Considering using PayPal or switching to PayPal to process credit card transactions for your business? Read this first.

As a merchant consultant, we have years of experience dealing with PayPal on behalf of clients. So we know when it works best or when it makes sense to go with another provider.

I’ll share some of my insider secrets with you below.

MCC Quick Take on PayPal

PayPal has been a household name for decades, and it’s probably the most well-recognized provider in the payments space.

Technically, PayPal is a PayFac (payment facilitator), which means they have their own underwriting criteria. While you don’t get a traditional merchant account (you get a PayPal merchant ID instead), PayPal puts you through a similar process when they’re onboarding you as a new business client.

- PayPal is significantly more expensive than traditional processors.

- They’re also more expensive than most other PayFacs.

- That said, they’re willing to negotiate rates for larger accounts.

- You have a better chance of getting a good deal if you incorporate other PayPal products into your payments suite.

- PayPal is notorious for its strict funds on hold policies and rolling reserves, which often change on a monthly basis.

Overall, PayPal is below average, even on their best days. They offer a wide range of payment solutions and have one the most reputable names in the industry, but it’s tough to justify their prices when you can get cheaper rates almost anywhere else.

PayPal Pricing and Credit Card Processing Rates

PayPal charges 2.99% + $0.49 per transaction for standard credit card and debit card transactions. If you’re using PayPal Checkout or PayPal Guest Checkout, that rate jumps to 3.49% + $0.49 for those transactions.

These rates are outrageously high, and there’s really no other way to say it.

Years ago, they used to charge 2.9% + $0.30 per transaction and 3.5% for American Express cards. These rates were still high (and I wouldn’t recommend paying them), but at least they were slightly more aligned with other PayFacs.

Some merchants have been grandfathered into older rates ranging from 1.9% to 2.2% + $0.30 per transaction, which is obviously much better.

For really large accounts, PayPal is willing to negotiate and customize rates. But this only applies to a fraction of their clients.

Other PayPal Fees

In addition to the standard fees you’ll pay to accept cards via PayPal, here are some other fees that PayPal charges for certain scenarios:

- Account Monitoring Service — $19.95 per month (plus $29.95 to set up)

- ACH Services Return Fee — $5 per return or unauthorized fee dispute

- Advanced Fraud Protection — $0.07 per transaction

- Buyer Authentication Service — $10 per month and $0.10 per transaction

- Card Verification Transactions — $0.30 per request

- Chargeback Protection — 0.40% per transaction

- Effortless Chargeback Protection — 0.60% per transaction

- Failure to Implement Express Checkout — 1% per transaction

- Payments Advanced — $5 per month

- Payments Pro — $30 per month

- Payments Pro Payflow — $30 per month

- Virtual Terminal — $30 per month

- Recurring Billing — $10 per month

- Recurring Payment Tool — $30 per month

- Uncaptured Authentication — $0.30 per transaction

Many of these are optional services.

The rates aren’t crazy or egregious, although many are higher compared to similar services from other providers. But if PayPal is going to charge these extras anyway, I think they should be offering more competitive pricing on standard transactions (don’t hold your breath; this won’t happen for the foreseeable future).

What Else Merchants Should Know About PayPal’s Credit Card Processing Services

Whether you’re currently using PayPal to process payments or you’re thinking of using them, here are some insights you should be aware of.

You Can Negotiate a Better Rate if You Bundle Other PayPal Services Into Your Contract

It’s no secret that PayPal’s rates are high—and I’ve tried to articulate this as often as possible throughout this review. However, PayPal is actually open to negotiations if you’re a larger merchant and if you’re interested in using other PayPal services.

I’m referring to some of those services and programs from the optional list of fees that we covered above.

For example, we’re negotiating directly with PayPal on behalf of a client.

In the exchange, the PayPal rep told us they could offer 0.15% + $0.10 per transaction for DCC only (IC++).

But if the client bundled DCC (IC++) with PayPal Wallet, the rate would drop to 0.12% + $0.08 per transaction, and the PayPal Wallet transactions would be 3.01% + $0.49 per transaction (normally 3.49% + $0.49). So just this single bundle already lowered the interchange plus plus rate and wallet rate.

The rep also continued to pitch PayPal’s risk solutions—saying that bundling DCC with Fraud Protection Advance would give them more room to lower basis points on the DCC offer.

I have mixed feelings about this because on the one hand, yes, you’re getting a lower rate per transaction. But on the other hand, you’re paying more for other services. So PayPal is getting your money either way.

If you need this stuff, that’s great. Otherwise, it’s likely not worth adding all these extras just to save money elsewhere, as the savings can almost be offset by the add-ons.

Payments Received Through PayPal May Not Be Immediately Available

Since PayPal is not a traditional merchant account, they assume some risk when it comes to fraud and chargebacks.

They do put you through an underwriting process, but it’s not quite the same as it would be if you go through a direct processor.

This means that PayPal often requires rolling reserves or holds funds, especially for smaller merchants who don’t have a longstanding history of sales.

For example, let’s look at an email from one of our low-volume clients. They’re a consultant that only has a handful of B2B transactions per month.

This email was sent in October 2024. PayPal notified them that their instant access to funds has increased from $10,500 to $29,200.

Great, right? In the short term—yes, this is obviously good news. But when you look at this closer, it means that the merchant only had instant access to $10,500 prior to October.

And this isn’t even all of the information. This is actually the 9th time that PayPal changed the amount of instantly available money for this client in 2024.

Most recently, in July it went from $5,800 up to $27,100. Then in August it dropped back down to $14,200, and then dropped again to $10,500 before this email from October.

There’s just so much fluctuation here from month to month. The money still belongs to our client, but PayPal just isn’t willing to instantly release more than a preset amount.

They’ve never had a single chargeback or dispute either. But because they’re small and operate in what PayPal deems to be a “riskier” space (online B2B consulting), that’s just how PayPal handles things.

PayPal Owns Braintree and Venmo

There are a few reasons why this is important to know.

First, this means PayPal is also willing to negotiate and lower your rates if you bundle in some Venmo for business services.

But second, I think Braintree is so much better than PayPal. Braintree’s technology is exceptional and its standard flat-rate pricing is cheaper than PayPal. Custom interchange-plus rates are also cheaper than PayPal and Braintree is more willing to negotiate.

Ok, but what if you want some specific PayPal services?

You can still get them from Braintree, and Braintree is more willing to negotiate your rate if you add-on PayPal services. I talk about this more in my Braintree review, and I think Braintree is the clear winner when stacked side-by-side with PayPal (even though it’s technically the same company).

Don’t Consider PayPal If You’re a High Risk Merchant

If you think that your customers are going to dispute your charges frequently or file chargebacks, PayPal isn’t for you.

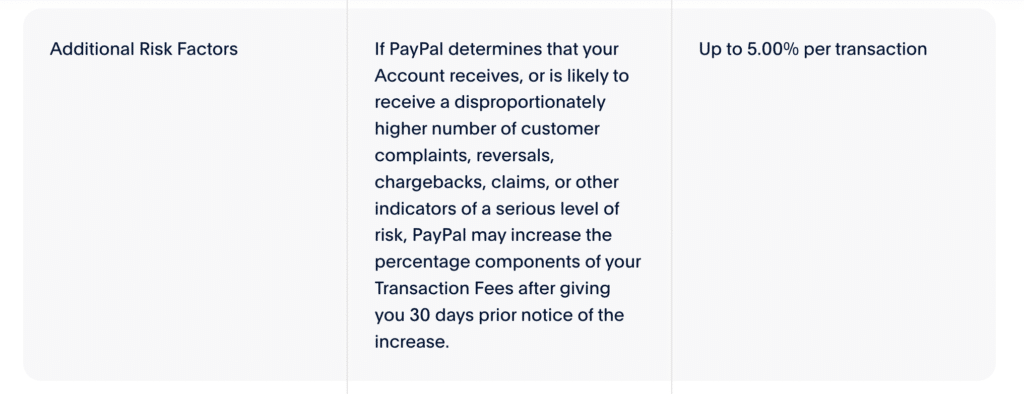

On top of PayPal’s already high rates, they’ll charge up to 5% per transaction if this stuff starts to be a problem. This is clearly stated directly on PayPal’s fee table:

5% is just outrageous—even for high-risk merchants.

All PayPal has to do is give you 30 days notice and they can jack up your rates.

Should You Switch to PayPal?

I don’t think so. PayPal is fine for smaller low-volume B2B services (as long as you don’t mind paying over 3% per transaction). But it’s not great for the vast majority of businesses.

Yes, high-volume merchants can get a better deal and have access to IC++ rates that aren’t advertised on PayPal’s website.

Even if you fall into this category, I can almost guarantee that you’ll get even better rates from another provider. One of which is Braintree—and since Braintree is owned by PayPal, you can still get any PayPal-specific features or services that you might be interested in.

But before you think about switching processors, the first thing you should do is look at your arrangement with your existing service provider. Try to negotiate with them directly and lower your fees. You have more leverage than you might realize.

Latest PayPal Updates and Noteworthy News

I do a roundup of the biggest news in the payments industry every month, and it seems like PayPal is always in the headlines.

Here’s just a small sample of the recent PayPal stories I’ve found interesting and highlighted:

- PayPal announced the expansion of its strategic partnership with Fiserv.

- They also announced the expansion of their strategic partnership with Adyen—bringing “Fastlane by PayPal” to US shoppers.

- In PayPal’s 2024 Q3 financial reports, they announced that payment volume increased 9% vs 11% in Q2.

- The call also gave some insights into Braintree, and how PayPal is focusing on value to grow Braintree with enterprise clients.

I’ll continue to update this on a regular basis and either add to the list or replace them with newer stories. You can also subscribe to our newsletter to get these types of insights delivered straight to your inbox each month.

Our Final Thoughts on PayPal

PayPal is probably a good fit for only two or three out of every 100 merchants.

They’ve got an incredible brand name that helps draw clients, and their technology is solid. But PayPal’s rates are just too high to justify.

If you want to use PayPal, definitely don’t just blindly accept the standard rates advertised on their website. They’re willing to negotiate if you bundle with other services, although smaller merchants will have a tougher time getting the best possible deal.

Whether you need help with PayPal or your existing processor, our team here at MCC can help. We’ll negotiate rates on your behalf so you can get the best possible deal on credit card processing.