Most of my days are spent auditing processor statements that are full of deceptive pricing tactics and hidden fees. But every once in a while, I come across a statement that doesn’t have any of these tricks.

So I want to make sure I give credit when it’s due, and Payroc definitely deserves it.

- Payroc’s statements are refreshingly transparent.

- Interchange fees and assessments are clearly itemized.

- The processor markup is obvious (and usually fairly priced).

- But best of all, all markups are clearly separated in their own section of the statement, which is surprisingly uncommon in the processing space.

I wish other processors would take a page from Payroc’s approach.

Let’s take a closer look at a statement from one of our clients at MCC so you can see what I’m talking about.

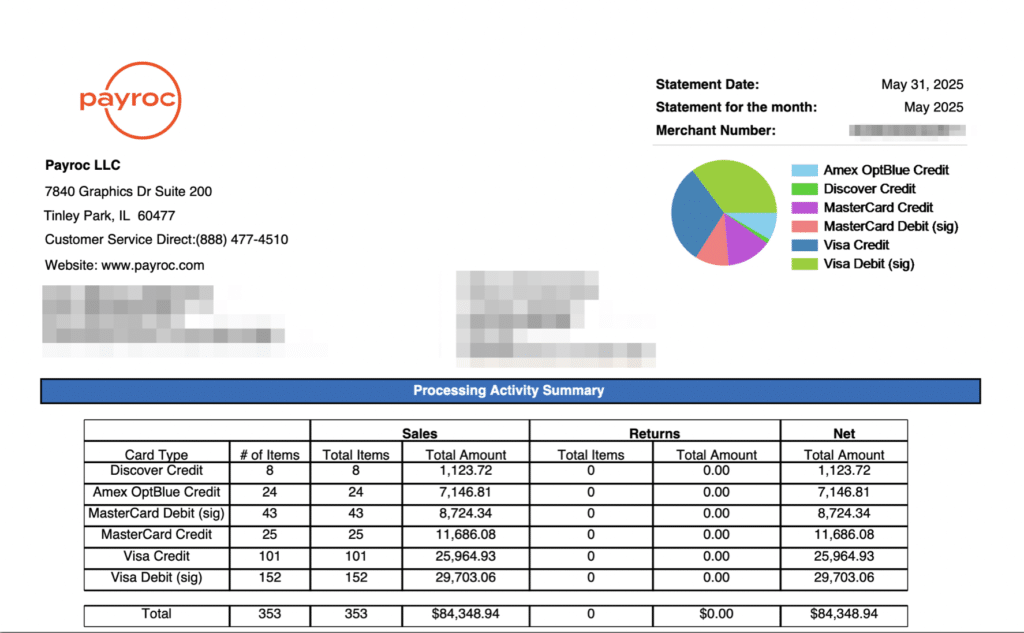

Processing Activity Summary: Straightforward and Similar to Other Processors

The first section of every Payroc merchant statement is pretty much the same info you get from any processor.

Payroc starts with a breakdown of processing activity by card type, and they also include a pie chart for those of you who like to visualize what cards are being run through your business.

Some merchant services providers have a daily deposit summary as the opening section in monthly statements. But I think I prefer this approach, and I think it adds more value for businesses.

While many of you won’t make any earth-shattering business decisions based on this data, it’s still something that you can keep a close eye on.

Particularly so for businesses with a higher volume of debit card transactions (especially with the chance of debit card interchange rates rising this year).

The most important number here is the total.

In this case, this merchant processed $84,348.94 on 353 transactions.

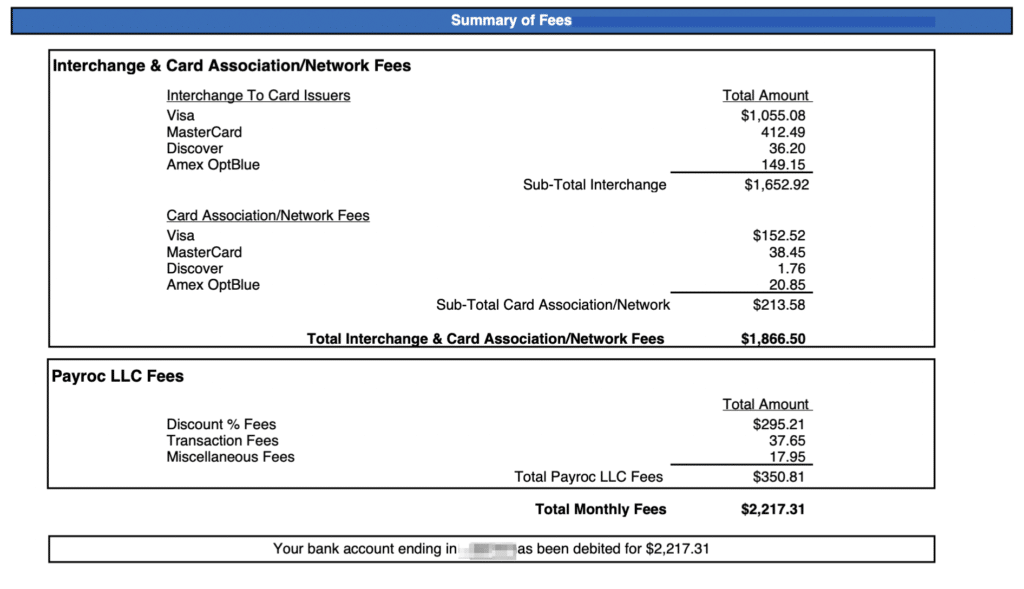

Summary of Fees: Truly Transparent With Payroc’s Fees Separated From All Non-Processor Charges

This is where Payroc stands out from practically every other processor on the market.

90% of providers are deceptive with their fee summaries because clever categorization allows them to bury additional markups alongside network assessments. Payroc doesn’t do that.

Instead, all interchange fees and card network fees are in one category, and all Payroc fees are in another:

I can’t overstate how refreshing this is to see. You’d think that this would be a standard practice industry-wide. But it’s not.

The vast majority of processors separate interchange fees as their own category, and then have “Other Fees” as a second category. And within those other fees you have a mix of assessments, card brand fees, and random processor-imposed fees that are much more difficult to spot.

Not Payroc.

Payroc gives you a summary of:

- Total interchange fees by card brand paid to issuing banks

- Total assessment fees going straight to the networks

- Payroc’s total markup as discount rate (charged as a percentage per transaction)

- Payroc’s total markup as a transaction fee (charged as a fixed dollar amount per transaction).

- Miscellaneous charges (this is still a markup going to Payroc, but it’s transparent).

We can see that this business paid $2,217.31 in total fees this statement period.

If we divide that by the total volume in the summary from section one ($84,348.94), we can calculate the effective rate at 2.628%.

It’s a solid deal, especially for a merchant that is hovering around $1 million in annual processing volume (not a ton for processing industry standards).

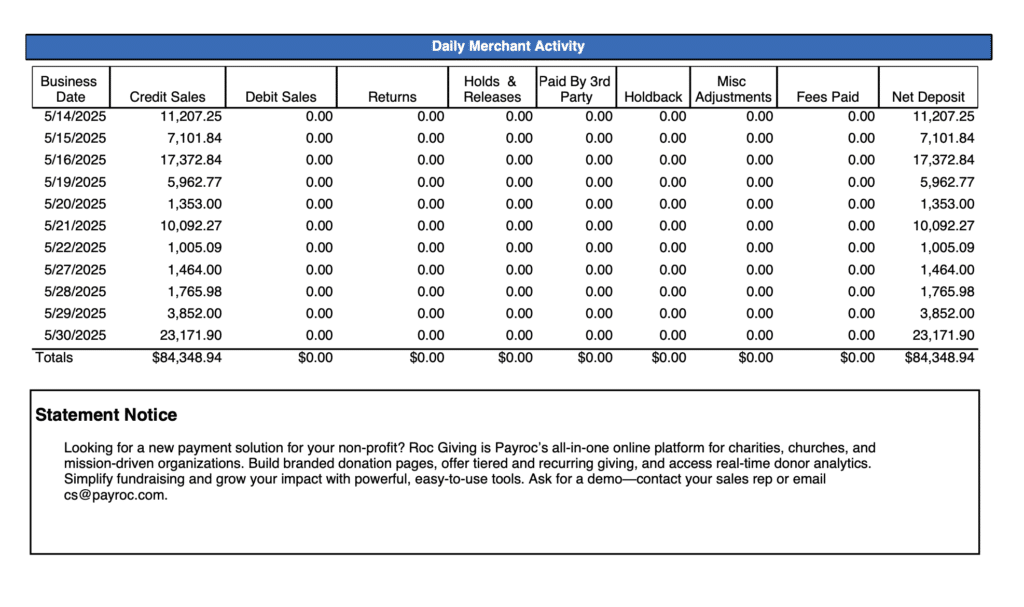

Daily Merchant Activity: Standard Stuff You’ll See on Every Statement

Next, Payroc shows a summary of net deposits by day to your bank account. If you have any holds, returns, and adjustments, they’ll be here, too:

This information is mostly going to be used when you’re reconciling your bank statements.

You’ll want to make sure that the net deposits in the far right column match the amounts that were actually deposited to your bank account.

The “Paid by 3rd Party” column is used if you have a direct agreement with American Express. This particular merchant is on an Amex OptBlue structure because their volume is low, so that’s all zeros.

Payroc also includes statement notices here. This particular notice isn’t relevant at all to our client (our client is in healthcare, and this statement notice is pitching non-profit processing for charities and churches).

That said, I’ll take an irrelevant service pitch any day of the week over the types of statement notices we get from other processors, notifying merchants of an upcoming rate increase.

Either way, don’t skip over this part of your statement because if any fees are changing ahead, this is where Payroc will let you know.

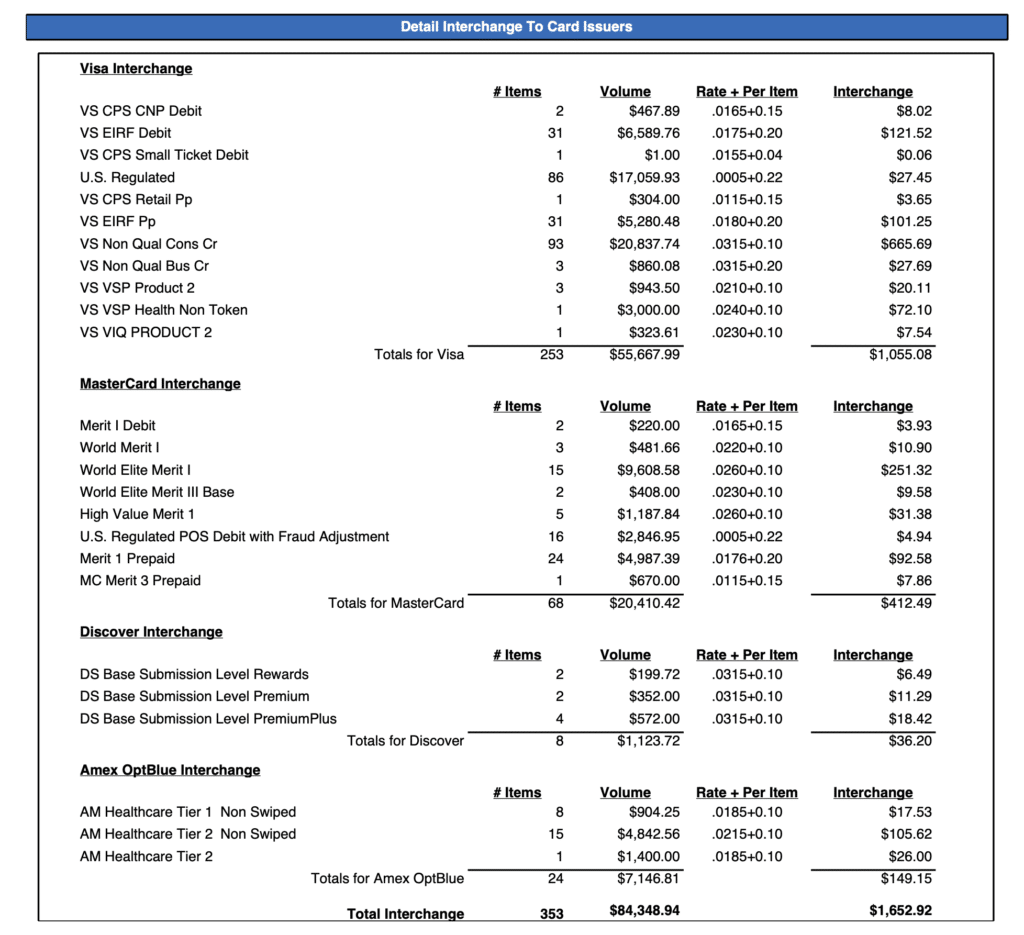

Interchange Breakdown: As Good As It Gets

Payroc isn’t the only processor that gives you a transparent breakdown of interchange rates. But the way this information is organized on the statements is just super clean.

Interchange rates are grouped by card network (Visa, Mastercard, Discover, Amex), and you can see exactly how many transactions were charged at each rate.

There’s no head scratching involved here.

And all of these totals match the summary from the very top section back on page one. (You’d be surprised how often I find totals that don’t match, and then have to manually figure out what exactly went wrong and where).

I also like that Payroc specifically makes an effort to say that the interchange fees are being paid to issuers.

While this is common knowledge in the processing industry, not every merchant understands this. It just continues to speak volumes about how transparent Payroc is in not only telling you how much you’re paying but exactly where that money is going.

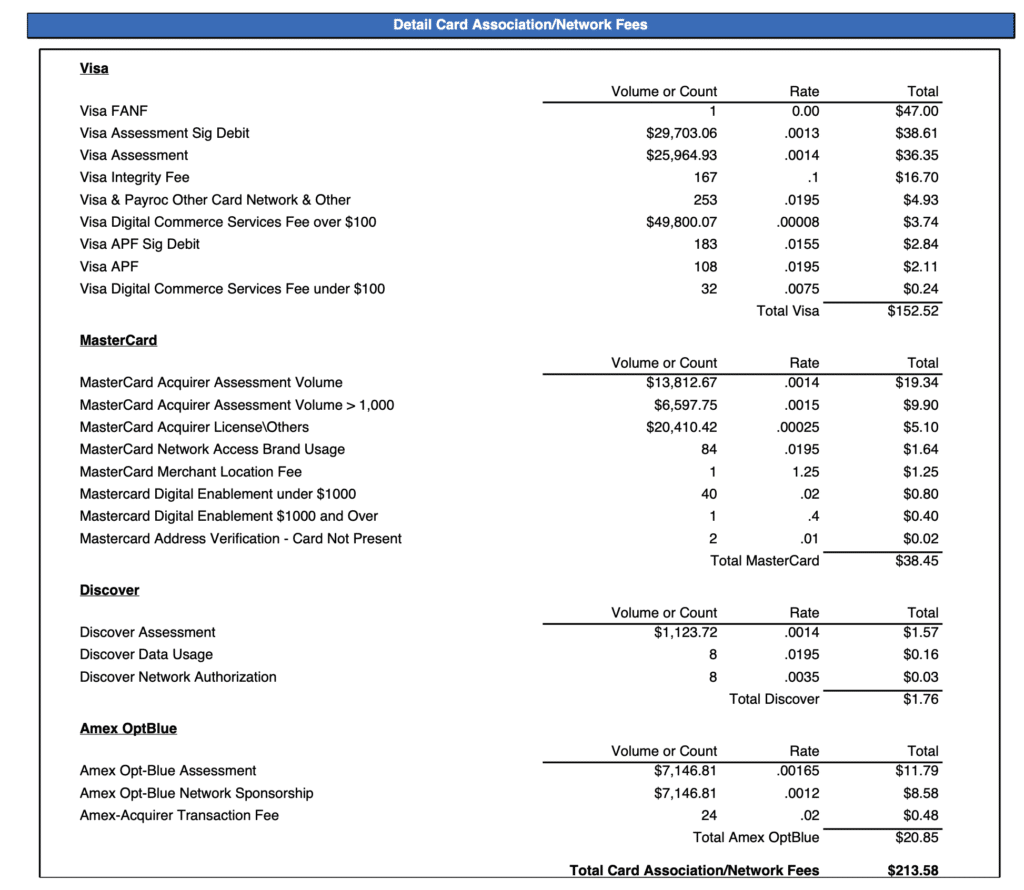

Card Association and Network Fees Breakdown: Even Better

This is arguably my favorite part of Payroc’s statements because they DON’T have any of their random processor-imposed markups mixed in with the network assessments.

Similar to the interchange breakdown, the assessments are also categorized by the card network.

Each fee is clearly itemized with a rate and total, and the totals match the summary amounts listed elsewhere on the statement.

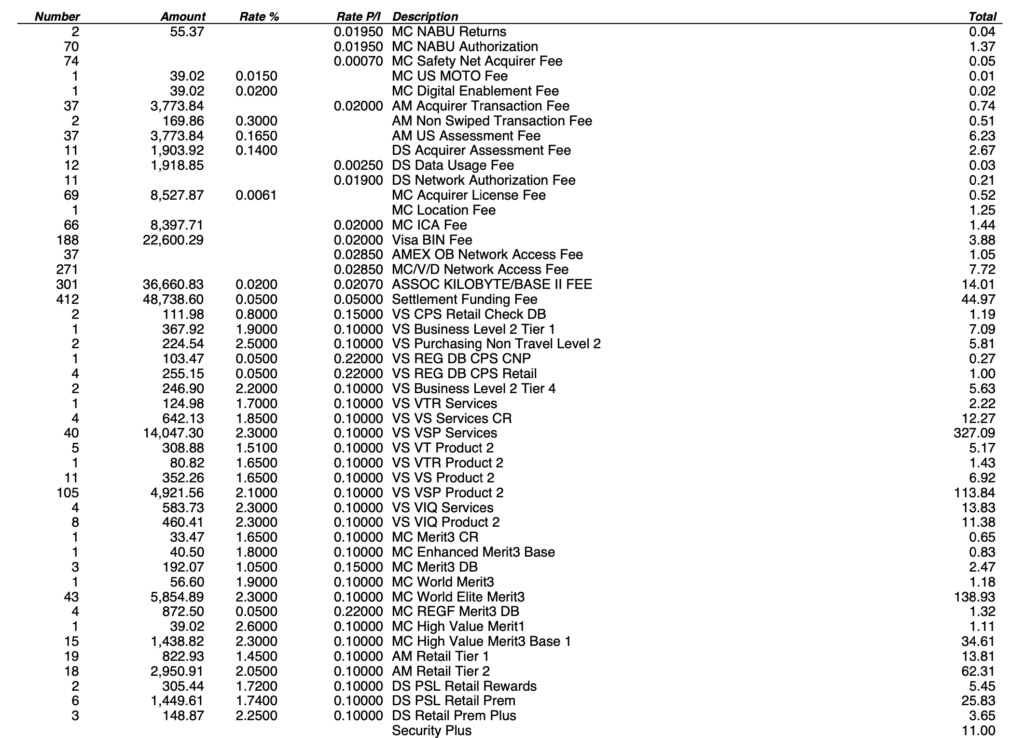

Let’s just quickly compare this to assessments itemized by a different processor so you can see the difference:

This is typically what we see from other providers when auditing statements:

- No grouping by card network.

- No logical order (MC, Amex, Visa, and Discover are randomly scattered throughout).

- Processor markups are also mixed in with network fees, making them harder to spot.

We’ve become so used to accepting this type of reporting from processors that we are genuinely excited to see when processors like Payroc make it easy on us.

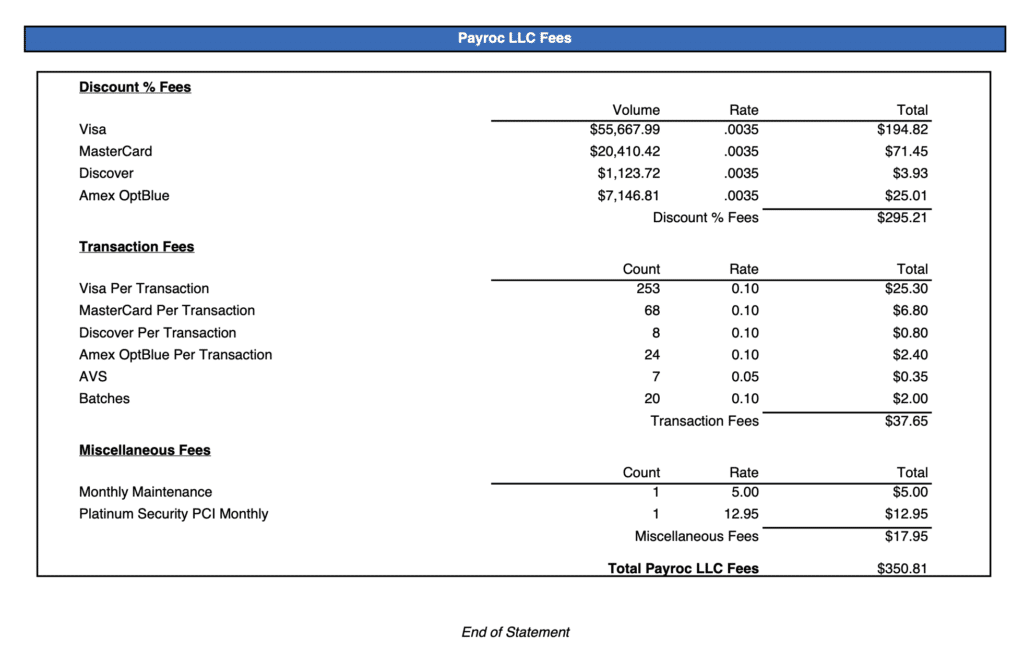

Payroc Fees Have Their Own Section, Which is Something I Wish Was Mandatory Industry-Wide

Here’s another reason why Payroc’s statements are great: they show you ALL of their fees in one place.

Wait, don’t all processors do this? Nope. Not even close.

What’s worse is that other processors pretend to do this. They’ll show you a total of just the discount rate, which is misleading. And then they group other transaction-based charges, monthly fees, and miscellaneous charges in a total titled “Other Fees” that also include network fees.

So if you just glance at those statements quickly, you might think you’re getting a good deal. But you have to do a lot of manual math to truly see what your processor is charging.

Looking at the statement example above, it’s super clear what Payroc is charging you.

- Discount Fees: Payroc’s markup charged as a percentage of each transaction

- Transaction Fees: Payroc’s markup is charged as a flat fee on each transaction

- Miscellaneous Fees: Other monthly charges and one-off fees that are also being paid straight to Payroc

This particular merchant pays:

- 0.35% + $0.10 per transaction

- $0.10 per batch

- $0.05 per address verification

- $5 per month in maintenance fees

- $12.95 per month in PCI fees

I can live with that.

How Payroc’s Pricing Compares

While 0.35% + $0.10 definitely isn’t the cheapest rate per transaction we’ve ever seen, it’s a decent enough deal for a merchant at this volume.

And the only “extra” markups being charged here total $17.95 per month. I usually think random monthly fees are bogus, but this amount is nothing to lose sleep over.

If we divide the total Payroc fees ($350.81) by the merchant’s total monthly volume ($84,348.94), get a total markup of 0.4159%. This is close enough to the 0.35% discount rate being charged (exactly what you want to see).

The further the discrepancy between your discount rate and the total markup percentage is an easy way to see if your processor is adding in junk fees elsewhere.

Other processors may charge 0.10% + $0.10 per transaction (a third of Payroc’s discount rate). But when you factor in the other fees, their total markup may be over 1% (100+ basis points).

At first glance, the 0.10% + $0.10 rate obviously looks like a better deal. But Payroc ends up being cheaper.

Your effective rate is also very telling. Remember, we calculated Payroc’s effective rate for this particular statement earlier on, and found this merchant was paying 2.628% effective.

So if your effective rate with another processor is 4% or 5%, you have to ask yourself what’s causing it to be so high? I can guarantee you it’s not interchange fees or assessments. So it has to be processor markups.

Payroc’s pricing is generally very good compared to other providers. And higher-volume businesses can negotiate deals better than 0.35% + $0.10.

I also love that Payroc pitches interchange-plus first on its website (then tiered, then flat-rate). Most processors do the opposite. They try to get you on a flat-rate or qualified plan first because it means more markup for them.

Final Thoughts on Payroc

Payroc’s statements are awesome. It’s the epitome of what transparency looks like in payment processing.

They don’t have nearly the market share as other processors, so we don’t see these statements quite as often. But I’m happy whenever these come across my desk because they are just so easy to read.

And while Payroc’s pricing is usually competitive, we’re still able to find savings for most Payroc customers, especially if you aren’t on an IC+ deal or you have a high volume that warrants a better discount.

So if you want my team to take a look, it’s still worth reaching out. Our audits are free, so there’s no risk to you if we don’t find opportunities to save you money.