Monthly minimum fees can be confusing for merchants because they may not be applied on every statement.

Unlike other charges imposed by your processor, monthly minimums aren’t fixed fees or a percentage of transaction volume. Instead, they’re a threshold that your processor expects you to meet, and if you don’t, you’ll make up the difference out of pocket.

Whether you’ve just signed a merchant agreement that contains a monthly minimum clause or you’re seeing monthly minimum fees applied to your merchant account, this guide will explain everything you need to know about these fees and how to avoid them.

What is a Monthly Minimum Fee on Merchant Accounts?

A monthly minimum fee is the minimum amount of processing fees a payment provider requires a merchant to generate in a given month. If your total processing costs don’t meet or exceed the threshold, you’ll be billed the difference.

For example:

- Your monthly minimum is $25.

- In a slow month, you only generate $10 in processing fees.

- Your processor will charge you an extra $15 to make up the difference.

It’s important to understand that this is not based on sales volume. It’s based on the fees you pay directly to the processor (not your total processing costs).

How Monthly Minimum Fees Are Calculated

Payment processors calculate monthly minimums by comparing the total fees a business generates against the contractual minimum.

While the exact terms vary by contract, most processors only count their markup on each transaction toward the threshold. Interchange fees, assessments, and other network pass-through fees are typically excluded, which makes it harder for low-volume merchants to meet the threshold.

Let’s say your processor charges you 0.25% (25 basis points) over interchange for each transaction.

If the interchange rate on a $100 transaction is 2.00% + $0.10, it would cost you $2.35 in fees to process this sale (interchange + processor markup). But only $0.25 of this counts toward your monthly minimum.

So if your monthly minimum is $25, you’d need to process enough for your processor markup to reach $25. At $0.25 per $100 transaction, that means you’d have to process $10,000 in credit card sales per month just to meet the threshold and avoid paying extra.

That’s why monthly minimums can be tricky. Merchants often assume their total fees count toward the threshold, when in reality, only a small portion does.

Why Payment Processors Charge Monthly Minimum Fees

Monthly minimums exist for the sole purpose of ensuring your processor generates revenue on your account. That’s it.

They’ll claim that it’s to help them cover overhead, support, maintenance, and other costs that go into maintaining your processing service. But as someone who knows the ins and outs of the processing world, I can tell you for certain that your processor isn’t hurting at all, even if you have a slow month.

A monthly minimum charge guarantees a nice profit for your processor, even if you’re running a seasonal business, occasional transactions, or just have a low-volume month.

Who Pays Monthly Minimum Fees?

Not every merchant account has a monthly minimum. These stipulations are more common with traditional merchant accounts than third-party payment aggregators like Square or PayPal (those flat-rate providers get more than enough to ensure a high profit on every transaction).

You’re more likely to have a monthly minimum if:

- You signed a traditional merchant services agreement.

- Your business has low or inconsistent processing volume.

- You operate seasonally or have long periods of downtime.

Even if you typically process enough to avoid this fee, you can still get hit with monthly minimums during slower months—especially if your agreement doesn’t count all processing fees toward the minimum threshold.

Are Monthly Minimum Fees Legal?

Yes, monthly minimums are legal and, unfortunately, they’re fairly common in the payment processing industry.

That said, processors must clearly disclose the terms of a monthly minimum charge in your contract. So if it’s not in your contract, they can’t charge it (they still might try, but you can fight to get it removed and refunded).

The payment processing industry is unregulated, and believe it or not, monthly minimums aren’t as egregious as some of the other junk fees we find on a regular basis.

Are Monthly Minimum Fees Negotiable?

Absolutely. Monthly minimum fees are 100% negotiable,

Many businesses don’t realize this, but everything other than the interchange fees and assessments charged by the card networks can be negotiated with your processor.

Monthly minimum fees are just another part of your processor’s markup. Your discount rate, PCI fees, monthly service charges, and other miscellaneous costs paid directly to your processor can all be negotiated.

Monthly Minimum Fee (MMF) Example

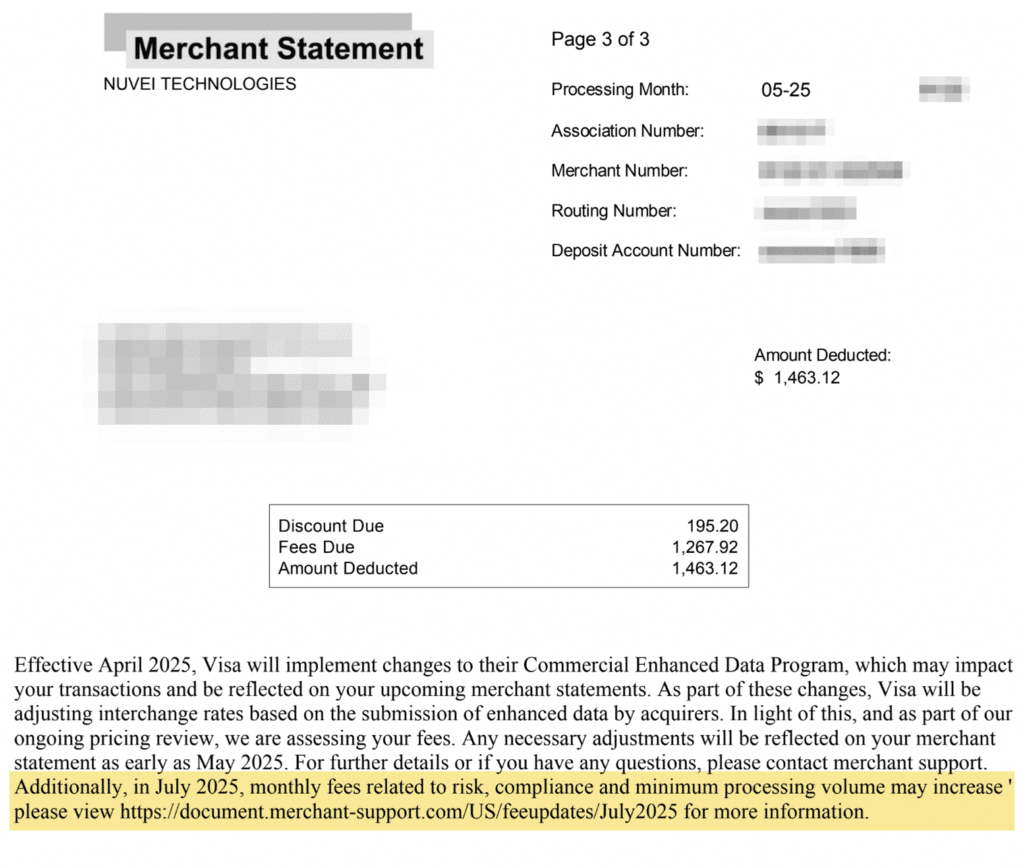

We see all different types of processors impose monthly minimums. Here’s a recent one from Nuvei that was just increased to $35 as of July 2025.

The increase notice was sent at the bottom of a statement, but didn’t actually include the amount. It just directed merchants to a link. Here’s that notice:

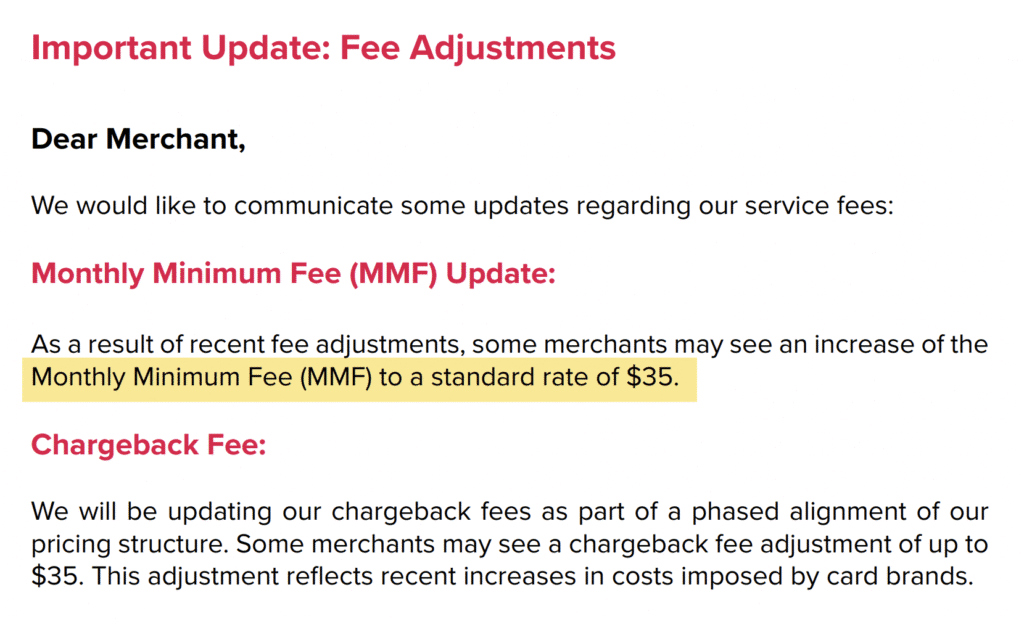

If you view the link, the information about the monthly minimum increase is on the last page of the document.

And as you can see, it’s being raised to $35:

Separately from the $35 minimum itself, this is just another one of those examples where it would be nice if the processor could just announce the increase without forcing you to jump through hoops to find it.

Why not just clearly and conspicuously put out a notice saying, “your monthly minimum is being raised to $35” instead of forcing you to find a link URL in the paragraph of a notice at the bottom of your statement, then find that exact fee on a multi-page update (that was mostly related to card brand fees).

The answer is simple. Processors don’t want to make things easy on you.

How to Avoid Monthly Minimum Fees

If you have a monthly minimum fee in your merchant services agreement, there are several strategies you can take to avoid this fee.

- Negotiate it out of your contract: This is the most effective long-term solution.

- Ask for a seasonal waiver: If you run a seasonal business, see if your processor can pause the minimum during slow months.

- Consolidate processing: Run all card payments through one account instead of splitting transactions between multiple providers.

- Increase processing volume: Incentive card payments during slow months to meet your threshold.

Working with a merchant consultant is also a highly effective way to avoid monthly minimum fees in credit card processing.

At MCC, we can help negotiate a better rate directly with your processor to ensure you’re getting the best possible deal (without bogus fees and minimums).

Final Thoughts

Monthly minimum fees are straight profit for your processor because they’re making money without actually doing anything. At least with a discount fee, you can justify some markup since there’s actually some work involved with processing a transaction.

If you’re stuck on a contract with a processor charging you a monthly minimum, you may not always be able to get it removed. That said, there are other ways you can save money on processing to offset those costs.

For example, other monthly service fees on your account can potentially be removed altogether, and your discount rate could be negotiated so you pay a lower fee per transaction. In this case, the hundreds or thousands of dollars saved every month is a net win, even if you’re still forced to pay a $25 monthly minimum.

Contact our team here at Merchant Cost Consulting for a free audit. We’ll assess your options to find out how much you can save without switching providers.