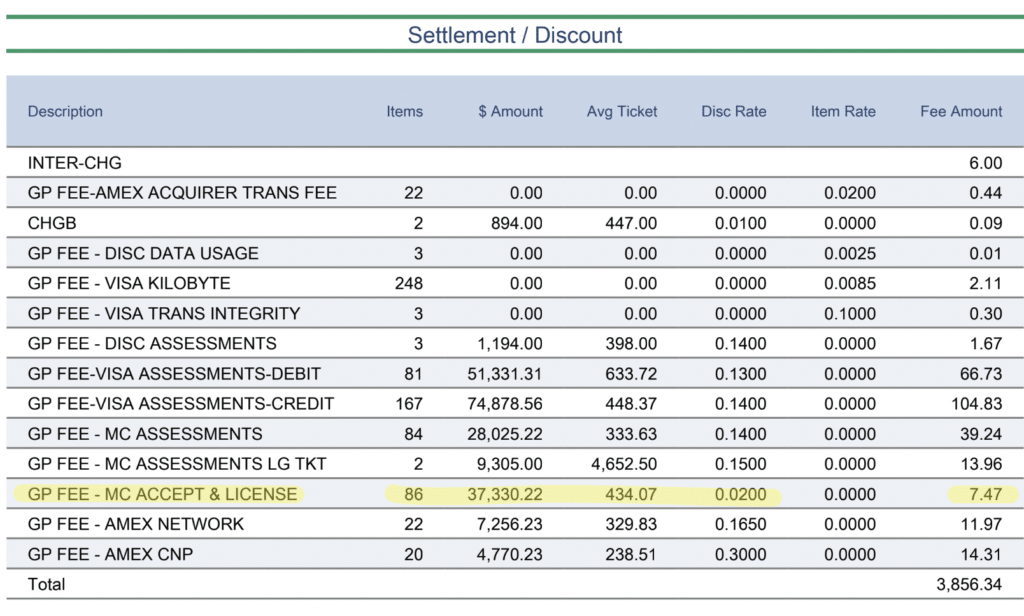

Global Payments Acquirer License Fee — 0.20%

Global Payments is charging 0.02% for the same fee, which is significantly higher (although the dollar amount is still marginal).

The problem here is that you can’t always take Global’s charges at face value. In fact, we’ve caught Global padding assessment fees on multiple occasions (read our Global Payments review for more information on this).

This means that they upcharge an assessment from the card network, making it appear as though the fee is coming directly from Mastercard. But in reality, the fee is higher, and they’re profiting from the difference.

For the example highlighted above, we can also see that this fee is itemized as MC Accept & License. This could mean that they’re bundling the MC ALF with another charge or potentially trying to mask it so nobody questions the rate. But it could also just be that Mastercard charges Global a higher rate for this assessment.

If you’re using Global Payments and your rate is higher than this, please let us know. The MC Acquirer License Fee should be the same for all merchants using the same acquiring bank.

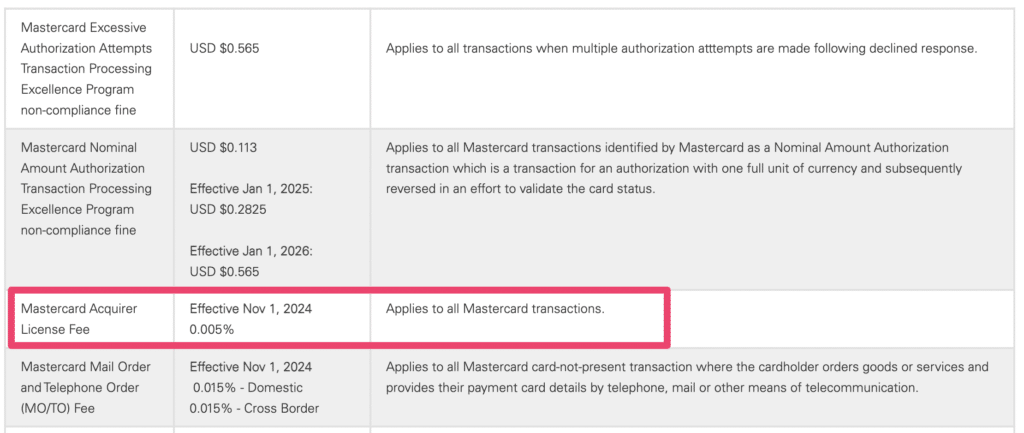

Fiserv Acquirer License Fee — 0.005%

Fiserv is generally transparent with its fees, which is one of the positives we highlighted in our Fiserv review.

I took this screenshot above directly from Fiserv’s website, where they published a list of assessments and pass-through fees.

Effective November 1, 2024, Fiserv is passing through the Mastercard Acquirer License Fee at a rate of 0.005% of total Mastercard transaction volume.

Is the Mastercard Acquirer License Fee Legit?

Yes, the Acquirer License Fee is a legitimate assessment fee that’s imposed by the card network and passed through your acquiring bank to your merchant statement. The fee is marginal and probably won’t cost you more than $5-$10 per month total—even if you’re processing tens of thousands of dollars worth of Mastercard transactions.

Can the Acquirer License Fee Be Reduced or Removed?

No—like all assessment fees, the MC Acquirer License Fee is non-negotiable. That said, you should make sure your processor isn’t overcharging you or marking up your assessments. This is an unethical practice that should be addressed. If you think your processor is overcharging you, contact our team here at MCC for an audit.