Monthly merchant processing statements are notoriously difficult to read. And while every processor has their own unique reporting format, it’s fairly common for fees to be categorized in different sections.

One of the fee categories found on most statements is simply titled: Other, Other Detail, or Other Fees.

This is a vague category that needs to be looked at closely because it’s often a favorite spot for processors to insert hidden fees. Let me show you what I mean.

How Processors Categorize Merchant Fees

Merchant statements typically have 3 or 4 categories of charges, separated into their own unique sections on the statements. It’s usually some variation of:

- Processing Fees — Your processor’s markup per transaction.

- Interchange Fees — Set by card networks and paid to issuing banks (should be the bulk of your charges).

- Assessment Fees — Paid directly to card networks. Sometimes included in the interchange section or itemized in the “Other” section.

- Other Fees — If assessments aren’t in their own section, they’re typically listed here alongside miscellaneous processor markups.

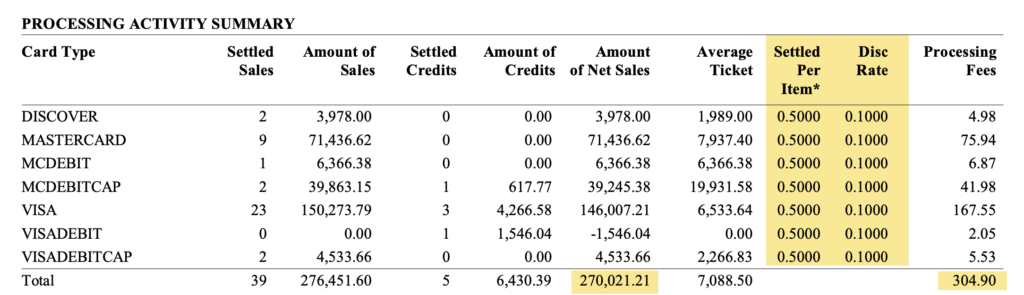

Here’s an example of fees categorized on a statement from one of our clients:

On the surface, this seems transparent.

We see this merchant’s total processing fees organized into three distinct categories:

- Processing Fees: $304.90

- Interchange Fees: $5,793.41

- Other Fees: $2,631.22

- Total: $8,729.53

But when you start to dig a bit deeper, you’ll quickly realize that certain fees are borderline miscategorized. Vague category titles like “Other” make it easier for processors to bury markups and hidden charges.

Why the “Other Fees” Category Can Be Misleading

If you’re just glancing at the statement without reading everything line by line, it’s easy to assume that your processor is only charging you $304.90 for the month.

That’s a small percentage of the $8,729.53 in total fees, and a great deal when you’re processing $270k in total volume:

When we look at the Processing Fees section, we can see this merchant is paying a 0.10% + $0.05 per transaction markup to their processor. And that’s where the $304.90 total comes from.

Very straightforward so far.

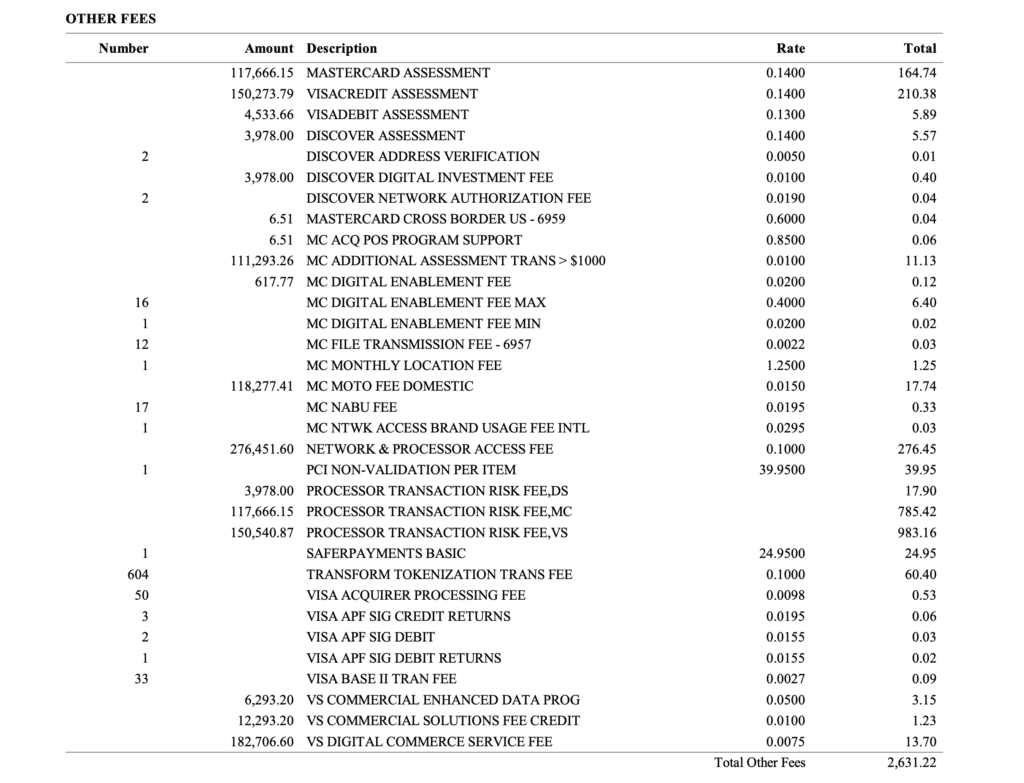

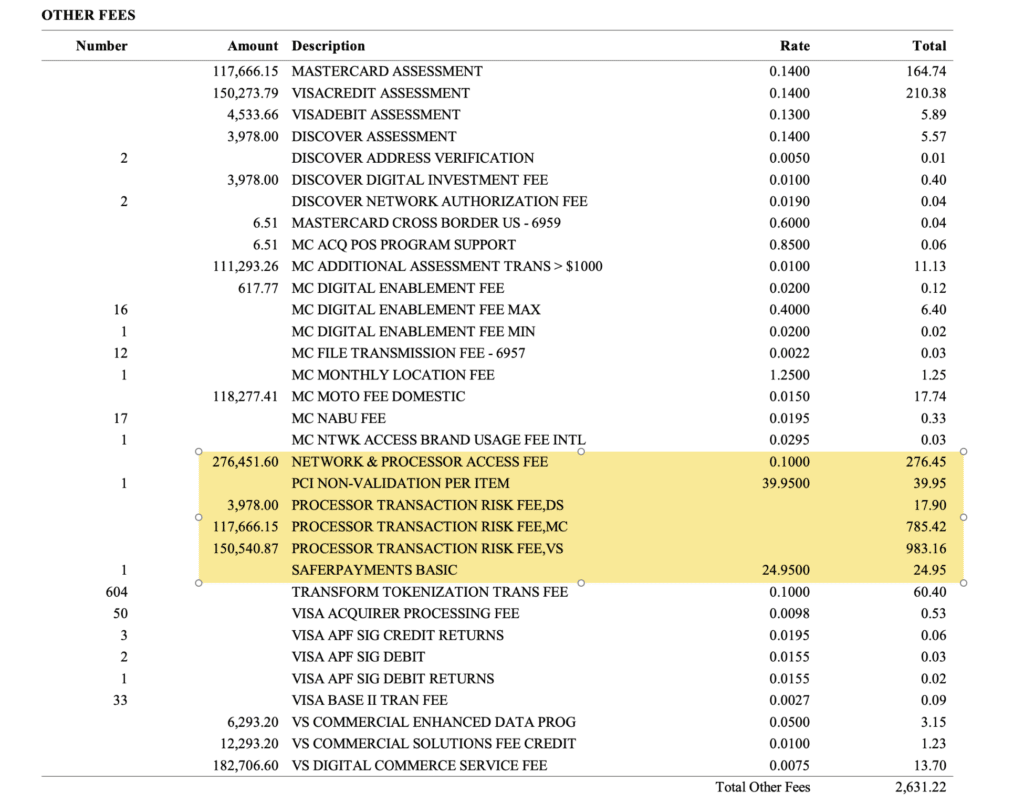

And if you just give a quick glance at the Other Fees, it looks like they’re all assessment fees and other pass-through fees coming from the card networks.

It’s easy to make this assumption because of the 33 line items on this section of the statement, 27 are non-negotiable pass-through fees.

But the other 6 are additional processor markups.

Other Fees Hiding in Plain Sight

Here is the exact same statement from above, but with the processor markups highlighted:

So many businesses overlook these charges because they are buried amongst legitimate network charges. And even the names seem legitimate enough that they don’t raise eyebrows.

We’ve got:

- Network & Processor Access Fee = $276.45

- PCI Non-Validation Fee = $39.95

- Processor Transaction Risk Fee (Discover) = $17.90

- Processor Transaction Risk Fee (Mastercard) = $785.42

- Processor Transaction Risk Fee (Visa) = $983.16

- SafePayments Basic Fee = $24.95

These six charges total $2,127.83 in fees.

Your Processor is Charging You More Than You Realize

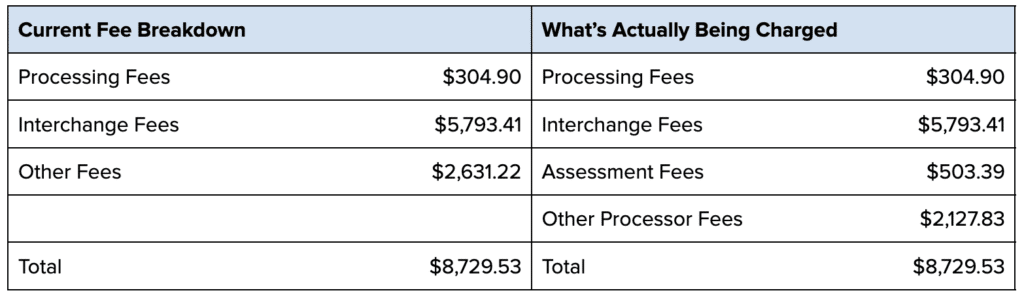

Due to a clever fee-categorizing technique, it looks like only $304.90 is going to the processor.

But after we dig deeper into the “Other Fees” category, we can see that this processor is actually charging $2,432.73 in total processor markups ($304.90 + $2,127.83).

That’s 8x more than what’s listed on the original summary of fee categories.

Another reason why this is so misleading is because just a few of those line items make up the bulk of the charges. Remember, just 6 of the 33 line items in the “Other Fees” are going to your processor. Yet these charges account for 81% of the “Total Other Fees” amount.

Let’s compare the difference between how this processor categorizes its fees and what would be a more accurate breakdown:

This takes the mystery out of the “Other Fees” and clearly shows what’s being paid to the processor vs. what’s going to the card networks.

Why This is So Important

Interchange and assessment fees are the only non-negotiable components of payment processing. Anything set by the card networks and paid either directly to them or the issuing banks can’t be adjusted.

But the fees paid to your processor? Those markups are 100% negotiable.

With markups buried in the Other Fees, it’s much more difficult for businesses to figure out which charges are non-negotiable vs. which ones can be removed or reduced.

Processors do this on purpose.

And by listing processing fees as a mere $300 when in reality that number is over $2,400 is misleading.

It gives merchants the perception that their processor isn’t charging them much and they’re getting a good deal. $300 on $8,700 in fees seems reasonable, and on $270k in processing volume, it sounds like a steal.

But you’re actually paying far more than advertised.

This lack of transparency makes it far less likely that you’ll push back against annual rate increases (which are inevitable). When your processor sends you a notice that your fees are increasing by 0.05%, you don’t question it because you don’t think 5 basis points will move the needle if you’re only paying a few hundred dollars.

Final Thoughts

There are thousands of dollars in hidden processor markups hiding in plain sight on monthly merchant processing statements.

Lots of these charges are buried alongside legitimate pass-through fees and network assessments, but everything is itemized in a single category like Other Fees, Other Detail, Other, or just plain Fees.

The only way to uncover those fees to find out what your processor is actually charging you is by going through each fee line-by-line.

Anything that’s not being charged by the card networks is on the table for negotiation. And lots of those charges can be removed from your statements altogether.