MCC codes are somewhat of a mystery to some business owners. Even though everyone who processes credit cards has one, it seems like most people don’t understand the significance of MCC codes for payment processing.

For those of you who feel overwhelmed or confused about merchant category codes, you’ve come to the right place.

I’ll explain what MCC codes mean for your business and credit card processing fees. This guide even covers specific MCC codes, explains how MCC codes are determined, and tells you how to find your MCC code.

What Are MCC Codes?

A merchant category code (MCC code) is a four-digit number that identifies the primary purpose of your business. MCC codes indicate the types of products or services that you offer to consumers.

These codes were originally developed for tax reporting and accounting purposes. But today, MCC codes play a crucial role in payment processing. Credit card processors, acquiring banks, payment service providers, and credit card networks all use MCC codes for things like setting fees and risk assessment.

How Are MCC Codes Determined?

MCC codes are determined based on your business type and the products or services provided. The International Organization for Standardization (ISO) sets the codes and comes up with the meanings. But credit card processing companies assign MCC codes to merchants during the application process.

For the vast majority of you reading this, you can’t request a certain merchant category code or change your MCC. That’s just not how it works.

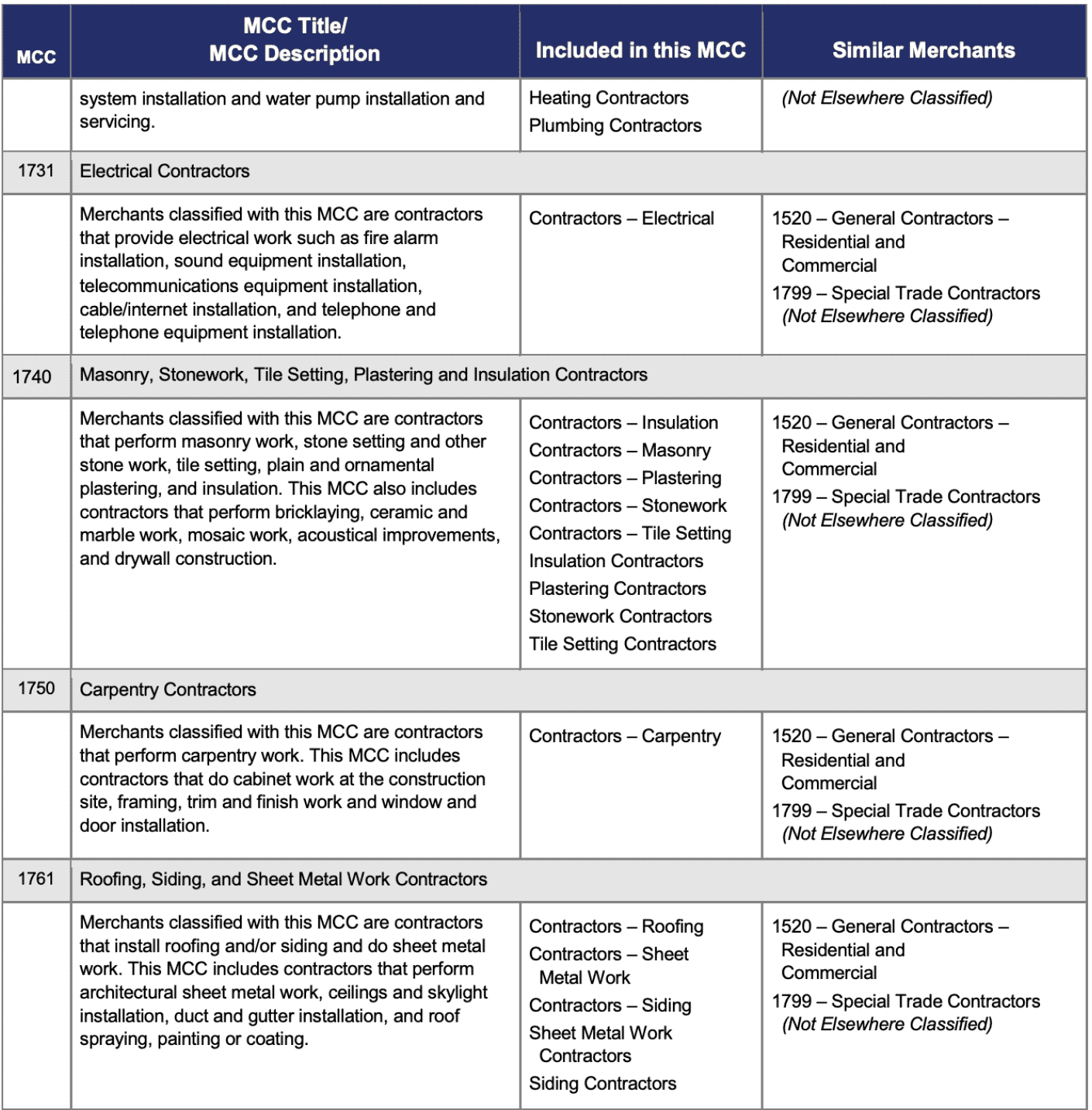

For example, contractors are assigned different MCC codes based on the type of jobs they complete. Here’s an excerpt from the Visa Merchant Data Standards Manual:

As you can see, “contractors” aren’t just grouped together. Electrical, masonry, carpentry, and roofing are all segmented into different categories.

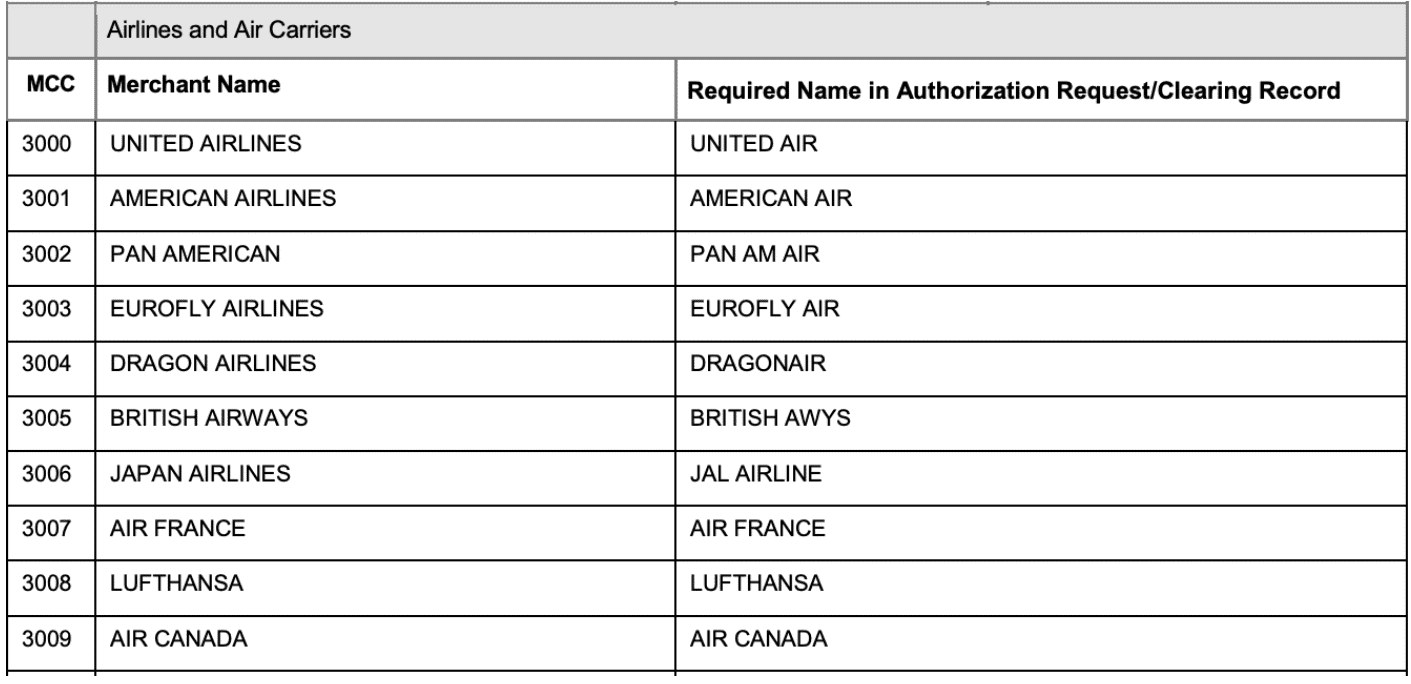

Some larger businesses (like Airlines) have their own merchant category code.

Here’s another example of some popular airlines from the same Visa resource.

Any business has the right to apply for a new MCC code. The process goes through a technical committee formed by ISO, called TC68.

Your company must have at least $10 million in annual revenue to be considered. However, this isn’t really made for small businesses or even local chains. It’s used for global giants like Hilton Hotels and Delta Airlines.

Full (MCC) Merchant Category Code List

Use this list as your merchant category code lookup resource.

Agricultural Services – MCC Codes 0001-1499

- 0742 – Veterinary Services

- 0763 – Agricultural Cooperatives

- 0780 – Horticultural and Landscaping Services

Contracted Services – MCC Codes 1500-2999

- 1520 – General Contractors (Residential and Commercial)

- 1711 – Air Conditioning, Heating, and Plumbing Contractors

- 1731 – Electrical Contractors

- 1740 – Insulation, Masonry, Plastering, Stonework, and Tile Setting

- 1750 – Carpentry

- 1761 – Roofing, Siding, and Sheet Metal

- 1771 – Concrete Work

- 1799 – Special Trade Contractors (Not Classified Elsewhere)

- 2741 – Misc Publishing and Printing

- 2791 – Typesetting and Plate Making

- 2842 – Sanitation, Polishing, and Specialty Cleaning

Transportation Services – MCC Codes 4000-4799

- 4011 – Railroads (Freight)

- 4111 – Suburban and Local Commuter (including ferries)

- 4112 – Passenger Railways

- 4119 – Ambulance

- 4121 – Taxi and Limo

- 4214 – Motor Freight Carries, Trucking, Moving and Storage, Local Delivery

- 4215 – Courier Services Air, Ground, and Freight Forwarders

- 4255 – Public Warehousing (Farm, Refrigerated Goods, Household Storage)

- 4411 – Cruises

- 4457 – Boat Leases and Rentals

- 4468 – Marinas and Marine Services

- 4511 – Air Carriers and Airlines (not classified elsewhere)

- 4582 – Airports, Air Terminals, and Flying Fields

- 4722 – Travel Agencies and Tour Operators

- 4782 – Bridge and Road Fees/Tolls

- 4789 – Transportation Services Not Classified Elsewhere

Utility Services – MCC Codes 4800-4999

- 4812 – Telecoms Equipment (including telephone sales)

- 4814 – Telecommunication Services including prepaid phone and recurring phone services

- 4816 – Computer Network and Information Services

- 4821 – Telegraph Services

- 4829 – Wire Transfer Money Orders

- 4899 – Cable, Satellite, and Other Television and Radio Services

- 4900 – Electric, Gas, Heating, Oil, Sanitary, and Water Utilities

Government Services – MCC Codes 9000-9999

- 9211 – Court Costs (including Alimony and Child Support)

- 9222 – Fines

- 9223 – Bail and Bond Payments

- 9211 – Tax Payments

- 9399 – Government Services Not Classified Elsewhere

- 9402 – Government Postal Services

- 9405 – Intra-Government Purchases

- 9700 – Automated Referral

- 9950 – Intra-Company Purchases

MCC Codes For Ecommerce

There is no single MCC for ecommerce or MCC for online retailers. Instead, merchant account providers and credit card companies typically use merchant category codes (MCCs) in retail segments to determine these transaction fees.

Common merchant categories to classify businesses in the ecommerce space include:

- Code 5937 – Antique Reproductions

- Code 5932 – Antique Shops, Sales, Repairs, and Restoration

- Code 5971 – Art Dealers and Art Galleries

- Code 5980 – Art Supply and Crafts

- Code 5940 – Bicycle Shops

- Code 5942 – Books

- Code 5946 – Camera and Photography

- Code 5441 – Children’s and Infant’s Clothing

- Code 5734 – Computer Software

- Code 5977 – Cosmetics

- Code 5311 – Department Stores

- Code 5714 – Draperies, Window Coverings, and Upholstery

- Code 5997 – Electric Razors

- Code 5732 – Electronics

- Code 5651 – Family Clothing

- Code 5992 – Florists

- Code 5712 – Furniture and Home Furnishings

- Code 5947 – Gifts, Cards, Novelties, and Souvenirs

- Code 4251 – Hardware Stores

- Code 5945 – Hobbies, Toys, and Games

- Code 5722 – Household Appliances

- Code 5844 – Jewelry, Watches, Clocks, and Silverware

- Code 5948 – Luggage and Leather Goods

- Code 5611 – Men’s and Boy’s Clothing

- Code 5691 – Men’s and Women’s Clothing

- Code 5999 – Misc. and Specialty Retailers

- Code 5699 – Misc. Apparel and Accessories

- Code 5399 – Misc. Merchandise

- Code 5733 – Musical Instruments

- Code 5995 – Pet Supplies and Pet Food

- Code 5661 – Shoes

- Code 5941 – Sporting Goods

- Code 5943 – Stationery and Office Supplies

It’s also worth noting that when a consumer checks their credit card purchases on a statement, they can usually see more information about the merchant once the transaction clears and the posting date is listed. Sometimes this information will contain the name of the listing categories for general or tax purposes. This may not show the four digit code, but the name will be there.

Other MCC Codes

- Retail Outlet Services – MCC Codes 5000-5599

- Clothing Stores – MCC Codes 5600-5699

- Misc Stores – MCC Codes 5700-7299

- Business Services – MCC Codes 7300 – 7999

- Professional Services and Membership Organizations – 8000-8999

How to Find Your Merchant Category Code (MCC)

The best way to find your merchant category code is by contacting your credit card processor directly. Ask them to disclose the MCC code that’s been assigned to your business.

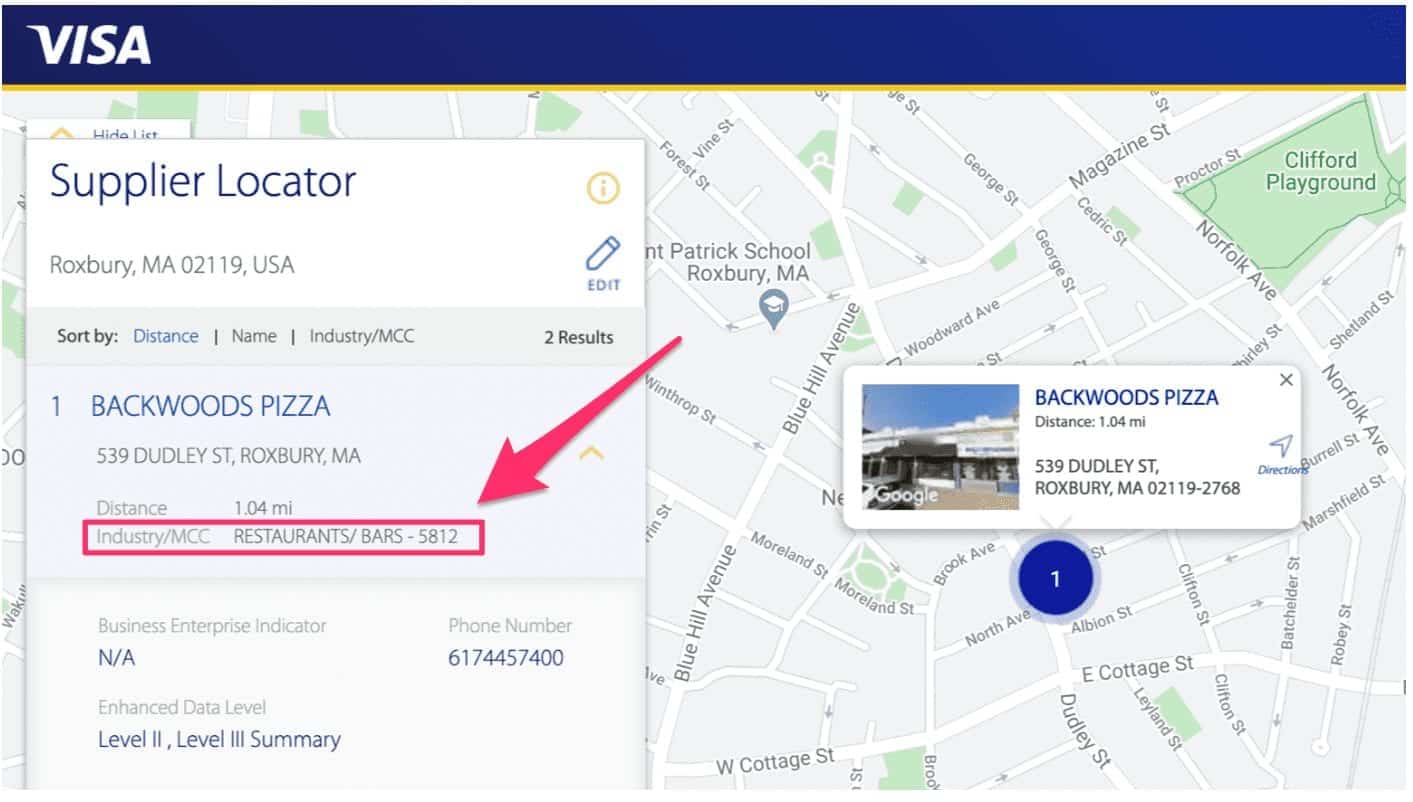

Alternatively, you can use the supplier locator tool from Visa to lookup MCC codes. Search for your own business, or other companies to see their MCC codes. For example, I used this resource to look up the MCC code for the pizza place where I had lunch yesterday.

The MCC code for Backwoods Pizza is 5812. This falls into the eating places and restaurant category. A fast food establishment does not fall into the same category. McDonald’s or Dunkin Donuts would have an MCC code of 5814.

Believe it or not, your merchant category code isn’t always easy to find. In most cases, it won’t be on your merchant statements. Even if you dig through old terms, contracts, and other paperwork, it might not turn up at all.

That’s because MCC codes mainly exist behind the scenes. You can’t change it or do much about it, so there’s no reason for processors to include them on a statement.

There are hundreds of different merchant category codes. All have slight variations, even if they appear to be in the same category. As you can see from this example, even two places serving food can have different codes.

So you shouldn’t make any assumptions. Always verify your code directly with your payment processor.

How MCC Codes Affect Credit Card Processing

Since your MCC code represents your predominant business activities, there are several different ways that it can influence credit card processing, including your rates, underwriting process, and perceived risk level.

Merchant Services Application

This comes into play when you’re applying for a new merchant account. Some credit card processing companies do not accept certain merchant categories.

So your application could be rejected from the beginning. With that said, don’t let that discourage you. There are plenty of processors out there that work with a wide range of merchants, including those in high-risk industries.

Interchange Rates

Credit card brands like Visa and Mastercard use MCC codes to calculate interchange fees and rates. This is the wholesale price paid by merchants for each credit card transaction.

Interchange rates vary slightly by credit card company. Your payment processor will add a markup to these rates as well. But either way, some businesses pay higher or lower interchange rates based on their MCC code.

High Risk Processing

An acquiring bank uses MCC codes to identify certain business types. Some of those business types might fall into a prohibited category. Acquiring banks may have their own proprietary website rules and algorithms to identify prohibited business types with an MMC code.

Some payment processors look at some businesses, like an advertising supported comparison service, and recognize that credit card payments to this merchant pose a higher risk.

Instead of rejecting an application outright (as previously discussed), MCC codes are used to measure and assess risk. If your company falls into a high-risk industry, it will be harder to find a credit card processor. But there are certain merchant services that specialize in high-risk credit card processing.

Chargebacks

Some MCC codes don’t offer the same chargeback protections to customers. For example, gambling and direct marketing transactions wouldn’t have the same protection as an eCommerce business.

Furthermore, if your company has a high risk merchant code, you could be hit with higher fees for each individual chargeback.

Consumer Credit Card Rewards

Depending on the credit card, customers get rewards based on MCC codes. They might earn 2x points or 3% cash back at restaurants.

Let’s say you have a convenience store with an attached restaurant. Consumers with these types of rewards cards would have more incentive to buy if your MCC code put you into the restaurant category.

Final Thoughts on MCC Codes

In most cases, there’s not much you can do about your MCC code.

With that said, it’s important that you understand how these codes affect your business and credit card processing rates.

For startups and organizations that haven’t applied for credit card processing just yet, you might want to consider your company’s primary purpose before you apply. Your response could impact your MCC code.

Have more questions about MCC codes? Want to learn other ways to lower your credit card processing rates? Request a free consultation with us here at Merchant Cost Consulting.