In addition to helping businesses save money on credit card processing, the Merchant Cost Consulting team is always keeping a close eye on everything in the payments world. From rate changes to new fees, technology updates, and relevant partnerships, it’s our goal to provide our readers and customers with newsworthy insights into our industry.

Here’s a closer look at what’s happening in September.

CardConnect Increases Fees

Effective September 2023, CardConnect officially increased its discount rates by 0.10%. This increase applies to all Visa, Mastercard, American Express, Discover, and PIN debit transactions.

They also increased authorization fees by $0.05 on all transactions for the same networks—Visa, Mastercard, Amex, Discover, and PIN debit.

Merchants can expect to see these changes reflected on their month-end statements.

Paya to Add $45 Pre-Arbitration Fee

Paya just announced a new $45 fee that will be implemented in October. This Pre-Arbitration fee applies to disputed transactions in the pre-arbitration cycle.

In the same notice to its customers, Paya said that they’re also reviewing changes to fee structure by the card networks and may be updating additional rates on statements as early next month.

PayPal to Add Support for Apple Pay

PayPal is rolling out support for its PayPal-branded debit and credit cards to work with Apple Pay. Previously, customers using a PayPal credit card were unable to add it to their Apple Wallet or Apple Pay.

This update has not been officially reported by PayPal yet—and not every PayPal or Apple Pay user is seeing the “Add to Apple Wallet” button on their PayPal cards.

But according to 9to5Mac and AppleInsider, this may be a sign of a soft launch before the rollout becomes official. Both reports also speculate that Venmo cards could also be supported for Apple Pay in the near future.

We’ll keep an eye out for any official announcements from PayPal in the coming weeks or months. You can also refer to our PayPal and Venmo page for new fees and updates.

Shopify to Offer “Buy With Prime” Button at Checkout

Shopify announced that a “Buy With Prime” button will soon be coming to its platform.

Amazon is going to release an app within Shopify’s ecosystem, giving US-based sellers using Amazon’s fulfillment network the option to add “Buy With Prime” to checkouts processed through Shopify Payments.

The full-scale rollout hasn’t happened yet, but Amazon is offering qualified merchants to register for early access.

RTP Network Eclipses New Milestone of One Million Payments in a Single Day

On September 1, 2023, The Clearing House reported a milestone event of over one million instant payments processed through the RTP network.

The RTP network currently processes over 60 million transactions per quarter. It’s used by over 370 banks and credit unions, as well as 150,000 businesses and 3+ million consumers.

This news comes less than two months after the federal government launched a competing real-time payment infrastructure—FedNow, which we reported in July.

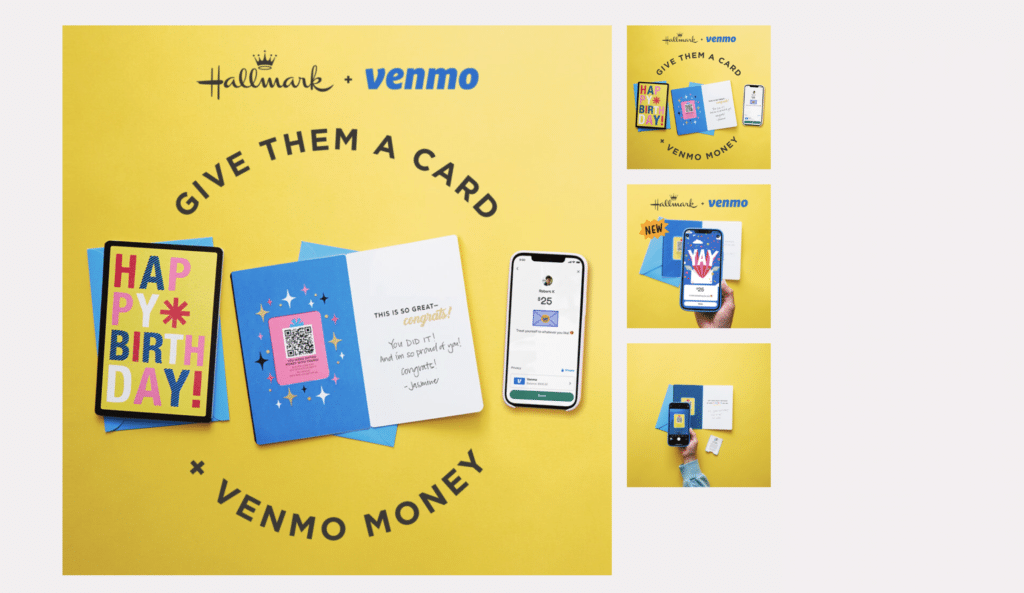

Venmo and Hallmark Announce Partnership for Sending Gifts in Cards

Hallmark and Venmo announced a unique partnership that allows people to send gifts to friends and family through Venmo using a QR code that’s embedded in a physical hallmark card.

Here’s what that would look like:

Over 78% of Venmo users already use the platform to send gifts to family and friends.

The sender can use the QR code to select a recipient and then enter a payment amount. When the recipient receives the card, they can use the QR code to receive the funds. Recipients have 180 days to claim their gift before the funds are sent back to the sender’s Venmo account.

Affirm Partners With Booking.com for BNPL

In a September 7th press release, Affirm announced its recent partnership with Booking.com.

Affirm is a Buy Now Pay Later (BNPL) service provider that allows customers to pay for goods or services over time.

The partnership with Booking.com will make this BNPL option available for customers across several different travel platforms within the portfolio of Booking Holdings Inc—including Priceline, KAYAK, and Agoda.

Customers will see an option at checkout to use Affirm’s BNPL service to make bi-weekly payments or monthly payments for travel reservations.

American Express and Afterpay End Relationship

Afterpay is another BNPL company. American Express joined Afterpay’s BNPL program in December 2020. But less than three years later, the arrangement is ending.

Effective October 2, 2023, American Express cards will no longer be an accepted payment option through Afterpay.

Hyundai Introduces Hyundai Pay—an In-Vehicle Payment Service

In a September press release, Hyundai announced a new in-vehicle payment option that will be available in the 2024 Hyundai Kona.

This will allow drivers to pay for things through securely stored credit card information that’s accessible through the vehicle’s touch screen.

Hyundai has partnered with Parkopedia, which will allow drivers to make parking payments and reservations at over 6,000 locations directly from the vehicle.

Like what you’ve seen on this page? Subscribe to our newsletter and get the latest payment industry news delivered straight to your inbox every month. In case you missed it, you can always check out last month’s updates here.