We pride ourselves on providing our readers with all of the biggest headlines in the payments space. From rate increases to mergers, acquisitions, and other headlines, we’re always trying to keep you informed about the latest happenings in the industry. Here’s what we dug up in April:

Adyen’s Report Finds $429 Billion in Fraud Losses For Retail Sector

Adyen just released its 2024 retail report, which contained some shocking numbers related to cybercrime and fraud in the retail space. Key takeaways include:

- Roughly 45% of global retail businesses have fallen victim to a cyber attack or data breach within the past 12 months

- In 2023, the retail sector lost $429 billion to payments fraud

- The average fraud loss per victim is $808.42, which is up 234% compared to 2022

- Enterprises lost an average of $2.98 million per cyber attack

- Luxury fashion retailers $3.97 million

- Health and beauty retailers lost $3.94 million

Bluefin Increases Rates by 0.20% Per Transaction

Effective May 1, 2024, Bluefin is increasing rates by 0.20% per transaction. This increase applies to all Visa, Mastercard, Amex, and Discover transactions. Read more here.

Fiserv Announces New Pass-Through Fees and Other Updates

Fiserv notified merchants about new pass through-fees and higher rates that went into effect during April. The processor also updated its terminal software, and announced that it’s no longer adding TeleCheck merchant accounts.

For a full list of the new fees and a more in-depth description of each, refer to our Fiserv processing fees page.

Lightspeed Announces Reorganization

In a press release earlier this month, Lightspeed announced that it’s eliminating roughly 10% of its headcount-related expenses. It’s part of the company’s cost-reduction initiative that focuses more on profitable growth.

According to Lightspeed, this will impact roughly 280 roles and the changes should be completed by the first fiscal quarter of 2025.

Mastercard Announces Team Realignment to Support Strategic Prioritizes

Mastercard is also restructuring internal teams to prioritize:

- Core Payments

- Commercial and New Payment Flows

- Services

In the announcement, Mastercard’s CEO said that the approach will reinforce Mastercard’s strategy and competitive advantage to drive growth and diversify revenue streams.

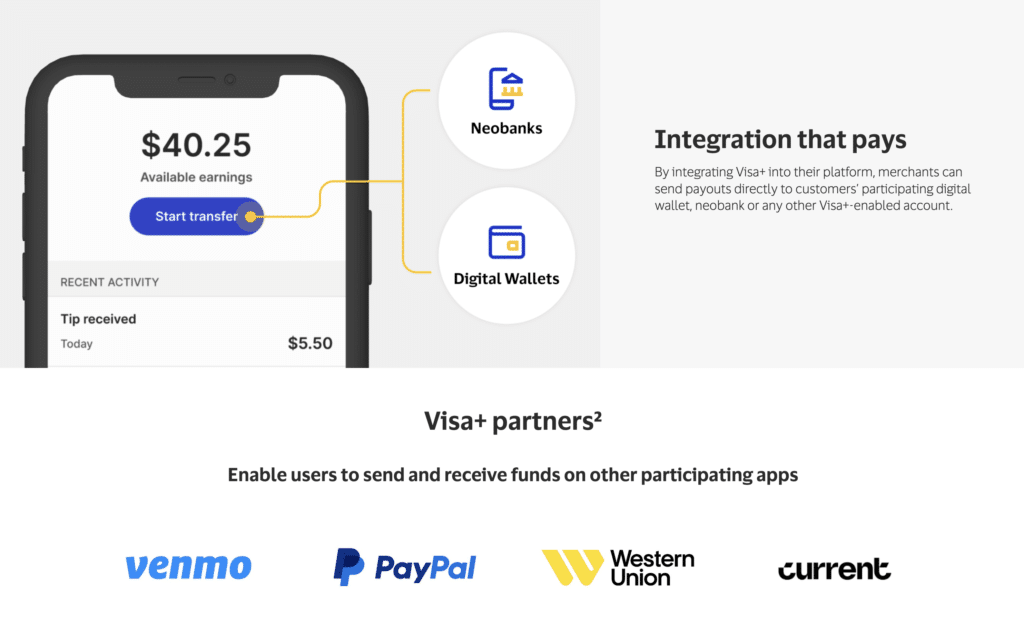

Visa to Roll Out Visa+ on PayPal and Venmo

Visa just announced the official launch of Visa+ on PayPal and Venmo.

Visa+ is a personalized receive-only payment address that’s linked to participating payment accounts—designed to bridge the gap between multiple P2P payment platforms.

Eligible users can use it to send and receive funds through participating apps, which now include PayPal and Venmo. Users don’t have to share any personal information to get paid, like an email address or phone number. They can just use their Visa+ payname for P2P transfers.

Nuvei Gets Acquired by Private Equity Firm, Advent

Nuvei, a Montreal-based payment processor, has entered into a definitive agreement to be taken private by Advent International for roughly $6.3 billion in an all-cash transaction.

Advent will acquire all issued and outstanding voting shares for $34 per share.

North American Bancard Partners With Visa

Fintech company North American Bancard is partnering with Visa—integrating its merchant services with the Visa Acceptance Platform.

Leveraging the platform will give NAB a fast and secure connection directly into the Visa Acceptance ecosystem via an integration with NAB’s Payment Exchange (PX) processing platform.

The integration gives businesses access to the entire suite of features available through the Visa Acceptance Platform, including Cybersource.

Fiserv is Prioritizing Pay by Bank

Many of us are familiar with pay by bank—as it’s commonly used for utilities and other bill payments. But Fiserv plans to pursue more pay by bank solutions for merchants as a way to help reduce merchant fees by up to 50%.

Not only can this help lower merchant fees, but it can also help eliminate chargebacks for pay by bank purchases.

PayPal Releases New Features Designed For Small Businesses

PayPal launched several new features that are specifically designed to help small businesses in its complete payouts solution. One of the most notable updates gives merchants the ability to accept more payments through options like:

- PayPal

- Venmo

- PayPal Pay Later products

The new complete payments solution also lets small businesses process payments directly on their website, instead of being redirected to a third-party page. Merchants can customize this checkout screen so it aligns with the branding of their website.

Furthermore, small businesses can leverage PayPal Vault, which allows customers to store payment data on their ecommerce website.

New payment processing pricing models will also be made available to PayPal merchants. Small businesses can now choose between flat-rate processing or interchange plus plus pricing through PayPal.

Toast Launches New Enterprise-Level Restaurant Management Suite

Toast rolled out a new Advanced Restaurant Analytics suite to over 100,000 locations across the US. Chains like Papa Gino’s, Bar Louie, Caribou Coffee, and Nothing Bundt Cakes are just a handful of companies benefiting from this new technology.

The software will allow companies to benchmark performance of specific menu categories against aggregated data available through other restaurants using Toast.

As a result, restaurants can identify potential areas to grow and expand their menu.

New integrations and Toast APIs are also available through the software—which will be made available on a tiered level to meet the needs of differently-sized restaurants.

PayPal to Consider Pricing Increases on Key Services

In an effort to drive more profitable growth, PayPal is exploring the idea of raising prices for its services.

The changes will most likely impact small and mid-sized businesses that don’t have the same bargaining power as larger companies. Merchants in this category will be less likely to switch providers and may just accept the changes.

Love the latest news? Subscribe to our newsletter to get the biggest payment stories delivered straight to your inbox. In case you missed it, click here for a recap of last month’s biggest stories.