Most payment processors mark up every credit and debit card sale with two components:

- Discount Rate: A percentage of the transaction (like 0.15% or 0.20%)

- Per Item or Per Transaction Fee: Fixed dollar charge regardless of transaction amount (like $0.05 or $0.10)

When combined, you’re paying 0.15% + $0.05 per transaction, 0.20% + $0.10 per transaction, or whatever you’ve negotiated with your provider.

These totals are often combined on monthly merchant statements. So it’s not always obvious how much each component costs you unless you’re willing to do some math.

- Merchants tend to focus more on the discount rate because, as a percentage of the sale, it’s typically a higher amount.

- But the “per item fee” or “per transaction” rate is equally important, and shouldn’t be underestimated.

- This is especially true for merchants processing a high volume of low-ticket transactions.

I’ll explain all of this using real-world examples from our clients.

Breaking Down the Numbers

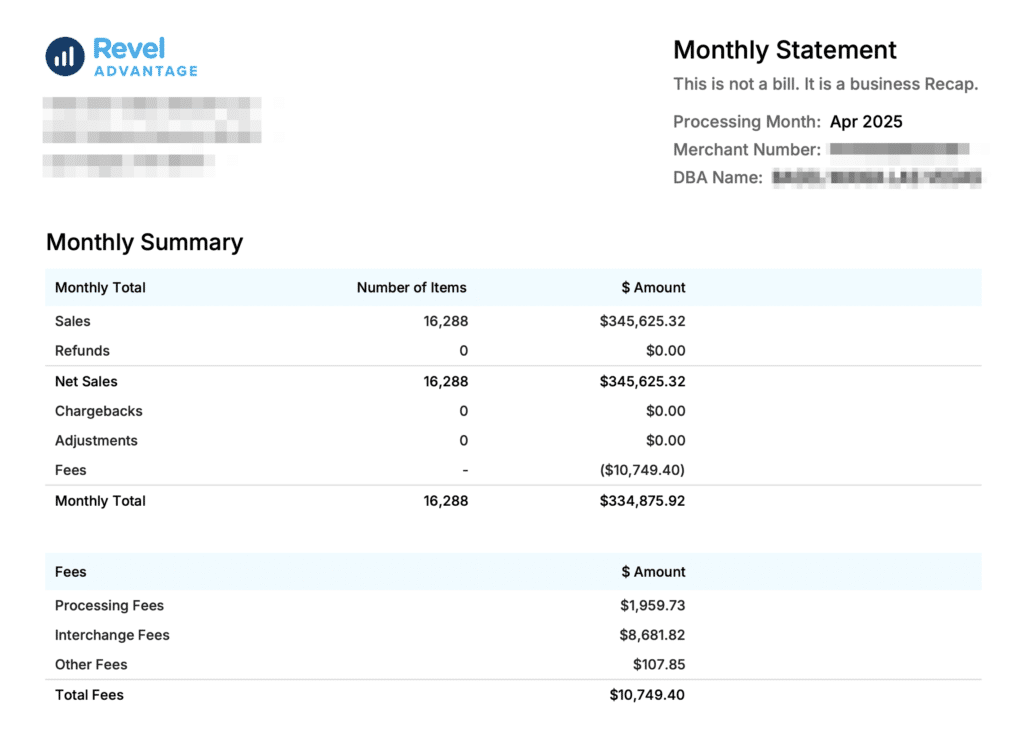

Let me show you a monthly statement summary from a local deli. They’re using Revel Advantage from Revel POS (which is owned by Shift4).

For added context, their average ticket is $21.22 for this statement period. Most of what they’re selling costs $5 to $15, and 95% of their menu is under $20. If one person is going in for a bagel and coffee, they could easily be out the door for less than $10.

Here are the numbers that matter:

- 16,288 transactions

- $345,625.32 in sales

- $10,749.40 total processing fees

Using this information, we can also calculate the merchant’s effective rate by dividing the total fees by total volume to get 3.11% effective.

Not bad, but I’d argue that this rate should be even lower when you consider the following:

- Zero chargebacks

- All transactions are in-person

- Over half of their transactions are debit cards

Either way, I can concede that a 3.11% effective rate is far from egregious or price gouging. Most merchants might look at this and be fine with it. But there’s still plenty of room for savings (and it’s hiding in the per-item charges).

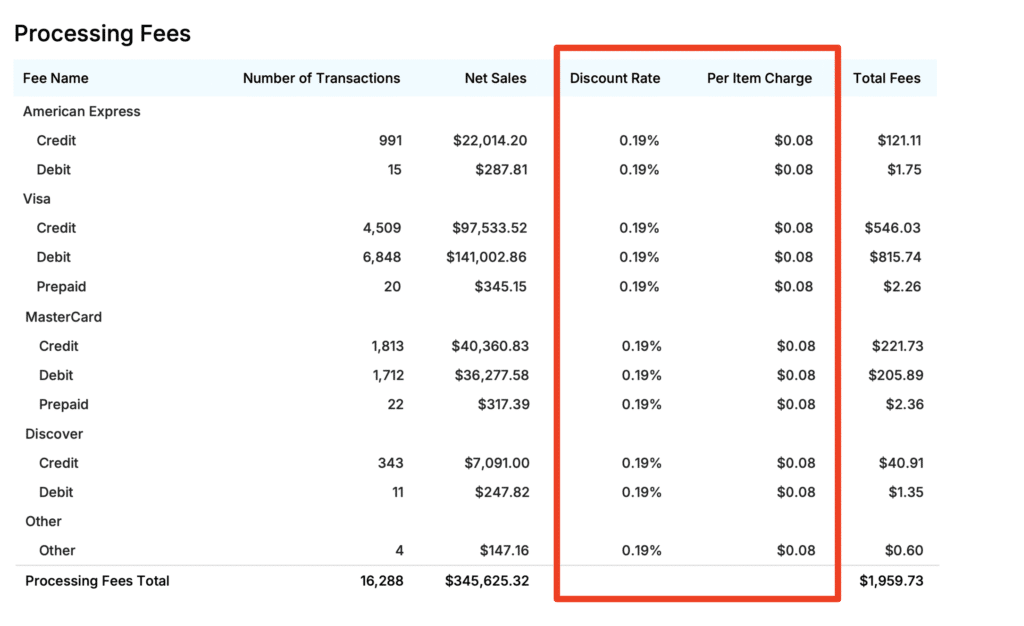

The Per-Item Fee Breakdown

When we look at the processing fees by card type, we can see that this merchant is paying 0.19% + $0.08 per transaction for all cards.

Again, lots of businesses might look at this and think they’re getting a decent deal. 0.19% + $0.08 sounds reasonable, and they could be doing a lot worse.

But that $0.08 per item charge adds up quickly.

- At 16,288 transactions this month, that’s $1,303.04 in per item fees alone.

- This represents over 66% of the processor’s total markup.

If you’re just looking at the far right column, which is the total of the discount rate and per-item fee for each category, it’s easy to gloss over this without thinking too much.

The Markup You’re Not Seeing

Now let’s take this one step further and calculate the effective markup for each category.

- Amex Credit – 0.55%

- Amex Debit – 0.61%

- Visa Credit – 0.56%

- Visa Debit – 0.58%

- Visa Prepaid – 0.65%

- Mastercard Credit – 0.55%

- Mastercard Debit – 0.57%

- Mastercard Prepaid – 0.74%

- Discover Credit – 0.58%

- Discover Debit – 0.54%

In total, that’s a 0.57% (57 basis points) markup, which is triple the 0.19% discount rate.

For some reason 0.19% + $0.08 per transaction just looks cheaper on paper. I would almost guarantee that if a processor presented this business with either 0.57% flat or 0.19% + $0.08, they’d choose the latter every time.

But the total cost ends up being the same.

Why Per Item Fees Are More Costly For Some Businesses But Not Others

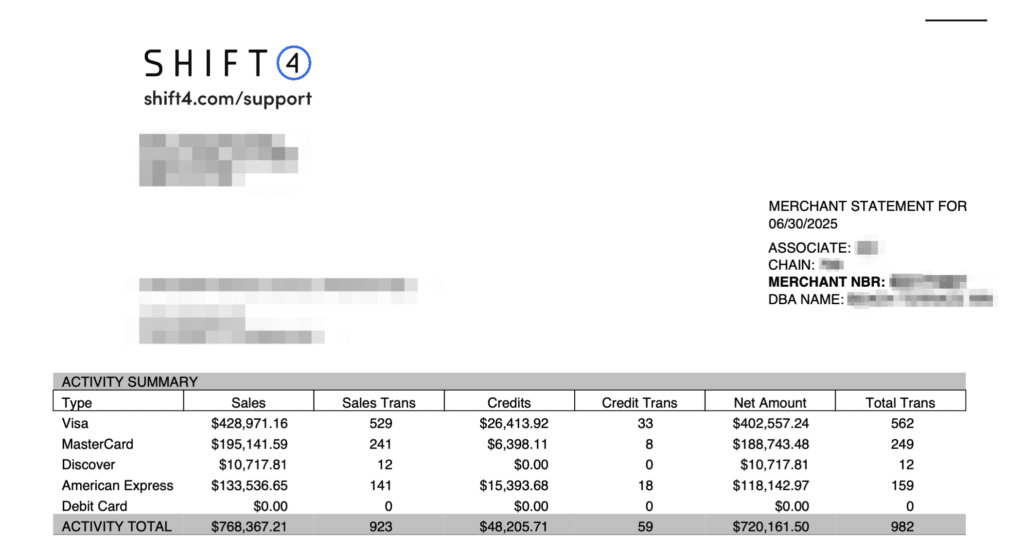

So far we’ve just been looking at a local deli with an average ticket of around $20. Now let me show you something on the complete opposite end of the spectrum, a hotel with an average transaction amount of over $700.

If we look at this summary, we can see $720,161 net sales on 982 total transactions (923 sales + 59 credits).

I chose this statement because it’s from Shift4, which is the parent company of Revel (used in the previous examples).

The statements are completely different in terms of how they’re formatted and presented to the merchant. In fact, we have to actually look in two different locations to see the total cost per transaction.

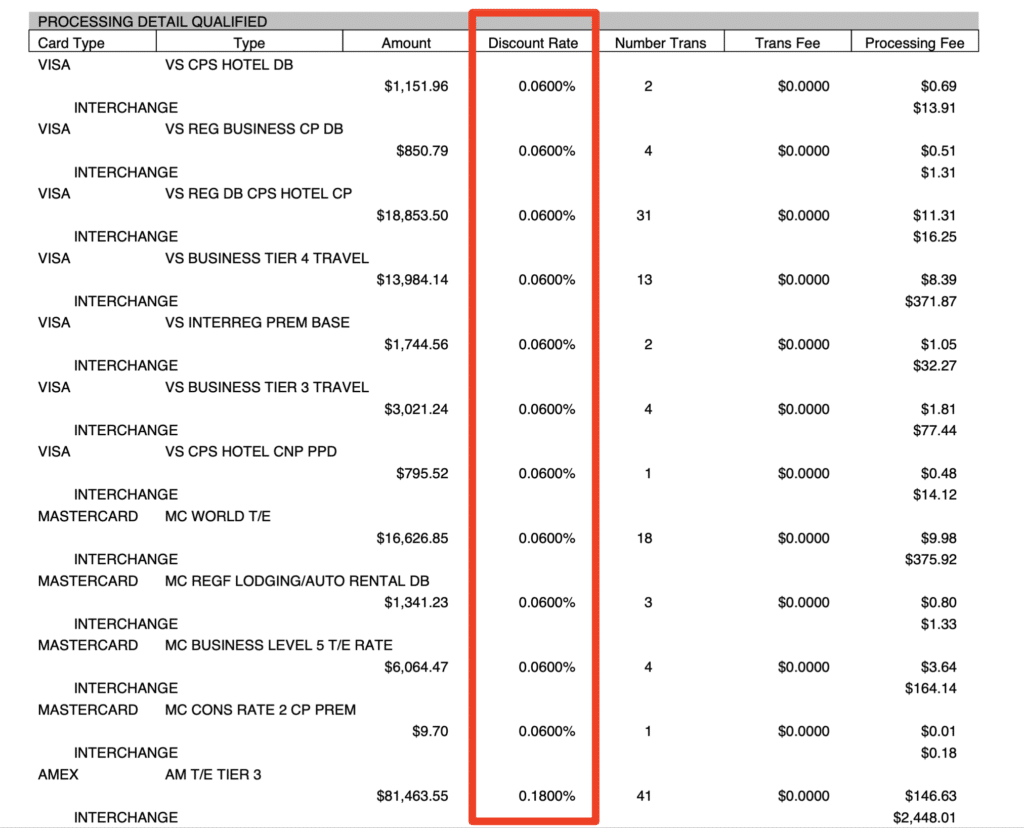

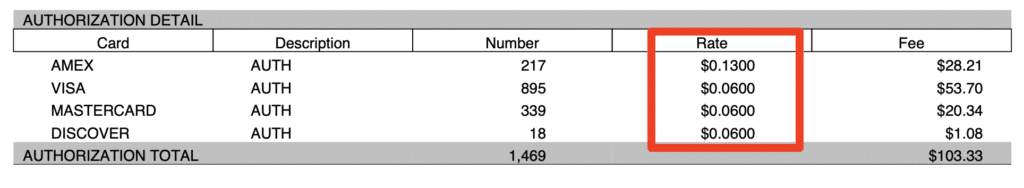

Here we can see this merchant is paying a 0.06% discount rate for Visa, Mastercard, and Discover. And 0.18% for American Express:

The per-transaction fee column is actually $0.00.

But if we look a bit closer on another page of the statement, we can see that Shift4 is charging them $0.06 per authorization for VS, MC, DS, and $0.13 per auth on Amex.

So in total, they’re paying 0.06% + $0.06 markup on all cards except Amex, which is 0.18% + $0.13.

But those per-item fees total just $103.33. And that’s based on 1,469 authorizations, which is higher than the 923 sales that were processed (because it’s a hotel and authorizations will always be higher).

Even if all of those transactions were charged at the Amex rate of $0.13, it would still cost this merchant less than $200 in per item fees.

That’s a marginal amount on $720k in net sales.

How to Handle Per Item and Per Transaction Fees

If your business does thousands or tens of thousands of small-ticket transactions, the per-item portion of your processor markup absolutely matters.

$0.08 or $0.06 may not seem like much.

But as you can see from the examples, $0.08 can be a ton when your average ticket is just $20 and you’re processing over 16,000 transactions every month. Whereas this doesn’t move the needle on 1,400 transactions and a $700 average ticket.

So, what can you do about this?

Negotiate your rate.

Your processor can charge you whatever they want to. And they’re going to continue charging you as much they want until you push back. Try to cut your per-item fees in half. Or shoot for an 80% reduction and hope to land in the middle.

If you want help determining whether or not you’re getting a fair rate based on your business type and volume, let our team here at MCC take a look at your statements. We’ll audit them for free and negotiate directly with your processor on your behalf. So you can save money without switching anything, and stop letting per-item fees eat into your profit margins.