The month of July has been a busy month in the world of payment processing and fintech. We’ve seen new technology, processing rate increases, significant acquisitions, and more.

Our team here at Merchant Cost Consulting diligently monitors these changes to ensure we keep our readers informed on what’s happening.

Here’s a closer look at some of the biggest headlines from July 2023.

Toasts Adds Then Removes $0.99 Customer Ordering Fee

Toast initially added a new $0.99 customer-facing processing fee to online transactions of $10 or higher placed through the online ordering platform.

But after facing some backlash, Toast reversed course on this decision and announced the removal of this $0.99 fee—which was active for less than a month.

Read more about Toast’s fees here.

Shift4 Offers $5,000 Signing Bonus and Will Pay $1 per Order to SkyTab Restaurants

Shift4 just announced that it will pay a $5,000 signing bonus to restaurants switching to SkyTab POS from another ordering system. New qualifying customers will also get paid $1 for every online order for the first three months of using the service.

The SkyTab POS platform for restaurants starts at $29.99 per month.

You can follow the latest Shift4 updates and rates here.

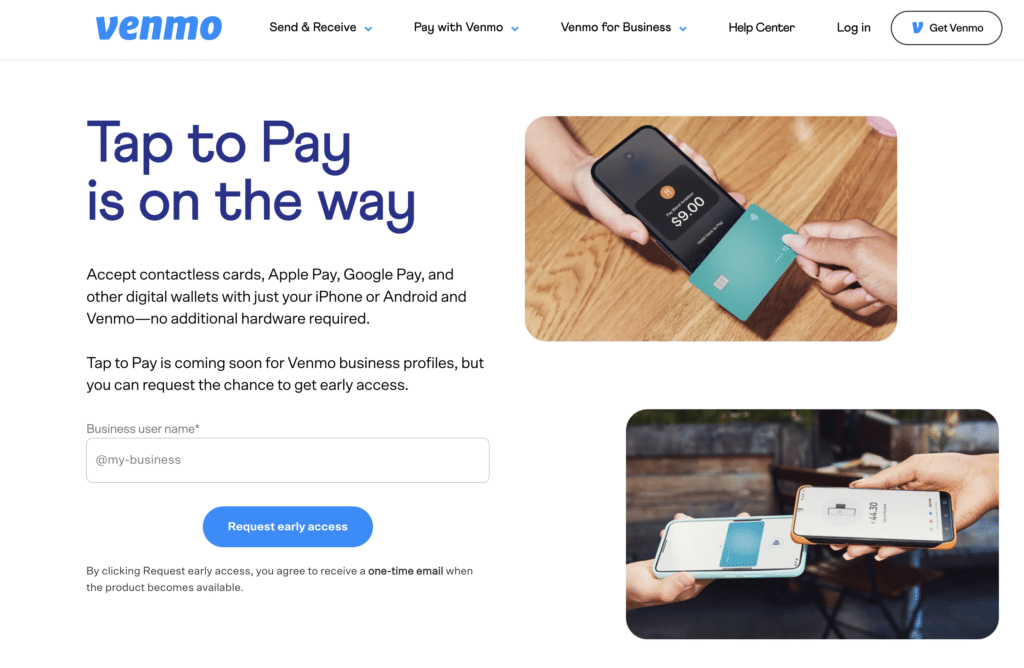

PayPal Announces Tap to Pay for Venmo

PayPal recently announced that it’s rolling out Tap-to-Pay capabilities for PayPal and Venmo Business profiles in the US.

It’s not currently available, but eligible businesses can request early access to get started.

Check out the latest PayPal and Venmo fees here.

Adyen Adds Tap-to-Pay Support to Android

Adyen is also adding Tap-to-Pay functionality to support in-person payments from Android devices. This announcement allows any compatible Android smartphone, tablet, kiosk, or handheld device into a contactless payment-enabled terminal.

This feature will be available for merchants in the United States and Singapore.

Adyen’s Android Tap-to-Pay rollout comes one year after Adyen launched Tap-to-Pay acceptance for iPhone, which went live last summer.

Apple Launches Tap-to-Pay in UK and Aims to Launch Apple Pay in India

Apple announced the expansion of its own Tap-to-Pay capabilities. This allows merchants in the UK to accept contactless payments from iPhones, which started rolling out in July.

Furthermore, Apple recently resumed talks to launch Apple Pay in India. This is a relatively small market for Apple when you consider the fact that 90% of smartphones in India are powered by Android’s operating system.

Currently, there’s no definitive date for the launch. But you can keep referring back to our blog and subscribe to our newsletter to stay informed on the latest updates.

Square Announces New Beta Products For US Sellers

Square is expanding its service offerings to US-based merchants.

They’ve launched a new credit card that runs on Amex’s network to provide merchants with a rewards program and flexible spending. Credit limits are determined by how much the merchant processes with Square.

They’re also expanding the Square Loans program in an effort to reach larger sellers. The new program allows merchants to pay on a fixed monthly schedule, as opposed to daily repayments.

Read more about Square’s credit card processing costs here.

Visa Acquires Pismo

Visa signed a definitive agreement to acquire Pismo for $1 billion in cash.

While the announcement has been made, the transaction is still subject to regulatory approval and other closing conditions. But Visa expects the deal to close by the end of 2023.

Pismo is a cloud-native issuer processing and banking platform that’s based in Latin America, Europe, and Asia-Pacific regions.

FedNow Goes Live

On July 20, 2023, the Federal Reserve announced that FedNow is officially live.

FedNow is the new instant payment infrastructure that makes it possible for US financial institutions of all sizes to offer safe and fast payment services. Institutions participating in the new FedNow service can send and receive instant payments 24/7/365.

At the time of the launch, 35 banks and credit unions and 16 other service providers have been certified to leverage transfers using this new system.

Among these providers, Adyen, FIS, and Fiserv all issued press releases to announce they’ve completed the FedNow testing and certification.

FIS to Sell 55% Stake in Worldpay

In a July 6, 2023, press release, FIS Global announced its plans to sell a 55% stake in Worldpay.

While FIS will retain 45% ownership in Worldpay, the majority stake is being sold to GTCR—a private equity fund. GTCR plans to invest up to $1.25 billion in additional capital to accelerate Worldpay’s growth strategy.

Worldpay will keep its continued access to the FIS suite of banking and treasury solutions with the ability to resell those solutions to clients.

Read more about Worldpay’s latest interchange rates here.

Merchant Lynx Services Acquires National Credit Card Processing

Merchant Lynx Services, an independent sales organization (ISO), has acquired National Credit Card Processing Group—a payment acceptance provider.

The acquisition positions Merchant Lynx with an entry point to offer services to clients in specific industries, like trucking parts and construction.

Merchant Lynx processed over $3.2 billion in transactions last year, and they’re the 54th largest merchant acquirer in the US, as ranked by Visa and Mastercard.

Marqeta Expands to Brazil

Marqeta is a California-based digital card issuer. In a July 11, 2023 press release, the company announced its expansion to Brazil.

With the expansion, Marqeta’s platform now operates in over 40 countries across the globe.

Fiserv Reports Q2 2023 Results

Fiserv released its Q2 results on July 26, 2023. While the full reports can be accessed here, key highlights include:

- 10% organic revenue growth (compared to 13% in Q1)

- 14% merchant acceptance organic revenue (compared to 18% in Q1)

- 23% growth in Clover revenue (compared to 22% in Q1)

- Plans to offer more value-added services to Clover POS

- 40 new ISVs selling Clover

- Clover to be used in Cleveland Browns stadium

- 6% growth in Carat revenue (compared to 16% in Q1)

- Carat releases Commerce Hub and Data and Insights command center

For more information, you can check out the latest Fiserv interchange rates here.